Better Than NVDA

![]() Better Than NVDA

Better Than NVDA

There’s a saying — from pre-internet times — about how “yesterday’s newspaper is good only for wrapping fish.” Or, alternatively, lining a bird cage.

There’s a saying — from pre-internet times — about how “yesterday’s newspaper is good only for wrapping fish.” Or, alternatively, lining a bird cage.

That is, whatever you’d find in yesterday’s newspaper would be overtaken by events chronicled in today’s paper. And in the internet age, that once-daily tempo has shrunk to… Hours? Minutes?

Anyway, the expression came to mind first thing Monday morning with the front page of The Wall Street Journal…

“Once under the radar,” said the Journal, “server maker Super Micro Computer has become a go-to supplier for companies and governments eager to participate in the AI rush. Runaway sales of its servers filled with Nvidia’s AI chips are projected to double the company’s revenue this year.”

The paper was quick to point out how SMCI vastly outperformed AI darling Nvidia — that’s the hockey-stick chart included on the front page. SMCI all but went vertical starting in mid-January.

The Journal opted to run with the story on Monday because that was the day SMCI became part of the S&P 500 index.

All of this is interesting… but not especially useful.

All of this is interesting… but not especially useful.

“Super Micro Computer’s shares have increased more than 12-fold in the past 12 months,” said the Journal.

Yeah, that was on Monday, when shares still traded north of $1,100 each. That gain is already back to 10-fold as of today, with shares trading below $950. God help any suckers who piled into SMCI because they read Monday’s WSJ. (Those wrapped fish are stinking to high heaven by now…)

Besides, when it comes to companies with links to Nvidia, there’s a much more attractive candidate right now.

This is the one James Altucher has been keen to tell you about all week — the one Nvidia is partnering with on its new cutting-edge “Blackwell” chip.

As a reminder, Nvidia has not yet made this company’s name public. But when it does — and that could come today on the final day of Nvidia’s annual developer conference — you could be looking at gains that would put SMCI to shame, never mind NVDA.

“I predict a 10,000% run in the coming years,” says James. That’s not instant riches. It’s something better — generational wealth for your golden years — to say nothing of your kids and grandkids.

![]() Wall Street to Fed: “It’s OK You Keep Letting Me Down”

Wall Street to Fed: “It’s OK You Keep Letting Me Down”

Wall Street keeps guessing wrong about the Federal Reserve’s intentions. Not that it’s really making any difference in the stock market’s performance.

Wall Street keeps guessing wrong about the Federal Reserve’s intentions. Not that it’s really making any difference in the stock market’s performance.

Going into 2024, the typical Wall Street economist was expecting the Fed to cut the benchmark fed funds rate six or even seven times this year — from 5.5% to 4% or even lower.

That was even though the Fed itself projected only three cuts after its policy meeting in mid-December.

After the next policy meeting in late January, Fed chair Jerome Powell threw a large bucket of ice water on those six-or-seven-cuts expectations. He went so far as to rule out a cut at the next meeting scheduled for mid-March. Mr. Market threw a brief hissy fit, only to set record highs a couple days later.

Yesterday, the mid-March meeting came and went.

The Fed stuck with its forecast of three cuts in 2024, while dialing back its projection for cuts in 2025. And Mr. Market was… just fine with that.

The Fed stuck with its forecast of three cuts in 2024, while dialing back its projection for cuts in 2025. And Mr. Market was… just fine with that.

All three of the major U.S. indexes climbed to record closes by day’s end — the first time that’s happened since November 2021.

That’s even though the Fed went out of its way to include the following sentence in its written statement: “The Committee is strongly committed to returning inflation to its 2% objective.”

A well-known financial blogger who shall remain nameless was borderline apoplectic: “The market’s reaction to the Fed rate decision is utterly insane.”

I respect this blogger, but unfortunately this is another instance of what I call just-world investing: In a just world, the markets would recognize that the Fed is nowhere near its 2% inflation target — and as a result, the fed funds rate will have to stay “higher for longer.” All else being equal, that should be a drag on the stock market, not a tailwind.

But it’s not a just world, all else is not equal, and should is the most dangerous word in all of investing.

But it’s not a just world, all else is not equal, and should is the most dangerous word in all of investing.

And, lo and behold, the major U.S. indexes are reaching higher into record territory today — up between half and three-quarters of a percent. At last check, the Dow is less than 200 points away from 40,000… the S&P 500 has pushed past 5,250… and the Nasdaq is within striking distance of 16,500.

Not joining in the rally is Apple — down nearly 4% now that the Justice Department is suing the company, accusing it of monopolizing the smartphone market. (That would be news to the many users of Android phones, but whatevs…)

Precious metals also rallied big-time after the Fed statement: Gold pushed past $2,200 for the first time… but at last check it’s pulled back to $2,170. Likewise, silver’s down 82 cents to $24.70.

Copper continues to hold the line on $4 a pound… crude hovers just over $80 a barrel… Bitcoin oscillates between $66,000–67,000.

![]() This Number Is Deceiving

This Number Is Deceiving

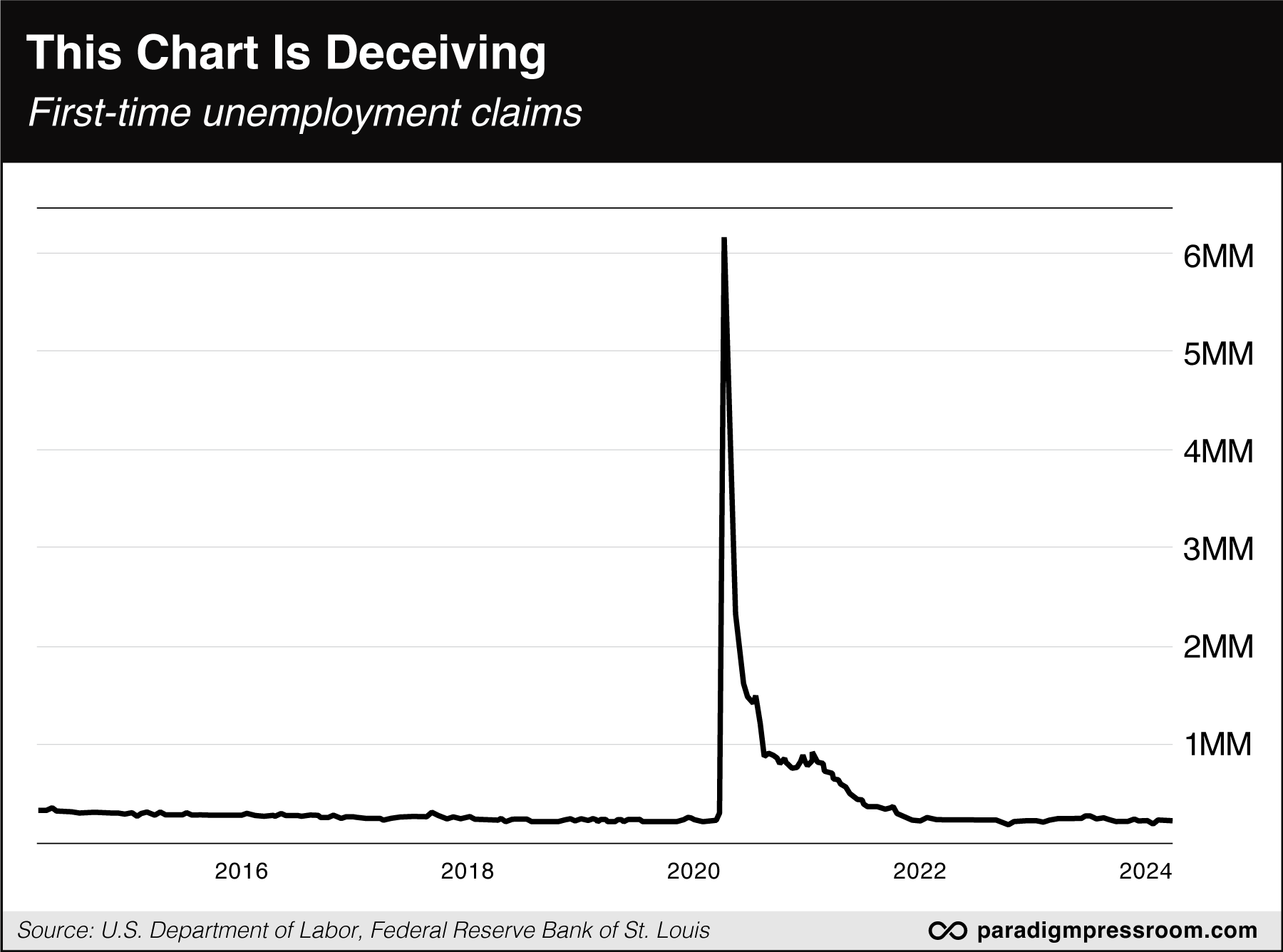

There’s a flurry of economic numbers this morning — and the one data point that catches our eye is ironically the one that conveys the least informational value.

There’s a flurry of economic numbers this morning — and the one data point that catches our eye is ironically the one that conveys the least informational value.

First-time unemployment claims in the week gone by numbered 210,000, down slightly from the week before.

This number spiked to a crazy-high 6.1 million during the COVID lockdowns four years ago. But for the last two years, it’s been pinned in the low-200,000 area — a number typically associated with a “robust” and “healthy” job market.

Except that this low-200,000 figure is deceiving. It doesn’t capture the reality of a labor market that is almost certainly deteriorating…

According to Bloomberg economists Anna Wong and Eliza Winger, there are two reasons this indicator has lost its utility…

- Most of the millions who collected unemployment during 2020–21 are not yet eligible to collect unemployment again, even if they were recently let go

- And if they are eligible for unemployment, the benefit level just isn’t keeping up with inflation. Unlike 2020–21, the pay available from working in the “gig economy” — driving an Uber, delivering for DoorDash, etc. — is more attractive than sitting on your duff, smoking dope and collecting unemployment. (Who says Americans have lost their work ethic?)

The takeaway as summarized by Bloomberg: “The economists calculated that if eligibility and the take-up rate of unemployment benefits had remained similar to levels before past recessions, unadjusted continuing claims would have been about 500,000 higher over the past year — on par with figures before the 1980, 1990–91 and 2001 recessions.”

These findings complement an array of numbers that point to a deteriorating job market — people getting their hours cut, temp workers being let go, etc.

But for the time being, the corporate media continues to fixate on the number of “new jobs created” each month — even if it’s one person holding down two or three jobs to make ends meet!

There are a handful of (marginally) more useful economic indicators out today…

There are a handful of (marginally) more useful economic indicators out today…

- The “flash PMIs” are a mixed bag. Both manufacturing and services registered over-50 levels for March, indicating growth instead of contraction… but the services number came in less than expected

- The leading economic indicators from the Conference Board delivered their first positive reading in two years, however weak they might be

- Mid-Atlantic manufacturing as measured by the Philadelphia Fed has now registered two consecutive months of growth — the first time that’s happened in nearly two years.

- Existing home sales grew 9.5% in February, well above Wall Street’s expectations. The median home price is $384,500 — up 5.7% from a year earlier.

Curiously, the National Association of Realtors attributes some of that jump in existing home sales to “life-changing” events in which sellers and buyers can “no longer delay” making a move.

Like taking a new job in a new city after getting fired? Or submitting to a return-to-office mandate to cling to an existing job? Yeah, this isn’t 2022’s job market anymore…

![]() Thought for the Day

Thought for the Day

We present the following, scraped from social media, with no further comment…

We present the following, scraped from social media, with no further comment…

Although it does synchronistically tee up the fodder for today’s mailbag…

![]() Mailbag: “Supreme Idiots” and the Musk Biography

Mailbag: “Supreme Idiots” and the Musk Biography

“Supreme idiots,” reads the subject line of a reader mail after we peeled the onion of the Supreme Court’s hearing on Monday into online censorship.

“Supreme idiots,” reads the subject line of a reader mail after we peeled the onion of the Supreme Court’s hearing on Monday into online censorship.

“It is very disheartening to realize that not one of the ultimate protectors of our constitutional rights had the clarity of thought to see that if the government is allowed to limit public discourse to only their side of an issue simply by pulling out the ‘national security’ card that the government will have a propaganda machine that puts the Nazis, North Korea, China and every other despotic regime in the recent history of the world to SHAME!

“Even worse, the latest addition to the bench does not seem to realize that the First Amendment, indeed the entire Constitution, was written with the express purpose of ‘hamstringing’ the government so that it would never be able to exercise the kind of control that this gang of nine seems ready to hand them on a silver platter!

“How far we have slid down the slippery slope from a ‘government of the people, by the people, for the people’ to a place where it is not hard to envision that noble ideal would ‘perish from the earth’.”

Dave responds: I’ll let the independent journalist Matt Taibbi — who came up close and personal with this subject while reporting on the Twitter Files — do the talking here. As he wrote on Tuesday…

“That a line about ‘the First Amendment hamstringing the government’ was uttered by one Supreme Court justice is astonishing enough. Listening as none of the other eight pointed out that the entire purpose of the First Amendment is to ‘hamstring’ government from interfering in speech was like watching someone drive a tank back and forth over Old Yeller. I needed a bite-stick by the end of the hearing…

“We’ve been had. I wondered last fall why the federal government didn’t just take the mild rebuke they received from the Fifth Circuit Court of Appeals and move on. Now I see the benefit in going to the high court. The government is on the precipice of gaining explicit permission to fully recharge its censorship machine, potentially leaving this new arm of the surveillance state more empowered than before.”

I’ll just add this: I’m old enough to remember when the ACLU stood up for the right of neo-Nazis to march through the mostly Jewish community of Skokie, Illinois, in the late 1970s.

As I mentioned a few years ago, the ACLU has since changed its tune. By 2018, it was considering “the potential effect on marginalized communities” when deciding which free speech cases it will litigate.

But now? To see free speech coded as a “right wing” cause in popular discourse? Flabbergasting…

“I recently read the book Elon Musk from cover to cover with enthusiasm,” a reader writes on the subject of the lightning-rod billionaire.

“I recently read the book Elon Musk from cover to cover with enthusiasm,” a reader writes on the subject of the lightning-rod billionaire.

“I previously had no considered opinion of him. But I now regard him as a conscientious, principled, idealistic and dedicated capitalist of the highest order. He is a genius, of course, but more importantly, he is a high-integrity individual with a very strong work ethic.

“Initially, he considered himself to be a little left of center, but as time progressed, he realized he was much further to the right. I think he is right to remain uncommitted politically. (I admired that he called Trump a ‘buffoon’ and a world-class bulls***ter, and in spite of making the Birch Society look pinko, I share his assessment.)

“With his vision, commitments and the responsibilities he has shouldered, it is little wonder that he had moments which resulted in a reputation of being an asshole. (He seems to be working on that.)

“Otherwise, I admire him.”

Dave responds: My wife, a former librarian, read the book too. And she previously read the same author’s biography of Steve Jobs.

While perusing online reviews of the Musk volume, she noticed something interesting. Most of the negative reviews could be summed up as: Why is there even a biography of this bad man? Such a thing should not exist.

In other words, the negative reviews had no substantive critique of Walter Isaacson’s approach to his subject. It was the fact that he took on the subject at all.

Isaacson is very much a creature of the power elite — editor of Time when the newsweeklies still mattered, president of the Aspen Institute and so on. Still, he pursued his subject in the spirit of old-fashioned journalistic inquiry: What is it that makes this fascinating individual tick?

But for a younger generation steeped in cancel culture — Isaacson is a boomer at age 71 — such an inquiry is off-limits. Musk is Nazi-adjacent, if not an actual Nazi, and that’s all you need to know.

This is what the world has come to — negative reviews of books people didn’t read because the subject matter itself amounts to wrongthink…