Forget the Fed

![]() Snapback Odds Are Strong

Snapback Odds Are Strong

What if Wednesday’s mini-crash had nothing at all to do with the Federal Reserve?

What if Wednesday’s mini-crash had nothing at all to do with the Federal Reserve?

I know — sounds crazy, right?

But we kinda-sorta said as much yesterday in our initial attempt to peel the onion. Recall the four possibilities we said were in play…

- It took the Fed to make Wall Street wake up and realize inflation is not “contained”

- Wall Street is simply throwing a hissy fit because the Fed is taking away the proverbial punch bowl

- Wall Street is freaking out because it realizes the Fed doesn’t know what it’s doing

- Wall Street got too far out over its skis; if it weren’t the Fed, something else would have knocked down the stock market.

Paradigm trading pro and hedge fund veteran Enrique Abeyta is all-in on No. 4.

Paradigm trading pro and hedge fund veteran Enrique Abeyta is all-in on No. 4.

“Big moves like this rarely happen because of the news,” he says. “They happen when traders shift their positions — and that’s where opportunity lies for you.”

We’ll get to the opportunity soon enough. But first, let’s unpack that shifting-positions thing.

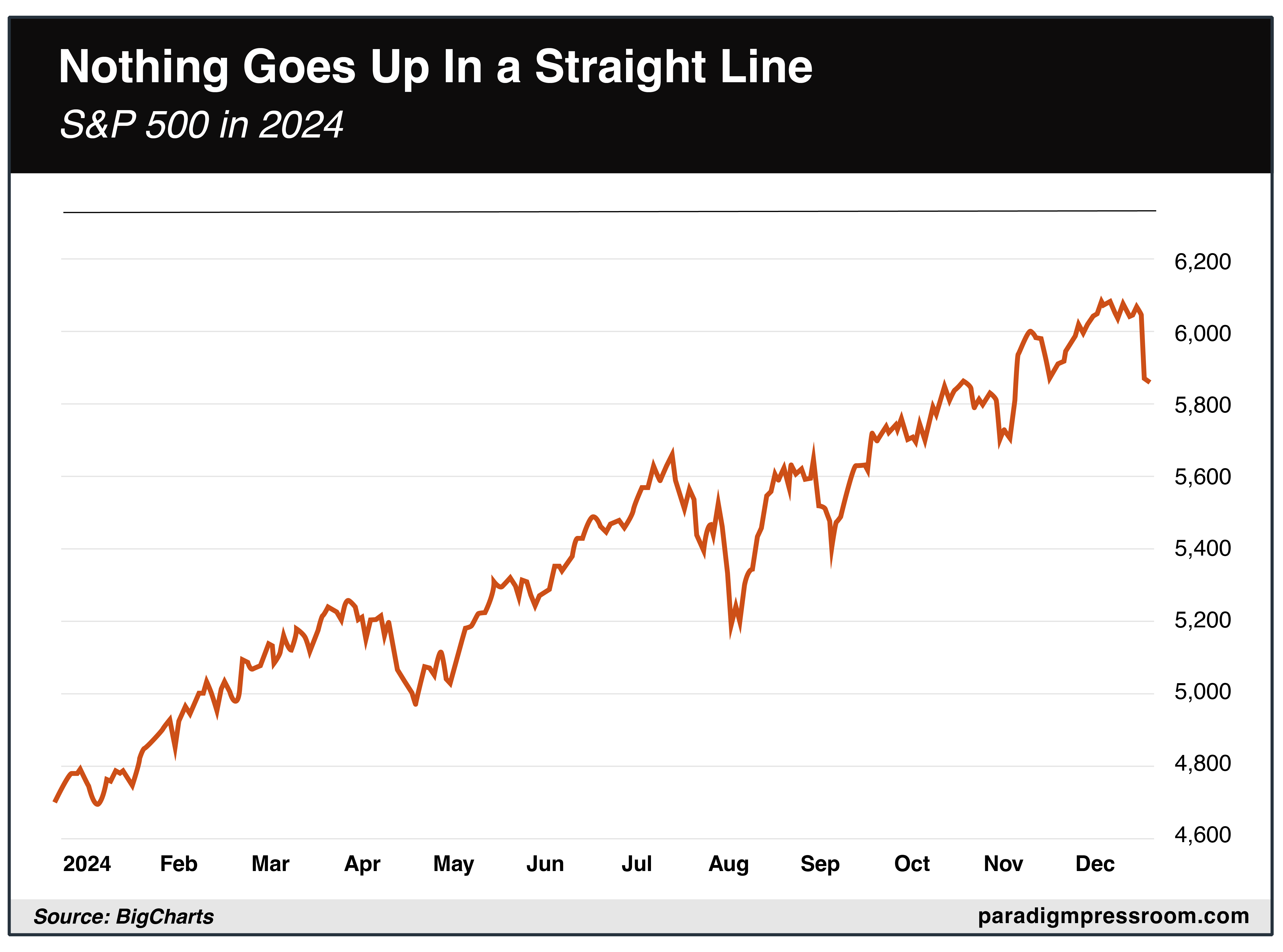

Even before Wednesday, December had already been a lousy month for the Dow Industrials and the equal-weighted S&P 500. That’s a version of the S&P in which all 500 stocks make up 0.25% of the index — as opposed to the usual top-heavy construction in which Apple makes up 7.6% of the index, Microsoft 6.5% and so on.

“Coming into December — and after the re-election of Donald Trump — the market had risen relentlessly for months,” Enrique writes in our sister e-letter Truth & Trends. “It was clear the stock market indices were very extended.”

For the “regular” S&P 500, it was up, up, up since a scare in early August — an episode widely attributed to another interest-rate shock, that time from the Bank of Japan.

“Going into Wednesday’s trading — even though most of the indices were down during December — the S&P 500 was very extended from its 50-day moving average.”

So that’s the backdrop. Now the opportunity…

“My experience has taught me that big drops like this usually snap back, especially this time of year,” Enrique continues.

“My experience has taught me that big drops like this usually snap back, especially this time of year,” Enrique continues.

“Remember that almost every professional money manager out there is up for the year. Many of them also are compensated based on their year-end performance.

“That doesn’t make any logical sense, but that’s how it’s done.

“This means they’re much more willing to buy stocks while they are down to support their positions. Especially on the back of the kind of ‘news’ we just got — an unimportant change in the bias of the Federal Reserve.”

But it’s not just the fact we’re approaching the end of the year. Any time the Dow Industrials have an extended stretch of losing days — the Dow broke its losing streak yesterday at 10 — the odds of a snapback are strong.

Enrique directs your attention to this table from the renowned Stock Trader’s Almanac, depicting all the episodes in which the Dow traded down at least nine days in a row. Yes, there are a lot of numbers here, but look at the bottom line in those last four columns…

Yep, after an extended losing streak there’s a better-than-70% probability that the Dow rallies in the next week and the next month. After three months, that probability rises to 82% — and the typical rally is nearly 6%.

“For many traders, this data might be surprising,” Enrique says — especially because, as he’ll readily concede, “the current selling pressure might feel terrible for most investors.

“But history tells us that being open to further upside is the best strategy. It’s a high-probability bet — and one that I think will pay off soon!”

[Editor’s note: If Enrique’s point of view resonates with you, you should know I just got word that he’s at the center of a major change we’re making here at Paradigm Press for 2025.

Please watch this one-minute video from our publisher Matt Insley explaining what’s going on – and what’s in it for you.]

![]() Snapback Underway Already…

Snapback Underway Already…

Indeed, the rebound might well be underway today — and not just in stocks.

Indeed, the rebound might well be underway today — and not just in stocks.

All the major U.S. stock indexes are solidly in the green — at last check, all up about 1.7%. The Dow is back above 43,000.

Bonds are rallying too, pushing yields down. The yield on a 10-year Treasury note is back to 4.51% after touching a seven-month high yesterday.

Precious metals are likewise showing signs of life — gold up $31 to $2.625 and silver up 43 cents to $29.42. It helps that the dollar is weakening relative to other major currencies, the U.S. Dollar Index back below 108.

Crude is not sharing in the rally, however. A barrel of West Texas Intermediate is back below $70.

And Bitcoin couldn’t hold onto $100,000. As we write, it’s $97,543.

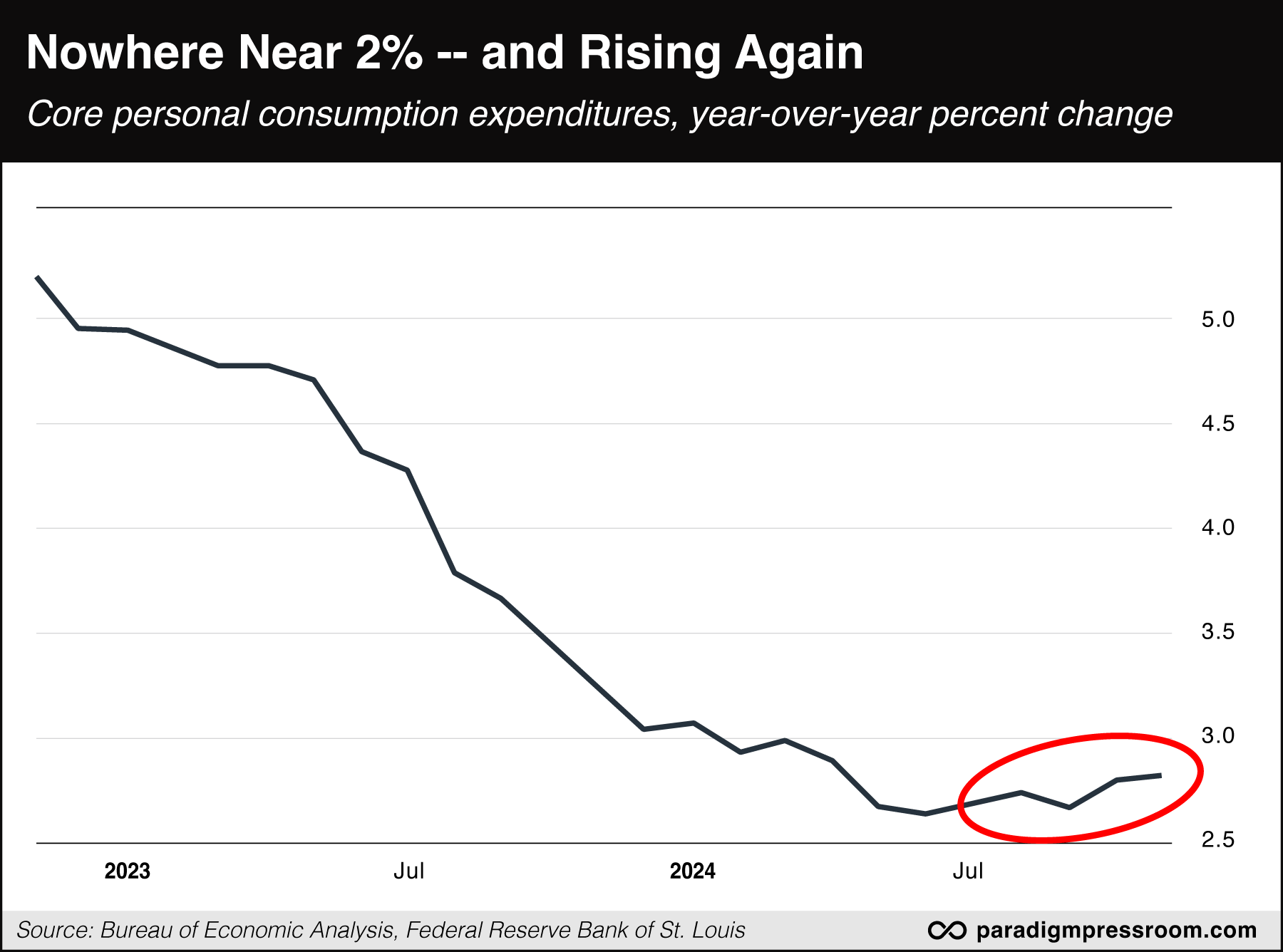

Behold, more evidence that inflation is proving to be “sticky.”

Behold, more evidence that inflation is proving to be “sticky.”

The Commerce Department is out this morning with “core PCE” — the Federal Reserve’s preferred measure of inflation. When Fed officials discuss their 2% inflation target, this is the number they have in mind.

Unfortunately, the number is nowhere near 2% — and at 2.8% it’s been moving higher four of the last five months…

If the Fed is looking for an excuse to “pause” its interest rate cuts, it’s here. Granted, there will be one more release of this number before the Fed’s next policy-setting meeting in late January.

![]() Less Than 12 Hours…

Less Than 12 Hours…

Wall Street certainly seems to have shaken off the threat of a “partial government shutdown” that came out of nowhere. But the threat lingers.

Wall Street certainly seems to have shaken off the threat of a “partial government shutdown” that came out of nowhere. But the threat lingers.

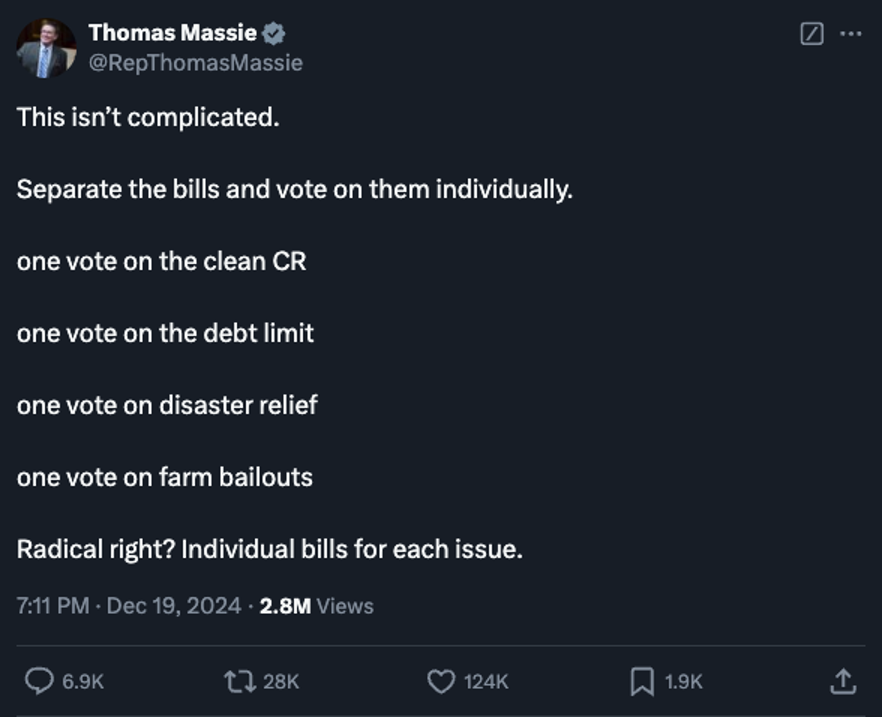

When we last left this saga yesterday, Donald Trump had deep-sixed an outrageous 1,547-page kitchen-sink “continuing resolution” that would have kept the government funded through mid-March — and averted a “partial government shutdown” effective midnight tonight.

So House Speaker Mike Johnson had to regroup. After cobbling together a 116-page alternative that met with Trump’s approval, it was put up for a vote late yesterday — and went down in flames, 174-235.

Only two Democrats voted for it — and 38 Republicans, mostly fiscal hawks, voted against it. Trump’s approval notwithstanding, it still smacked of business-as-usual.

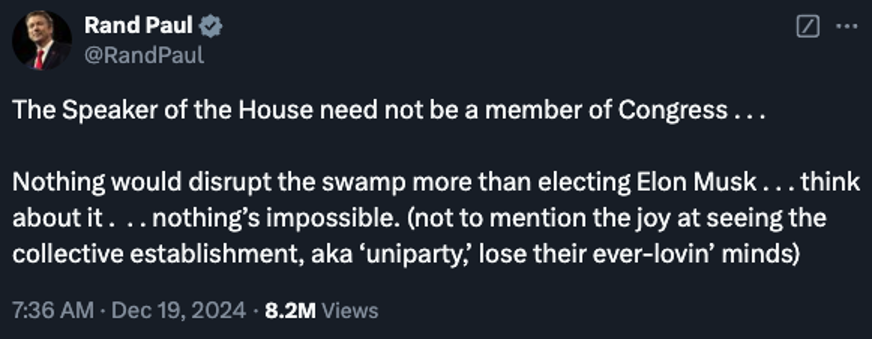

With the benefit of hindsight, it appears Trump was actually OK with the original monstrosity. It was Elon Musk who was not — and he marshaled his followers on X to raise hell with their congresscritters. Trump boarded a train that was already in motion.

At least that’s what Nick Catoggio reports at The Dispatch. “If I'm not mistaken, this is the first time since Trump took over the [Republican] party that some other populist has managed to impose his will on it.”

One member of Congress’ upper chamber is duly impressed…

Meanwhile, President Biden cut short a trip to Delaware so he could return to Washington – and Vice President Harris cancelled a trip to California.

Presumably all of that is to keep tabs on the situation — and for Harris to act as a tie-breaking vote in the Senate — but there’s no shortage of speculation, including from members of Congress, that a “25th Amendment moment” is nigh and Harris will occupy the Oval Office for a few weeks until January 20.

If that’s really what’s going down, don’t expect an announcement before the market closes today. Just sayin’…

![]() Follow-ups: Electricity Shortages, TikTok

Follow-ups: Electricity Shortages, TikTok

The following is one of our occasional reminders that the electric grid is still in dire shape.

The following is one of our occasional reminders that the electric grid is still in dire shape.

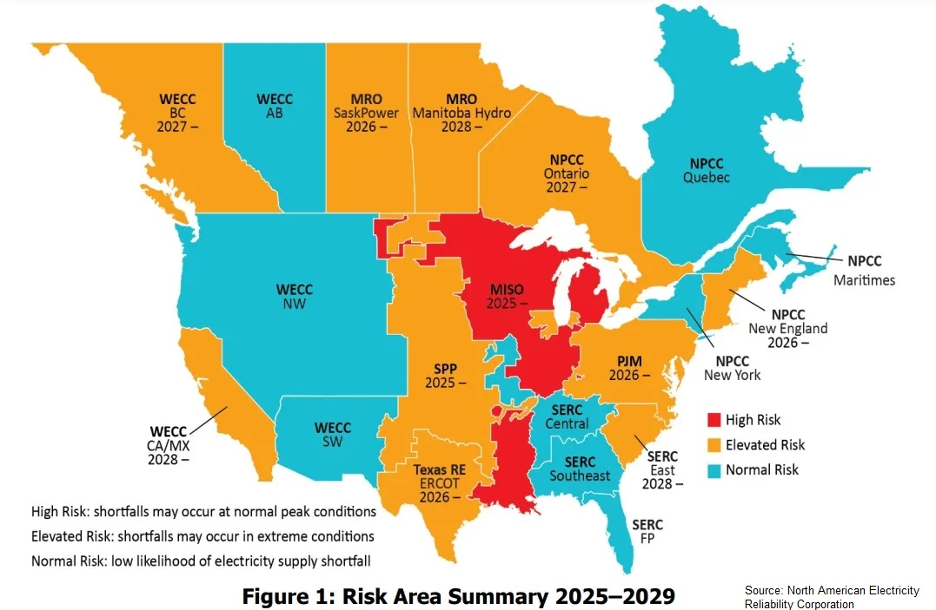

The North American Electricity Reliability Corporation is out with its annual “Long-Term Reliability Assessment” of the continent’s power grid.

“We’re seeing demand growth like we haven’t seen in decades,” says John Moura, NERC’s director of reliability assessment and planning — thanks in large part to the explosion of data centers processing AI. The buildout of new power plants simply isn’t keeping up with the closings of older coal and nuclear plants.

As has been the case in recent years, the area of the country at highest risk of planned blackouts during times of peak demand is the red area on the map. It’s served by the regional grid operator MISO and it stretches from the Upper Midwest to the Lower Mississippi River valley. This map comes straight from NERC’s report…

Orange areas are at lesser risk – but they’re not free and clear. That includes the grid operator PJM, whose service area stretches New Jersey west to Chicago. PJM was *this* close to imposing rolling blackouts during a Christmas Eve cold snap two years ago.

For the record: Under an impending death sentence, TikTok will make its case for a reprieve before the U.S. Supreme Court.

For the record: Under an impending death sentence, TikTok will make its case for a reprieve before the U.S. Supreme Court.

As we’ve chronicled since last spring, TikTok will be banned next month under legislation passed by Congress and signed by Joe Biden — assuming TikTok’s Chinese owners can’t line up an American buyer.

TikTok, along with some of its users, is challenging the constitutionality of the law. So far it’s had little success in the lower courts, but the Supreme Court has agreed to take the case. Oral arguments are set for Friday, January 10.

We won’t dwell on the matter today, seeing as we shared further background and our deep skepticism of Congress’ justifications for the law only a few days ago.

There’s only a nine-day gap between the time the high court hears the case and the time the law takes effect on January 19. The most likely outcome is that the Supreme Court puts the ban on hold long enough to send the case back to lower courts for further review.

![]() Does Anyone Really Know What Time It Is?

Does Anyone Really Know What Time It Is?

In case you missed it…

In case you missed it…

Hear, hear! The end of time change can’t come soon enough – and it shouldn’t be a partisan issue.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets