Banana Republic Investing

![]() “Sometimes You’re in the Cabinet, Sometimes You’re in Prison”

“Sometimes You’re in the Cabinet, Sometimes You’re in Prison”

There’s a money-and-markets angle to the Hunter Biden pardon — even if it’s not obvious on the surface.

There’s a money-and-markets angle to the Hunter Biden pardon — even if it’s not obvious on the surface.

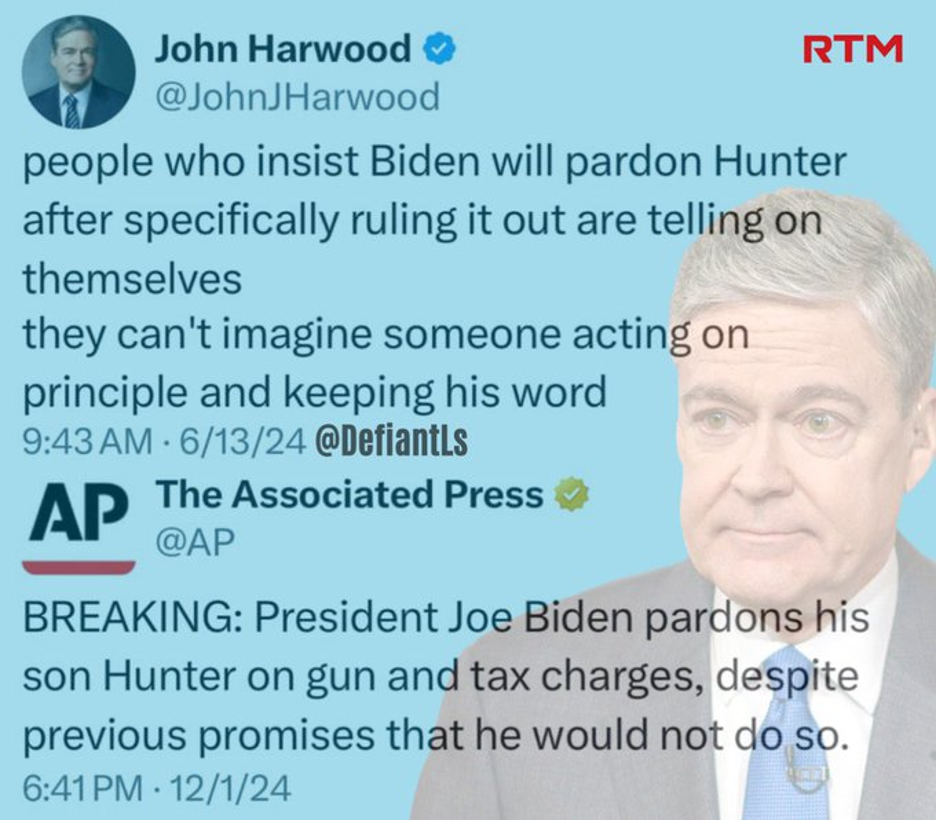

The news broke last night. You can read about the details anywhere. And perhaps you’ve already seen the social-media roasting accorded to the establishment hack journalist John Harwood for a tweet from last June…

But I’ll cut Mr. Harwood some slack — sort of.

He made that statement before Joe Biden’s debate meltdown and ultimate defenestration by his fellow Democratic Party bigwigs. Once that happened, Joe’s mindset might well have shifted to scorched-earth and anything-goes.

“There's no sugarcoating what the elder Biden has done,” writes Robby Soave at Reason: “He has issued what may well be remembered as the most disreputable presidential pardon in U.S. history, and he has done it at a time when his party is attempting to make the argument that President-elect Donald Trump is a unique and pernicious threat to democracy, law and order, and American political norms.”

Which brings us to a wider point about what it means to be an investor in a banana republic — because that’s the trajectory now.

Which brings us to a wider point about what it means to be an investor in a banana republic — because that’s the trajectory now.

In a recent interview on the Macro Voices podcast, economist Pippa Malmgren spoke of her time attending the London School of Economics in the 1980s. In particular, she spoke of her classmates who hailed from countries that at the time were still called “Third World.”

“People come from all over the world to the LSE,” she said, “and I remember friends whose parents were in government, and they used to say, very casually, some years my parents are in the cabinet, and some years my parents are in prison.

“And in most countries, you go back and forth between power and prison. That's normal.

“The U.S. has not been like that, but I suspect that we're going to see some of that.”

That’s not an indictment of one party or the other, by the way; it’s just a reflection of the divisions in the country that remain despite Trump securing a popular-vote victory.

The newest member of the Paradigm Press team knows this phenomenon all too well.

The newest member of the Paradigm Press team knows this phenomenon all too well.

He’s Enrique Abeyta. “The Maverick” is the nickname he earned at Wharton and lived up to during his hedge-fund days… and it’s the name we’ve given his new trading service.

Last week we spent a fair amount of time introducing you to his unconventional strategy — especially how he discovers lucrative trades in the revisions to the earnings estimates issued by Wall Street analysts. (Don’t try this at home; as Enrique explains here, he relies on both a Bloomberg terminal and proprietary software to unearth these profit opportunities.)

Today we want to shift gears a bit and tell you about his family background — especially on his mother’s side in South America. It’s 100% relevant to this “power and prison” theme.

“My mother fled her home country Uruguay during a military dictatorship in the 1960s,” Enrique recalls. “Her father was the CEO of one of the major utilities and telecommunications companies in the country, as well as a founder of a major opposition political party.

“My uncle was jailed for seven years during the period of political conflict. He went into prison with almost 200 others, and fewer than a dozen made it out.”

Ultimately his mother married just so she could stay in the United States and avoid being sent back to Uruguay — where she would almost surely have been thrown in prison. In time, she forged a successful career in health care.

Enrique says his mom “instilled in me several important characteristics that define me to this day” — including “the ability to learn and adapt to my environment.”

Enrique says his mom “instilled in me several important characteristics that define me to this day” — including “the ability to learn and adapt to my environment.”

He applies that skill to his investing and trading strategies: When the facts change, he adjusts.

It’s been phenomenally successful. At his hedge fund, he managed over $4 billion… tripled the performance of the S&P 500… and vaulted himself into the top 3% of money managers in the world.

And the most powerful tool at his disposal is this chart pattern…

See that little stair-step pattern in the yellow circle? Simple as 1-2-3.

That’s the pattern that tipped off all the top 10-performing stocks of 2024 — everything from Nvidia’s 200% gain to Vistra Corp.’s 320% leap.

For the last several days, Enrique has been showing readers like you how to harness the power of this pattern to get in on next year’s top-performing stocks right now.

But all good things must come to an end — and that includes the charter-subscriber offer for The Maverick. We’re shutting it down at midnight tonight. Click here so you don’t miss out.

![]() Once More, the 48-Hour Rule

Once More, the 48-Hour Rule

As sometimes happens, the mainstream is a few days late catching up to us…

As sometimes happens, the mainstream is a few days late catching up to us…

That’s Friday’s Wall Street Journal: “Wall Street isn’t thrilled about the return of Donald Trump’s tariff threats, but traders are hardly panicking,” the article begins.

“Some investors said they had learned lessons from the craze for trading on Trump’s social media posts that followed his first electoral win. Back then, Trump often sparked big swings in stocks, commodities and currencies with surprise broadsides — only for the moves to unwind when negotiations progressed, he de-escalated, or workarounds mitigated the biggest threats to the economy or corporate profits.”

If you’ve been following these missives lately, this should have a familiar ring: It’s Knuckman’s law — which we named after Alan Knuckman, our eyes and ears at the Chicago options exchanges.

Alan invoked this law time and again during Trump’s first term: Don’t overreact to every little thing Trump says. Or even the big things. Give it 48 hours for events to shake out and markets to simmer down.

Last week’s market action — as we laid out in real-time — was a perfect example. The Dow climbed to record levels despite whatever jitters came about after Trump threatened 25% tariffs on goods from Canada and Mexico, plus an additional 10% tariff on Chinese goods.

And so it goes with Trump’s threat to the BRICS countries over the holiday weekend. The implications are earthshaking… but we’re going to allow a little time before jumping to conclusions.

Come back tomorrow, after we give it all some time to marinate…

In the meantime, the major U.S. stock indexes are a mixed bag as a new month begins.

In the meantime, the major U.S. stock indexes are a mixed bag as a new month begins.

The Dow and the S&P 500 notched weekly and monthly record closes on Friday but today they’re moving in opposite directions — the Dow down a quarter percent, the S&P up a quarter percent. The Nasdaq is up 1% and on track to notch a record close today, over 19,420.

Among the big movers is Intel — up 5.6% after CEO Pat Gelsinger abruptly announced his “retirement.”

Among the big movers is Intel — up 5.6% after CEO Pat Gelsinger abruptly announced his “retirement.”

Bloomberg has an exclusive in which it says the board lost confidence in his turnaround plans. But the story’s veracity is open to question: Earlier in the day Bloomberg beclowned itself by saying Gelsinger was out “after more than 40 years at the company.”

Later, it issued a correction — “after more than 30 years at the company.”

Well, yeah. He was not a lifer who’d never seen business done any other way, as the early hot takes implied. He did join the company in 1979 as a quality-control technician at the tender age of 18. But he left in 2009 to spread his wings — taking on CEO jobs first at EMC, then at VMware.

It was his breadth of experience both inside and outside the company that prompted the board to bring him on as CEO in early 2021 — replacing a “hired gun” named Bob Swan.

We’ll leave it to others to Monday-morning quarterback Gelsinger’s departure. Suffice to say he had nearly four years to right the ship and evidently the board’s patience was not unlimited…

The commodity complex is losing ground as geopolitical tensions are moribund — at least for the moment.

The commodity complex is losing ground as geopolitical tensions are moribund — at least for the moment.

Gold is down eight bucks to $2,640; silver has shed 16 cents to $30.43. Crude is down a quarter at $67.76.

Still, it appears Washington is moving heaven and earth to open up new fronts against Russia. After a three-year lull, Islamist rebels in Syria are suddenly on the march against the Russia-allied regime of Bashar al-Assad. And protests egged on by Western “non-governmental organizations” are destabilizing the government in Georgia, which like Ukraine lies on Russia’s doorstep. Some analysts are seeing parallels to the coup that Washington engineered in Ukraine in 2014.

Bitcoin remains mired in the $96,000 range.

![]() Spend, Spend, Spend — and Quickly!

Spend, Spend, Spend — and Quickly!

The Biden administration is embarking on a last-minute spending spree — with the approval of many Republicans.

The Biden administration is embarking on a last-minute spending spree — with the approval of many Republicans.

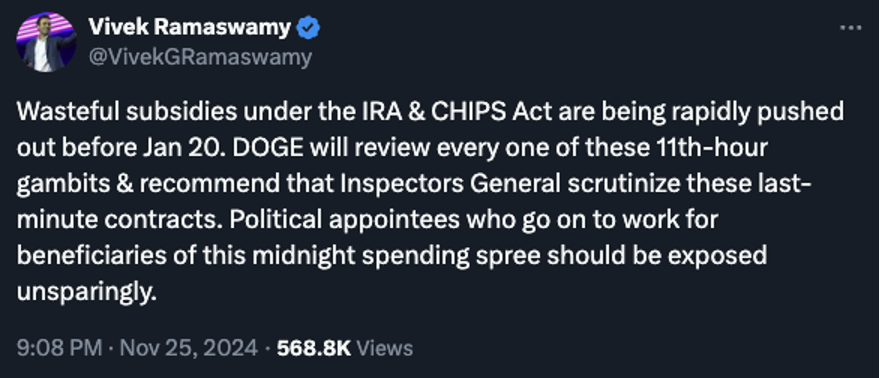

Although the misnamed “Inflation Reduction Act” — packed with pork for green-energy projects — was passed in 2022, much of the allocated funding has yet to be spent.

“So now there is a mad scramble to sign contracts,” says Paradigm’s Jim Rickards, drawing on his Beltway-insider sources. “You actually can’t spend the money that fast, but you can sign a contract with a five-year life or three-year life saying you’ll spend it over three or five years. The idea is to sign the contract now so that even when Trump becomes president, even though the money hasn’t been spent, it has been appropriated and it’s contractually bound.

“And that’s the key. Bind the spending in contractual form so Trump can’t do anything about it. There’s a lot of wasteful government spending that’s in the pipeline.”

To be sure, these maneuvers are on the radar of the incoming “Department of Government Efficiency” led by Vivek Ramaswamy and Elon Musk…

But lo and behold, many congressional Republicans are partial to the IRA. Indeed, red states are “getting the lion’s share of the funding,” says today’s Wall Street Journal.

“There are too many things in there that are too important to too many constituencies,” says Sen. Kevin Cramer (R-North Dakota).

Funny how that works…

![]() Surprise, Surprise, Surprise…

Surprise, Surprise, Surprise…

From the Department of We-Told-You-So comes this little news item we managed to overlook last week…

From the Department of We-Told-You-So comes this little news item we managed to overlook last week…

Let’s rewind briefly: As mentioned in our Nov. 15 edition, Haliey Welch — aka the “Hawk Tuah Girl” — was warning her followers about crypto scammers who sought to latch onto her name and notoriety.

We smelled a rat. “We’re just gonna put it out there,” we said: “What if this ‘scam alert’ is an elaborate ruse laying the groundwork for Welch to pursue her own crypto venture?”

Sure enough, a memecoin called HAWK will launch this Wednesday on the Solana blockchain.

“As the name implies,” says the casino.org site, “memecoins are cryptocurrencies based on viral internet moments or famous people. Some of the most popular assets in this corner of the digital currency space have been inspired by pets and politicians, including President-elect Trump.”

Yeah, we totally saw this coming. Er — maybe a better way to phrase it is that we totally anticipated this development.

Now Welch is facing her own accusations of scamminess: “Some X users expressed concern that HAWK could be a ‘rug pull’ — a crypto colloquialism describing the scenario in which a project’s backers bail without warning,” says casino.org.

“That often occurs when a memecoin has been rapidly bid up, leaving unwitting investors holding the bag on an asset that has subsequently lost a significant amount of its value.”

Welch promises that won’t be the case. “Nope,” she replied on X to one such comment.

[More background about rug pulls in a 5 Bullets edition from January.]

We sincerely hope this is the last time we have occasion to mention this story. Somehow, we have a feeling it won’t be…

![]() Questioning the “Melt-Up”

Questioning the “Melt-Up”

A couple of readers wrote to take issue with Enrique Abeyta’s guest essay on Saturday — in which he laid out the reasons he expects a 1980s-style “melt-up” in the stock market.

A couple of readers wrote to take issue with Enrique Abeyta’s guest essay on Saturday — in which he laid out the reasons he expects a 1980s-style “melt-up” in the stock market.

“There was a big difference when the real world had to live with 18% interest rates vs 5.5%,” writes one. “The 40-year toboggan ride down the bond market has enjoyed from 18% to minus 1.5% is unavailable this time.

“I’m 86 and I was farming in the 1980s when my farm operating loan cost 23% and my wheat price was going down.”

“Abeyta does not mention a massive difference between then and now — one that your very own Jim Rickards constantly emphasizes,” writes another.

“Abeyta does not mention a massive difference between then and now — one that your very own Jim Rickards constantly emphasizes,” writes another.

“The debt-to-GDP ratio today is about 120%, while in Reagan’s day it was about 30%. Rickards brings this up again and again as an overwhelming headwind against a repeat of the debt-fueled growth that characterized Reagan’s term.

“Abeyta does touch, ever so briefly, on U.S. government debt, but only to make the ‘cleanest dirty shirt’ argument. OK. But that sidesteps Rickards’ concern that our massive debt overhang puts us in a very different situation, one where every dollar of new debt produces LESS than a dollar of economic activity.

“Does Abeyta not read Rickards’ work? Or has Rickards changed his mind and now thinks we CAN repeat the debt-fueled growth of the ’80s? As a Paradigm reader I can’t figure out what you guys are trying to say.

“Of course I don’t expect you to be right all the time. But I’d sure like you to be consistent, or at least when you’re not, to explain why.”

Dave responds: I’ve said it before, but it’s always worth saying again: We don’t enforce a “company line” around here.

The last thing we want is for our editors to censor or second-guess themselves. Many of them had to do just that during their Wall Street careers — wondering what clients or advertisers or the board of directors might think. When they come to work for us, they know they can speak freely.

You’ve paid good money for your subscription(s) and you deserve the editors’ unvarnished, no-holds-barred opinions.

On those occasions when their opinions diverge, we respect your intelligence enough to weigh those opinions and come to your own conclusions.

In the meantime, we thank you for your thoughtful inquiry. We’re blessed to have the most observant and engaged readership of any e-letter out there…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Last chance: The charter-subscriber offer to Enrique Abeyta’s The Maverick expires tonight at midnight. If you want access to the lowest rate available, give this a look right away.