Finally!

![]() Bitcoin’s Burst Higher (But What’s Next?)

Bitcoin’s Burst Higher (But What’s Next?)

After a couple of failed attempts last week, Bitcoin finally burst through its record high of $69,000 this morning.

After a couple of failed attempts last week, Bitcoin finally burst through its record high of $69,000 this morning.

Checking our screens, it’s over $72,000. It took two years and four months… but it happened.

Bitcoin is enjoying the tailwind of fresh demand via the spot Bitcoin ETFs that started trading two months ago.

And there’s ample anticipation of the next “halving,” a preprogrammed event that keeps the quantity of Bitcoin strictly limited: Starting around April 20, Bitcoin miners will have to expend twice as much computer power to generate the same quantity of Bitcoin.

With both of the previous halvings in 2016 and 2020, Bitcoin soared to further record heights roughly 15–18 months later.

For that reason and many others, veteran crypto hand Ari Paul likens the present moment of the current crypto bull market to the fifth inning of a baseball game.

For that reason and many others, veteran crypto hand Ari Paul likens the present moment of the current crypto bull market to the fifth inning of a baseball game.

“This stage,” says Paul, the founder of BlockTower Capital, “is marked by a frequently ‘overextended’ market with elevated funding rates.”

It brings greater volatility… along with more participation from everyday folks.

Then comes the sixth inning — what Paradigm’s senior crypto analyst Chris Campbell calls “the FOMO stage,” in which still more people pile in for fear of missing out.

Then comes the sixth inning — what Paradigm’s senior crypto analyst Chris Campbell calls “the FOMO stage,” in which still more people pile in for fear of missing out.

“More retail investors hear stories of massive gains. Euphoria sets in. Many lesser-known altcoins go on hype-fueled runs. People start reaching for the levers.”

To be sure, both Chris and our resident crypto evangelist James Altucher believe Bitcoin still has plenty of runway ahead of it; James is on record forecasting $100,000 Bitcoin by year-end.

But a funny thing is happening right now. Many “altcoins” — smaller cryptos with truly explosive long-term potential — are lagging.

The truly good ones — and there are only a few — can be had at more attractive prices now than was the case in late 2023. James has been pounding the table about them for the last week.

That’s because Wednesday morning is going to be what he calls the “trigger event.” A different preprogrammed event in the crypto space is set to take place at that time. James says it will send one coin soaring for 100X gains by 2030.

If you haven’t watched his interview yet — you won’t have to pay a thing to learn the name of this coin — time’s a-wasting. Here’s the link.

![]() “We’re Going to Ban TikTok and You’re Going to Like It”

“We’re Going to Ban TikTok and You’re Going to Like It”

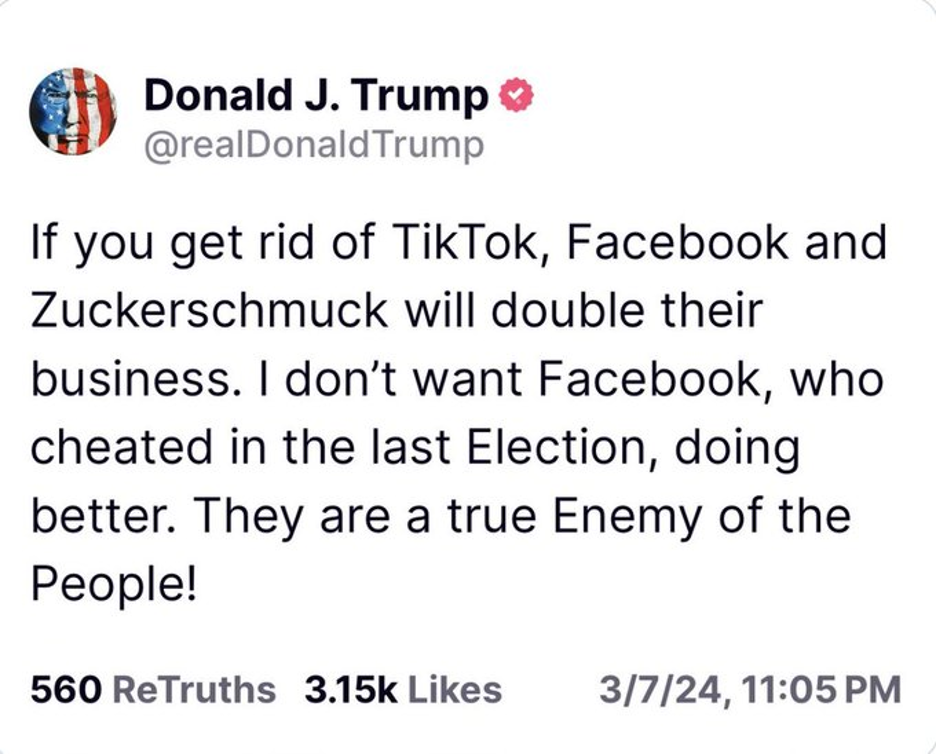

Our Bullets No. 2 and 3 today have a little of everything — free enterprise, free speech, the consent of the governed… and the stupid 2024 election.

Our Bullets No. 2 and 3 today have a little of everything — free enterprise, free speech, the consent of the governed… and the stupid 2024 election.

Maybe you’ve seen the news: On Wednesday, the House will likely pass a bill that effectively bans the social media app TikTok. If it passes the Senate, Joe Biden says he’ll sign it.

Strictly speaking, the bill gives TikTok’s Chinese owners six months to sell their U.S. operations, lest the app be banned. Given the glacial speed at which cross-border sales of enormous businesses like TikTok usually proceed, that’s not a realistic timeframe.

So for all intents and purposes we’re talking about banning a platform used by 170 million Americans to exercise their First Amendment rights.

Actually, most of Washington, D.C. — both major parties — does believe that. Fervently.

Over the last year, your editor has weighed in from time to time in defense of TikTok and against this moral panic in the Beltway. A few salient points worth bearing in mind right now…

- The primary reason the feds have TikTok in their crosshairs is that it’s one of the few social media apps used by Americans — along with X-formerly-Twitter under Elon Musk’s ownership — that’s not totally under the thumb of the FBI, CIA, DHS, etc.

- Anyone who complains about China’s jurisdiction over TikTok usually ignores U.S. jurisdiction over Google, Facebook and Amazon — who surely hand over foreign customers’ data to the U.S. government

- Based on publicly available information, there’s no evidence TikTok spies on U.S. customers or propagandizes them. “I’ve been trying for years to find any links to the Chinese state,” writes the investigative reporter Chris Stokel-Walker — who’s done plenty of reporting critical of TikTok. “I've spoken to scores of TikTok employees, past and present, in pursuit of such a connection. But I haven’t discovered it.”

In the final item on that list I included the disclaimer “based on publicly available information” for a reason. The House Energy and Commerce Committee voted 50-0 in favor of the ban bill Thursday after a secret briefing by the “intelligence community.”

Whatever the spooks said was enough to convince Rep. Elise Stefanik (R-New York) that TikTok aims to “mobilize young Americans on behalf of the CCP.” Added Rep. Frank Pallone (D-New Jersey): “I take the concerns raised by the intelligence community this morning very seriously.”

But peasants like you and me don’t get to evaluate that evidence for ourselves before Congress acts.

![]() Where’s the Effort to PERSUADE the American People?

Where’s the Effort to PERSUADE the American People?

It’s taken the better part of four years to get to this juncture. And the entire time there’s been no effort — nothing at all — to sell the urgency of such a radical step to TikTok’s users.

It’s taken the better part of four years to get to this juncture. And the entire time there’s been no effort — nothing at all — to sell the urgency of such a radical step to TikTok’s users.

We’re talking 170 million people, half of the U.S. population. And contrary to what you might think, fully 75% of those 170 million are of voting age. Whatever happened to the consent of the governed?

I first noticed this phenomenon when Donald Trump tried to ban TikTok via executive order in 2020. (His move was slapped down by the courts as presidential overreach; that’s the whole rationale for doing a ban via legislation.)

As I wrote at the time while discussing Chinese social media stocks in The Profit Wire, “If there were a genuine threat from the Chinese Communist Party, the president could use his bully pulpit and rally young Americans around the necessary sacrifice of their silly dance videos, right?”

But he didn’t do that. Nor has Joe Biden. Hell, his speechwriters could have easily slipped it into the State of the Union last minute on Thursday night after the House committee’s unanimous vote.

On Friday, TikTok tried to mobilize its users to call their congress members. Usually, large call volumes to Capitol Hill can move the needle on key legislation.

Not here. Indeed, the calls spurred congress members to dig in their heels: “They made the point for us,” Rep. Kat Cammack (R-Florida) told The Wall Street Journal.

And then there’s the hypocrisy. Not just Joe Biden’s campaign launching a TikTok account last month… but Donald Trump’s flip-flop on a ban…

And then there’s the hypocrisy. Not just Joe Biden’s campaign launching a TikTok account last month… but Donald Trump’s flip-flop on a ban…

There’s a theory that Trump has come under the sway of Jeff Yass — a GOP megadonor who owns a stake in TikTok. But from here, it looks like just shameless opportunism.

Still, Trump’s implication about the deep state at work is absolutely on the mark. According to The Wall Street Journal, the Biden administration’s point person in pushing the TikTok ban on Capitol Hill is Deputy Attorney General Lisa Monaco.

Monaco is a real piece of work. A decade ago, when she was a “counterterrorism” adviser to Barack Obama, she literally said teenage rebellion was the sign of a budding terrorist.

I kid you not. During a speech at Harvard discussing the “warning” signs that someone is becoming “radicalized to violence,” she cited an example: “Parents might see sudden personality changes in their children at home — becoming confrontational.”

That’s the deep state’s mindset behind this moral panic — that TikTok’s user base has the not-yet-fully-formed brain of a rebellious teenager who might go off half-cocked at any moment with a bomb or an AR-15, yelling either “MAGA!” or “Free Palestine!” all made possible by “CCP” mind control.

No wonder they feel like they don’t have to sell it to everyday folks — their contempt for everyday folks is manifest.

Still, the timing is fascinating. Let’s assume the House passes the bill on Wednesday, the Senate acts this week or next and the bill becomes law before the end of the month.

In that eventuality, TikTok’s parent company will have to sell or more likely shut down the U.S. app… about six weeks before Election Day.

I dunno, could get interesting…

![]() The Stock Market: Close Call

The Stock Market: Close Call

What looked like the start of a giant whoosh taking all the bullish momentum out of Wall Street… has failed to materialize.

What looked like the start of a giant whoosh taking all the bullish momentum out of Wall Street… has failed to materialize.

Late on Friday, the bottom fell out in the darling stock of 2023–24 — Nvidia. No sooner was it pushing higher in the morning, toward the $1,000 mark, when sellers showed up — and NVDA ended the day down more than 5%.

It was much weekend fodder for finance types on X/Twitter — especially in light of a couple recent bull-market magazine covers. (Magazine covers can be a contrarian indicator…)

As NVDA goes, so goes the semiconductor sector, so goes technology and so goes the market as a whole. Or so it’s seemed for the last several months.

At last check, NVDA is down another 1% on the day, and the chip sector about 1.75%. But the major U.S. averages are holding up fine — all of them down about a half percent, the S&P 500 a hair below 5,100 again.

“I’m not in any hurry to quick-call a major crash in NVDA shares (or semis, for that matter),” writes Paradigm trading pro Greg Guenthner at The Trading Desk. “Yes, I think we should be looking for downside action in this group to start the week. But it’s impossible to say whether the music has stopped.”

Besides, Mr. Market’s short attention span will be consumed soon enough by the February inflation numbers — due tomorrow morning, and coming just a week ahead of the next Federal Reserve meeting.

Elsewhere, crude is little changed at $77.81. Gold continues to hang out in record territory, the bid now $2,182. And silver’s up to $24.42. Speaking of which…

![]() Costco Silver From the Great White North

Costco Silver From the Great White North

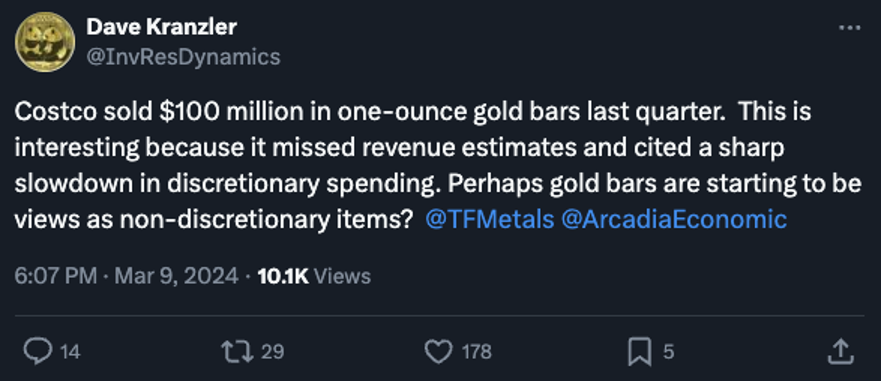

Costco customers can’t get enough precious metals. Six months after COST began selling 1-ounce gold bars and three months after it diversified into U.S. Silver Eagles…

Costco customers can’t get enough precious metals. Six months after COST began selling 1-ounce gold bars and three months after it diversified into U.S. Silver Eagles…

This is interesting. When available — and it appears they’re already sold out — Costco will sell you a tube of 25 Canadian Maple Leaf silver coins for $679.99. (Limit five tubes, please.)

That’s a modest premium over the spot silver price — and a far better deal than you’ll get from anyone selling American Silver Eagles. Alas, the reviews are not favorable — many reports of damaged packaging.

Costco did sell Silver Eagles briefly during December — but it did so on the downlow. No press release, no coverage in the corporate media. That was a sharp contrast with the 1-ounce gold bars it started selling last fall.

Just speculating here, but it’s possible Costco couldn’t continue to swing a good discount. Either that, or the U.S. Mint is still having trouble furnishing enough supply to its dealer network. Earlier in the decade, the Mint had a devil of a time obtaining 1-ounce silver blanks because of COVID lockdowns and supply-chain snags. (Why other government mints rebounded so quickly and not the U.S. Mint no one has ever explained.)

Meanwhile, here’s some further food for thought from a veteran precious metals hand…

As the aforementioned Greg Guenther quipped last fall, “Pretty insane that gasoline and gold are both loss leaders at COST in 2023.”

Imagine if they start selling ammo in 2024!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets