The Trump Speed Bump

![]() Recession Incoming

Recession Incoming

For all the jubilation over an election result that didn’t take weeks to thrash out… there’s a fly in the ointment. Maybe a swarm of them…

For all the jubilation over an election result that didn’t take weeks to thrash out… there’s a fly in the ointment. Maybe a swarm of them…

“A recession is likely,” says Paradigm macroeconomics maven Jim Rickards. As Jim sees it, no amount of interest rate cuts by the Federal Reserve can forestall that outcome.

“Trump’s policies will be good for the economy over the next two–four years, but the next six–nine months will likely be the legacy of Biden’s inflation, excess spending, deficits and regulatory burdens that are pointing to a recession now.”

Bad news for Trump? Not necessarily…

“In Ronald Reagan’s first term, he inherited a recession from the Carter years,” says Jim, reaching for a historical analogue baby boomers remember well.

“In Ronald Reagan’s first term, he inherited a recession from the Carter years,” says Jim, reaching for a historical analogue baby boomers remember well.

“This dominated the first few years of his presidency until his policies turned the economy into a robust growth machine.

“We see the incoming Trump presidency seeing a similar timeline. Expect some tough economic times in the first 12–18 months before a pivot to a strong economy in the second half of the Trump term.”

The U.S. economy slipped into recession in July 1981 — six months into Reagan’s term. It was a bad one — by some measures, the worst since the Great Depression. Demand for homes and cars dried up as millions of workers lost their jobs.

It dragged on for 16 months, until November 1982. But it did set the stage for a strong recovery and an economic expansion that lasted all the way until the summer of 1990.

“Recessions happen,” says Jim. “Politically it’s good to get them out of the way at the start of your term so you can finish strong.”

By the way, the Reagan experience might be the reason you hear much media chatter about trying to push through the bulk of Trump’s agenda during his first two years.

By the way, the Reagan experience might be the reason you hear much media chatter about trying to push through the bulk of Trump’s agenda during his first two years.

“He obviously has the House and the Senate now on his side, so it could be that for the next two years we see this direction,” says Stefan Gratzer, managing director at J.P. Morgan Private Bank. After the 2026 midterm elections, Gratzer tells Bloomberg it might be “not so easy to do those things.”

Indeed, the president’s party usually loses ground in Congress during midterm elections.

Here again, the Reagan experience is illustrative. Reagan pushed through sizable chunks of his agenda in the first two years despite a split Congress — Republicans in charge of the Senate, Democrats in the House.

But the task became much harder after the 1982 midterms — Republicans losing a seat in their already-slender Senate majority and Democrats adding a whopping 26 seats in the House.

Even if the economy is headed into recession, Jim anticipates ample moneymaking opportunities going into 2025.

Even if the economy is headed into recession, Jim anticipates ample moneymaking opportunities going into 2025.

That’s because of Jim’s patent-protected AI stock scanning software called Project Prophecy 2.0. It has an uncanny ability to sniff out news before it happens — including a 102% gain in anticipation of Trump’s election victory.

Other examples include…

- Occidental Petroleum before Russia invaded Ukraine in February 2022. The resulting gain — 214%

- Goldman Sachs before Trump’s shock election victory in November 2016. The resulting gain — 328%

- Moderna Inc. before COVID became widespread in the United States in March 2020. The resulting gain — 564%.

Frequently, the gains can materialize in a matter of days — not weeks or months.

Don’t believe it? Click here… let Jim walk you through a 15-second demo… and decide for yourself.

All that said, an incoming recession might be the least of our concerns this morning. Read on…

![]() WWIII Looms, Gold Leaps

WWIII Looms, Gold Leaps

As a new week begins, precious metals are doing exactly what precious metals are supposed to do — serving as a hedge against geopolitical catastrophe.

As a new week begins, precious metals are doing exactly what precious metals are supposed to do — serving as a hedge against geopolitical catastrophe.

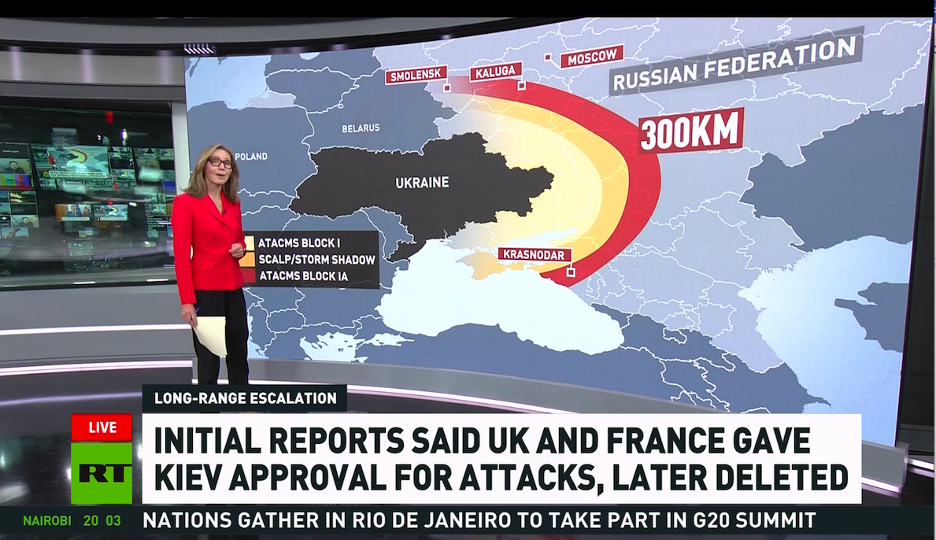

Over the weekend, as if to scream to the world I’M STILL RELEVANT, Joe Biden authorized Ukraine to use long-range missiles provided by Washington to strike inside Russian territory.

(So much for the “smooth transition” to a new administration, huh?)

ATACMS, these missiles are called — short for Army Tactical Missile Systems — with a range of 190 miles. Ukraine can operate them only with coordinates provided by or confirmed by the United States or its allies. Thus Washington keeps tiptoeing ever closer to becoming a direct combatant in what for the moment remains a proxy war.

Exactly how Moscow plans to respond to this escalation, it’s not saying. Russian English-language state TV is wall-to-wall with maps showing the territory now potentially under threat…

Previously Vladimir Putin has said if NATO supported long-range strikes in Russia, NATO would be “at war with Russia.” Would airstrikes on U.S. bases in Europe be off-limits?

And that doesn’t even get into the North Korean question. Assuming North Korean forces are fighting on Moscow’s side — which Moscow still won’t confirm — what does it mean if Washington is directly supporting attacks on the troops of yet another nuclear-armed country besides Russia?

With all those questions swirling, gold has powered nearly $50 higher this morning, back to $2,611. Silver is up nearly a buck to $31.15. Crude is also reacting — up $1.77 to $68.79.

With all those questions swirling, gold has powered nearly $50 higher this morning, back to $2,611. Silver is up nearly a buck to $31.15. Crude is also reacting — up $1.77 to $68.79.

The stock market, meanwhile, is in rally mode — the S&P 500 up nearly a half percent and only four points away from reclaiming the 5,900 level. The Nasdaq is up stronger, the Dow nearly flat.

All eyes are on Nvidia — the last of the “Magnificent 7” companies to report its quarterly numbers, after the closing bell on Wednesday. For the moment, NVDA is down 1.3% on news that its high-end Blackwell chips are overheating, depending on how they’re used.

Meanwhile, Netflix is up 1.9% on the day — immune, it seems, to any backlash over widespread streaming glitches during the Mike Tyson-Jake Paul fight Friday night.

Meanwhile, Bitcoin is powering higher, *this* close from reclaiming the $92,000 level.

![]() The 48-Hour Rule, aka “Knuckman’s Law”

The 48-Hour Rule, aka “Knuckman’s Law”

Assuming the world doesn’t end before Jan. 20 of next year, it’s time to revisit “Knuckman’s law.”

Assuming the world doesn’t end before Jan. 20 of next year, it’s time to revisit “Knuckman’s law.”

Not that Alan Knuckman — Paradigm’s eyes and ears at the Chicago options exchanges — ever called it that. That’s the name we gave it during Trump’s first term.

Alan’s rule of thumb: Don’t react to anything Trump says for 48 hours. Give events that much time to shake out.

It’s worth bearing in mind at a time when we’re already seeing headlines like this…

“The return of trade wars and governance-by-tweet,” says the subhead to a Bloomberg article anticipating Trump’s second term.

“Large corporations crave predictability, and the primary economic policy of Donald Trump is chaos. Whether it’s the threat of steep new tariffs or retribution, chief executive officers and their carefully drawn plans will once again be at the whims of a leader who’s emboldened to reorder the economy.”

And so the market freaked out when Trump named Robert F. Kennedy Jr. to run the Department of Health and Human Services.

And so the market freaked out when Trump named Robert F. Kennedy Jr. to run the Department of Health and Human Services.

XBI, the big biotech ETF, took a 3% spill on Friday. Pfizer and Moderna, the companies behind the COVID jabs, sold off 5% — which made for great fun in the meme-o-sphere…

“We are not surprised the sector has been under pressure on the potential for RFK Jr. having oversight of the various agencies within HHS (including the FDA, the CDC, NIH and Medicare/Medicaid) given his previous stated views on the industry,” said a note from JPMorgan Chase.

Then everyone took the weekend to chill.

Today XBI is up a half percent. Truth be told, XBI had run up too far too fast in the immediate aftermath of the election results — and it was already in the process of correcting that overshoot when the RFK news crossed the wire.

Now there’s been time to stop and think. The reality is that RFK Jr. might not survive the Senate confirmation process. And if he does, exactly what will he prioritize in a sprawling bureaucracy that oversees one-quarter of the federal budget?

We have a feeling Knuckman’s law will prove itself useful many times over the next four years. Stay tuned…

![]() Your Government In Action

Your Government In Action

For the record: The Pentagon still can’t pass an audit.

For the record: The Pentagon still can’t pass an audit.

The Department of Defense has undergone annual audits for seven years. It has yet to pass. Indeed on this go-round, only nine of the Pentagon’s 28 agencies passed. (The audit itself, by the way, cost $178 million.)

But hope springs eternal: “I believe the department has turned a corner in its understanding of the challenges, and more importantly, in addressing those challenges,” says Under Secretary of Defense and Chief Financial Officer Michael McCord.

The history of attempts to audit the Pentagon is even more pitiful than the headline news suggests.

The history of attempts to audit the Pentagon is even more pitiful than the headline news suggests.

We’ve recounted the history before, but it’s worth revisiting today: Way back in 1990, Congress passed a law ordering the Pentagon to be audit-ready by 1996.

But there were never any “or else” consequences attached to the deadline, which Congress kept pushing back. The Pentagon didn’t even get around to attempting an audit until — well, that first of seven failed audits in 2018.

From time to time, American leaders performatively wrung their hands about the Pentagon’s inability to maintain its books. Perhaps the most infamous instance occurred on the day before the 9/11 attacks in 2001 — when Defense Secretary Donald Rumsfeld fessed up that, “According to some estimates, we cannot track $2.3 trillion in transactions.”

That’s $2.3 trillion going back only five years to the original 1996 deadline. By 2013, the total swelled to about $8.5 trillion. As far as we can tell, no one in an official capacity has even tried to update the total since.

Investment implications? For the last couple of years, the defense sector has more or less tracked the S&P 500 — after two decades of spectacular outperformance. As Jim Rickards noted here last week, that outperformance is set to resume under a Trump administration.

![]() Mailbag: Bond Vigilantes, Gun Ownership

Mailbag: Bond Vigilantes, Gun Ownership

After Enrique Abeyta’s observations about the bond market in Friday’s edition, a reader writes…

After Enrique Abeyta’s observations about the bond market in Friday’s edition, a reader writes…

“The financial media and newsletter writers keep asking the question, ‘Where are the bond vigilantes in our fiscally dominated economy?’

“They will not be showing up.

“I would like to propose an alternative hypothesis. The bond vigilantes of yore are retired or in nursing homes.

“We are now dealing with the crypto bros and gals (age 25–45) who are approaching government overreach from a different playbook. They will rally their followers on Reddit or Telegram, elect their candidates and then silently retreat.

“James Carville, update your wish!”

Dave responds: No doubt, you’re onto something. It’s still early days but Bitcoin appears to be proving its mettle as a store of value alongside gold.

Both stand to thrive amid government profligacy — and much as we cheer on the stated aims of the Musk/Vivek DOGE, we have our doubts it will come to anything.

And if that’s the case, the bond vigilantes are bound to show up sometime. We’re in a new cycle of generally rising interest rates that began in 2020 and if history is any guide will continue well into the 2050s.

At the very least, we could wind up with a “Liz Truss moment” as happened in the U.K. two years ago…

“Talk about tone-deaf,” a reader inveighs.

“Talk about tone-deaf,” a reader inveighs.

“The shot (pun intended) at the end of the 5 Bullets (pun two) on Thursday was way off target.

“Clearly, Dave has never lived in a part of the country where people use guns and are self-reliant. Perhaps he should stop shooting himself with his own words.”

Dave: Au contraire. My wife and I are delighted to make our home in a place where gun deer season is currently underway and normal folks own perhaps five firearms.

Which brings to mind the following gag I ran across the other day, its creator and origin unknown…

-How many guns should a normal person have?

-About five

-That sounds like a gun enthusiast to me

-No, a gun enthusiast has 15

-That sounds like someone obsessed with guns

-No, people obsessed with guns have hundreds

-That sounds like a psycho

-No, psychos seldom own guns, or just get one or two

-That sounds like a normal person though

-No, a normal person has about five, we already covered that.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets