Again With the Gas Stoves

- Team Biden tries and tries again

- SPX, a 14-month high (and a 15-month round trip)

- More fallout from Washington’s economic sanctions

- Queen Bey… and tricky Swedish statistics

- “Nice planet you’ve got there. Be a shame if…”

![]() If at First They Don’t Succeed… (Gas Stove Ban)

If at First They Don’t Succeed… (Gas Stove Ban)

Uh-oh: “We feel this huge sense of urgency,” says Energy Secretary Jennifer Granholm — who last appeared in our virtual pages brimming with confidence that the entire fleet of U.S. military vehicles can be electrified by 2030.

Uh-oh: “We feel this huge sense of urgency,” says Energy Secretary Jennifer Granholm — who last appeared in our virtual pages brimming with confidence that the entire fleet of U.S. military vehicles can be electrified by 2030.

From E&E News, the energy-and-environment website run by Politico: “In the semiannual Unified Agenda — released Tuesday — the Biden administration outlines a packed energy policy agenda in the second half of 2023 and early 2024, targeting the natural gas sector with regulations on gas stoves and methane emissions.

“Federal regulators will also turn their attention to a flurry of other areas, including transmission, heat pumps and protections for the public lands in Alaska.”

Yeah, so they haven’t given up on gas stoves.

Yeah, so they haven’t given up on gas stoves.

You might recall five months ago, the Consumer Product Safety Commission floated the idea of banning new gas stoves — on the theory that they emit pollutants like nitrogen dioxide that are linked to respiratory illness.

At the time, we suggested it might be a trial balloon — just to see how badly the notion would get roasted on social media. And it was — sauteed, too.

So now the Biden administration is pursuing a different gambit via a different agency.

“The Department of Energy is aiming to finalize a regulation on gas stoves by January 2025,” reports E&E. “The proposed rule, released earlier this year, sets standards for energy efficiency levels rather than emissions — and could prohibit sales of roughly half the current gas stove models on the market.”

“You can be sure they’re devising technical workarounds that will have the same effect as the gas stove ban using indirect instead of direct methods,” Jim Rickards wrote presciently to his Strategic Intelligence readers in March.

“You can be sure they’re devising technical workarounds that will have the same effect as the gas stove ban using indirect instead of direct methods,” Jim Rickards wrote presciently to his Strategic Intelligence readers in March.

The appliance industry says the rules could double the time it takes to boil water. “Manufacturers say it will be impossible to achieve the changes,” according to The Washington Times, “without reducing the sizes of burners and changing their designs, which would result in longer waits to put dinner on the table.”

Jim Rickards again: “My advice is to buy a new gas stove now while you still can. A good one should last for 20 years. Hopefully, by then the climate alarmist nuts will have been driven from Washington and common sense will return.”

But in the meantime, the control freaks and power trippers have a single-minded focus.

But in the meantime, the control freaks and power trippers have a single-minded focus.

“They don’t care what voters think,” says Jim. “They just pursue the agenda.”

It’s one of those cruel realities in which you have to invest accordingly — or risk getting steamrollered.

That’s why we’ve been pounding the table all week about the pursuit of deep-sea mining — to recover nickel, cobalt, copper and other metals essential for electric-vehicle batteries.

It’s not a hypothetical, pie-in-the-sky thing. The technology already exists — and the regulatory obstacles are clearing. (Again, it’s that single-minded focus of the green-energy obsessives.)

Last night, Jim’s colleague Ray Blanco convened his $16 Trillion Super-Mine Summit with some very specific — and very lucrative — details about a tiny $1-a-share company with rights to a rich swath of territory in the Pacific Ocean, just north of the equator.

If you couldn’t join the event live, we’re making a replay available for a limited time only. Events are moving quickly — and a pending change to international law could be the catalyst for a near-term doubling of the share price. Follow this link for instant access to the summit.

![]() A 14-Month High… and a 15-Month Round Trip

A 14-Month High… and a 15-Month Round Trip

The U.S. stock market is set to end the week at a 14-month high.

The U.S. stock market is set to end the week at a 14-month high.

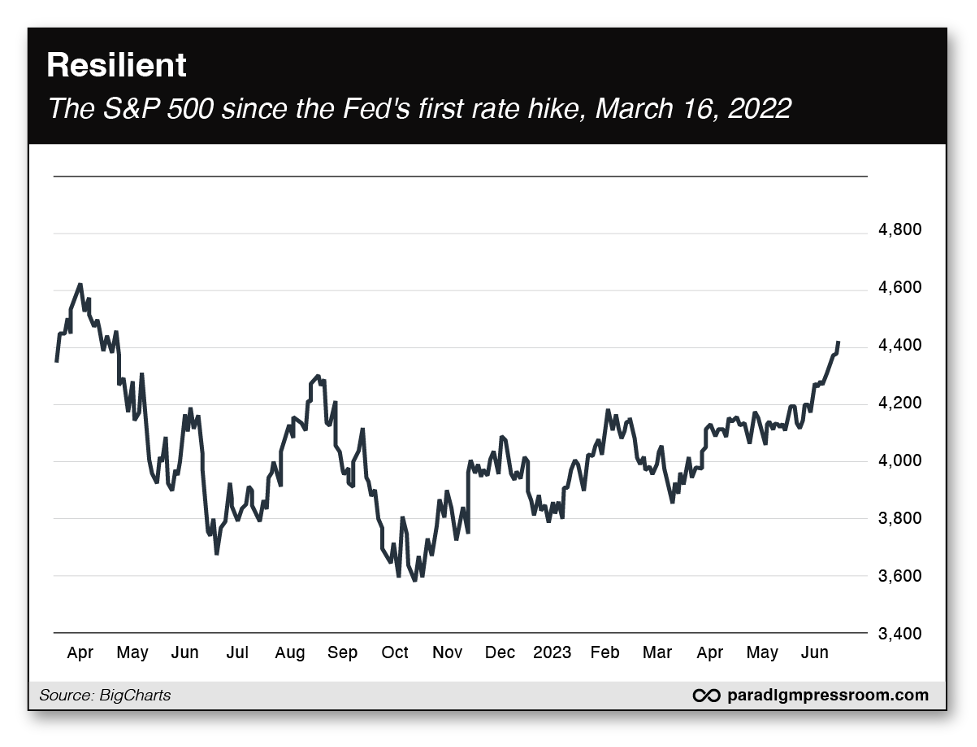

At last check, the S&P 500 was up another third of a percent on the day at 4,440. Looking at the charts, “There’s no reason for the SPX not to hit 4,650,” ventures colleague Sean Ring at our sister e-letter The Rude Awakening.

“We've seen 10 straight hikes in interest rates and the market is standing strong,” Paradigm trading authority Alan Knuckman told readers of The Profit Wire yesterday. Indeed, the S&P has recovered all its losses going back to the Federal Reserve’s first increase on March 16 of last year…

Not bad for the steepest rate-raising cycle since the early 1980s.

And the big economic number of the day suggests no change to the course the Fed has charted on rates through the end of 2023.

And the big economic number of the day suggests no change to the course the Fed has charted on rates through the end of 2023.

We loathe the University of Michigan consumer-sentiment data for reasons we spelled out last year… but the Fed pays close attention to the “inflation expectations” portion of the survey.

And those expectations have climbed down considerably. Survey respondents expect 3.3% inflation over the next year. That’s a drop from 4.2% last month, indeed the lowest since May 2021.

From the Fed’s vantage point, inflation expectations still aren’t “anchored,” but they’re moving in the right direction. As noted here yesterday, the Fed is on track to raise the fed funds rate two more times in quarter-percentage-point increments before year’s end — to a peak of 5.75%.

Go figure: The U.S. economy might take a hit this fall from… the resumption of student loan payments.

Go figure: The U.S. economy might take a hit this fall from… the resumption of student loan payments.

At long last, the pandemic moratorium on federal student loans runs out soon. Interest will start accruing again on Sept. 1, and payments are due in October.

Researchers at Barclays project the following…

- An average payment of $390 a month, translating to…

- A reduction in monthly personal incomes of 8% and…

- A reduction in consumer spending of $15.8 billion per month.

Sorta makes you wonder if student loan forgiveness will be a campaign issue next year, right? Gotta rescue the economy!

I see our publisher Matt Insley is soliciting reader feedback on the topic at our sister e-letter The Rundown. Might as well do the same here, so we can have a lively mailbag next week. (I suspect we’re running out of steam with aliens, heh.) Here’s the new address: feedback@paradigmpressroom.com

A 5 Bullets follow-up: The labor dispute affecting ports on the West Coast is over — pending final approval of a new contract.

A 5 Bullets follow-up: The labor dispute affecting ports on the West Coast is over — pending final approval of a new contract.

The Pacific Maritime Association has come to terms with the International Longshore and Warehouse Union on a six-year deal covering 22,000 dockworkers at 29 West Coast ports — including the big ones at Los Angeles and Long Beach. They’d been working without a contract for a year.

As we mentioned earlier this month, the National Retail Federation was getting itchy about shipments from overseas for back-to-school and even the holidays. Thus it urged the White House to step in, which it did — acting Labor Secretary Julie Su was put on the case.

It’s the second such intervention in less than 12 months, after the administration leaned on Congress last year to impose a new contract on railroad workers.

![]() Blowback From Washington’s Economic Warfare

Blowback From Washington’s Economic Warfare

The U.S. government looks mighty lonely in its effort to strangle China’s technology sector.

The U.S. government looks mighty lonely in its effort to strangle China’s technology sector.

Politico hosted a “Global Tech Day” in London yesterday. Here’s the lead to its story about the event…

“Officials from the European Union, Malaysia and Singapore are skeptical about the United States' efforts to cut China out of the global high-tech trading system, expressing reluctance to join Washington as it works to throttle the rapid expansion of the world’s second-largest economy into a global technology power.”

Yep, the European Union is on Washington’s side when it comes to Russia… but not China. Lucilla Sioli of the European Commission gave lip service to over-reliance on delicate supply chains from Asia, but she was insistent about maintaining ties to Beijing. "We want to work with China as an economic power.”

Well, as long as Washington has frozen the dollar-based assets of Russia’s central bank, how about just handing them over to Ukraine?

Well, as long as Washington has frozen the dollar-based assets of Russia’s central bank, how about just handing them over to Ukraine?

That’s the idea behind a bill that’s got bipartisan traction on Capitol Hill, and it has an exceedingly clever acronym, even by Washington standards — the Rebuilding Economic Prosperity and Opportunity (REPO) for Ukrainians Act.

Repo Man comes after the Russkies now…

Per a statement from the House Foreign Affairs Committee, the legislation would “provide additional assistance to Ukraine using assets confiscated from the Central Bank of the Russian Federation and other sovereign assets of the Russian Federation.”

As we’ve chronicled ever since Russia invaded Ukraine, freezing the Russian central bank’s dollar-denominated assets was colossal blunder.

Leaders in dozens of other countries outside of Washington’s orbit started wondering if they’re next… and they’re taking preventive measures to get out from under the dollar’s thumb. After your editor spent years screaming into the wilderness about “de-dollarization,” the phenomenon now makes near-daily headlines in mainstream financial media.

Of course, what the mainstream still doesn’t see is that the BRICS grouping of Brazil, Russia, India, China and South Africa is set to introduce a super-currency alternative to the dollar at their summit starting on Aug. 22. Jim Rickards calls it “the most significant development in international finance since 1971.”

If you haven’t acquainted yourself with this development yet, we devoted the entirety of our 5 Bullets to it a week ago Wednesday.

![]() Stupid Statistics Tricks

Stupid Statistics Tricks

Here’s an excellent reminder that nearly all economic statistics deserve at least a side-eye…

Here’s an excellent reminder that nearly all economic statistics deserve at least a side-eye…

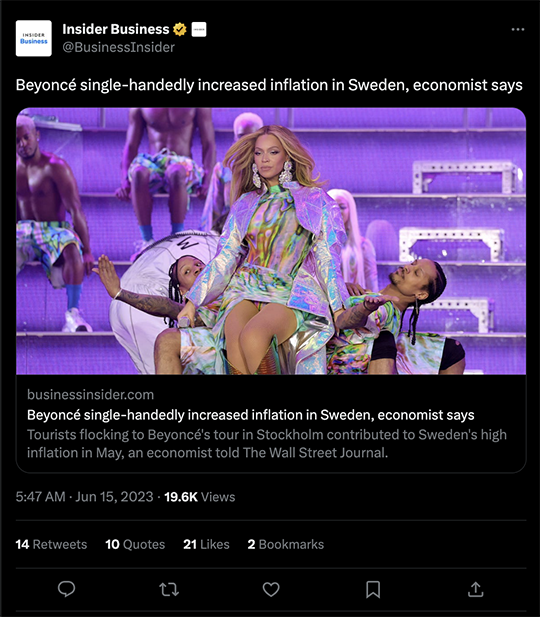

An economist at Denmark’s Danske Bank says the launch of Beyonce’s world tour in Stockholm last month skewed the Swedish inflation figures.

Swedish inflation clocked in at 9.7% for May — higher than the 9.4% many economists expected. Danske Bank’s Michael Grahn chalks up the discrepancy to elevated demand and prices for hotel rooms and restaurant meals. Many Americans flew over for Beyonce’s two sold-out shows, taking advantage of a depressed Swedish krona.

"I wouldn't... blame Beyonce for [the] high inflation print,” Grahn tells the BBC, “but her performance and global demand to see her perform in Sweden apparently added a little to it."

Bruce Springsteen will play three shows in Gothenburg later this month, but Grahn does not expect the phenomenon to repeat. “What we saw with Beyonce was a little bit special,” he tells CNN.

This is a good reminder that many economic statistics are aggregates… and the way those aggregates are compiled may or may not reflect your day-to-day existence. We’re sure inflation is painful for the Swedes right now, but for those who can’t afford to see a Beyonce concert, or who couldn’t care less about Beyonce… it’s a little less painful than average.

![]() “Nice Planet You’ve Got There. Be a Shame If…”

“Nice Planet You’ve Got There. Be a Shame If…”

To the mailbag, where a longtime reader is mashing up two of our themes this week — mining and extraterrestrials.

To the mailbag, where a longtime reader is mashing up two of our themes this week — mining and extraterrestrials.

“Why would aliens bother to invade Earth for our minerals?” she wonders. “Seems like our little backwater of the galaxy would be a little out of their way for resources — including water — that can be found floating around in space in billions of solar systems and in far greater quantities than exist on Earth.

“In fact, I've long hypothesized that just as the discovery of new sources of treasure and resources made difficult and dangerous exploration lucrative on Earth, extraction of desperately needed resources from space rocks and moons will probably be what propels us into space.

“Not really loving the new name, but still love The 5!”

“I’m still chuckling about the recent comments you’ve posted about alien life, and Tuesday’s 5 Bullets prompted me to write again.

“I’m still chuckling about the recent comments you’ve posted about alien life, and Tuesday’s 5 Bullets prompted me to write again.

“The comments brought to mind a funny episode in my life, 30 years ago when I was in college. While browsing the local Blockbuster Video (remember those?!) with my girlfriend, I laughed at the title of a movie I saw, Aliens Among Us, based on the true story!”

“She looked at me in all seriousness and said, ‘How do you know it isn’t true?’ I was stunned, as I had met her in astronomy class of all places!

“A couple days later, I circled back to the conversation and explained my position as logically as I could…

“OK, so if I grant you that somehow sentient life lives on a planet surrounding the closest star to us (Proxima Centauri, 4.2 light years away) and then they then figure out we’re here and next they develop the technology to somehow travel that enormous distance (some 25 trillion miles!) and then they don’t land in downtown Washington, D.C., but crash in Roswell, New Mexico, or Billy Bob’s backyard in Louisiana, and then somehow the government keeps it a secret…

“How on Earth does this have any semblance of possibility?! Talk about a conspiracy theory! 😂

“Oh my, I’m still laughing, and your discussion brought the story back to mind! The fact that grown adults still entertain this idea as even a possibility just reminds me how silly we are.

“Thanks for the great laugh reminder! 😂”

Dave responds: Chuckle all you want, but I’ll say it again. The way things are going, I can totally see a dark time in the near future when people like you will be denounced on TV as “alien denialists” and bounced off social media platforms. You must be unvaxxed and lurve Putin too!

OK, time to reel in my imagination and reset for a three-day weekend. We have our usual Saturday wrap-up tomorrow… and a special edition on Monday while the markets are closed for Juneteenth. Catch you then!

Have a good weekend,

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets