Abolish the Presidency, Says Altucher

![]() Abolish the Presidency, Says Altucher

Abolish the Presidency, Says Altucher

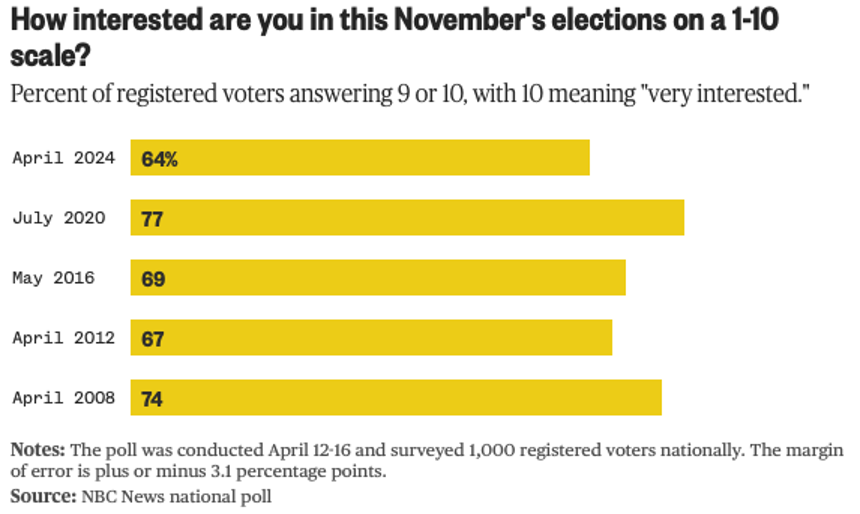

Wait, not everyone feels invested in The Most Important Presidential Election In History™?

Wait, not everyone feels invested in The Most Important Presidential Election In History™?

“The share of voters who say they have high interest in the 2024 election has hit a nearly 20-year low at this point in a presidential race,” says NBC News this morning— describing the results of a poll it commissioned.

Gosh, interest was higher even in April 2012 — when Mitt Romney had all but sewn up the GOP nomination against an incumbent Barack Obama.

It was during the 2012 campaign cycle that Paradigm’s out-of-the-box investor James Altucher penned a not-entirely facetious proposal to… simply… do away with the presidency.

“I think the institution of the presidency has largely ruined my life and the lives of most other people,” James wrote. Best, he said, to just abolish the whole thing.

“I think the institution of the presidency has largely ruined my life and the lives of most other people,” James wrote. Best, he said, to just abolish the whole thing.

“First off, the Constitution doesn’t even address the powers of the presidency until Article II,” he pointed out. “The Founders clearly thought the legislative branch was more important, i.e. the actual branch that creates laws, declares wars, etc.”

Of course, the last time Congress actually declared war was during World War II. Ever since, it’s punted on that weighty responsibility and handed it off to… the president.

Result? “So the president, I guess, took ‘actions’ in Korea, Vietnam, Iraq, Afghanistan, Grenada (??), and a dozen other places I would never want to step foot in,” James wrote.

“It’s such simple math: if you get rid of the presidency, millions of American children will live to be adults instead of dying on foreign soil. And millions of civilians in other countries would be left alone. Seems like a good deal.”

But what about the military the president oversees, defending our way of life and whatnot? “Here’s what’s really defending my way of life,” James said pointedly. “Not somebody fighting in a jungle in Vietnam or Afghanistan but global capitalism.

“The more we trade and do business and support the economic development of third-world countries, the less likely they are to want to bomb us (which has happened once in 50 years and not by a country but by a terrorist group that we successfully fought more through seizing bank accounts than through military actions).”

Aside from running the military during wartime, making treaties and appointing Supreme Court justices, James wondered what a president does that’s actually legal.

Aside from running the military during wartime, making treaties and appointing Supreme Court justices, James wondered what a president does that’s actually legal.

“All of the other stuff is artificial,” he said. “He can go to funerals. He can create new cabinet-level departments (Education, HUD, etc.) that require massive buildings and budgets and take away people from private industry to give them sinecure BS jobs that last forever. I guess he runs the CIA so we can spy on people. Like how we spied on people so we avoided 9/11. Errr...”

Those are the highlights of James’ piece. You can read the whole thing here if you like (some of the pop-culture references are painfully dated)... but I imagine if you’re a James Altucher subscriber you’re much more interested in what he has to say today about AI, crypto and his other investing fortes.

Lucky you, he’s convening a Q&A session on Zoom this week — during which he’ll be giving away $1,000 every minute for 60 minutes.

The discussion gets underway this Thursday at 2:00 p.m. EDT. As long as you’re a registered viewer, you’re eligible to win — and to be a registered viewer you simply need to enter your name and email address on this form. Easy-peasy.

![]() Everyone Is a Spy

Everyone Is a Spy

As for the Congress… much has taken place since we signed off for the week on Friday…

As for the Congress… much has taken place since we signed off for the week on Friday…

Of particular interest for our Bullet No. 2 is this: If you run a convenience store or a gym or maybe you own some commercial property… the feds might one day dragoon you to spy on your customers or tenants.

Late Friday night the Senate followed the House’s lead and voted 60-34 to extend Section 702 of the Foreign Intelligence Surveillance Act for two more years. Joe Biden immediately signed it into law.

Tucked into this legislation is a brand-new provision — what critics call the “Everyone Is a Spy” clause.

The feds now have the power to order tens of millions of small businesses with a Wi-Fi router to hand over their data stream on demand.

While hotels and restaurants are exempt, many other businesses are not.

"An enormous range of businesses would still be fair game," protests a coalition of privacy and civil liberties groups — "including grocery stores, department stores, hardware stores, laundromats, barber shops, fitness centers, and — perhaps most disturbingly — commercial landlords that rent out the office space where tens of millions of Americans go to work every day, including news media headquarters, political campaign offices, advocacy and grassroots organizations, lobbying firms and law offices."

"An enormous range of businesses would still be fair game," protests a coalition of privacy and civil liberties groups — "including grocery stores, department stores, hardware stores, laundromats, barber shops, fitness centers, and — perhaps most disturbingly — commercial landlords that rent out the office space where tens of millions of Americans go to work every day, including news media headquarters, political campaign offices, advocacy and grassroots organizations, lobbying firms and law offices."

The language of the legislation is so broad that it could apply to “anyone who could physically access a wire, a cable box Wi-Fi or a phone or a computer,” a congressional staffer tells independent journalist Matt Taibbi.

Even cable installers, repairmen and house cleaners could be served with an FBI subpoena.

Oh, and they’d be under a gag order — forbidden to notify their customers/clients/tenants about this warrantless spying. (Remember the “good old days” of the Patriot Act and it was only libraries that were under these orders if you checked out “suspicious” books?)

But for members of Congress, it’s all good. If the feds scoop up data that happens to include the communications of congresscritters, they have to be notified.

So much for quaint old American values like “equality under the law.”

![]() The “Everything World War III” Bills

The “Everything World War III” Bills

Meanwhile on Saturday, the House voted to spend $95 billion of money the government doesn’t have to stir up more trouble around the globe.

Meanwhile on Saturday, the House voted to spend $95 billion of money the government doesn’t have to stir up more trouble around the globe.

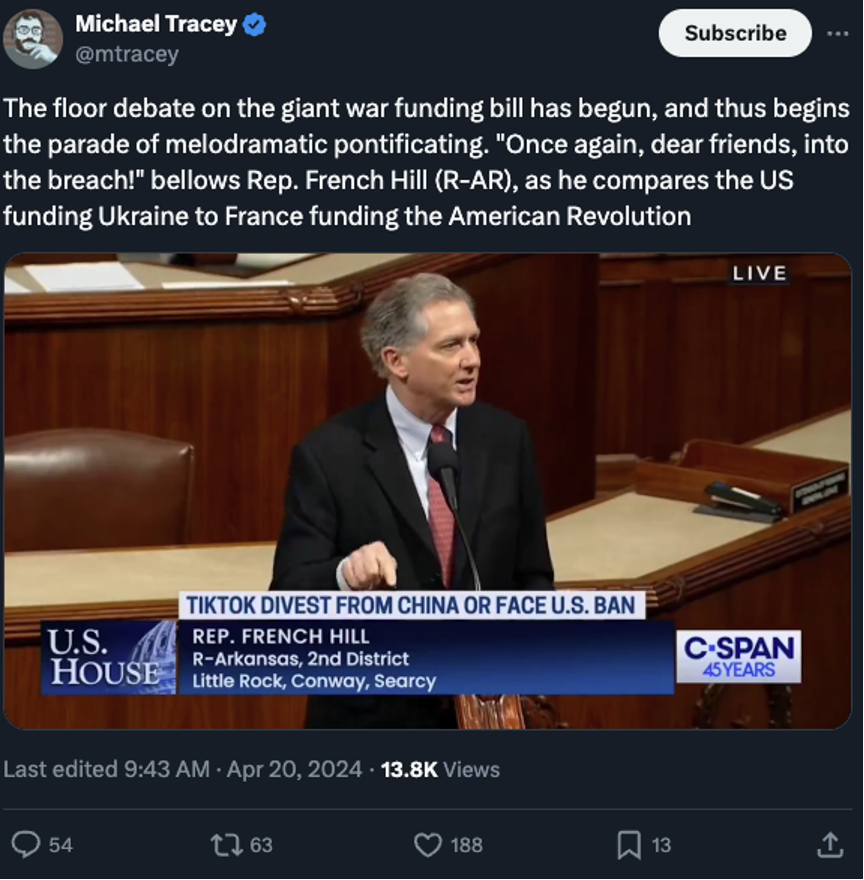

There’s $61 billion for Ukraine… $26 billion for Israel… $8 billion for Taiwan. All of it passed in separate bills by overwhelming margins with much bloviating and tortured historical analogies…

Does someone want to inform the gentleman from Arkansas that France’s aid to America during the Revolution — which was not out of sympathy for America but rather spite for England — ultimately helped bankrupt France and toppled the government in 1789?

Anyway, we won’t dwell too much on the dollars and cents or the recipients today; colleague Sean Ring did that just fine in today’s Rude Awakening.

It’s the fourth bill — the godawful-named “21st Century Peace Through Strength Act,” also passed by an overwhelming margin — that has our attention…

For starters, the outright confiscation of U.S. Treasuries owned by the Russian Central Bank is nearly a done deal.

For starters, the outright confiscation of U.S. Treasuries owned by the Russian Central Bank is nearly a done deal.

We’ve warned about the folly of this step for many months now. It was already an extreme step to freeze $300 billion in Treasuries owned by Russia — an act that prompted other governments around the world to start shrinking their dollar reserves.

But as Paradigm macro maven Jim Rickards has said, seizing those assets takes it to a whole new level. It is an effective default on the U.S. Treasury’s obligations to pay its debts.

Most of the $300 billion in Treasuries is held in European banks; seizing those assets requires the cooperation of European authorities, and they’re understandably reluctant to take such an extreme step.

But there’s about $6 billion in Treasuries held in the United States… and this new bill gives the president the authority to confiscate them.

Long term, that’s bad for Treasuries… and good for gold. As Jim told his Strategic Intelligence readers last month, “Gold is the liquid, safe alternative and appeals to many investors in a world where Treasuries can be confiscated at will.”

The “21st Century Peace Through Strength Act” also includes a revised version of the TikTok ban.

The “21st Century Peace Through Strength Act” also includes a revised version of the TikTok ban.

We won’t dwell today on the reasons this is a terrible idea; we already did that when the House debated and passed the original version last month. Suffice to say that under the revised legislation, TikTok’s Chinese owners have up to a year instead of just six months to sell their U.S. operations.

The revised timetable is convenient for congresscritters. No longer will they have to confront angry constituents while campaigning this fall. It all gets pushed back after Election Day now. (By one count, fully half the U.S. population uses TikTok to exercise their First Amendment rights and a super-majority are of voting age.)

All in all, a grim weekend for peace and prosperity and freedom. The four bills will be bundled into a single bill for the Senate to rubber-stamp next.

Only 13 representatives out of 435 took the consistent principled position on all four votes — the position expressed in Jefferson’s ideal of “peace, commerce and honest friendship with all nations, entangling alliances with none.”

![]() Gold on Sale

Gold on Sale

“Mr. Slammy” — aka the hidden hand that takes down the price of precious metals — has been busy ever since the markets opened last night to start a new week.

“Mr. Slammy” — aka the hidden hand that takes down the price of precious metals — has been busy ever since the markets opened last night to start a new week.

It wasn’t a waterfall drop — just a steady stream downward. At last check, gold was down nearly 2.5% or $58 to $2,333. Silver is taking it much worse, down over 5% or $1.50 to $27.14.

There’s no news catalyst for this price action; the mainstream is trying to chalk it up to the fact that Israel didn’t conduct any bigger follow-up bombing of Iran this weekend, but that was already evident on Friday.

Sometimes, there just isn’t an explanation. Volatility happens. In this present instance, gold is “waking up after a long snooze and needs to get the crust out of its eyes,” says Paradigm trading pro Greg Guenthner.

Our old friend Chuck Butler, still holding forth at his Daily Pfennig e-letter, is positively Zen: “The short paper traders are having a field day today, so just ignore this trading and go out and mow the lawn, or play golf or do something that doesn't involve watching the short paper trades and their engineered takedown again.”

There was an explanation for the previous big slam on Friday, April 12, by the way.

There was an explanation for the previous big slam on Friday, April 12, by the way.

In an announcement overlooked by both mainstream and alternative media, CME Group — the giant exchange overseeing futures and options trading in commodities — said that day it planned to jack up margin requirements for traders. Raising margin requirements forces traders to fork over more cash in case their trades go against them.

That announcement assured gold would not end the week over $2,400. [Credit where it’s due: The Financial Sense podcast was all over the story, if no one else was.]

Perhaps the takeaway is this: For all the drama of the last 10 days or so, gold is still holding the line on $2,300 — a level it had never seen until this month!

That’s resilience — and a sign that Greg Guenthner’s target before year-end of $2,600 remains in play.

As for stocks, the major averages are all in the green — but not dramatically, and not enough for the S&P 500 to reclaim the round-number level of 5,000.

As for stocks, the major averages are all in the green — but not dramatically, and not enough for the S&P 500 to reclaim the round-number level of 5,000.

Crude is up modestly to $83.35. In its latest post-halving iteration, Bitcoin has pushed past $66,000.

Several of the “Magnificent 7” names report their quarterly numbers later this week including Microsoft, Google parent Alphabet and Facebook parent Meta.

The big economic numbers don’t come until later this week — the Commerce Department’s first guess at first-quarter GDP on Thursday, and the Federal Reserve’s preferred measure of inflation on Friday.

![]() Mailbag: An Infrastructure Lament

Mailbag: An Infrastructure Lament

“The United States is entering a period where we will be seriously short on lots of critical infrastructure,” a reader writes after our latest update on the shortage of electrical transformers.

“The United States is entering a period where we will be seriously short on lots of critical infrastructure,” a reader writes after our latest update on the shortage of electrical transformers.

“If you and I can see this, why can’t our leadership see it? It would appear that they are clueless.

“Time to call it what it is. Incompetence at the highest level. Time for responsibility to be demanded and repercussions to be felt for being irresponsible to your job and what the person was supposed to be in charge of.

“Heaven help us all, we will need it shortly.”

Dave responds: With infrastructure, as with much else these days, appealing for divine intervention seems like a far better risk-reward proposition than thinking we can vote our way out of this…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets