Donald Trump, Crypto Bro

![]() Trump’s Tech Revolution Is Here

Trump’s Tech Revolution Is Here

Donald Trump's re-election has sparked optimism in Silicon Valley. Despite past tensions between the president-elect and industry leaders, our AI-and-crypto expert James Altucher believes Trump’s second term could usher in a new era of growth and innovation for the tech industry.

Donald Trump's re-election has sparked optimism in Silicon Valley. Despite past tensions between the president-elect and industry leaders, our AI-and-crypto expert James Altucher believes Trump’s second term could usher in a new era of growth and innovation for the tech industry.

Since Election Day? “The Nasdaq's 1,000-plus-point surge,” James says, “is just the preview of tech's next chapter.” This uptick is seen as a harbinger of tech's promising future under the new administration.

A key reason for optimism is the election of Vice President JD Vance.

- “With Vice President JD Vance — a former venture capitalist with deep ties to Silicon Valley — Trump's administration brings a unique understanding of the tech industry to Washington,” says James.

Vance's experience working with influential figures like Peter Thiel positions Vance as a powerful ally for tech innovation in the federal government. Accordingly, “Trump's team has promised investment in AI and quantum computing… signaling a new chapter in America's tech dominance,” James adds.

“Defense contracts are expected to pour billions into cutting-edge research, while looser regulations could help driverless cars hit the road more quickly.”

This could accelerate the deployment of new technologies and foster innovation across a wide range of sectors.

“Perhaps no industry celebrated Trump's victory more enthusiastically than crypto,” James notes.

“Perhaps no industry celebrated Trump's victory more enthusiastically than crypto,” James notes.

“Bitcoin's surge past $75,000” — now surpassing $90,000, in fact — “is just the beginning,” he says. “Trump has vowed to make America ‘the crypto capital of the planet.’”

Trump’s plans include adding Bitcoin as a federal reserve asset and promising to end the SEC's crackdown on digital currencies. “With Republicans comfortably controlling Congress, crypto-friendly laws seem more likely than ever.”

James’ takeaway? “The message is clear: Smart money is already moving to capitalize on the Trump economy 2.0.”

The impact of Trump's presidency on the tech industry appears to be overwhelmingly positive. The administration's focus on innovation, deregulation and domestic production is expected to create numerous opportunities for growth and advancement in the tech sector.

As James puts it: “The revolution isn't coming — it's already here. Those who recognize and act on these opportunities early stand to reap extraordinary rewards.”

[James Altucher just opened the doors to a very limited “beta test” for his newest research service. One where you could see opportunities for the biggest market returns of your life.

Its strategy involves a specific and little-known subniche of the stock market — a subniche we simply can’t reveal to everyone. (You’ll understand why when you click here now.)

But James is only allowing 250 readers the chance to join his “beta test.” The good news is: YOU’RE invited to take part!

However, your invite will expire on Thursday at 9:29 a.m. EST. After that? It’s off the table.

So if you’re interested in potentially seeing the most explosive market returns of your life… Click here now before time runs out.]

![]() Inflation Moves in Wrong Direction

Inflation Moves in Wrong Direction

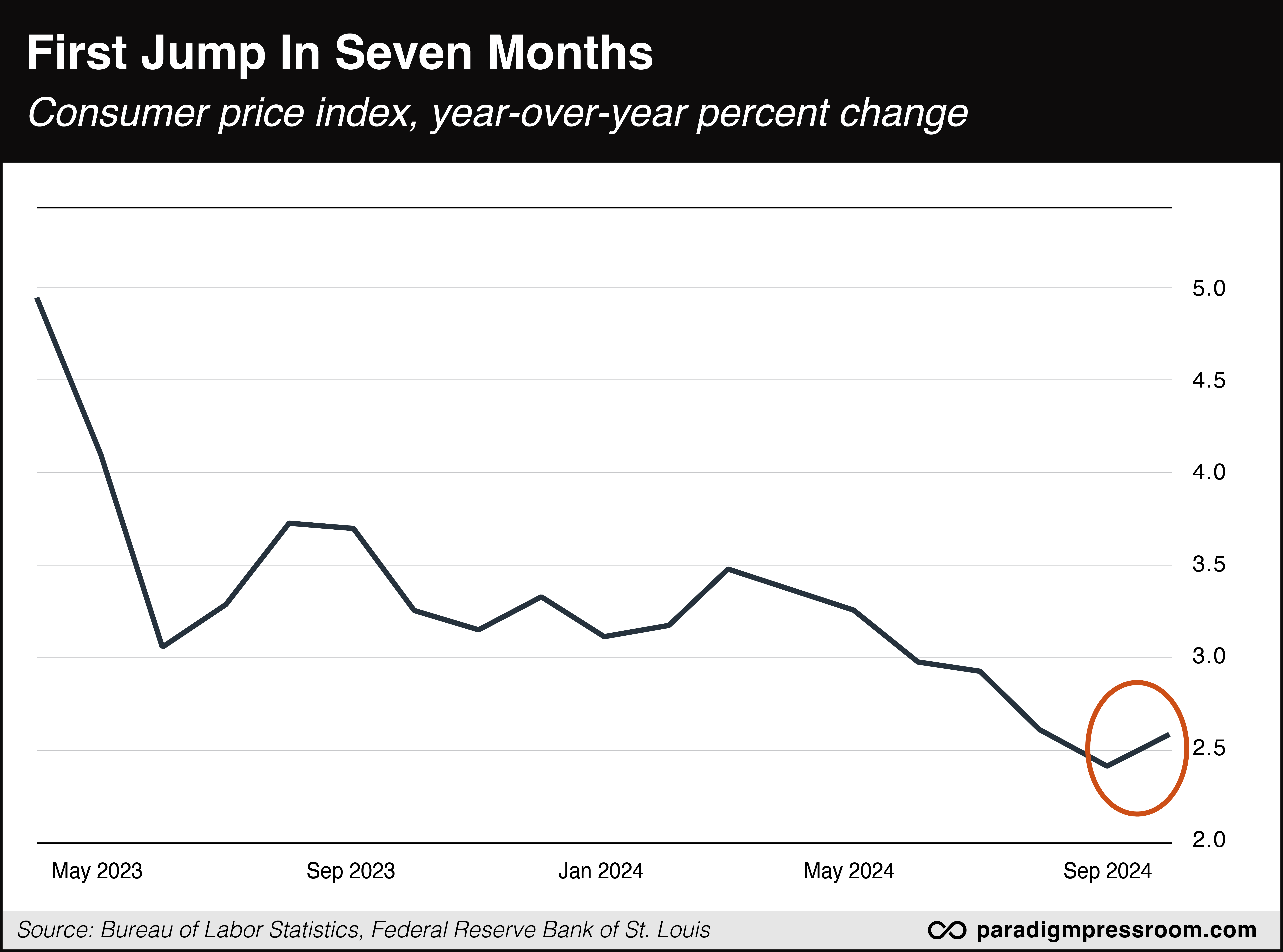

The latest consumer price index (CPI) data released today shows inflation ticking up with prices rising 2.6% year-over-year in October, matching Wall Street expectations but higher than September's 2.4% increase.

The latest consumer price index (CPI) data released today shows inflation ticking up with prices rising 2.6% year-over-year in October, matching Wall Street expectations but higher than September's 2.4% increase.

This uptick suggests inflation is moving in the wrong direction, potentially complicating the Federal Reserve’s recent pivot toward monetary easing.

Despite the setback, the Fed is unlikely to abandon its rate-cutting trajectory so soon after initiating it.

The futures markets, in fact, still indicate an 82% probability of another quarter-point cut at the Fed's meeting next month. While the CME's FedWatch tool is notoriously unreliable for long-term predictions, it tends to accurately forecast what happens at the next FOMC meeting.

All told: This persistent expectation of a rate cut, coupled with the Fed's reluctance to abruptly halt its easing cycle, suggest the inflation increase is unlikely to derail the central bank's current monetary policy course.

Despite the Nasdaq’s monster post-election rally, the index is taking a breather today. The tech-heavy Nasdaq has pulled back 0.25% to 19,230. Meanwhile, the Dow is up 165 points to 44,075 while the S&P 500 is up about 0.10%, slightly under 6,000.

Despite the Nasdaq’s monster post-election rally, the index is taking a breather today. The tech-heavy Nasdaq has pulled back 0.25% to 19,230. Meanwhile, the Dow is up 165 points to 44,075 while the S&P 500 is up about 0.10%, slightly under 6,000.

Checking on the commodities complex, oil is up 0.20% to $68.27 for a barrel of West Texas crude. But precious metals are floundering in the red today (more on that in a moment). The price of gold’s pulled back 0.40% to $2,596.30 per ounce. At the same time, the price of silver continues to slide; the white metal is down 0.15%, hanging onto $30.

Finally, Bitcoin continues its record-setting post-election pace. At the time of writing, the flagship crypto is up another 3% to $92,500 now. Ethereum, meanwhile, has pulled back to $3,290.

![]() Why Precious Metals Plunged Post-Election

Why Precious Metals Plunged Post-Election

Donald Trump's decisive win in the 2024 U.S. presidential election triggered a sharp decline in gold and silver prices. The immediate market reaction saw gold prices fall by 2.8% and silver prices drop by 4.5%.

Donald Trump's decisive win in the 2024 U.S. presidential election triggered a sharp decline in gold and silver prices. The immediate market reaction saw gold prices fall by 2.8% and silver prices drop by 4.5%.

According to CEO of the annual New Orleans Investment Conference and newsletter-industry stalwart Brien Lundin: “I should have cautioned that a clear-cut win by Trump would evaporate any perceived geopolitical risk being factored into the gold price by some speculators and, therefore, result in a short-term sell-off.

“This short-term trade seems destined to reverse soon,” Mr. Lundin adds, emphasizing that the current bull market in precious metals is not built on geopolitical risk, but rather on a long-term trend of monetary easing and increasing debt…

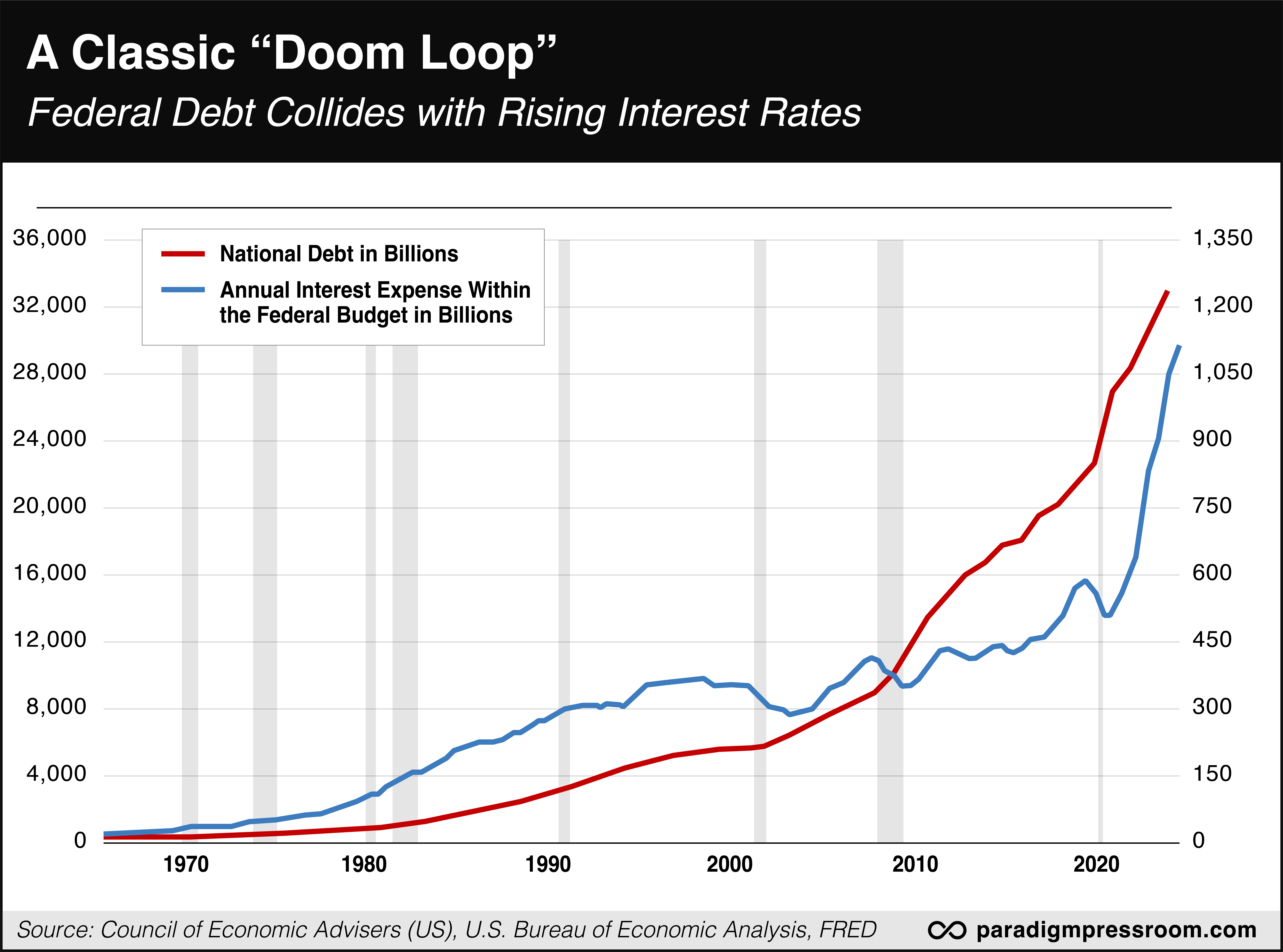

“The red line above shows the federal debt, which began to accelerate higher with the post-2008 Great Financial Crisis rescue efforts and truly exploded higher with the fiscal and monetary response to COVID...and then the desperate federal spending as the Biden administration attempted to ensure their re-election,” Lundin says.

“This fiscal stimulus ran in direct opposition to monetary policy, as the Fed attempted to kill off inflation with severe rate hikes. You can see the effect of rising rates meeting head-on with soaring debt loads in the blue line above, showing federal interest expense.

; “This is a classic debt trap… a 'doom loop,' as many have called it… in which the Fed must lower rates to keep the house of cards erect,” says Lundin.

; “This is a classic debt trap… a 'doom loop,' as many have called it… in which the Fed must lower rates to keep the house of cards erect,” says Lundin.

“Neither party addressed this situation at all during the campaign, and neither is motivated in the least to do anything about it. Far to the contrary, in fact, as control of the White House and both houses of Congress have never promoted spending restraint,” he says.

And while the stock market and dollar have surged on expectations of lower taxes and looser regulations, Treasury yields have also risen, “in recognition of the inflationary consequences,” he points out.

Lundin, therefore, views the sell-off in gold and silver as “just crazy,” based on a total misunderstanding of the fundamentals behind precious metals in 2024.

“This is a truth that the markets will realize shortly,” he concludes, “which makes this an extraordinary investment opportunity.

“The key to profiting from a secular bull market like this one in the metals is to buy the dips. And this is one heck of a dip.”

![]() DOGE: All Bark, No Bite?

DOGE: All Bark, No Bite?

As expected, Trump has tapped Elon Musk plus former GOP presidential candidate Vivek Ramaswamy to lead the newly created Department of Government Efficiency (DOGE), a name that presumably nods to Musk's favorite crypto Dogecoin.

As expected, Trump has tapped Elon Musk plus former GOP presidential candidate Vivek Ramaswamy to lead the newly created Department of Government Efficiency (DOGE), a name that presumably nods to Musk's favorite crypto Dogecoin.

DOGE won't be a formal government agency. Instead, it will function as an external advisory group, partnering with the White House and Office of Management and Budget to tackle what Trump calls “massive waste and fraud” within the scope of the $6.5 trillion annual government expenditure.

Heh, speak of the devil…

Notorious for his aggressive cost-cutting at X-Twitter, Musk has set an ambitious goal of trimming $2 trillion from the federal budget. He promises, in fact, to “send shock waves through the system.”

Notorious for his aggressive cost-cutting at X-Twitter, Musk has set an ambitious goal of trimming $2 trillion from the federal budget. He promises, in fact, to “send shock waves through the system.”

[Sidebar: No word yet whether Musk will eliminate the max $7,500 tax credit for EV buyers. Or if repaying the billions of dollars in federal subsidies that Tesla’s received over the years is on the table… But that would certainly go a long way to building Musk’s credibility.]

Vivek Ramaswamy (Vance’s personal friend and “nametake” of Vance’s son) suspended his own presidential campaign to back Trump. And he brings his “SHUT IT DOWN” mantra to Team Trump, having previously advocated for eliminating numerous federal agencies.

The announcement has raised eyebrows, of course. Critics question the feasibility of Musk's $2 trillion target, with some experts calling it “mathematically impossible” without touching major programs like Social Security and Medicare. There are also worries about potential conflicts of interest, given Musk's companies hold lucrative government contracts (see also sidebar above).

But Trump has likened DOGE to the Manhattan Project, setting a deadline of July 4, 2026 — America's 250th birthday — for the duo to complete their work. He's framed the initiative as a gift to the nation, promising a leaner, more efficient government.

As Musk and Ramaswamy prepare to take on Beltway bureaucracy, only time will tell if their Silicon Valley-style disruption can truly revolutionize government efficiency. Or if DOGE will end up being more bark than bite.

![]() Chase Bank Plays “Chicken” With a 10-Year-Old

Chase Bank Plays “Chicken” With a 10-Year-Old

In a world where banks are supposed to safeguard our hard-earned cash, a 10-year-old girl's entrepreneurial spirit was met with financial malfeasance.

In a world where banks are supposed to safeguard our hard-earned cash, a 10-year-old girl's entrepreneurial spirit was met with financial malfeasance.

Young Kinley Maner, a budding poultry mogul from rural Arizona, found herself embroiled in a nightmare with Chase Bank after selling prized chickens she’s raised at a county fair.

But after Kinley's sale of six chickens netted her a $2,100 check from the Small Stock Association, Chase Bank stubbornly refused to deposit the funds.

Apparently, a disconnected phone number for the Small Stock Association was all it took for the bank to freeze Kinley’s mother’s bank account and hold the child's money hostage for over a year.

The family's attempts to reason with Chase went nowhere. The check writer even showed up in person on three separate occasions to verify the transaction! To no avail.

It took the Maner family reaching out to local CBS affiliate KPHO for Chase Bank to acknowledge its error. Suddenly, when faced with potential bad press, the bank miraculously found a way to verify the check and return Kinley's money.

“I was surprised when I got it, but I also was excited,” Kinley says. She plans to do something fun with a portion of her earnings and deposit the rest to her college fund.

Who knows? Perhaps law school is in young Kinley’s future… On second thought, the poultry biz might be more lucrative.

Take care! And we’ll be back tomorrow with more of the 5 Bullets..

Best regards,

Emily Clancy

Paradigm Pressroom’s 5 Bullets