AI’s 2007 Moment

![]() Survey Says…

Survey Says…

The typical retail investor loves AI. The typical American citizen, not so much.

The typical retail investor loves AI. The typical American citizen, not so much.

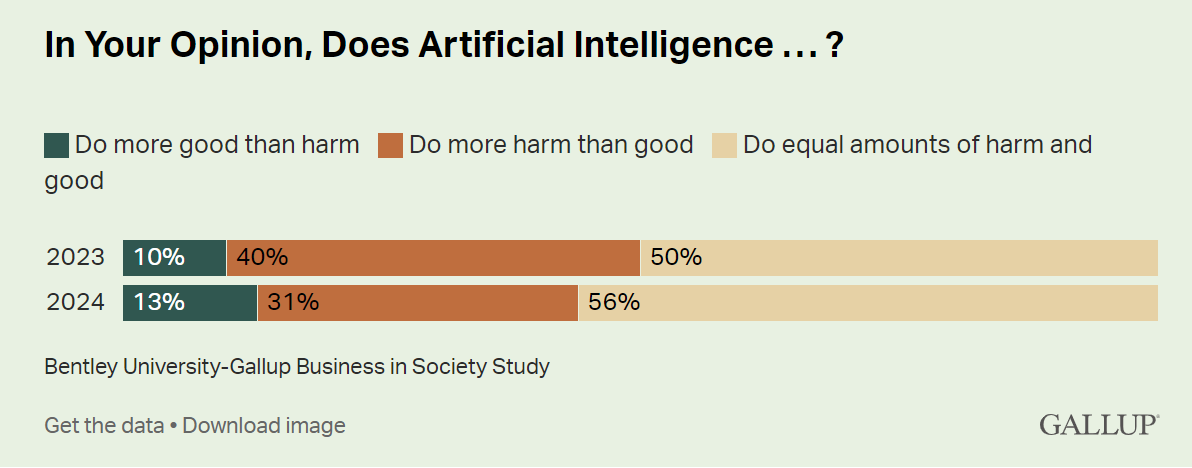

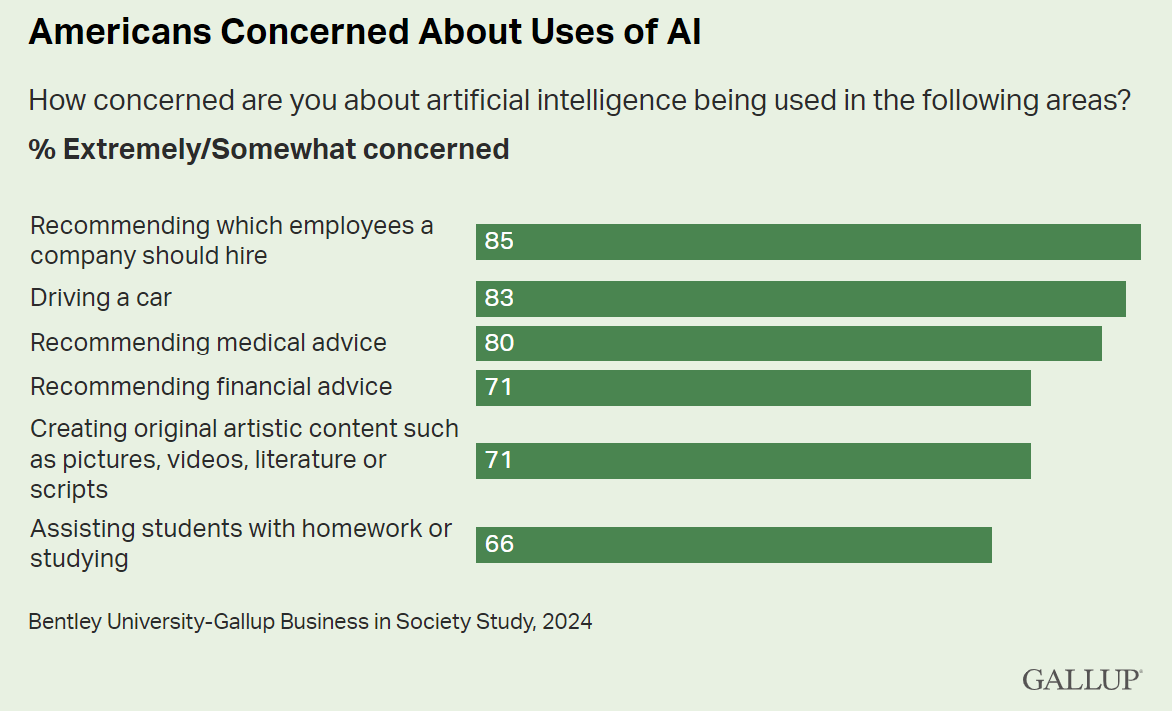

Starting last year, the Gallup pollsters began asking people about their attitudes toward AI. They’ll do so every year as long as such polling remains relevant.

This year, the survey finds a majority (56%) who believe AI will do good and do harm in equal amounts.

But nearly a third (31%) believe it will do more harm than good — down from last year, but still a substantial minority.

Drill down into the specifics and you find supermajorities worried about AI’s impact on everything from hiring and firing… to medical advice… to self-driving cars. (Elon Musk still has a lot to prove…)

In addition, 75% of survey respondents believe AI will “reduce the total number of jobs” while an even higher percentage (77%) trust businesses either “not much” or “not at all” to use AI responsibly.

Seen in this light, a lot is riding on today’s rollout of new Apple gear equipped with what the company calls “Apple Intelligence.”

Seen in this light, a lot is riding on today’s rollout of new Apple gear equipped with what the company calls “Apple Intelligence.”

At about the same time this edition of 5 Bullets hits your inbox, Apple CEO Tim Cook will conduct his annual product-release event.

In recent years, this event has become something of a snooze — especially as it applies to AAPL’s flagship product, the iPhone.

An upgraded camera? New capabilities for the home button? An app that counts your daily steps more accurately? No one cares anymore.

For days now, Paradigm’s AI authority James Altucher has been forecasting that today’s event will be different. Its impact will be on a par with the original iPhone rollout in 2007.

Recall there was a nearly six-month gap between the time Steve Jobs took the stage to introduce “an iPod, a phone, an internet communicator” in a single device… and the time it was actually released.

Days before the release in June 2007, James went on CNBC to predict Apple’s market cap would grow tenfold.

No one believed it. “Everyone was glued to their BlackBerrys, and people were still wondering if Apple was full of crap.”

The naysayers were missing the point: “That moment wasn’t just about phones or social media; it was about a generational shift, the kind of tectonic change that rewrites everything.”

James believes today’s event is of equal or even greater magnitude.

James believes today’s event is of equal or even greater magnitude.

Granted, this time there are fewer naysayers.

“Apple is about to release something that WILL change the game. Many have caught on,” says James. “Analysts are pounding the table this time.

“But they aren’t talking about the right thing. While all eyes are on Apple, there’s a tiny AI company — a critical supplier — flying under the radar.”

Makes sense, right? AAPL’s market cap did grow tenfold in the decade after the iPhone’s release. But Apple is a mature, dividend-paying blue chip nowadays: Don’t expect it to equal that performance.

Instead, James says look to this tiny supplier with the potential to 10X your money in a year — and perhaps 100X over the next decade.

![]() All the Job Growth in All the Wrong Places

All the Job Growth in All the Wrong Places

A brief postscript to the August job numbers discussed in Friday’s edition…

A brief postscript to the August job numbers discussed in Friday’s edition…

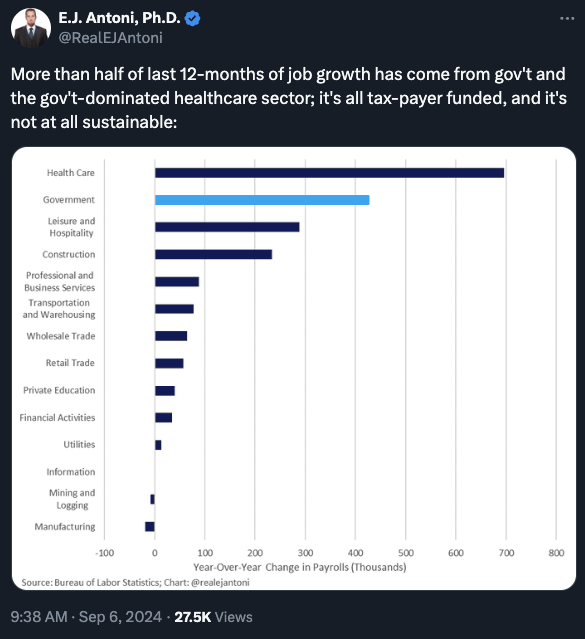

That’s according to economist E.J. Antoni at the Heritage Foundation. We mention this data point because it’s the continuation of a trend.

Recall that last month the government revised a year’s worth of figures from April 2023–March 2024 — erasing 818,000 “new jobs.”

The revisions revealed that whatever job growth occurred during those 12 months was “even more dependent on government and education/health care than thought.”

That is, the least productive and most parasitic corners of the economy.

The U.S. stock market is staging a modest recovery after its worst week all year.

The U.S. stock market is staging a modest recovery after its worst week all year.

All the major U.S. indexes are in the green, the S&P 500 up over a half percent at 5,440 — about 4% beneath its record close notched in mid-July. The Dow’s gain is stronger, the Nasdaq’s weaker.

Gold remains stuck just below $2,500 but silver has clambered its way back above $28. Bitcoin has inched back over $55,000 for the moment.

The oil price is up nearly a buck to $68.40. It started moving moments after the National Hurricane Center upgraded a disturbance in the Gulf of Mexico to Tropical Storm Francine. Hurricane-force winds will be lashing oil and gas operations off the Texas and Louisiana coasts come Wednesday morning.

Then again, this oil rally might just be an oversold bounce.

The big economic release this week comes Wednesday with the official inflation numbers. That will be the last major data point before the Federal Reserve decides whether to cut the fed funds rate a quarter-percentage point or a half. That decision comes Sept. 18, a week from Wednesday.

![]() De-dollarization, Continued: The BRICS 2024 Agenda

De-dollarization, Continued: The BRICS 2024 Agenda

From the it’s-big-if-it’s-true file… the BRICS constellation of countries is drawing up ambitious new “de-dollarization” plans.

From the it’s-big-if-it’s-true file… the BRICS constellation of countries is drawing up ambitious new “de-dollarization” plans.

This year’s summit of BRICS leaders takes place in Kazan, Russia from Oct. 22–24. Member nations now include the original four of Brazil, Russia, India and China… the later addition of South Africa… and this year’s entrants of Iran, the United Arab Emirates, Ethiopia and Egypt.

The agenda, according to Russia’s official news agency Tass, includes “a common unit of account (Unit), a platform for international settlements in BRICS digital currencies (Bridge), a payment system (Pay), a settlement depository (Clear), an insurance system (Insurance) and a BRICS rating alliance.”

The name of the common currency, the Unit, is not new: Paradigm’s macroeconomics maven Jim Rickards confirmed that for us two months ago. Also not new is that 40% of the Unit’s value will be pegged to gold, and the rest to the BRICS countries’ fiat currencies.

But the rest of the agenda makes clear that the Unit will have a support structure allowing BRICS member nations to bypass SWIFT — the financial-messaging system that greases the gears of the global economy. SWIFT is based in Europe, but largely operates under Washington’s influence.

To be sure, Russia is the BRICS country most eager to get out from under the dollar’s thumb — and most eager to publicize this agenda.

To be sure, Russia is the BRICS country most eager to get out from under the dollar’s thumb — and most eager to publicize this agenda.

Many of Russia’s banks and other financial institutions were kicked out of SWIFT after Moscow invaded Ukraine in early 2022. And as we’ve mentioned regularly, the dollar- and euro-based assets of the Russian Central Bank were frozen.

Other countries that aren’t Washington’s allies wonder if they might be next. Whether they’re as eager to go down the de-dollarization road as Russia remains to be seen. China? Definitely. India? Maybe not so much.

Whatever is announced at the leaders’ summit next month will be hammered out well beforehand. As Jim told us last year, working groups from the BRICS nations hold 160 meetings every year in addition to the annual gatherings of the presidents and prime ministers.

Coincidentally or not… the day after Russia laid out the BRICS agenda, Donald Trump promised a “100% tariff” on countries that “leave the dollar.”

Coincidentally or not… the day after Russia laid out the BRICS agenda, Donald Trump promised a “100% tariff” on countries that “leave the dollar.”

At a rally in Wisconsin Saturday, Trump said the dollar has been “under major siege” for eight years and he’s determined to maintain the dollar’s status as the globe’s reserve currency.

“You leave the dollar and you’re not doing business with the United States because we are going to put a 100% tariff on your goods,” he said.

Exactly what criteria his administration would use to determine whether a country is “leaving the dollar,” he did not say.

“The statement follows months of discussions between Trump and his economic advisers,” says Bloomberg, “on ways to penalize allies or adversaries who seek active ways to engage in bilateral trade in currencies other than the dollar.”

It would be nice if the future of the dollar would come up during the Trump-Harris debate tomorrow night… but we’re not counting on it.

![]() No Ordinary Dime

No Ordinary Dime

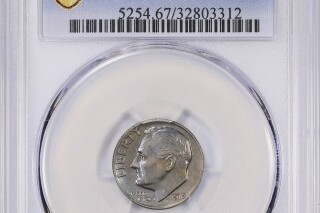

There’s nothing about the metal value of this coin that makes it worth $500,000.

There’s nothing about the metal value of this coin that makes it worth $500,000.

It’s no ordinary dime…

[GreatCollections photo]

Nope, this Roosevelt dime is dated 1975 — a decade after the U.S. Mint stopped making dimes with silver.

Nor is it valuable just because it’s a proof coin — made with a high-quality finish especially for collectors.

What makes this coin valuable is that someone at the San Francisco Mint screwed up nearly 50 years ago.

Then and now, proof coins are made only in San Francisco. Thus, they have an “S” mint mark.

But of the 2.8 million proof dimes made in 1975, two were missing the “S.”

“While serious coin collectors have long known about the existence of these two rare dimes,” says The Associated Press, “their whereabouts had remained a mystery since the late 1970s.”

One of them was sold at auction in 2019 for $456,000 and sold again privately a few months later — price unknown.

The other belongs to three sisters from Ohio who recently inherited it from their brother. He and their mother bought the dime in 1978 for $18,200 — about $90,000 in today’s dollars. “Their parents, who operated a dairy farm, saw the coin as a financial safety net,” says the AP.

The dime sat in a bank vault for years; now the sisters are ready to part with it. Auctioneer Ian Russell of GreatCollections in southern California expects it to fetch $500,000 next month.

That’s a 27X gain in 46 years. Not bad — although the S&P 500 has grown over 56X in the same time frame. Just sayin’!

![]() This Year’s October Surprise: Coming In September?

This Year’s October Surprise: Coming In September?

Russia, Russia, Russia in the mailbag…

Russia, Russia, Russia in the mailbag…

“I saw in the Thursday edition you talked about how recently Tenet was accused of being paid by Russians to run stories favorable toward Russia, and just today one of my friends was talking about it and shared an article with me and it gave me a pretty good laugh, so I thought I should pass it on.

“Note it is dated as being from FOUR years ago. As I thought Robert Barnes had adequately explained in a video, the DOJ has used indictments to pump out political propaganda before and they're doing it again.

“The embarrassment of withdrawing a case four years ago as soon as a lawyer showed up to defend the accused company is why the DOJ has only indicted two Russian individuals, who they reasonably believe will not come to America to defend themselves in a court of law, and not RT or Tenet; so long as no one challenges them they can and will continue to parade around the indictment as a matter of fact instead of a baseless accusation made for political gain.

“So you can add all that to your healthy skepticism of whether or not anything that comes from the government is to be taken at face value as well as knowing just how ironic the name ‘Department of Justice’ is.”

Dave responds: I remember that case well. In 2018, a grand jury convened by Special Counsel Robert Mueller indicted 13 Russian nationals and three Russian companies for plotting “information warfare” against the United States with Facebook memes and such.

The indictments fueled the narrative of “Russian meddling,” and with no risk prosecutors would ever have to prove their case. After all, it’s not as if these Russians would ever face trial in the United States, right?

But then one of the companies, called Concord Management, actually demanded its day in court! In early 2020, the Justice Department quietly dropped the case, tail between its legs.

So yes, this farce is similar — only this one is dragging Americans’ names through the mud. The timing is concerning…

Given the number of people who vote early or vote by mail now, the proverbial “October surprise” might be unleashed in September.

What will be this election cycle’s version of the Hunter Biden laptop story?

Recall it was dismissed as “Russian disinformation” and suppressed on social media before everyone acknowledged it was authentic — and indeed was the basis for a federal prosecution of Hunter Biden…