YouTube Meme to Crypto Queen?

![]() YouTube Meme to Crypto Queen?

YouTube Meme to Crypto Queen?

Never did I imagine I’d be writing about the “Hawk Tuah Girl” in a financial e-letter. But here we are.

Never did I imagine I’d be writing about the “Hawk Tuah Girl” in a financial e-letter. But here we are.

If you’re not familiar with the young woman I’m referring to, her name is Haliey Welch.

Back in June, she achieved sudden notoriety when she was approached by a couple of YouTube bros in Nashville’s Broadway district. With little prompting, she proceeded to vividly describe a minor variation on a certain sex act. (We’ll leave it at that in our PG publication.)

Her newfound fame landed her merchandise deals and a podcast. No word on what she’s earning from all this — but it’s surely substantial, seeing as the podcast alone is ranked in the top five on Spotify. (I know, where’s the giant meteor when you need it?)

She even threw out the first pitch one day at a New York Mets game. (Imagine the awkward conversations in the stands that began, “Mommy, who’s that?”)

Anyway, Ms. Welch has made it known that she has nothing to do with the launch of a new crypto.

Anyway, Ms. Welch has made it known that she has nothing to do with the launch of a new crypto.

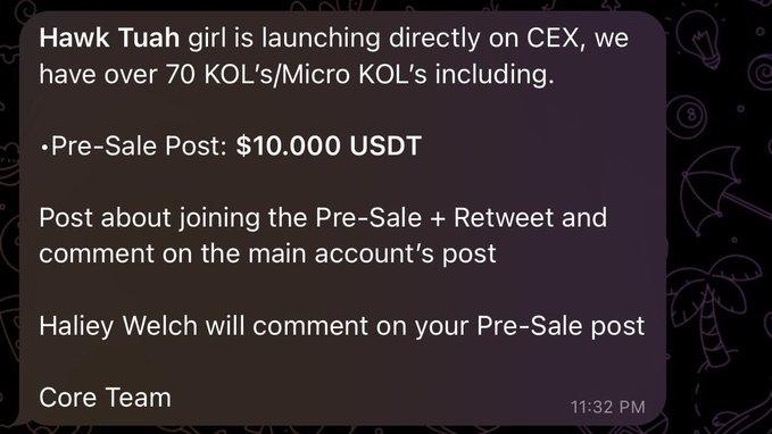

A few days ago, someone on X-formerly-Twitter posted this screenshot claiming she was one of more than 70 influencers — dubbed “key opinion leaders” or KOLs — backing the presale of a new coin.

Not so, she says. “This is fake, I can’t stop people scamming or lying using my name,” Welch posted on X.

We’re just gonna put it out there: What if this “scam alert” is an elaborate ruse laying the groundwork for Welch to pursue her own crypto venture?

We’re just gonna put it out there: What if this “scam alert” is an elaborate ruse laying the groundwork for Welch to pursue her own crypto venture?

As near as we can tell, there’s no identifying information about the name of the scam coin or the name of the scam operator behind it — only that screengrab above, reposted by others. (“CEX” simply means a centralized exchange. It’s not a name brand, as it were.)

There’s only one article from a “reputable” news source we can find on this story. Newsweek cites a Welch spokesperson — apparently Welch is well-off enough to employ a PR pro — who says the following…

Between merchandising scams and crypto scams using her name and likeness, her fans have been scammed out of tens of millions of dollars. She's been educating herself on the space, even attending Bitcoin conferences so she can be informed what is the right way to do things so her community will never be cheated again. [Emphasis ours]

Oh right, she’s attending Bitcoin conferences so she’ll be more hip to how crypto scammers are latching onto her stardom — lest her benighted followers be swindled out of “tens of millions of dollars.”

Yeah, pull the other one.

Even before the “scam” came to light on Monday, at least half of her feed on X was devoted to crypto…

Whether scammers are glomming onto Welch’s name or Welch is on the verge of launching TuahCoin or somesuch… the timing is no coincidence.

Whether scammers are glomming onto Welch’s name or Welch is on the verge of launching TuahCoin or somesuch… the timing is no coincidence.

“In just nine days since the election, cryptocurrencies have absolutely exploded,” our James Altucher wrote yesterday to his Altucher’s Investment Network subscribers.

“Bitcoin surged 31% to record highs, while Ethereum jumped 29% to $3,100, and Solana rocketed 35% to $215.”

“The catalyst? Donald Trump's decisive victory and his pro-crypto agenda.”

Read on for James’ state-of-the-crypto-market briefing…

![]() The Trump Bump in Crypto: An Update

The Trump Bump in Crypto: An Update

It’s not just Trump’s promise to make America “the crypto capital of the planet” that’s driving the crypto rally — or his pledge to fire SEC chair Gary Gensler on Inauguration Day.

It’s not just Trump’s promise to make America “the crypto capital of the planet” that’s driving the crypto rally — or his pledge to fire SEC chair Gary Gensler on Inauguration Day.

“Trump floated the idea of eliminating capital gains taxes on U.S.-made cryptocurrencies,” says James — “a move that would revolutionize how Americans use digital assets.”

With that, traditional financial institutions are making new aggressive moves into the crypto space.

“Just last week,” James tells us, “Franklin Templeton expanded its $410 million money market fund to the Ethereum blockchain. Meanwhile, Robinhood just relisted Solana, Cardano and Ripple while adding support for new tokens, like Pepe.

“This is just the beginning. With the blessing of government regulators, I expect we’ll see major banks and financial institutions make bold bets in cryptocurrency.

“I wouldn’t be surprised if we even saw Coinbase acquire or merge with a big bank.”

What’s James’ near-term outlook for the “Big Three” cryptos?

What’s James’ near-term outlook for the “Big Three” cryptos?

“Bitcoin is the safest bet of the bunch,” he says. It’s “the oldest and most established cryptocurrency.”

Meanwhile, “Ethereum is going through some growing pains” — even though it boasts “one of the largest developer communities in crypto. It’s like the App Store of blockchain — offering everything from decentralized exchanges to lending platforms.” That said, “the network is struggling with scaling issues and user experience challenges.

“This has created an opening for Solana” — which James recommended in 2021. It’s up 1,770% since.

“Solana's growth has been supercharged by the explosion of memecoins and its simple user experience. Next year could bring another catalyst — a potential Solana ETF.

“I expect both Ethereum and Solana to outperform Bitcoin,” James says. Between the two, it’s a tossup. “Solana has momentum, but Ethereum has history and the largest user base in crypto.”

Beyond the big three, the usual advice applies about “buyer beware.” Especially where — ahem — “influencers” are involved.

As you likely know, James has been keen for several weeks about five tiny cryptos that he and colleague Chris Campbell have researched thoroughly. They believe all five have the potential to 10X your money in the next 12–18 months. And the election outcome has only reinforced their conviction.

To help you make the most of the present opportunity in crypto, James and Chris have assembled a “curated crypto box”. It’s “an actual physical box,” Chris tells us — “filled with physical items designed to help increase your wealth during the coming crypto boom.”

Yes, supplies are limited. Follow this link to learn how to claim yours today. Once you act, we’ll ship it direct to your home.

![]() Tech Growth: Back to the Future

Tech Growth: Back to the Future

Even as many semiconductor stocks are missing out on the post-election rally… “tech growth is the place to be!” says Paradigm chart hound Greg Guenthner.

Even as many semiconductor stocks are missing out on the post-election rally… “tech growth is the place to be!” says Paradigm chart hound Greg Guenthner.

Greg was eyeing the ARK Innovation ETF (ARKK) at the start of the month. Cathie Wood’s flagship fund was the poster child for the 2020–21 mega-boom in tech-adjacent stocks — and the ensuing mega-bust in 2021–22.

But the price action looked intriguing two weeks ago: “A series of higher highs and higher lows emerged from a constructive multiyear base,” Greg says. “I was reluctant to call it an uptrend but anticipated an explosive rally.”

And here we are…

“I didn’t expect a breakout the following week. But that’s how frothy speculative markets move.

“The simple fact this group of unwanted and unloved ‘innovation’ stocks is moving higher together for the first time since early 2021 is the most bullish sign on Wall Street.

“We want to keep the ARKK ETF companies on our radar — Coinbase (COIN), Roblox (RBLX), and Roku (ROKU) just to name a few. Remember, these stocks were the focal point during the last melt-up for a reason: They all had a big story.

“Almost four years later, the most resilient companies have left behind their drastic drawdowns as they rise to their potential.”

Indeed, ARKK smacks of an “echo trade” — a powerful moneymaking concept we’ll explore next week.

In the meantime, and for no obvious reason, there’s a sea of red on Wall Street as the week winds down.

In the meantime, and for no obvious reason, there’s a sea of red on Wall Street as the week winds down.

At last check, the S&P 500 is down 1.25% or 75 points to 5,875. All told, the index has shed 126 points from Monday’s record close just over 6,000. The Nasdaq’s losses are steeper, the Dow’s less so.

Sometimes the market just gets ahead of itself and needs time to digest its recent gains. But that doesn’t fill space on mainstream financial websites — so the media flail about looking for “reasons.” Today they’ve latched onto a speech by a regional Federal Reserve president saying an interest rate cut next month is “not a done deal”... along with a “solid” retail sales number.

C’mon. Other than the New York Fed, regional Fed presidents don’t matter — and this one doesn’t even have a vote on the Fed’s Open Market Committee this year. And the retail sales number wasn’t all that solid — more about that momentarily.

Not much movement in precious metals, with gold at $2,564. At least silver will hang onto the $30 handle to end the week. Crude is down over a buck to $67.58.

Bitcoin, like the major stock indexes, is digesting its recent gains, currently $89,437.

Economic indicators: Going into the election, both consumer spending and industrial output were looking anemic.

Economic indicators: Going into the election, both consumer spending and industrial output were looking anemic.

The Census Bureau is out with the October retail sales figures. The headline number was fine — up 0.4%, and the September number was revised higher.

But the number is skewed by a bump in auto sales — sales of necessity, given the number of vehicles wrecked by Hurricanes Helene and Milton.

If you back out auto sales, you end up with a much more modest increase of 0.1% — in contrast with Wall Street’s expectations for a 0.3% jump.

Meanwhile, the Federal Reserve reports U.S. industrial production fell 0.3% in October — a number dragged down by both the hurricanes and the Boeing strike (which is now over). All told, 77.1% of America’s industrial capacity was in use last month, the weakest reading since January.

![]() Bond Vigilantes: Still in Hibernation

Bond Vigilantes: Still in Hibernation

“Have you seen what has been happening to bond yields?” asks the newest member of the Paradigm team, hedge fund veteran and trading pro Enrique Abeyta.

“Have you seen what has been happening to bond yields?” asks the newest member of the Paradigm team, hedge fund veteran and trading pro Enrique Abeyta.

Ever since the Fed started cutting short-term interest rates two months ago, longer-term yields have been rising. That’s not usually how it works.

The yield on a 10-year Treasury has leaped from 3.7% to 4.45% in only two months.

This jump has brought on much chatter about a return of the “bond vigilantes.” Back in the 1970s, these vigilantes would show up in the bond market anytime it seemed as if the Fed would go on another money-printing spree or Congress would go on another spending spree.

They’d sell bonds as a vote of no-confidence in Uncle Sam — sending yields sky-high.

But as Enrique sees it, the bond vigilantes are still in hibernation.

But as Enrique sees it, the bond vigilantes are still in hibernation.

“We think the move in bond yields is mostly indicative of how investors were positioned going into the first rate cut,” he says.

“That cut had been talked about all year and we think there was an overwhelming consensus that it was happening. There was also a consensus that more cuts would happen after it.

“When EVERYONE is anticipating something, they are usually positioned in such a way that when it happens, you get the opposite result of what folks are thinking. That is what we think is happening right now.”

If the bond vigilantes were coming out of their slumber, Enrique says we’d see a bigger jump in yields than this. The current 4.45% on the 10-year note is no higher than it was in June.

Yes, the bond vigilantes will emerge sometime — but not now. “This (smallish) move in rates and these (lowish) rates are not something that changes the trading and investing backdrop,” says Enrique. “Not yet at least.”

![]() Mailbag: “Cool Your Jets”... and a DOGE Applicant

Mailbag: “Cool Your Jets”... and a DOGE Applicant

“Cool your jets, Dude!” a reader writes after I (once again) questioned the “America First” bonafides of the early Trump appointees.

“Cool your jets, Dude!” a reader writes after I (once again) questioned the “America First” bonafides of the early Trump appointees.

“I see that you like to be ‘above it all,’ but can’t we wait to find out how the new administration performs before trashing it?

“And highlighting a 20-year-old story of a young warrior’s support for a war as dispositive when it comes to how he will run the military is weak at best. I shudder to think what I believed 20 years ago — we all change and grow. I hope that for you as well.”

Dave responds: OK, how about Mr. Hegseth’s much more recent (2018) hopes that the Third Temple will be built on the site of the Temple Mount/Al-Aqsa Mosque in Jerusalem?

Would he use his position to help bring about that outcome — and, of course, set off a conflagration throughout the Middle East and South Asia?

I don’t expect anyone will ask him about that at his confirmation hearings. But at least I hope a Republican will confront him about his (even more recent) criticism of the Biden administration for… not arming Ukraine quickly enough.

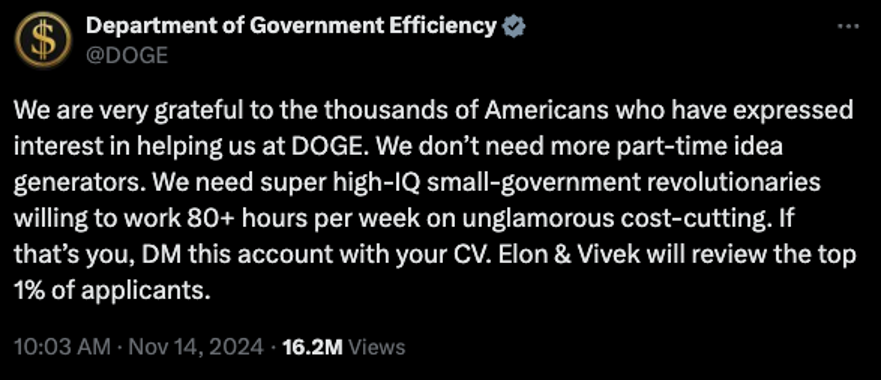

“I have applied to the Department of Government Efficiency,” a reader writes.

“I have applied to the Department of Government Efficiency,” a reader writes.

“I am firmly convinced that DOGE will make a list that will have to be approved by Congress in a bill and will have to pass it. I feel we have to try to not succumb to cynicism.

“Maybe we fail. But we will 100% fail if we don't give it a shot. Here's to hoping I get a shot at it (although I am not sure I am prepared to take a 75% pay cut...).

“Any and all ideas are welcomed. Rand Paul's annual waste report is a good start. Imagine if we just stopped funding studies that did not have broad value for human society or, maybe, stopped them altogether.

“Little by little — wish me luck!”

Dave: Godspeed.

It seems many would-be applicants were stymied when they discovered they couldn’t direct-message the DOGE account. “DMs not open,” said one.

Also, one must be a paying premium member of X to message the DOGE — minimum $8 a month.

And are you sure about that 75% pay cut? Elon Musk has said the “compensation is zero” although he didn’t make clear whether that means the gig is unpaid.

Musk and Trump both have enough irons in the fire that mainstream and alternative media alike will probably forget about the DOGE after — at the latest — the first 100 days of the administration.

But we pledge to stay on top of the DOGE in these virtual pages long after everyone else moves on. As I said on Tuesday, Musk’s stated goal of slashing the federal budget by $2 trillion is imperative if we’re going to have real, enduring prosperity for the masses — and not a fragile funny-money prosperity enjoyed by only the upper crust.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets