Trump’s Crypto Catalyst

![]() Crypto’s Crowning Victory (After Trump)

Crypto’s Crowning Victory (After Trump)

It remains to be seen how Donald Trump will make the United States “the crypto capital of the planet”... but all the same, Bitcoin roared to record levels over $80,000 this weekend.

It remains to be seen how Donald Trump will make the United States “the crypto capital of the planet”... but all the same, Bitcoin roared to record levels over $80,000 this weekend.

(And it’s over $84K as we go to virtual press. Whew…)

Bloomberg quotes one Le Shi, Hong Kong managing director at the market-making firm Auros: “With the dust from Trump’s victory still settling down, it was only a matter of time before a run-up of some sort occurred given the perception of Trump being pro-crypto, and that’s what we’re seeing now.”

But that’s hardly the whole story. It’s not just the presidency.

Besides, the mainstream isn’t going to tease out where Bitcoin is going from here. We will…

Crypto’s first over-$80K reading coincided with a crowning victory for the crypto lobby on Saturday.

Crypto’s first over-$80K reading coincided with a crowning victory for the crypto lobby on Saturday.

As we told you before Election Day, crypto PACs poured unprecedented amounts of money into congressional races this year.

The biggest single chunk of cash — $40.1 million — turned a blue Senate seat red. Ohio auto dealer (and crypto entrepreneur) Bernie Moreno knocked off three-term Democrat Sen. Sherrod Brown, the vocally anti-crypto chair of the Senate Banking Committee.

But the crypto lobby is not partisan — and so it also plunked down substantial sums on two crypto-friendly Democratic House members running for open Senate seats.

On Thursday, Elissa Slotkin won a tight race in Michigan. And then on Saturday, an even tighter race in Arizona also broke crypto’s way…

Of the 34 Senate races this year, there were 31 in which the trade group Stand With Crypto could identify pro- and anti-crypto candidates. Of those 31, the pro-crypto candidate won 19.

The margins are even more impressive in the House. Of the 435 seats, a solid majority of 268 will be held by pro-crypto members. (And that number might yet rise with 18 House races yet to be decided.)

"Welcome to the most pro-crypto Congress in American history," says Coinbase CEO Brian Armstrong.

“For the first time in crypto's entire existence — all 15 years of it — we're about to have regulatory tailwinds instead of headwinds,” says Paradigm crypto analyst Chris Campbell.

“For the first time in crypto's entire existence — all 15 years of it — we're about to have regulatory tailwinds instead of headwinds,” says Paradigm crypto analyst Chris Campbell.

“It’s like crawling through mud for four years, then someone throws you a pair of monster truck keys.

“Justin Slaughter, former adviser at the SEC and CFTC, shared a quote from a Biden White House staffer that sums it up: ‘No Dems are going to fight with crypto to the death anymore. We have too many other things to worry about and crypto clearly has more staying power than we thought.’”

Chris’ plain-English translation: “We bet on the wrong horse.”

So how does the more favorable regulatory environment translate to crypto valuations?

“In the entire history of Bitcoin, it's never gone below its Election Day price after the fact,” Chris informs us. “Not once.”

“In the entire history of Bitcoin, it's never gone below its Election Day price after the fact,” Chris informs us. “Not once.”

Granted we’re working from a small data set. But it does go back to the Obama-Romney contest of 2012.

What does that mean now? “If history is any indicator,” Chris says, “$67K is a floor.

“But beyond price, here’s what I expect in 2025:

- “Treasury starts playing nice with banks and crypto

- “Arbitrary anti-crypto lawsuits? Poof. Gone

- “Stablecoin legislation actually has a shot

- “The ETF floodgates crack open (though maybe not immediately).

“For years, crypto's been playing defense against a regulatory onslaught. Now? The table's turned. The anti-crypto army just got its marching orders: Retreat.”

If $67K is the new floor… then what’s the ceiling?

If $67K is the new floor… then what’s the ceiling?

Rewind to what our resident crypto evangelist James Altucher said in this space on Election Day: In the event of a Trump win, “the pattern is measuring up to $95,000, but markets have a funny way of gravitating toward round numbers. In this case, that's $100,000.”

Which is a solid 25% from here, give or take.

Longer term, the Paradigm team is exploring a scenario under which Bitcoin would soar to $279,000 by year-end 2025. That’s a 2.5X gain.

Stay tuned for more about that in the weeks ahead…

![]() Small Caps Play Catch-Up

Small Caps Play Catch-Up

“It’s beginning to feel a lot like melt-up season everywhere you look!” says Paradigm chart hound Greg Guenthner — especially in small-cap stocks.

“It’s beginning to feel a lot like melt-up season everywhere you look!” says Paradigm chart hound Greg Guenthner — especially in small-cap stocks.

As we mentioned the day after Election Day, all the major U.S. stock indexes rallied hard — but the -cap Russell 2000 rallied harder. It’s worth a closer look today…

“Finally, the smaller, more speculative names leaped above the choppy range that has trapped this group since July,” says Greg. “By the end of the day, the Russell 2000 ETF (IWM) printed its largest single-day return in over two years. The IWM chart tells the story…

“Small caps have been a tricky trade for most of the year. IWM was one of the strongest Q4 2023 melt-up movers, yet it failed to extend higher in the new year.

“Instead, investors shifted their focus to the NVDA breakout and the growing semiconductor bull that dominated market discourse during the first half of 2024.

“That’s changing following the election. IWM is putting all that chop in the rearview as it races to catch up with the major averages (it’s currently up more than 19% year to date).

“A rising tide is lifting riskier assets, and the smallest boats — small caps — are benefiting the most. I expect these beat-down names to outperform during the melt-up.

“Remember: Most of these names have plenty of ground to recover following the 2022 sell-off. We’ll see just how high they can run into the holiday season.”

![]() Two “Trump Trades”

Two “Trump Trades”

If you’re looking to pile into small caps for a reason other than “number go up,” consider this…

If you’re looking to pile into small caps for a reason other than “number go up,” consider this…

“The market is betting on a more business-friendly climate with lower regulations and restrictions,” says Paradigm income pro Zach Scheidt. “And this is great news for many of the smaller companies listed on U.S. exchanges.”

So he’s on the same page with Greg Guenthner: “I’m excited to see IWM surging higher. And I believe the index could have much further to run. After all, small-cap stocks have been treading water for years while mega-cap stocks have been making new highs. So just a ‘catch-up’ trade could result in several quarters of outperformance.”

Another “Trump trade” Zach says is worth your while — the oil field services industry.

Not oil-and-gas itself, necessarily. Yes, it will benefit from a more favorable tax-and-regulation environment. But higher production might keep a lid on prices.

But that’s no issue for the services companies. “That’s because these companies help to provide the equipment and expertise to drill new wells and extract more oil from existing wells.”

There are three big names in the sector, and they’ve been busy snapping up smaller competitors in recent months — Schlumberger (SLB), Halliburton (HAL) and Baker Hughes (BKR).

Meanwhile, today might be the day the S&P 500 notches its first close over 6,000.

Meanwhile, today might be the day the S&P 500 notches its first close over 6,000.

The index crossed that barrier intraday on Friday, only to close five points shy. As we write today, it’s up a quarter percent at 6,010. The Dow’s gain is stronger; the Nasdaq is flat.

Meanwhile, it’s another day for precious metals to get crushed — or for you to scoop up precious metals bargains, depending on your point of view.

Gold is down 2.5% or $67 to $2,616. Interestingly, silver’s percentage loss is about the same; usually it gets clobbered worse. The bid on silver is down to $30.48, a one-month low.

It’s the mining stocks taking the worst hit today — the HUI index down 6.4% and under 300 for the first time since early September.

Crude is likewise getting pummeled — down over two bucks at $68.12.

![]() Undecided Voters Gave Trump the Edge

Undecided Voters Gave Trump the Edge

A quick election postscript…

A quick election postscript…

Six days before Election Day, we devoted a fair amount of digital ink to the undecided voter. The Good Authority site told us that “Over the past two election cycles, undecided voters have clearly favored Donald Trump.”

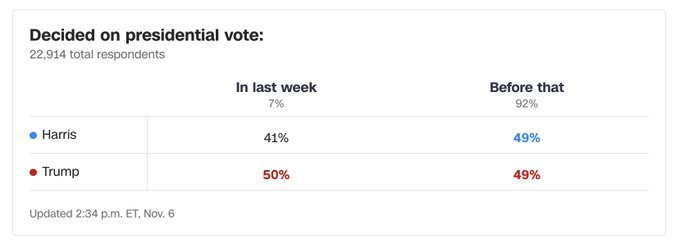

And so it went this time. According to the exit polls, about 11 million people — 7% of those who cast a vote — made up their minds in the week before Election Day.

Trump carried this group by a nine-point margin — compared with a dead heat among those who’d made up their minds beforehand…

“The idea that ‘undecided voters’ don't exist is a total myth,” says our favorite political reporter Michael Tracey. It’s just that “most people are not scrolling for political news on X all day.” Heh…

![]() Mailbag: Censorship, Cruelty, Budget Cuts

Mailbag: Censorship, Cruelty, Budget Cuts

After I mentioned on Friday that Jim Rickards’ post-election debrief got the banhammer from YouTube, we heard from a couple of like-minded readers…

After I mentioned on Friday that Jim Rickards’ post-election debrief got the banhammer from YouTube, we heard from a couple of like-minded readers…

“I wondered how long it would take for Jim’s excommunication @ ScrewTube. Now I know. Move on over to Rumble, Jim. They’re great with free speech and have their own infrastructure, so they don’t need someone else’s servers etc.”

“If you switch to Rumble,” says another, “there will not be an issue with getting de-platformed. It’s also free for subscribers to watch unless the subscriber wants to cut out commercials. I suggest that you check it out. There is also a way to make money for Paradigm Press.”

Dave responds: As I mentioned early this year, Rumble is definitely on our radar. But for the moment, the number of available eyeballs on YouTube is still too big for us to pass up.

Besides, at this point it behooves us to bide our time and see whether the leadership at YouTube/Google/Alphabet might come to the same conclusions that Mark Zuckerberg did (and, arguably, Jeff Bezos).

“I enjoy your work very much…

“I enjoy your work very much…

[After 14-plus years of doing this, I know what word is coming next…]

“… but have to comment about your statement re ‘Russia's cruel invasion of Ukraine.’

“We had militarized Ukraine, which then went on to attack the Russian speakers in the eastern Donbass, the Luhansk and Donetsk, killing upward of 15,000. These entities had declared themselves independent, and at their call for help Russia went in with a small contingent, not planning at the time for a full-scale war.

“This has been my understanding from interviews given by Scott Ritter, Douglas Macgregor and others.

“Again, I greatly enjoy your writing, and look forward to it each day.”

Dave: I don’t think it’s a contradiction to call the invasion “cruel”... and at the same time acknowledge that the invasion was the inevitable result of serial provocations by Washington, D.C., over the course of two decades.

Also — and not to be pedantic about it — please exercise care with the use of the word “we.” You didn’t militarize Ukraine and neither did I. It was three successive administrations in Washington — yes, including Trump’s — that did that.

As Richard Maybury, one of the newsletter industry’s graybeards, is fond of reminding readers… the government and the people are not the same thing.

On the subject of slashing the size of government, “Elon Musk needs to visit with David Stockman,” writes a member of our Omega Wealth Circle.

On the subject of slashing the size of government, “Elon Musk needs to visit with David Stockman,” writes a member of our Omega Wealth Circle.

“David, as you may recall, was Reagan's first director of the Office of Management and Budget (OMB), where he was tasked with cutting waste and inefficiency. He went about the job enthusiastically, and did have a few successes, but as I recall, finally quit in frustration. I'm sure he would have some lessons learned to share with Elon.

“Personally, I hope Trump/Elon go more for the Milei chain saw approach by eliminating whole departments and even agencies, but we'll just have to see.”

Dave: I bet Mr. Stockman would have much to say, all worthwhile.

He and his wife Jennifer graciously hosted me and a handful of colleagues at their Manhattan penthouse some years ago; in the realms of both politics and high finance he is sui generis.

And yes… he did leave the Reagan administration after five years, realizing he was fighting a losing battle. In the end, Reagan tripled the national debt over two terms — a feat no one has matched since. Stockman published a bridge-burning memoir, The Triumph of Politics, in 1986.

I might have more to say about the coming budget battle tomorrow. Or not, depending.

Meanwhile, if you want a real blast from the past, check out this NBC News special from Feb. 13, 1981 titled “A Day With President Reagan.”

About 23 minutes in, there’s a lengthy section with David Stockman drawing detailed strokes of a budget plan for Reagan’s cabinet, in office barely three weeks.

(The special was also one of David Brinkley’s final assignments for NBC before he moved on to reinvent the Sunday morning talk show at ABC…)