The “47” Investment Playbook

![]() “Trumping” the Stock Market

“Trumping” the Stock Market

“It’s not too soon to start building a portfolio that will outperform the stock market in the early years of the new Trump administration,” says Paradigm’s macroeconomics maven Jim Rickards.

“It’s not too soon to start building a portfolio that will outperform the stock market in the early years of the new Trump administration,” says Paradigm’s macroeconomics maven Jim Rickards.

In yesterday’s edition, we invited our crypto-and-AI authority James Altucher to share his investment outlook for the Trump 47 presidency. Today it’s Jim’s turn.

While the broad market rallied hard in the week following Election Day, Jim cautions that “not all stocks will perform well under the new administration” — while “some will perform brilliantly.”

While you hear a lot of media chatter about Trump’s plans for tariffs, Jim sees the tariff agenda within the broader sweep of American history.

While you hear a lot of media chatter about Trump’s plans for tariffs, Jim sees the tariff agenda within the broader sweep of American history.

“Trump will pursue a 21st-century version of what was originally known as the American System,” he tells us.

The American System’s roots go all the way back to the nation’s first Treasury secretary, Alexander Hamilton. The name itself was coined by leading statesmen from the first half of the 19th century like the Kentuckian Henry Clay.

“The American System,” says Jim, “relied on the following policies:

- “High tariffs to support manufacturing and high-paying jobs

- “Infrastructure investment (public and private) to support productivity

- “A strong army and navy to protect the U.S. but not to fight foreign wars

- “A central bank with limited powers to provide liquidity to commerce

“To the extent there was government spending, it was for productive projects such as canal and road building and later to support railroads. To the extent that early central banks existed, they were for secure lending to sound entities (including the U.S. government) and not for purposes such as printing money, fixing interest rates or ‘stimulus.’

“The entire program could be summarized as sound money, smart investment and a strong military in the service of high-paying American jobs.”

Key to the 21st-century version of the American System is a proposition that Jim sums up like this: “Foreign companies will be free to sell goods to Americans but only if they are manufactured in the U.S.”

Key to the 21st-century version of the American System is a proposition that Jim sums up like this: “Foreign companies will be free to sell goods to Americans but only if they are manufactured in the U.S.”

So… Which sectors stand to prosper under this agenda? Jim offers the following shopping list…

- Oil and natural gas drilling, production and refining. “This sector will benefit from Trump’s ‘drill, baby, drill’ policies,” Jim says — “including increased leasing on federal lands, increased offshore drilling, replenishment of the Strategic Petroleum Reserve, new pipelines and expanded refinery capacity”

- Mining (gold, silver, copper, lithium). “Industrial metals will be in increased demand related to the expansion of U.S. manufacturing. Precious metals will be in demand as a hedge against geopolitical uncertainty and as a non-digital store of wealth”

- Defense and national security. Here, Jim says the edge will go to defense and intelligence contractors with extensive research-and-development programs and not the developers of costly boondoggles

- Auto manufacturing. “Foreign manufacturers will face huge tariffs,” Jim says

- Cryptocurrency plays. “Trump will ease SEC and other regulatory constraints on cryptocurrency mining, distribution and use” [We’ll come back to this one….]

- Banking and finance. “As the economy grows, banks profit as intermediaries without the need for high leverage and high risk”

- Trucking and airlines. Jim says they’ll benefit from lower prices for diesel and jet fuel.

Sectors to avoid? Jim is sour on Big Pharma and Big Food, given the potential influence of Robert F. Kennedy Jr. in the administration.

And Jim expects Elon Musk’s Department of Government Efficiency could be a drag on government-dependent sectors like health care and green energy.

It’s early days. We’ll stay on top of all these themes in the weeks and months ahead. But in the meantime, we direct your attention to the “Trump bump” in crypto — with Bitcoin breaking through $90,000 only yesterday.

The Paradigm crypto team of James Altucher and Chris Campbell have assembled a “Curated Crypto Kit.”

“It’s part of a giveaway offer,” says Chris — “and contains several items we feel could prove invaluable during the next crypto boom.” With the boom now underway, Chris says it will help “grow your wealth in the coming election melt-up.”

Only a few hundred of these boxes are available today: Click here to learn how to claim yours.

![]() Gold: How Low Can It Go?

Gold: How Low Can It Go?

“No sugarcoating it: Gold has entered into what I hope is a short-term bear market,” writes colleague Sean Ring, “with its price well below the 50-day moving average.”

“No sugarcoating it: Gold has entered into what I hope is a short-term bear market,” writes colleague Sean Ring, “with its price well below the 50-day moving average.”

As it turns out, “This is nearly the pattern followed in 2016 when Trump was elected for the first time.”

We sprinkled occasional warnings in these daily missives — that the run to nearly $2,800 in late October was too far, too fast. Especially since neither silver nor the mining stocks were keeping pace.

Sure enough, gold has been in a Trump slump, breaking below $2,600 yesterday — a level that until mid-September marked an all-time high!

“I suspect it will find its footing between $2,480 and $2,400, though the descent could stop at any point,” Sean writes in this morning’s Rude Awakening.

“I’m still long the miners, with all their accompanying pain. One could say that I have a ‘shorn ring.’ With that said, I still love gold’s long-term story, so I’ll stay positioned this way. The yellow metal needed a respite, and it's getting one.

“However, we'll see a swift recovery once The Donald’s fiscal plans are announced.”

Old friend Chuck Butler, still holding forth at his venerable Daily Pfennig e-letter, concurs: “Do not panic sell here!

“If anything, use all this selling to buy at cheaper levels.... With inflation on the rise again, this will get gold going again... Will you look to buy at these cheaper levels, or will you procrastinate and buy once gold is back to $2,700 and beyond?”

For the moment, gold has stabilized at $2,576 — and while silver dipped below $30 overnight, it’s back to $30.44 now. Elsewhere in the commodity complex, crude is quiet at $68.56

For the moment, gold has stabilized at $2,576 — and while silver dipped below $30 overnight, it’s back to $30.44 now. Elsewhere in the commodity complex, crude is quiet at $68.56

Meanwhile, at last check the major U.S. stock indexes have barely budged from yesterday’s closes, the S&P 500 at 5,983.

Signs of stress remain in the Treasury market, but for the moment the yield on a 10-year note has eased off yesterday’s highest-since-early-July level of 4.45%.

After cracking through the $90,000 barrier yesterday, Bitcoin is back under $89,000.

The big economic number of the day is the producer price index: Wholesale inflation is running 2.4% year-over-year — up from 1.9% a month earlier. So like the consumer inflation numbers released yesterday, inflation at the wholesale level is moving in the wrong direction.

And speaking of yesterday’s release: The official inflation rate of 2.6% would be substantially higher were it not for falling gasoline and diesel prices. (The AAA national average for regular unleaded this morning is $3.08 — down from $3.35 a year ago.)

Scads of other things you need for day-to-day living — shelter, electricity, vehicles, health care and auto insurance — continue galloping higher.

![]() Follow-Ups

Follow-Ups

For the record: The revival of a dockworker strike is in view.

For the record: The revival of a dockworker strike is in view.

As you’ll recall, East Coast and Gulf Coast longshoremen walked off the job on Oct. 1 — only to return 72 hours later.

The International Longshoremen’s Association reached agreement with the U.S. Maritime Alliance when it comes to pay — but the strike was merely suspended while the two sides continued to thrash out other issues.

Well, those talks broke off yesterday — with the union decrying a “renewed attempt to eliminate jobs with automation.”

There are still two months for the two sides to come to terms. But if they don’t, 45,000 workers will walk again on Jan. 15.

Reminder: Shipping and logistics experts say a strike lasting longer than a week could foul up supply chains for months — with downstream effects worse than COVID because the problem this time would not be higher demand but constrained supply.

Also for the record: Small-business sentiment ticked up before the election.

Also for the record: Small-business sentiment ticked up before the election.

The monthly Optimism Index from the National Federation of Independent Business came out this week — jumping 2.2 points to 93.7, the strongest reading since early 2022.

Seeing as the survey was conducted before the election, the “uncertainty” portion of the index leaped from a record of 103 to another record of 110. (Here, higher numbers are bad.)

Look for that uncertainty figure to plunge next month. And given the NFIB’s Republican-skewing membership, the headline number will likely soar — as it did after Trump’s win in 2016.

![]() Bureaucracy Gone Wild, Butter Edition

Bureaucracy Gone Wild, Butter Edition

Here’s some federal idiocy that perhaps Elon Musk and Robert F. Kennedy Jr. could nip in the bud.

Here’s some federal idiocy that perhaps Elon Musk and Robert F. Kennedy Jr. could nip in the bud.

Costco is recalling nearly 80,000 pounds of butter because — get this — the labels lack the words “Contains Milk.”

It’s right there on the FDA website: “Butter lists cream, but may be missing the Contains Milk statement.”

“Affected products,” according to the Metro website, “included 32,400 pounds or 900 cases of Kirkland Signature Salted Sweet Cream Butter and 46,800 pounds or 1,300 cases of Kirkland Signature Unsalted Sweet Cream Butter.”

You can’t make this stuff up. Right? We’re not talking about a missing “processed in a facility that also processes peanuts” label, after all.

“Many social media users mocked the butter recall,” says Metro, “for being about an obvious ingredient.”

It’s interesting to contemplate: How many people are unaware that a dairy product contains milk?

And how many would be subject to adverse effects from said dairy product?

And is there any reason that we as a society couldn’t collectively agree that the lack of such a label might have the salutary effect of, shall we say, thinning the herd?

![]() “Give the Guy a Chance!”

“Give the Guy a Chance!”

“Hear hear!” says a longtime reader after Tuesday’s cautionary edition.

“Hear hear!” says a longtime reader after Tuesday’s cautionary edition.

“And a round of applause for you (clap, clap, clap, clap, clap).

“Even though (or maybe because) some readers will only wish the ‘clap’ part for you.”

Indeed, there was criticism, although I don’t know whether the critics would go so far as to wish an STD upon me.

“I note the weighting in your Trump vs. the 15% article is heaviest on the negativity toward President-elect Trump and his picks to head government agencies,” said one.

“I sincerely hope that the next four years of your posts are not so snarky and reflective of your sour-grapes loss. Come on, Dave, the man hasn’t even been sworn in yet.”

Dave responds: “Sour-grapes loss”? You did see the part at the beginning where I celebrated the power elite’s ballot-box humiliation, no?

Another reader took exception to my line about “a high risk that the guy who rode into office on a wave of revulsion with endless Middle East wars will launch… another Middle East war.”

Another reader took exception to my line about “a high risk that the guy who rode into office on a wave of revulsion with endless Middle East wars will launch… another Middle East war.”

“Pure speculation,” he counters. “Why not give Trump the benefit of the doubt and call him out if he falls flat?

“He had a lot of legacy deep state folks in his previous administration who worked against him even before he became president and he was still able to accomplish several important policies.

“It is possible that Trump could cut the military budget by reducing the 750 military bases in 80 countries while still investing in weapons for our own defense. It is also possible that Trump could defend Israel at all costs by providing intelligence, weapons and negotiation pressure on aggressor countries in the region.

“I saw an interview today with RFK Jr. where he said Trump hated John Bolton but Trump said it was good that he had Bolton in his administration because other countries knew he was a war hawk and that in itself was a deterrent. RFK said from what he has seen he believes that Trump will listen to his advisers but in the end will make the final decision even if that means overruling their advice (just as President Kennedy did in the Cuban Missile Crisis).

“I’m not sure what Trump will accomplish this term but I sense that he has the same dissatisfaction with government dysfunction and corruption as most Americans and am hopeful that he and the team he is building will be able to bring about real change. Come on, man — give the guy a chance.”

Dave: “The second Trump administration is shaping up to be at least as aggressive and confrontational as the first one,” writes the foreign policy analyst Daniel Larison.

“Republican hawks like to repeat the phrase ‘peace through strength’ to defend their support for ever-higher levels of military spending, but in practice they are never very interested in the peace part of that formulation. The phrase serves as little more than window dressing to conceal their reckless militarism.”

Besides, if Ben Shapiro is over the moon with these picks — and he is — that alone should tell you how awful they are.

At the very least, I hope the defense secretary-designate will be confronted about his past during his confirmation hearings — you know, given that Trump first rode to power on a wave of disgust with the Iraq War…

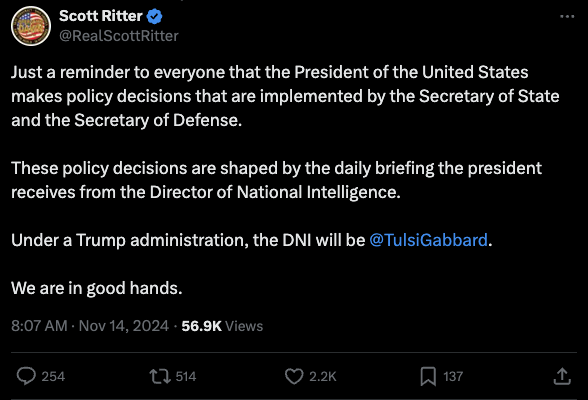

There is potentially one saving grace, as the former UN weapons inspector Scott Ritter points out…

Well, assuming she wins Senate confirmation. Which is hardly a sure thing.

If she does, her first and most urgent task must be to debunk the “Iran tried to assassinate Trump!” canard — which the deep state is pushing hard because that’s how it can get Trump on board with its own regime-change agenda in Tehran.

A final thought, seeing as you brought up “defending Israel at all costs”... How exactly does that square up with an “America First” foreign policy?

“I do not want to make the government more efficient,” writes our final correspondent, with Elon Musk’s DOGE in mind. “I want it to do much less than what it is doing.

“I do not want to make the government more efficient,” writes our final correspondent, with Elon Musk’s DOGE in mind. “I want it to do much less than what it is doing.

“How about eliminating 95% of what it does. You know, the part not authorized by the Constitution! That includes Social Security, Medicare, corporate welfare, individual welfare, picking industry winners and losers, spying on citizens without warrants, groping them at airports without warrants and transferring money from those who have earned it to those who have not.”

Dave: Totally concur. By the way — since you brought up airports — what does it mean if a self-professed dog killer is put in charge of the TSA?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets