Four Reasons for Yesterday’s Dump

![]() The Fed Fouls the Punch Bowl

The Fed Fouls the Punch Bowl

Well, that was interesting.

Well, that was interesting.

There’s a saying on Wall Street about the Federal Reserve “taking away the punch bowl” — an alcoholic analogy for when the Fed does something to withdraw its monetary stimulus.

Yesterday Jerome Powell and crew didn’t take away the punch bowl as much as they deposited a turd in it.

Little did we suspect how foreboding our words would be in yesterday’s edition — when previewing the Fed’s every-six-weeks policy proclamation…

… there’s no drama about the decision itself: The benchmark fed funds rate will be cut another quarter percentage point to 4.5%.

But there might be a surprise included with the FOMC’s economic forecasts for next year — or during Powell’s press conference. With signs that inflation is accelerating, will he tamp down expectations for aggressive rate cuts in 2025?

The answer was yes. The Fed signaled only two more rate cuts next year — down from four back in September.

The answer was yes. The Fed signaled only two more rate cuts next year — down from four back in September.

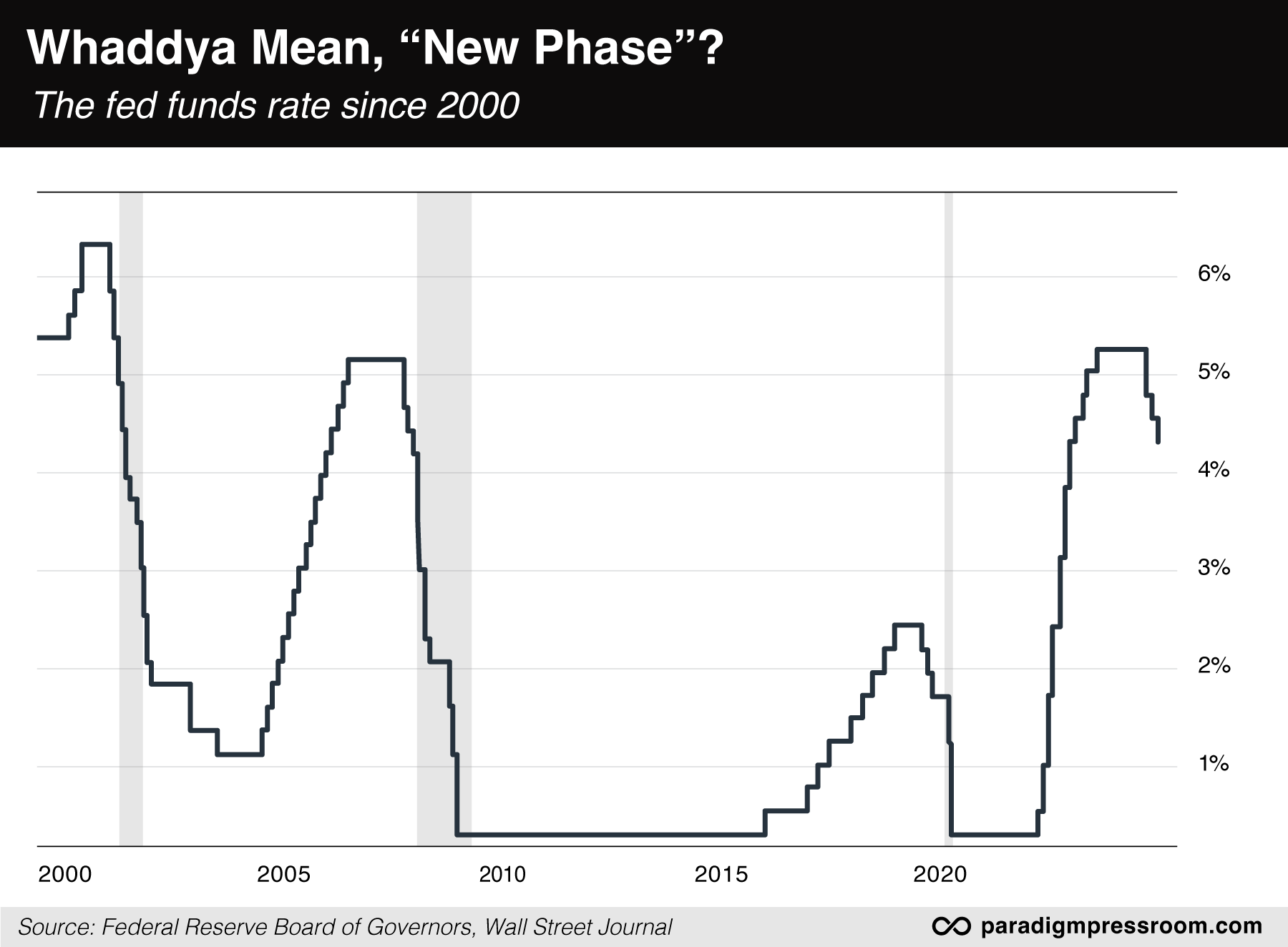

After cutting the benchmark fed funds rate from 5.5% to 4.5% over the last three months, Fed chair Jerome Powell said, “From here, it’s a new phase, and we’re going to be cautious about further cuts.”

With that, the Fed knocked the living snot out of every asset class except the dollar and (curiously) oil.

The Dow Jones Industrials have slid for 10 straight days now. The last time that happened was late September 1974 — when Gerald Ford was only a few weeks into his presidency and Barry White topped the charts with “Can’t Get Enough of Your Love, Babe.”

We’ll conduct a full damage assessment of the markets — and take a look ahead — in Bullet No. 2.

But first, let’s dive deeper into why Mr. Market reacted so badly to what the Fed did. There are four possibilities in play — and they’re not mutually exclusive.

No. 1: It took the Fed to make Wall Street wake up and realize inflation is not “contained.”

No. 1: It took the Fed to make Wall Street wake up and realize inflation is not “contained.”

Of course, we’ve been telling you for months that inflation isn’t yet under control. Even the official inflation rate is ticking higher again.

And forgive us for harping on the historical record once more, but the evidence is overwhelming: Once inflation sails beyond the 5% level as it did in 2021–22, it takes a decade or longer to get back to “normal” 2% inflation.

But to hear the mainstream tell it, it’s all about Trumpy-Trump-Trump.

The Financial Times says Powell “acknowledged that some [Fed] officials had begun to include assumptions about Donald Trump’s policies in their forecasts, a marked shift from his initial stance of avoiding speculation about what the next administration would do.

“Some economists fear that the president-elect’s plans for tariffs, mass deportations and tax cuts could lead to higher inflation, lower growth and more volatility, further complicating the Fed’s task of finding a ‘neutral’ rate that neither slows nor accelerates growth.”

That’s not altogether wrong — but it’s not the whole story. Again, inflationary forces are already at work that have nothing to do with Trump.

No. 2: Wall Street is simply throwing a hissy fit because the Fed is taking away the proverbial punch bowl.

No. 2: Wall Street is simply throwing a hissy fit because the Fed is taking away the proverbial punch bowl.

Wall Street has become addicted to the Fed’s EZ money ever since the 2008 financial crisis. Not coincidentally, stocks have been in a secular (long-term) bull market since March 2009.

Still, Wall Street has shaken off Fed disappointments before. Going into this year, the widespread expectation was the Fed would cut rates six times during 2024, starting in the spring. Instead the Fed waited until the fall and cut only four times — to be precise, one super-sized cut in September and two smaller cuts since.

That disappointment notwithstanding, the stock market marched higher all year without even a 10% correction. Even after yesterday’s drop, the S&P 500 is up 25% year-to-date.

No. 3: Wall Street is freaking out because it realizes the Fed doesn’t know what it’s doing.

No. 3: Wall Street is freaking out because it realizes the Fed doesn’t know what it’s doing.

This is your editor’s preferred explanation — but hey, I’m in the “End the Fed” crowd.

Hear me out, though: How can Jerome Powell breezily declare the Fed is entering a “new phase” when the previous one lasted only three months?

Looking at the history of the fed funds rate so far this century, slowing the rate-cut cycle now would be a huge anomaly…

Worse, slowing the rate-cut cycle now suggests that Powell and crew realize perhaps it was a mistake to start it in the first place.

This wouldn’t be the first time it’s dawned on Mr. Market that the Fed is neither omniscient nor infallible. Or that Fed leaders are simply making it up as they go along. But every time feels like the first time.

As Paradigm’s macro maven Jim Rickards sees it, the Fed is in reaction mode — waiting to see the job numbers and inflation numbers as the next rate decision looms in late January. Will the Fed pause in the face of resurgent inflation — or will it cut again because the job market is deteriorating, signaling an impending recession?

“This kind of data dependence is revealing,” says Jim, “because it shows the Fed is following markets and not leading them.

“That’s bad news for investors because if the Fed were leading the economy, they would get ahead of the coming recession. They’re not doing either.”

No. 4: Wall Street got too far out over its skis; if it weren’t the Fed, something else would have knocked down the stock market.

No. 4: Wall Street got too far out over its skis; if it weren’t the Fed, something else would have knocked down the stock market.

This comes back to something Paradigm chart hound Greg Guenthner mentioned in Monday’s edition: The market hasn’t had a 10% pullback since October 2023. That’s hardly unprecedented, but it is unusual.

When the market rises so relentlessly for so long, it becomes vulnerable to any negative catalyst. If it weren’t the Fed now, it would be a surprise job number or a bad earnings report from Nvidia later.

“We’ve been dealing with bad breadth and plenty of sneaky downside action for weeks,” Greg writes his Trading Desk readers this morning. “But Powell gave the herd what it wanted: an excuse to sell.”

So those are your four possibilities behind yesterday’s market dump. Again, they might have some overlap.

Now let’s move on to the damage assessment and see what might happen from here…

![]() The Numbers (and Some Perspective)

The Numbers (and Some Perspective)

Not surprisingly, the major stock averages are rebounding today. The Dow is on track to break that 10-day losing streak.

Not surprisingly, the major stock averages are rebounding today. The Dow is on track to break that 10-day losing streak.

That said, it’s not a robust rebound. The Dow lost 1,100 points yesterday and at last check has recovered only 161 of them. The S&P 500 is clambering its way back toward 5,900. The Nasdaq is back above 19,400.

Perspective: The S&P is more or less bouncing off its 50-day moving average. It’s only 3.2% below its all-time high set on Dec. 6, not even two weeks ago. A short-term bear market — meaning a 20% drop from the high — would put the S&P at 4,872. That number was an all-time high less than a year ago!

“I think it’s possible we do get a strong snapback into early January,” says the aforementioned Greg Guenthner. “From there… who knows? I’m going to stay as nimble as possible, riding whatever bounce we get, then reassessing during the middle of next month as the seasonality tailwinds begin to dry up.”

Beyond stocks, bonds also got clobbered yesterday, and that punishment is carrying into today — prices down, yields up. The yield on a 10-year Treasury note is up to 4.57%, the highest since Memorial Day.

Precious metals got the beat-down, too. The spot price of gold tumbled from $2,635 before the Fed announcement to nearly $2,580, then rebounded over $2,620 this morning. At last check, the bid is back to $2,594. Still, colleague Sean Ring at The Rude Awakening says that rebound is constructive and suggests an eventual rally back to record levels near $2,800.

Precious metals got the beat-down, too. The spot price of gold tumbled from $2,635 before the Fed announcement to nearly $2,580, then rebounded over $2,620 this morning. At last check, the bid is back to $2,594. Still, colleague Sean Ring at The Rude Awakening says that rebound is constructive and suggests an eventual rally back to record levels near $2,800.

Again, perspective — today’s price of $2,594 was a record high only three months ago!

Silver, unfortunately, isn’t demonstrating the same resilience — $30.30 pre-Fed, $28.82 now. Ouch.

Some of that weakness in precious metals can be chalked up to strength in the dollar relative to other major currencies: The U.S. dollar index has leaped to 108.26 — a level last seen in the autumn of 2022.

Bitcoin’s been knocked down to barely $100,000 — although that round number seems to be holding.

As mentioned above, crude was oddly resilient in the face of the Fed and the strong dollar: It’s still holding the line on $70 a barrel this morning. But that action might be meaningless long-term; oil is still smack in the midpoint of its trading range the last couple of months.

![]() Market Meltdown, Government Shutdown?

Market Meltdown, Government Shutdown?

Hard to say, but maybe the market’s rebound today would be stronger were it not for the sudden threat of a “partial government shutdown.”

Hard to say, but maybe the market’s rebound today would be stronger were it not for the sudden threat of a “partial government shutdown.”

Not that there’s anything wrong with that…

Ordinarily, the markets shake it off whenever this happens. But this time it came out of the blue.

With business scheduled to wrap up for the year tomorrow, Congress was on track to pass a “continuing resolution” funding the government through mid-March.

A “CR” is what congresscriters do these days in lieu of passing an honest-to-God budget — keeping spending on autopilot while throwing in “a variety of unrelated legislation they want to clear in the final days of the current session of Congress,” as Politico puts it.

Sure, a few Freedom Caucus Republicans squawk about this “Christmas tree” bill — this year’s model ran to 1,547 pages — but the business-as-usual crowd in both parties was set to pass it to avoid a partial shutdown on Saturday.

And then, after the markets closed yesterday afternoon, Donald Trump blew the whole thing up.

And then, after the markets closed yesterday afternoon, Donald Trump blew the whole thing up.

“We should pass a streamlined spending bill,” he said. “The only way to do that is with a temporary funding bill WITHOUT DEMOCRAT GIVEAWAYS combined with an increase in the debt ceiling.”

Even before Trump’s statement, Elon Musk was badgering congress members on X to reject the CR.

“Trump and Musk Unleash a New Kind of Chaos In Washington,” says the oh-so-predictable CNN headline.

We’re not really sure what Trump wants to see in this bill — for that matter, he’s probably not sure himself — but it’s fun to watch him give ulcers to all the usual suspects including House Speaker Mike Johnson, who promised to end this sort of nonsense when he won the job.

![]() Tax Relief for Americans Overseas?

Tax Relief for Americans Overseas?

When the new Congress convenes next year, one agenda item might be tax relief for Americans overseas.

When the new Congress convenes next year, one agenda item might be tax relief for Americans overseas.

As we mention now and then, the United States is one of only two countries on the face of the Earth that taxes your income no matter where you earned it. (The other is the northern African state of Eritrea.)

The result is that oftentimes, American expats pay taxes to two countries — the one where they’re living, and the United States.

The burden is especially outrageous for “accidental Americans” who happened to be born in this country while their parents were here for a visit or a temporary work assignment.

The only way you can get out from under this obligation is to give up your U.S. citizenship. About 4,000 Americans have done so this year alone. (The aforementioned Sean Ring did so back in 2011; he holds Italian and U.K. citizenship now.)

On the campaign trail this fall, Donald Trump promised to remedy this injustice. And a member of the tax-writing House Ways and Means Committee is working up legislation to make it happen.

“There’s fundamental unfairness in the way this is currently done,” Rep. Darin LaHood tells The Wall Street Journal — “so it’s exposing that, reminding people this is being done and letting people know there’s a clear remedy.”

We hope the legislation passes — but real relief won’t come until there’s an overhaul or repeal of the Foreign Account Tax Compliance Act of 2010. After passage of FATCA, many foreign banks closed the accounts of their U.S. customers; compliance with IRS reporting requirements was just too onerous.

![]() Final Thoughts

Final Thoughts

In light of the day’s news, we conclude with an oldie but goodie…

In light of the day’s news, we conclude with an oldie but goodie…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets