Even Worse Than Congress

![]() The Media Is Hated More Than Congress!

The Media Is Hated More Than Congress!

“Our profession is now the least trusted of all. Something we are doing is clearly not working.”

“Our profession is now the least trusted of all. Something we are doing is clearly not working.”

So wrote Washington Post owner Jeff Bezos this week — justifying his edict prohibiting the paper’s editorial board from endorsing a presidential candidate.

I know, I know — we already wrestled with this topic on Monday. But it comes back to an ongoing theme in these digital pages — the malpractice of corporate media. (It’s something I know a thing or two about, having worked in the TV news racket for 20 years.)

After more than a decade of owning the Beltway rag… Bezos now realizes his media plaything/ego vehicle has become a tainted brand.

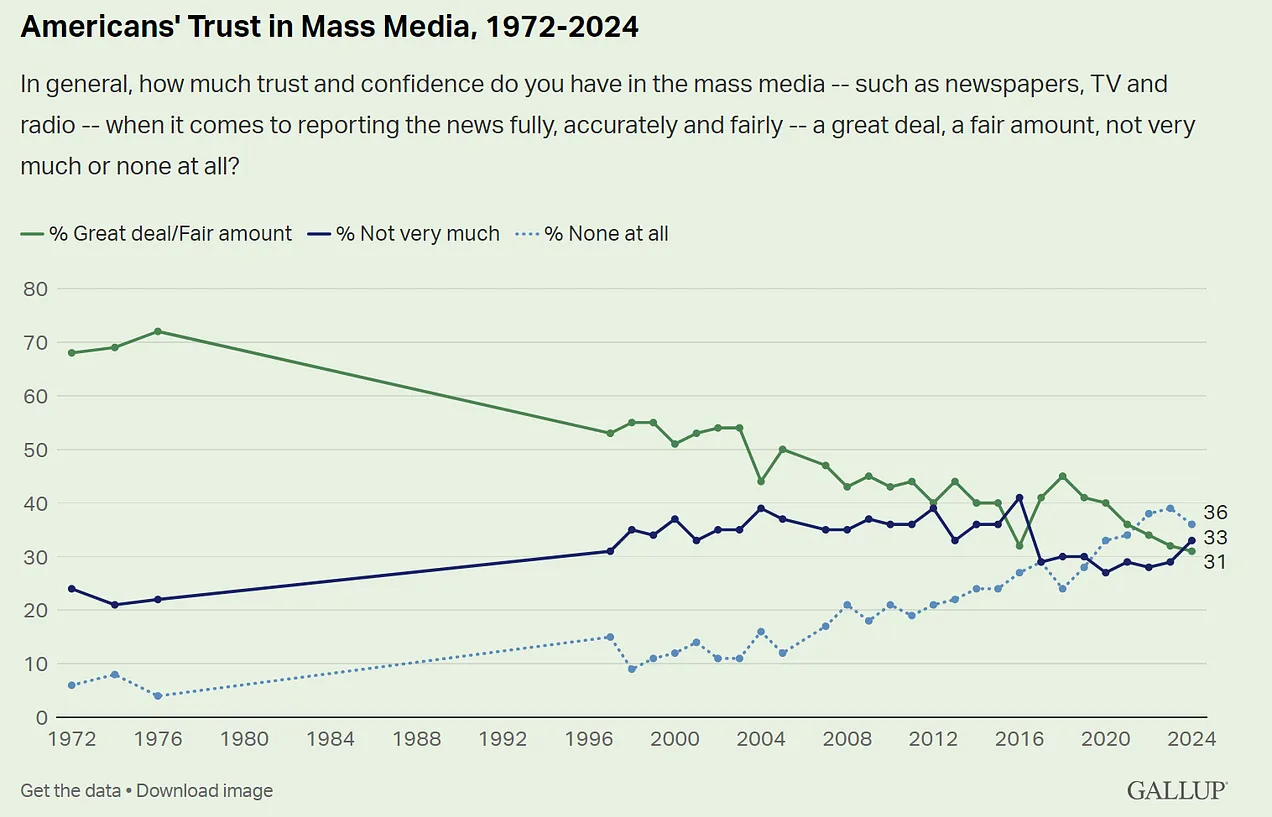

“In the annual public surveys about trust and reputation,” he wrote, “journalists and the media have regularly fallen near the very bottom, often just above Congress.

“But in this year’s Gallup poll, we have managed to fall below Congress.”

It’s true. Only 31% of Americans have a “great deal” or “fair amount” of confidence in the media. Even Congress garners 34%.

It’s true. Only 31% of Americans have a “great deal” or “fair amount” of confidence in the media. Even Congress garners 34%.

That 31% is a record low in Gallup polling going back more than 50 years…

As it happens, much of the decline the last two years has been driven by Democrats — 70% expressing confidence in 2022, 54% now.

In contrast, Republicans lost their confidence — to the extent they had it in the first place — in a single year, 2016. (Among independents, it’s been just a steady decline over time…)

Bezos is paying a price for his decision: The paper reports that “at least 250,000” subscribers have canceled. “The figures represent about 10% of the Post’s digital subscribers.”

Bezos is paying a price for his decision: The paper reports that “at least 250,000” subscribers have canceled. “The figures represent about 10% of the Post’s digital subscribers.”

But it’s a price Bezos appears willing to pay in hopes of rebuilding the credibility the paper lost on his watch, as it threw itself into taking on anything and everything Trump-adjacent.

“In the digital age,” writes the journalist and civil libertarian Glenn Greenwald, “the quickest and cheapest way to earn a profit is to purposely attract an audience that is fiercely loyal to one party or ideology, and continuously feed them validation that they are right about everything.

“Outlets that do that — such as the Post — are then captive to their own readership: They may no longer engage in the act of journalism — which, by definition, validates nobody and at times alienates everyone — and instead must become more akin to political activists who are forced every day to demonstrate their fealty to their readers' partisan loyalties and ideological precepts.”

How times change.

How times change.

Leonard Downie Jr. was the Post’s executive editor from 1991–2008, when the paper was still owned by the Graham family. He flamboyantly refused to vote… and he instructed his staff to “cleanse their professional minds of human emotions and opinions.”

Of course, then and now the Post was part and parcel of America’s power elite… but its leadership recognized it had to at least give lip service to impartiality.

Bezos is coming to recognize the same. “We must be accurate, and we must be believed to be accurate,” he wrote. “It’s a bitter pill to swallow, but we are failing on the second requirement.”

Greenwald again: “It may not be ideal to have a billionaire owner single-handedly override the partisan preferences of his editorial board. But it would be far more alarming if he acted to quash actual journalism.

“In this case, Bezos, as the owner of a paper that already loses tens of millions every year, is attempting to respond to a clear reality that his employees refuse to admit: Namely, if they continue doing what they are doing, it will only make them more hated, less trusted and less relevant than they are now.”

![]() Mr. Market’s Halloween Scare

Mr. Market’s Halloween Scare

Earnings reports and economic numbers have put a minor scare into Mr. Market on this Halloween.

Earnings reports and economic numbers have put a minor scare into Mr. Market on this Halloween.

Start with earnings disappointments from two of the Magnificent 7 companies:

- Microsoft beat the vaunted analyst estimates on both earnings and revenue… but it “guided lower” on revenue for the coming quarter as it continues to pour money into AI. At last check, MSFT is down 5.6% on the day

- Facebook parent Meta recorded record revenue… but the pace of growth in digital advertising is slowing. As we write, META shares have shed 3.4% of their value.

More potential thrills ’n’ chills from the Mag 7 are coming after the close today when Apple and Amazon report their numbers.

Meanwhile, the Commerce Department is out with “core PCE” — the Federal Reserve’s preferred measure of inflation. When Fed officials speak of their 2% inflation target, this is the number they have in mind.

Unfortunately, the year-over-year increase held steady in September at 2.7%. The number has been stuck at this level, more or less, for five months now.

It’s one more data point suggesting the Fed won’t be as aggressive with its interest rate cuts as Mr. Market was counting on a few weeks ago. (The Fed makes its next decision on rates one week from today.)

With this double-whammy, nearly every major asset class is getting clobbered today.

With this double-whammy, nearly every major asset class is getting clobbered today.

The Nasdaq is taking it worst — down 2.4% on the day and down almost 3% from Tuesday’s record close. The S&P 500 is down 1.6% on the day and down nearly 2.5% from its record close two weeks ago. The Dow is holding up best with a loss of 1%.

Bonds are also selling off, pushing yields up. The yield on a 10-year U.S. Treasury note is now over 4.3%, the highest in nearly four months.

And “Mr. Slammy” is showing up in the precious metals markets. Gold is down over $50 to $2,735 and silver is down $1.21 to $32.54. Mining stocks as represented by the HUI index are down nearly 3.8%.

Hmmm… What was it we were saying on Tuesday about silver being unable to break through $35 and the HUI over 350? We’re disappointed, but not surprised.

Bitcoin’s flirtation with record highs over $73,000 on Tuesday didn’t last long. Now it’s back below $71,000.

If you want something that’s up, it’s crude — up nearly a buck to $69.58.

![]() THIS Is Who Might “Drain the Swamp”?

THIS Is Who Might “Drain the Swamp”?

Your editor was agog at this lead to a Wall Street Journal article this week: “Billionaire investor John Paulson says he would work with Tesla chief executive Elon Musk to enact massive federal spending cuts if Paulson were to become Treasury secretary in a second Trump administration.”

Your editor was agog at this lead to a Wall Street Journal article this week: “Billionaire investor John Paulson says he would work with Tesla chief executive Elon Musk to enact massive federal spending cuts if Paulson were to become Treasury secretary in a second Trump administration.”

This was the first I’d heard Paulson was possibly in the running for Treasury secretary — but apparently Trump was talking him up for the job earlier this year because he “makes a hell of a lot of money. He makes money everywhere he goes, actually.”

Paulson was also one of Trump’s earliest Wall Street backers during the 2016 campaign cycle.

“It is relatively unusual for an ally of a presidential candidate to talk openly about the role he or she might play in a future administration,” the Journal points out. “Treasury secretary is one of the most prominent positions in the government, interfacing with Wall Street, business leaders and foreign heads of state.”

It’s at this moment we should recount how John Paulson achieved his renown in the financial world.

It’s at this moment we should recount how John Paulson achieved his renown in the financial world.

The Journal article says he “burst into prominence by reaping an estimated $3 billion betting against subprime mortgages during the 2007–09 financial crisis.”

Which is true, but it’s not the full story.

In the run-up to the financial crisis, Goldman Sachs would often package up subprime mortgages and sell them to clients as mortgage-backed securities. Goldman go-getters knew these mortgages were destined to go sour. They’d send each other internal emails bragging about the “sh*tty deal” they just made.

Key point: In many cases, Goldman created these securities only so that John Paulson could short the hell out of them — which, of course, was not disclosed to the buyers.

So no, it wasn’t just John Paulson’s investing acumen that netted him $3 billion ahead of the financial crisis. It was his active participation in other individuals’ overt acts of fraud — which the feds never prosecuted because Goldman was among the institutions deemed “too big to fail.”

Presumably Trump is aware of this history and just… doesn’t… care.

But considering that Trump ascended to the presidency in part because of lingering outrage over the fallout from the 2008 financial crisis… the irony is thick.

And in another demonstration of how you can’t have enough contempt for the power elite in this country…

And in another demonstration of how you can’t have enough contempt for the power elite in this country…

“Retired Gen. Mark Milley gave a fawning speech on Monday to a sea of tailored suits at the American Bankers Association’s annual convention in New York,” reports the independent journalist Ken Klippenstein.

Milley was named chair of the Joint Chiefs of Staff by Trump in 2019. He retired last year at age 65 to cash in on his four-star career.

“From a capped military salary of $204,000 a year, Milley’s income has skyrocketed,” Klippenstein reports.

Not only is he a “senior adviser” at JPMorgan Chase, “he’s joined the faculties of Georgetown and Princeton, and also entered the lucrative paid speaking circuit. For his speeches, Milley is represented by the Harry Walker Agency.”

Anyway, here’s what Milley said: “I know people thank all of us in uniform for our service, but I want to thank you and your service because the two key components of national security and the international scene is a strong military and a strong economy… I know that the people in the crowd are controlling basically $24 trillion, $25 trillion of a $30 trillion economy. So good on you for doing that.”

The speech had zero substance, as Klippenstein documents — much blather but no insight about the messes in the Middle East and Ukraine.

“Milley dares not stick his neck out to make any predictions or even offer any suggestions for an end to all this,” Klippenstein writes. “Just this week, Milley was quoted all over the press as calling Donald Trump a ‘fascist.’ But he didn’t make a single direct reference to Trump in his talk. For the national security state, it doesn’t matter who the next president will be.”

Nor for the bankers. JPMorgan Chase CEO Jamie Dimon prospers no matter who’s in the Oval Office.

Milley’s speech is a vivid reminder of Thomas Jefferson’s words in a letter to John Taylor in 1816…

“And I sincerely believe with you, that banking establishments are more dangerous than standing armies; & that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale."

![]() Comic Relief

Comic Relief

You can’t make this stuff up (and you’ve gotta watch)…

You can’t make this stuff up (and you’ve gotta watch)…

![]() Mailbag: What Does Musk Want?

Mailbag: What Does Musk Want?

In response to a reader’s query on Tuesday — “Musk donated $75 million to Trump's campaign. What could Musk want from Trump for $75 million?” — another reader writes…

In response to a reader’s query on Tuesday — “Musk donated $75 million to Trump's campaign. What could Musk want from Trump for $75 million?” — another reader writes…

“I think it's two things: (1) I actually think he believes in free speech; and (2) he said that he is likely to go to prison for something if Trump doesn't win. He and his companies are under investigation separately by, I think, 26 different government agencies. What would you pay if it kept you free?

“Maybe more insightful is how much money would you spend being principled? That question often makes me wonder how principled I really am. But maybe not everyone is bad and just looking out for themselves like we are.”

Dave responds: Musk’s commitment to free speech is questionable at best. But you do raise a valid point: As we mentioned last week, even The New York Times acknowledges that Musk’s companies “have been targeted in at least 20 recent investigations or reviews, including over the safety of his Tesla cars and the environmental damage caused by his rockets.”

“I just love Emily and enjoy her articles,” a reader writes after yesterday’s edition.

“I just love Emily and enjoy her articles,” a reader writes after yesterday’s edition.

“I’ll be glad when all the political #*&@ is behind us but I’m following it, as it certainly drives the financial world. More, more…”

Dave: You’ll be glad, I’ll be glad, Emily will be glad…