Banana Republic

![]() The Chickens Come Home To Roost

The Chickens Come Home To Roost

Really, is there any doubt?

Really, is there any doubt?

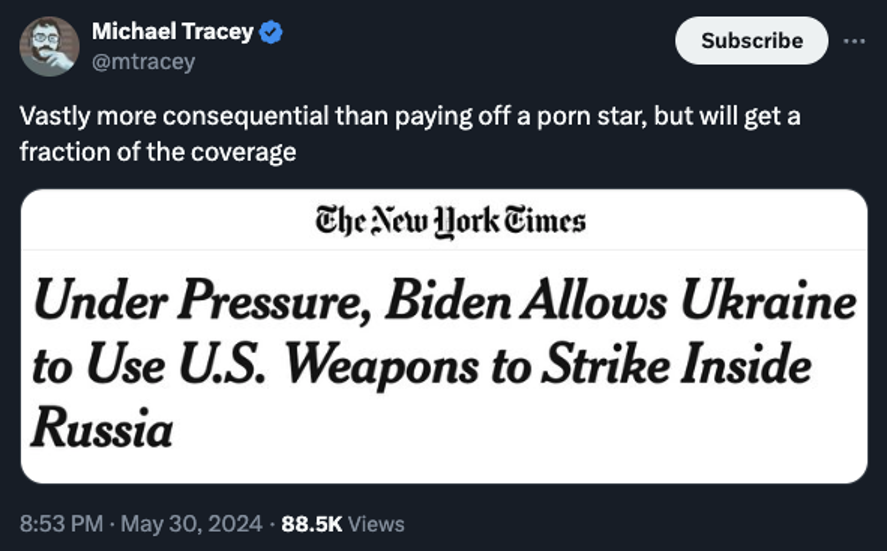

Yesterday, Joe Biden did what he swore up and down he wouldn’t for the last two-plus years – allow Ukraine to use American weaponry to strike inside Russian territory.

It’s not a total surprise if you’ve been keeping up with these daily dispatches, where we fret about the escalation cycle; war between the two nuclear superpowers would have some rather unfortunate effects on global commerce and markets.

But in today’s Wall Street Journal, Donald Trump’s guilty verdict is spread across the entirety of the front page “above the fold”... while the Ukraine weapons decision is consigned to Page A16.

Of course we don’t want to trivialize Trump’s conviction. There could easily be long-term financial consequences – as we sussed out nearly two years ago when the feds raided Mar-a-Lago.

Of course we don’t want to trivialize Trump’s conviction. There could easily be long-term financial consequences – as we sussed out nearly two years ago when the feds raided Mar-a-Lago.

The question now: How credible is the dollar as the globe’s reserve currency when the former occupant of the Oval Office, and credible contender to occupy it again, is a convicted felon?

Especially when the conviction is not for violent or fraudulent acts with an identifiable victim, but rather… a mislabeled bookkeeping entry for payments rendered to the star of Trailer Trash Nurses Vol. 6.

Basically we’re looking at the Latin Americanization of the United States…

Yep. Whether in personal or international relations… karma’s a female dog.

“In the last quarter century, nine Latin American presidents have either been impeached and removed from office or resigned to avoid that outcome,” wrote political scientist Michael Lind in 2022.

“In the last quarter century, nine Latin American presidents have either been impeached and removed from office or resigned to avoid that outcome,” wrote political scientist Michael Lind in 2022.

“In the same period, three of the four impeachments in U.S. history have occurred (Bill Clinton, and Trump twice).

“Americans who have watched too many PBS documentaries about the rise of the Third Reich no doubt will continue to fear demagogues in the European mold,” Lind wrote at the Persuasion website.

“A more plausible worry is the Latin Americanization of U.S. politics, with the left-right distinction replaced by a dichotomy of insider oligarchy and outsider populism, and with impeachment weaponized by the party that controls Congress to expel presidents of the other party from the White House, for good reasons or bad.”

At a time when much of the Global South is already trying to get out from under the dollar’s thumb because of sanctions and other forms of economic warfare… who wants anything to do with the currency of a “banana republic”?

Of course, the fate of the dollar is a long-term question. There are shorter-term financial consequences of the Trump conviction, as we’ll unpack in Bullet No. 2…

![]() Advantage Trump?

Advantage Trump?

For one thing, the odds of Donald Trump’s return to the presidency in 2025 might have just gone up.

For one thing, the odds of Donald Trump’s return to the presidency in 2025 might have just gone up.

From The Hill: “Former President Trump’s fundraising page crashed shortly after he was convicted on 34 felony counts by a New York jury, an issue his campaign attributed to an influx of donations.”

No surprise – considering how Trump’s campaign turned his Georgia mugshot into a successful fundraising vehicle.

These developments reinforce Jim Rickards’ belief that Trump will win a second term in November.

Jim laid out a comprehensive case during a video stream we released last night, shortly after the verdict, titled Scandals, Secrets and Scoundrels.

The venue for Jim’s pre-election investment confab couldn’t have been more appropriate – the Watergate Hotel in Washington, D.C.

Jim drew parallels between the events that brought down Richard Nixon 50 years ago and the events of today. He described how Trump could pull off a landslide in the Electoral College even if Biden pulls off another win in the popular vote. And he identified three buys and three sells to consider now, well before Election Day. (Hint: Long Big Oil, short Big Tech. But really, you should watch in full for the names and tickers.)

Oh, and he answered a selection of questions from readers just like you – covering the gamut from gold to “Biden Bucks,” aka a central bank digital currency.

Like the Whiskey Bar roundtable earlier this week, Scandals, Secrets and Scoundrels is yours to watch absolutely free. We won’t try to sell you anything. We just hope you watch and feel good about the value and insight Paradigm Press delivers.

In addition, our team recorded several shorter videos during our stay at the Watergate – yours truly included. Watch this space for announcements and links during June.

![]() If You Look Really Closely, Inflation Is Slowing Down

If You Look Really Closely, Inflation Is Slowing Down

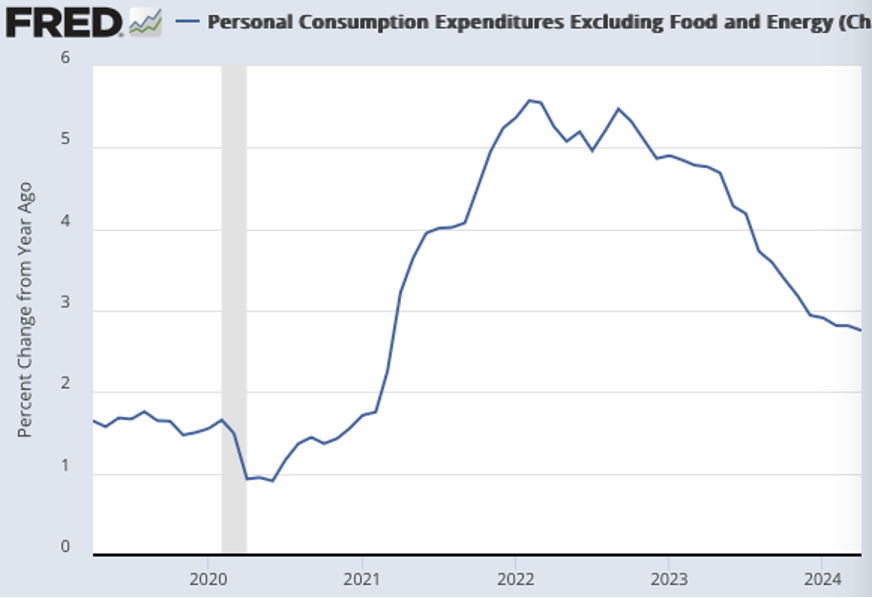

If inflation is slowing down, it’s barely detectable judging by the Federal Reserve’s preferred measure.

If inflation is slowing down, it’s barely detectable judging by the Federal Reserve’s preferred measure.

The Commerce Department issued its read on “core PCE” this morning. By this yardstick, consumer prices jumped 0.2% in April – compared with 0.3% in March.

That’s the right trajectory – but one month does not constitute a trend. Meanwhile, year-over-year core PCE is still running 2.8% – far greater than the Fed’s 2% inflation target.

This will be the last reading on core PCE before the Federal Reserve’s next policy-setting meeting on June 12. Any “pivot” to lower interest rates now would look reckless – which isn’t to say it can’t happen!

To the extent Mr. Market is reacting to this number, he’s nonplussed.

To the extent Mr. Market is reacting to this number, he’s nonplussed.

At last check the Dow is marginally in the green at 38,173… but the S&P 500 is down a half percent, clinging to the 5,200 level… and on top of yesterday’s tech swoon, the Nasdaq is down another 1.25% at 16,526. “Nothing too alarming,” ventures Trading Desk editor Greg Guenthner — “but it’s clear the averages are losing steam here.”

Treasury yields are backing off, the 10-year note just over 4.5%. Crude is sliding, a barrel of West Texas Intermediate off more than a buck at $76.70. No joy in crypto-land either, with Bitcoin just over $67,000.

Precious metals are losing ground as May winds down. Still, gold is in line to notch a monthly close over $2,300 and silver is set to end the month over $30 for the first time in over a decade.

![]() Even the Mainstream Silver Outlook Is Bullish

Even the Mainstream Silver Outlook Is Bullish

At least one large bank is willing to stick its neck out and forecast substantially higher silver prices less than a year out.

At least one large bank is willing to stick its neck out and forecast substantially higher silver prices less than a year out.

It’s true that silver will end May over $30 for the first time in over a decade – and that’s a substantial increase from $26.40 only a month ago.

But “Mr. Slammy” – the shadowy forces that rule over precious metals – made certain that the recent highs over $32 wouldn’t stick. What’s more, silver trades in Shanghai at a 12% premium over the price in New York. Frustrating.

Still, there’s cheer to be found in a new report from the Swiss banking colossus UBS – forecasting $34 silver by the end of September… $36 by year-end… and $38 by June 2025.

“Why are we raising our price forecasts?” write the UBS analysts. “According to the Silver Institute, total industrial demand is expected to rise by 9% to 711 million ounces, driven by demand from the photovoltaic sector, which is estimated to increase by 20% year-on-year to 232 million ounces.”

As for supply, UBS says mine production will likely fall this year, leaving a shortfall equal to 17% of annual global demand.

$38 a year from now? Not bad. But we daresay it’s not out of line to aim higher.

The next target beyond $38 is the old high of $50 notched in both 1980 and 2011. And as Paradigm’s commodities trading guru Alan Knuckman is fond of reminding us, that 2011 price adjusted for inflation would be nearly $68 now.

But getting to $68 or beyond will require patience and, depending on your risk tolerance, a strong stomach.

![]() Mailbag: Politics (Ugh) and Praise (Yay)

Mailbag: Politics (Ugh) and Praise (Yay)

“How old are you, Dave?” a reader writes, after I said some less-than-reverent things about Ronald Reagan’s presidency on Wednesday.

“How old are you, Dave?” a reader writes, after I said some less-than-reverent things about Ronald Reagan’s presidency on Wednesday.

“I wonder, because your opinions appear to be from the brainless left side of the political spectrum.

“Having lived long before Reagan's terms, and now living well past his presidency, I am always amused at some of you young upstarts who know little about what Reagan did for this country... especially in view of what's happened to us over the past 3½ years!

“Let's face it... ALL congresses and presidents are big spenders!

“They have an endless supply of our money to do just about whatever they want to with it.

“I hope you're quite happy with 40-IQ-Biden, and what he has done to this country.

“But I'm afraid your happiness is soon over, as the adults are nearly ready to sweep the empty-headed kids out of Washington!

“Good-bye wokeness and all of its total nonsense.”

Dave responds: I love how one day I’m accused of being a “MAGA megaphone” and another day I’m told I’m in the tank for Biden.

Reminds me of a saying back in my journalism days, before the business became totally corrupted: “If you offend people on both sides, you’ve done your job well.”

As for my age, I defer to the timeless words of Ian Anderson – too old to rock ’n’ roll, too young to die…

“Dave writes some great, insightful stuff, Emily does as well,” says our next correspondent.

“Dave writes some great, insightful stuff, Emily does as well,” says our next correspondent.

“It would be nice if there were an easy way to share these emails on social media. Might even lead to a few new subscribers.”

Dave: Well, there’s not a one-click solution – but for easy linking, most of our issues are posted shortly after they’re emailed at paradigmpressroom.com.

Of course, if the hall monitors on your favorite social media site decide the content is too edgy and they send you a nastygram, we can’t be held responsible!

“I just finished reading another awesome 5 Bullets and was inspired to unload my thinking on you,” says our final reader email of the week.

“I just finished reading another awesome 5 Bullets and was inspired to unload my thinking on you,” says our final reader email of the week.

“I love the early-warning thinking I get from 5 Bullets, Rude Awakening, Jim Rickards, indeed all the great and original thinkers of the Rickards/Paradigm juggernaut.

“I have long read a dwindling list of financial newsletters. But with my Omega Wealth Circle membership, I get exposure to great broad-stroke thinkers as well as deeply specialized experts in many specific areas.

“Through sometimes painful comparisons in my experience, the other newsletters just don’t compare to the value Rickards/Paradigm brings me, and the poor souls are on my personal chopping block. Hence the word ‘juggernaut’! I read a ton, but I find I lose out when other folks (non Paradigmians), good as they might be, get some of my eyeball time.

“Thanks to the whole Omega team for providing a daily avalanche of good thinking and good ideas for my brokerage account. I also have loved devouring every training opportunity, most recently Greg Guenthner’s excellent videos. Please, more training!!! I am like a ravenous beast wanting to be fed your collective knowledge. You have all breathed new life into my 71 years and I am grateful.

“Finally, Is there any way that is easy to assure I get everything Omega sent to my email inbox with texted alerts? I am frequently frustrated when I miss articles and potential trades (especially when they pay off).

“I realize I can go to the Paradigm page but my email inbox is so huge I spend all my time whittling it down, hoping that all Omega is showing up in it, but it isn’t.

“Thanks with great appreciation to all.”

Dave: Thanks for the effusive praise. I’ve forwarded your inquiry to our customer-care director Dustin Weisbecker.

Now… if you’re reading this and wondering “What’s this Omega Wealth Circle thing?”... that’s our premier VIP level of service.

Once you’re in the Omega Wealth Circle, you get all-you-can-eat access to everything we publish. And this access comes at a price that’s substantially less than you’d get subscribing to all of our services individually.

The Omega Wealth Circle isn’t for everyone… and we don’t open membership to just anyone. But if you already have two or more subscriptions with us, you can expect an invitation sooner or later.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets