How to Trade Election Results

![]() A Trader’s “Incredible” Superpower

A Trader’s “Incredible” Superpower

“The longer I trade, the less inclined I am to pay any mind to the talking heads on TV,” says Greg Guenthner, Paradigm’s trading expert, who offers actionable insight into the world of investing and market analysis.

“The longer I trade, the less inclined I am to pay any mind to the talking heads on TV,” says Greg Guenthner, Paradigm’s trading expert, who offers actionable insight into the world of investing and market analysis.

His philosophy extends to politics as well, with Greg avoiding, ahem, speculating on election outcomes. Likewise, he underscores the importance of focusing on real-time market information rather than relying on predictions or external opinions.

“Most investors rely too heavily on predictions and guesswork instead of simply weighing actual evidence they can gather in the market right now,” he explains.

Focusing on predictions, meanwhile, distracts investors from understanding the current market forces affecting their investments.

Focusing on predictions, meanwhile, distracts investors from understanding the current market forces affecting their investments.

“No rigorous analysis of the markets can glimpse the future. But that doesn't make it worthless! In fact, today's price holds incredible power,” Greg says.

“How the price of a stock reacts (or fails to react) to news, earnings or any other event is some of the most valuable information you'll ever receive,” he adds.

“Here’s what will change when you finally admit that your predictions are worthless and you begin to use actual, real-time information to inform your decisions…

“Here’s what will change when you finally admit that your predictions are worthless and you begin to use actual, real-time information to inform your decisions…

- You’ll avoid buying stocks in downtrends: “When you finally figure out you have no clue when a stock is going to stop going down, you'll quit guessing and just wait for the price to begin to recover,” Greg says.

- You’ll be cautious with earnings gambles: “I actually put on some of my best trades after earnings are released when I have a clearer picture as to where the stock is trending.”

- You’ll embrace trends: “Some investors insist on fighting the markets,” says Greg. “Sure, you might find a needle in a haystack. But most of the time, the trend will win. Don't fight it!”

Regarding how to trade the election results? Greg advises patience…

“It will be tempting to start mapping out how the next four years will affect the investing landscape. My best advice: Just wait,” he says.

“It will be tempting to start mapping out how the next four years will affect the investing landscape. My best advice: Just wait,” he says.

Two words. Simple, but not always easy!

He reminds traders (and investors) of the market's unexpected reaction to Donald Trump's 2016 victory — where initial drops in futures were followed by substantial gains.

“Give it some time,” Greg repeats. Learning to ignore outside opinions is a major trading hurdle that everyone in this business has to eventually scale.

“Once you develop some consistency in your trading style, you’ll find you aren’t as interested in interacting with the media noise machine,” he concludes. Instead, the market “will reveal everything you need to know.”

[Our customer service team just added a $511 credit to your account. And we want to make sure you don’t miss this opportunity.

Take a moment to explore this offer and discover how to apply your credit to one of our most profitable research services — immediately.

![]() The Fed’s Dual Mandate

The Fed’s Dual Mandate

“The seventh FOMC meeting of 2024 has arrived, and we are here for a complete analysis of what it means for markets and your money,” says Paradigm’s macro authority Jim Rickards.

“The seventh FOMC meeting of 2024 has arrived, and we are here for a complete analysis of what it means for markets and your money,” says Paradigm’s macro authority Jim Rickards.

Following a 0.50% rate cut in September, Jim forecasts that the Fed will cut interest rates by 0.25% today, bringing the federal funds target rate to 4.75%. Plus, Jim anticipates another 0.25% cut at the FOMC’s December meeting.

He notes the Fed's measured approach signals: What's the hurry? “A 0.50% rate cut can always be rolled out at some future meeting if needed,” says Jim.

“A 0.25% rate cut tomorrow and in December will have the desired effect, at least in the Fed’s eyes, without appearing too political or too panicked.

“Powell’s continuation of the rate cut path is rooted in the Fed’s so-called ‘dual mandate,’” Jim notes. Namely? Price stability and unemployment.

“Powell’s continuation of the rate cut path is rooted in the Fed’s so-called ‘dual mandate,’” Jim notes. Namely? Price stability and unemployment.

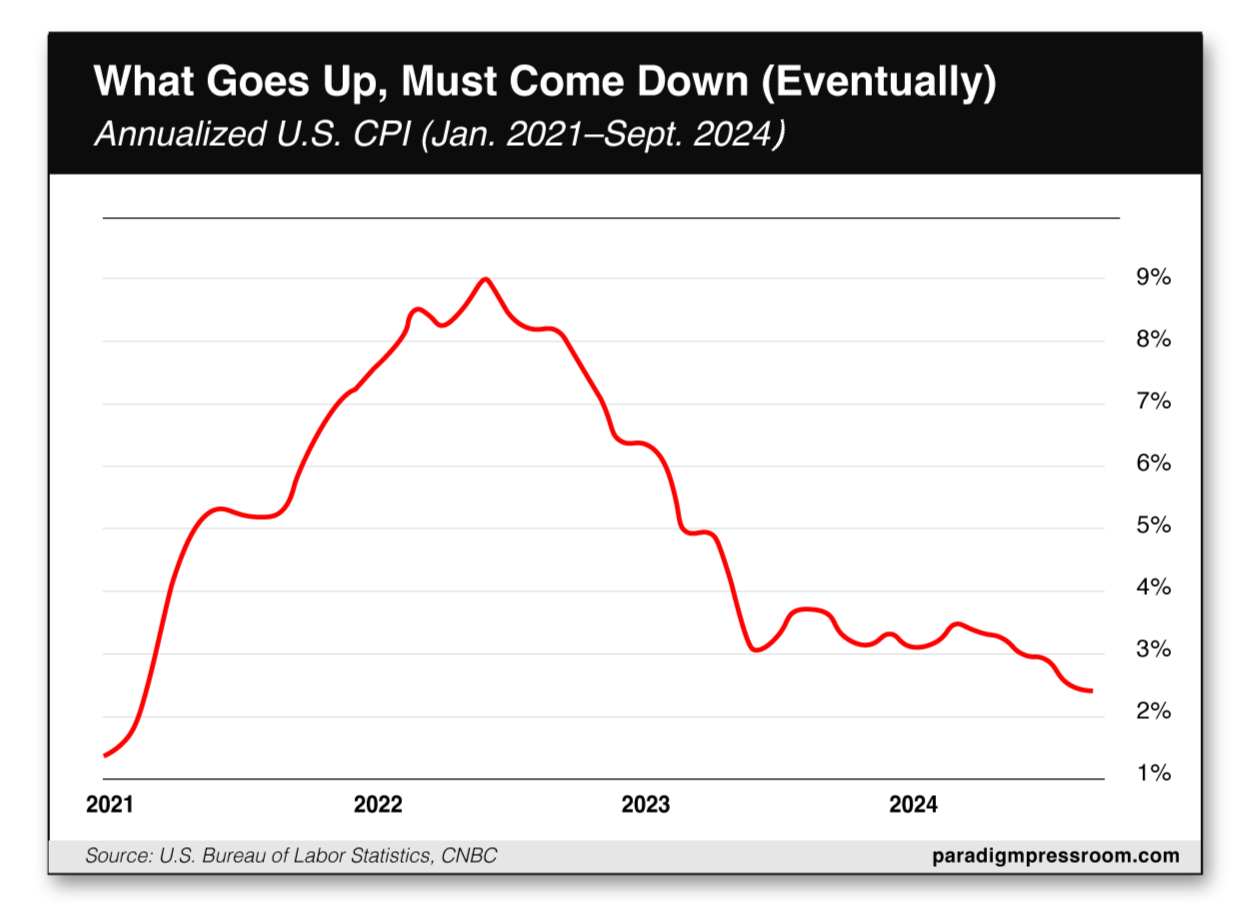

As for the first half of the Fed’s mandate: “Inflation news has been positive in recent months,” Jim says. “Here’s the tale of inflation [using] the Consumer Price Index on a year-over-year basis…

“With inflation under control [at 2.4%], Powell and the Fed have not only pivoted from rate hikes to rate cuts, they have also pivoted from concern about inflation to concern about jobs,” Jim says.

The most recent employment data shows overall job growth has stalled, with the private sector actually losing jobs. Plus, previous months’ job figures have been revised downward substantially..

The Fed is trying to address this issue with interest rate cuts. However, there's a sense that the Fed may be reacting too slowly to this economic warning sign.

“At this point,” Jim says, “it is clear the Fed will cut rates at its Dec. 18 meeting and is likely to cut rates at its early 2025 meetings as well.”

As for Trump's victory, it won't immediately change how the Federal Reserve makes decisions. Nevertheless, “there will be implications in terms of Jay Powell’s tenure as chair and appointments to the board of governors to fill vacancies.”

Jim adds, “For now, it’s steady as she goes.”

The market continues to hold up well in this post-election environment. Of the three major stock indexes, the Nasdaq is faring best: up 1.30% to 19,235. Meanwhile, the S&P 500 is up 0.65%, just a hair below 6,000. The Big Board is up 0.10% to 43,765.

The market continues to hold up well in this post-election environment. Of the three major stock indexes, the Nasdaq is faring best: up 1.30% to 19,235. Meanwhile, the S&P 500 is up 0.65%, just a hair below 6,000. The Big Board is up 0.10% to 43,765.

The price of oil today is up 0.65% to $72.23 for a barrel of West Texas Intermediate. And precious metals have rebounded. Gold is up 1% to $2,705.60 per ounce, and silver is up 1.65% to $31.85.

At the same time, crypto continues to rock ’n’ roll with Bitcoin breaking into record territory at $76,350. As for Ethereum, the crypto is up 6.75% to $2,865.

![]() Two Winners, One Loser (Lower Interest Rates)

Two Winners, One Loser (Lower Interest Rates)

“Rate cuts will benefit certain companies while putting pressure on others that will find it more difficult to operate in this environment,” says Paradigm’s retirement-and-income specialist Zach Scheidt, adding to Jim Rickards’ assessment above.

“Rate cuts will benefit certain companies while putting pressure on others that will find it more difficult to operate in this environment,” says Paradigm’s retirement-and-income specialist Zach Scheidt, adding to Jim Rickards’ assessment above.

“On the winning side,” Zach says, “one area that I like a lot is utilities. With lower interest rates,” for instance, “utility companies [can] borrow money to build more power plants and other big infrastructure projects that help provide power to AI and other high-tech data centers.”

Plus, growing profits could mean growing dividends for utility stocks “as the lower rates help generate more business.”

Then there’s the consumer staples sector: “Lower rates tend to decrease the value of the U.S. dollar compared to other currencies,” Zach explains.

“When the dollar’s relative value falls, companies with large international businesses can generate higher profits from overseas markets [as] profits made in stronger currencies are exchanged into more ‘weak’ U.S. dollars,” he notes.

“On the other side of the equation, consumer lending companies tend to do poorly when interest rates fall, because they can't charge exorbitant interest rates when lending,” Zach says.

“On the other side of the equation, consumer lending companies tend to do poorly when interest rates fall, because they can't charge exorbitant interest rates when lending,” Zach says.

“One company in this category to avoid is Ally Financial Inc. (ALLY),” he says. Because of interest-rate cuts, “each new loan the company offers will be a little bit less profitable for Ally.

“Ally has already extended loans to struggling consumers, especially auto loans, which are starting to run into trouble. We're [seeing] more delinquencies and defaults, which will hurt Ally's underlying business,” Zach says.

“We sold this position from our portfolio last year,” he notes. “If you held on, waiting for the stock to recover, you don't want to wait any longer.”

Zach key takeaway: “Simply because interest rates are going lower, we're going to be in a different trading environment, a trend that will continue for some time,” he says.

![]() A Victory Lap for Legacy Automakers

A Victory Lap for Legacy Automakers

Jim Rickards’ chief analyst Dan Amoss explores one upshot of Trump’s reelection: “Companies can make cars that customers want” by phasing out Corporate Average Fuel Economy standards (aka CAFE).

Jim Rickards’ chief analyst Dan Amoss explores one upshot of Trump’s reelection: “Companies can make cars that customers want” by phasing out Corporate Average Fuel Economy standards (aka CAFE).

Introduced in 1975, CAFE standards require automakers to meet specific fuel-efficiency targets for their vehicle. Initially set at 18 mpg for passenger cars in 1978, the standards gradually increased to 27.5 mpg by 1985. After decades of minimal changes, recent updates aim to significantly improve fuel economy, targeting 55 mpg by 2026.

Dan notes that manufacturing a car according to current standards adds around $5,000–10,000 to a vehicle’s sticker price. Repealing CAFE standards could reduce costs, increasing consumer demand and automakers’ profits.

“Several Wall Street analysts have speculated legacy automakers — specifically the ‘Detroit’ [companies] — would be the biggest winners of a second Trump term and Republican control of Congress,” CNBC says.

“The current environmental regime would pressure the core business of legacy [automakers, trucks,] to decarbonize by the end of the decade while shifting quickly to an EV portfolio,” says BoA analyst John Murphy. “We see F and GM as the main beneficiaries from the Trump administration.”

Dan adds: “General Motors Co. (GM) and Ford Motor Co. (F) trade at four or five times earnings. But if investors get more confident in their cash flows, they could get a valuation uplift.”

![]() Pubs, Pints and Pennies

Pubs, Pints and Pennies

At the Flying Duck Pub in Ilkley, England, patrons can now help themselves to a shiny new penny after every pint. Sorta like a reverse tip…

At the Flying Duck Pub in Ilkley, England, patrons can now help themselves to a shiny new penny after every pint. Sorta like a reverse tip…

This in protest to the U.K.’s Chancellor of the Exchequer Rachel Reeves cutting the draft-beer duty by a single penny. Among pub keepers, the cut’s been labeled nothing short of “insulting.”

“I don't think consumers are necessarily going to see that penny directly, but we are putting an honesty box at the bar where people can help themselves to a penny after every pint they buy,” says the Flying Duck’s manager Kyle Hamilton.

“A lot of pubs are struggling as it is,” he expresses. “With [the] cost-of-living crisis, pubs are one of the big ones that are taking a massive hit.”

The penny-per-pint reduction? “It's a very nominal effect.” I’d say so…

Here's the kicker: While the duty on draft beer has been reduced, other alcohol duties are set to rise. Starting in February, non-draft drinks including wine and spirits will see their taxes increase; meaning, while you’ll save a penny on your lager, your G&T will cost you more.

This is part of a broader budget strategy in the U.K. aimed at stabilizing public finances. But it seems to overlook the struggles faced by pubs already grappling with rising costs.

To add to the complexity, there's an increase in employers' National Insurance contributions from 13.8% to 15% on an employee’s earnings above £175 starting in April.

And the BBC says: “The threshold at which employers start paying the tax on each employee's salary will be reduced from £9,100 per year to £5,000.”

So we’re raising a pint today to this historic English pub… Here’s to the Flying Duck’s longevity! Despite onerous taxes.

Take care! We’ll be back on Friday…

Best regards,

Emily Clancy

Paradigm Pressroom’s 5 Bullets