After $100K, What’s Next for Bitcoin?

![]() Bitcoin’s Next Act: A Triple in 13 Months

Bitcoin’s Next Act: A Triple in 13 Months

“I expect Bitcoin to hit $300,000 by the end of 2025,” says Paradigm’s resident crypto evangelist James Altucher.

“I expect Bitcoin to hit $300,000 by the end of 2025,” says Paradigm’s resident crypto evangelist James Altucher.

As you’re likely aware, Bitcoin broke the $100,000 barrier last Wednesday — even earlier than James’ aggressive post-election forecast. (He figured $100K by Inauguration Day.)

“The signs were all there,” he says — “Wall Street's growing appetite for crypto, Trump's pro-crypto stance and the flood of institutional money pouring in.”

Let’s home in on that last factor…

“Last month, something game-changing happened,” says James: “Options trading began on Bitcoin ETFs.”

“Last month, something game-changing happened,” says James: “Options trading began on Bitcoin ETFs.”

Result? “Wall Street's biggest players now have a new toy to play with, and they're not holding back. Just look at the numbers: In its first hour of trading, Bitcoin ETF options saw 73,000 contracts change hands. That's not just impressive — it's a sign of things to come.”

Meanwhile, “Major corporations are starting to treat Bitcoin like digital gold,” James goes on.

He points to MicroStrategy — which just bought another $1.5 billion of Bitcoin, bringing the total value of its stash to $40.5 billion. (Yes, MSTR shares are way overvalued, as colleague Davis Wilson pointed out here last week. But that’s not the point today…)

“Even pharmaceutical companies are getting in on the action,” says James. He points us to a microcap called Acurx Pharmaceuticals (ACXP) that recently announced it’s putting $1 million of its cash into Bitcoin.

Meanwhile James reminds us that BlackRock's Bitcoin ETF alone saw inflows of $5.4 billion just last month.

At the same time, Donald Trump’s choice for chair of the Securities and Exchange Commission, Paul Atkins, is even more crypto bullish than it seems on the surface.

At the same time, Donald Trump’s choice for chair of the Securities and Exchange Commission, Paul Atkins, is even more crypto bullish than it seems on the surface.

It’s not just that Atkins is co-chair of a pro-crypto lobbying group and that he’s set to replace the notoriously anti-crypto Gary Gensler.

Under Atkins’ leadership, “we're likely to see approval for even more cryptocurrency ETFs,” says James — “including ones for Solana and Ripple. The days of regulatory uncertainty are coming to an end.”

Bottom line: “Remember how the internet changed everything in the '90s? Cryptocurrency is having its own internet moment right now.

“Here's what it all means for investors: We're witnessing the early stages of a historic wealth-creation event.”

James’ Early-Stage Crypto Investor readers have already seized on some of the early moves — a 133% gain in over two months… a 484% gain in just over 13 months… and a massive 789% since last August.

But James is certain the next stage of the crypto rally will be even more lucrative. And he doesn’t want you to miss out.

James is also certain the next stage begins tomorrow.

That’s when a handful of giants including Bill Gates and BlackRock “will make an unprecedented crypto move,” says James — and for six tiny cryptos that are on his radar, they’re liable to rise “higher than anyone can imagine.”

Follow this link and James will show you how to seize upon crypto’s December melt-up.

![]() Washington’s Favorite Head-Chopping Jihadi

Washington’s Favorite Head-Chopping Jihadi

Precious metals are performing their risk-hedging role now that after nearly 14 years, the Obama administration’s regime change op in Syria is complete.

Precious metals are performing their risk-hedging role now that after nearly 14 years, the Obama administration’s regime change op in Syria is complete.

At last check gold is up nearly $40 to $2,671 and silver has rallied $1.25 to $32.19. The HUI index of mining stocks has vaulted back above the 300 level — up a solid 5.3% to 312.

Crude is likewise up big, more than 2% — now trading for $68.64.

You can read anywhere about how the Assad dynasty in Syria suddenly collapsed in a heap after more than 50 years.

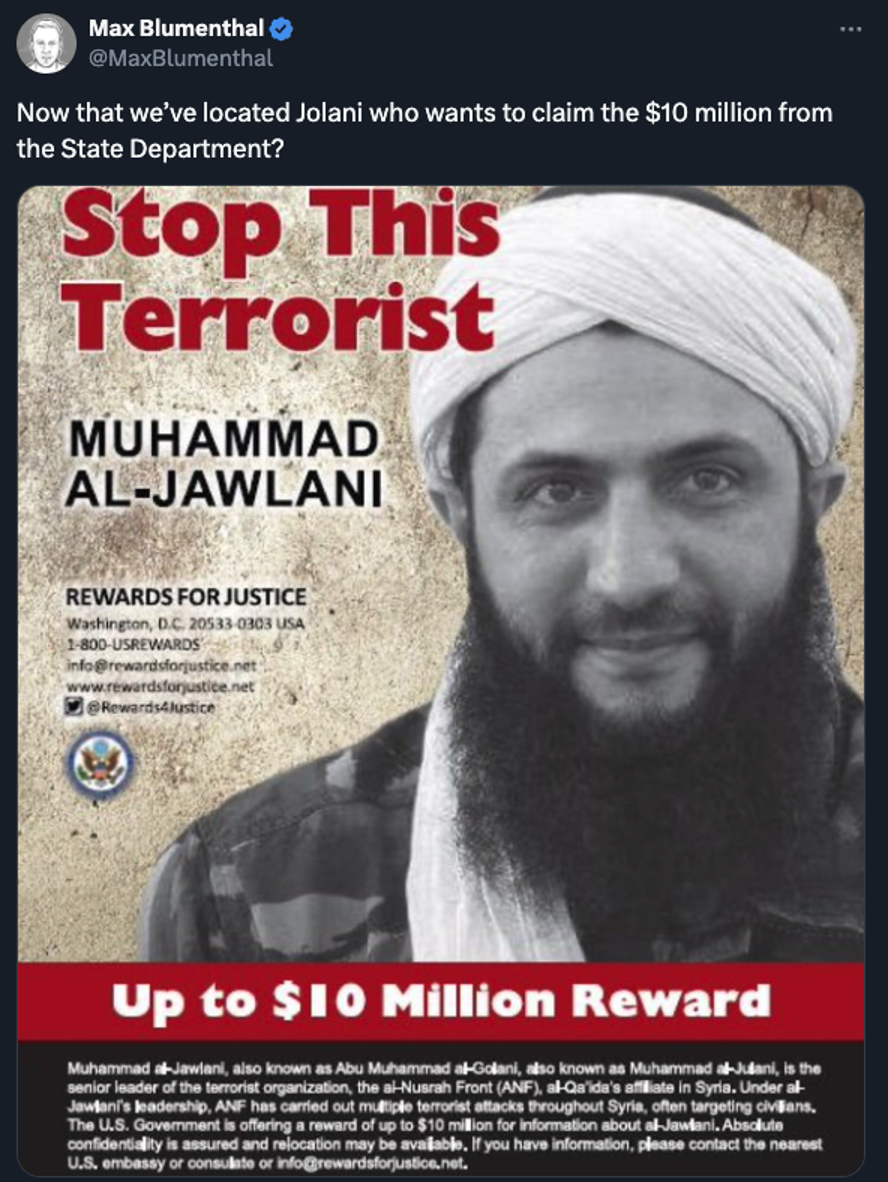

What you might not have seen is that the “liberation” of Damascus that’s being celebrated in corporate media is led by a guy who’s still on Washington’s terrorist list…

For real. Back in the day, Abu Mohammad al-Julani was the leader of al-Qaida’s Syrian faction. Before that, he fought U.S. troops in Iraq.

“I think there are at least a couple of hundred white grave markers in U.S. national cemeteries, courtesy of this guy,” observes Paradigm’s energy and military-affairs expert Byron King. “And many thousands of wounded vets, courtesy of roadside bombs, snipers, etc.”

But amid the Arab Spring uprisings of 2011, the Obama administration saw an opportunity to topple Syrian dictator Bashar al-Assad — long a goal of Washington’s allies Israel and Turkey.

But amid the Arab Spring uprisings of 2011, the Obama administration saw an opportunity to topple Syrian dictator Bashar al-Assad — long a goal of Washington’s allies Israel and Turkey.

And if that meant fighting on the same side as the people who attacked the United States on Sept. 11, 2001… the Obama crew felt that was a price worth paying. Yes, they’re head-chopping jihadis but they can be OUR head-chopping jihadis.

“AQ [al-Qaida] is on our side in Syria,” said a memo from Jake Sullivan to his boss, Secretary of State Hillary Clinton. That’s the same Jake Sullivan who’s Joe Biden’s national security adviser. (We have WikiLeaks to thank for the fact this sordid bit of history is public.)

The war had settled down to a dull roar the last three years or so — until Julani launched an offensive late last month and Assad’s army turned tail.

Yesterday Julani delivered a victory speech at the biggest mosque in Damascus — and declared Sharia law. Syria’s Christian community, about 10% of the population, is looking to get the hell out.

But for the Beltway crew, it’s all good. Julani is already promising to get along with Israel — which has moved quickly to seize a chunk of Syrian territory for itself. Turkey is doing likewise.

To be sure, pipeline politics are at work here — as they often are in that part of the world.

To be sure, pipeline politics are at work here — as they often are in that part of the world.

Specifically it’s about how to get bountiful natural gas from the Persian Gulf to Europe. As you can see from the map, Washington and Moscow are backing competing pipeline projects that pass through Syria. Syria under Assad was tight with Moscow for many years.

But there’s no guarantee the Washington-backed project will come to fruition. That’s because it’s not just Julani’s faction versus Assad’s in Syria; it’s a messy multisided civil war in which other head-chopping jihadis not aligned with Julani will want a say. ISIS, for instance — they’re still around — could easily stage attacks on pipeline sites.

Indeed Syria might well descend into the disaster that Libya has been ever since Obama overthrew Muammar Gaddafi in 2011 — though, hopefully, without open-air slave markets.

Assad’s ouster also potentially sets the stage for a new phase of the conflict between Washington and Moscow.

Assad’s ouster also potentially sets the stage for a new phase of the conflict between Washington and Moscow.

Maybe Donald Trump will wind down Washington’s proxy war against Moscow in Ukraine — but the locus could easily shift to the Middle East.

It was sobering to listen to historian Michael Vlahos interviewed last night on John Batchelor’s syndicated radio show.

Vlahos sees an analogy between the present moment and the run-up to World War I: Large powers like Russia and Germany blundered into circumstances in which they found themselves at the mercy of small client states (Serbia for Russia, Bulgaria for Germany).

“If you look at the situation today,” Vlahos says, “the U.S. seems to have benefited from the collapse of Syria, which was always part of its policy. But it is at the mercy of Turkey and Israel, who have enormously reckless expansionist goals.”

Those goals “will of necessity I think bring Israel and Iran into conflict — and potentially Turkey as well — in a way that Russia will have to respond to. And it begins to look like 1914…”

We’ll leave it there today. We’re sure there will be follow-on developments to pull apart in the days and weeks ahead…

![]() Stocks Basking in Crypto’s Glow

Stocks Basking in Crypto’s Glow

The stock market is basking in crypto’s glow, according to Paradigm’s income-investing pro Zach Scheidt.

The stock market is basking in crypto’s glow, according to Paradigm’s income-investing pro Zach Scheidt.

Bitcoin’s rise to $100K “shows there is a lot of enthusiasm or ‘animal spirits’ in the overall market,” says Zach — as investors big and small shift out of defensive plays and are willing to put capital to work in more risky plays, like crypto, tech and AI.

“In other words, crypto’s rise is a good thing for the overall bull market and indicates the trend is likely to continue, at least for the next couple of months or until something unexpected reverses the bullish sentiment in play.

“Indeed, the Nasdaq and the S&P 500 just hit record highs and I expect we’ll see the indexes shoot even higher in the coming weeks and months.”

That said, the major indexes are taking a breather as the new week begins.

That said, the major indexes are taking a breather as the new week begins.

At last check, the Dow is ruler-flat… the S&P 500 is down about a third of a percent… and the Nasdaq is likewise down more than a third of a percent, back below 20,000.

All the indexes are holding up well even as AI darling Nvidia is down nearly 3% on the day — after news that China has opened an antitrust investigation of the company. It seems that’s how Beijing is reacting to Washington’s decision last week to slap more limits on the export of high-end chips to China.

The big economic number due this week is the official inflation report, due Wednesday.

![]() Comic Relief

Comic Relief

One more thing about Syria and Abu Mohammad al-Julani before we get to the mailbag…

One more thing about Syria and Abu Mohammad al-Julani before we get to the mailbag…

![]() Mailbag: A Different Kind of Health Insurance

Mailbag: A Different Kind of Health Insurance

On the subject of health insurance costs — made a hot topic by the murder of insurance executive Brian Thompson — a reader writes…

On the subject of health insurance costs — made a hot topic by the murder of insurance executive Brian Thompson — a reader writes…

“Marinate on this. If I have a bunch of car wrecks and tickets, my auto insurance goes up. Life insurers conduct an age verification and ‘background’ check on your health to determine the rate you pay for that life insurance policy.

“Soooo, why don't health insurers do the same… check my blood work every year, link my ‘workout monitor’ to track my exercise and request my grocery receipts to see my food choices? If I make healthy lifestyle choices, why do I have to pay the same as some overweight, alcohol-drinking, ultra-processed food-eating customer?

“I am a newsletter subscriber and LOVE all your content… yes, I also own crypto.”

Last, a brief note of general praise, which is always welcome…

Last, a brief note of general praise, which is always welcome…

“Always enjoy reading everything plus I get a free laugh, meaning you are a great writer and do enjoy all the great information, great sense of humor, and funny, that mostly the information is always useful and informative. Many thanks.”

Dave responds: My, my, thank you! Your note offsets the one from the individual who says my “comments and views are more often than not disgusting, offensive, one-sided and I don't want to be subjected to his opinions ever again.”

If only I knew what the proverbial “last straw” was, but she didn’t offer specifics. The mailbag in Thursday’s edition? Alas, it shall forever remain a mystery…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. There’s no doubt Trump’s election was the catalyst for Bitcoin’s latest rally — just as our James Altucher predicted in October.

Now James is anticipating a new crypto catalyst — one that Trump himself might not see coming. And it’s happening tomorrow.

“If this event plays out like I believe it will,” James says, “this could be even bigger than his election.”

Again, we’re talking about something happening in less than 24 hours.

If you didn’t heed James in October, now’s your second chance. And he says it might be your last chance – for reasons that will become clear when you click here.