Leaked: Wall Street's Secret AI Profit Machine

![]() Diversification (Still) Matters

Diversification (Still) Matters

The AI revolution is far from over, but it's entering a more inclusive phase.

The AI revolution is far from over, but it's entering a more inclusive phase.

In other words, AI investing isn't just about high-tech chips and cool software anymore.

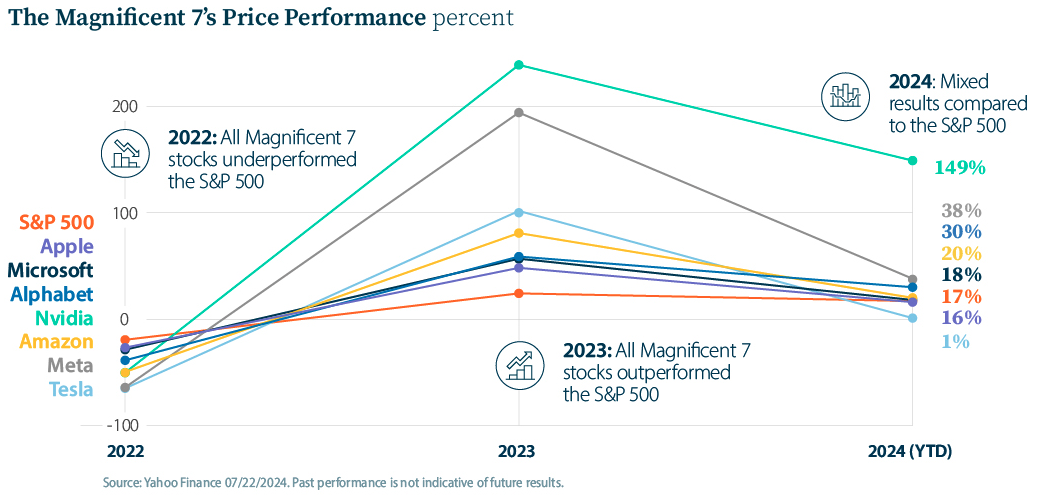

To wit, many of the “Magnificent 7” stocks, including the biggest of the big AI stock Nvidia, are starting to retrace their steps:

Source: Visual Capitalist

Click to enlarge

This retracement is indicative of the market rotation story we’ve been driving home recently.

And an article at Bloomberg on Thursday affirms as much: “While tech and communications remain the top two performers on the MSCI World Index year to date — up 19% and 14%, respectively— they are the two worst performers so far this quarter…

“Investors are selling AI giants to snap up smaller stocks [that] had lagged behind.” All to say, investors are spreading their bets…

“My favorite opportunity right now — a peculiar sector of the stock market that I’ve been following for the last 20 years,” Paradigm’s AI specialist and iconoclast investor James Altucher said at last night’s live — and lively — event. (In real-time, for instance, one pumped viewer told our Paradigm team: “Alright. The banter is cool AF.”)

“My favorite opportunity right now — a peculiar sector of the stock market that I’ve been following for the last 20 years,” Paradigm’s AI specialist and iconoclast investor James Altucher said at last night’s live — and lively — event. (In real-time, for instance, one pumped viewer told our Paradigm team: “Alright. The banter is cool AF.”)

Back to James: “I call them ‘Superstocks’ because, right now, a massive economic force is about to send these stocks into the stratosphere. They are virtually the only stocks with the potential to return 1,000% gains in a year.

“In fact, these special investments have quietly outperformed the rest of the market over the last hundred years,” he says. “Most investors have no idea what they are...And Wall Street has gone to great lengths to hide them.

“I want to be very clear,” James adds, “I am still bullish on AI and crypto. That hasn’t changed. Half our position on Nvidia is still open.”

Nevertheless? “You will probably never have a chance to buy Bitcoin for $10,000 or $20,000 ever again. Those days are gone,” he says. “Same thing with Nvidia. It’s up almost 1,000% in two years.

“The difference is the opportunity in these ‘Superstocks’ is just getting started,” says James. “Researchers at Nasdaq, the world’s second-largest stock exchange, say these stocks are ‘historically undervalued’ and ‘poised for a significant rally.’

“Starting July 31, the biggest stock market trigger opportunity, by far, will be in these ‘Superstocks,’” James concludes.

![]() Persistent Bugger: Inflation

Persistent Bugger: Inflation

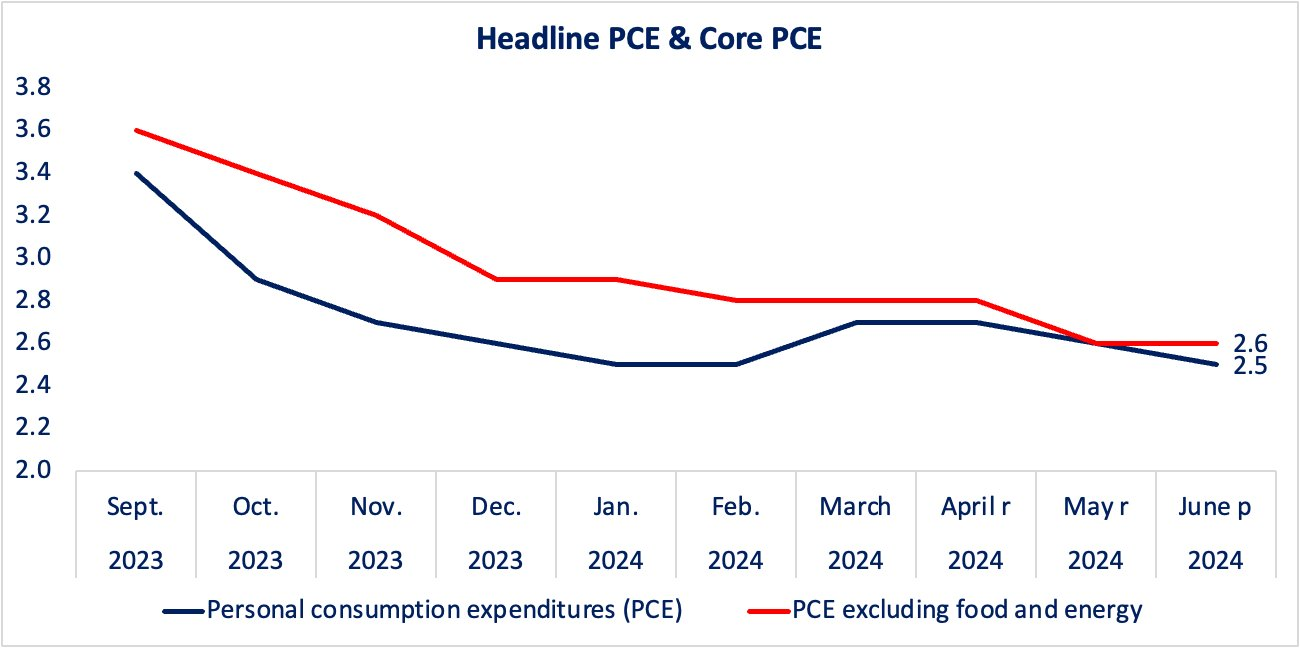

Inflation remains stuck closer to 3% than the Federal Reserve’s preferred 2% target.

Inflation remains stuck closer to 3% than the Federal Reserve’s preferred 2% target.

The Commerce Department issued its read on “core PCE” this morning. By this yardstick, consumer prices rose 0.2% in June — compared with 0.3% in May.

As mentioned, for the second straight reading, the year-over-year inflation rate is stuck at 2.6% versus the 2.5% economists anticipated.

Courtesy: X platform

By the way, this will be the last reading on core PCE before the Federal Reserve’s next policy-setting meeting on Wednesday, July 31.

Any “pivot” to lower interest rates now would undermine the Fed’s inflation target; nonetheless, earlier this month, Powell telegraphed that he’d consider some wiggle room.

Will the Fed cut interest rates next week? Unlikely. But traders are still betting on two rate cuts this year, with one probable 0.25% cut in September.

Taking a look at stocks today, all three major U.S. indexes are firmly in the green. But it’s the DJIA that’s rallying most — up almost 2% to 40,720. Meanwhile, the S&P 500 and tech-heavy Nasdaq are both up about 1.5% to 5,480 and 17,420 respectively.

Taking a look at stocks today, all three major U.S. indexes are firmly in the green. But it’s the DJIA that’s rallying most — up almost 2% to 40,720. Meanwhile, the S&P 500 and tech-heavy Nasdaq are both up about 1.5% to 5,480 and 17,420 respectively.

As for the commodities complex, oil is down 1% to $77.45 for a barrel of WTI. But gold and silver are grabbing some attention. The yellow metal, for instance, is up 1.40% to $2,387.10 per ounce. Its silver counterpart is up 0.30%, above $28.

The crypto market is rocking ’n’ rolling at the time of writing. Bitcoin has revved up 4% to $67,355. Likewise for Etherum — up 4% — to $3,245.

![]() [Follow-up] Copper Crunch

[Follow-up] Copper Crunch

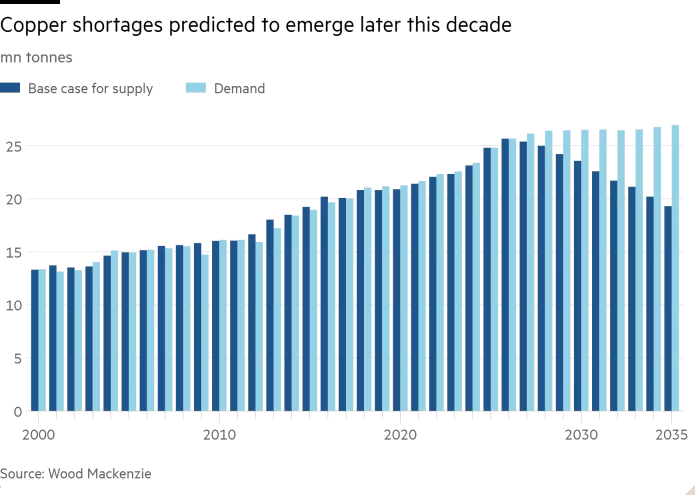

The BOA analysts now predict that by 2030, copper demand will outstrip supply by about 5 million tonnes, or 15%.

The BOA analysts now predict that by 2030, copper demand will outstrip supply by about 5 million tonnes, or 15%.

This supply gap — resulting especially from growing copper demand for so-called green technologies plus current copper prices being too low to encourage mining projects — will only widen into the 2030s unless something gives.

Source: Wood Mackenzie, The Financial Times

As a result? We might see more direct deals between miners and end-users — like car companies starting to finance mines to secure their supply, for example.

[Sidebar: I’ve long believed Elon Musk’s privately held Boring Co., which ostensibly exists to build underground tunnels, is a means to an end: ultimately, to mine the smorgasbord of metals that Teslas require. Lithium, cobalt and copper, to name a few.

And there’s heavy machinery for that, called “Prufrock” which “porpoises” — allegedly accomplishing in “a matter of weeks” what traditional methods accomplish in years.]

“To date, the only major financing deal for copper by a car company with a miner — between which smelters and several layers of manufacturers and suppliers sit — has been Stellantis, owner of the Jeep, Fiat and Peugeot brands, with McEwen Copper,” says a Financial Times article.

On the other hand…

“Not everyone buys the dire copper supply predictions,” the article notes. “Some are confident that at 25 million tonnes per year, the copper market is liquid enough to not need direct intervention.”

“Not everyone buys the dire copper supply predictions,” the article notes. “Some are confident that at 25 million tonnes per year, the copper market is liquid enough to not need direct intervention.”

According to Jimmy Hermansson of Danish cable manufacturer NKT: “In 2013 there were predictions of supply gaps in 2023, but that’s not what happened. We have secured copper for our order backlog. Beyond that, it’s speculative.”

To deal with shortages, major cable manufacturer Nexans is “boosting recycling from 5% to 30% of its supply as ‘the key’ to coping with tight supply,” FT says.

Nexans COO Vincent Dessale says: “There’s enough copper in the world — but the capacity for extraction is not increasing as fast as consumption.”

Meanwhile, some countries and industries are exploring their options…

- China, for instance, is switching to aluminum for long-distance power lines. (William Oplinger, CEO of American aluminum giant Alcoa, predicts an additional 1 million tonnes of aluminum demand due to such substitutions.)

- And copper used in plumbing — which accounts for about 9% of total copper demand — could easily be replaced with other materials.

At the same time, miners including Ivanhoe Mines are developing ways to work smarter, not harder. Ivanhoe Electric's Typhoon technology, for example, can spot electrically conductive metals like copper, gold, silver and nickel beneath the Earth’s surface.

“In May, Ivanhoe Energy announced an alliance with BHP to use Typhoon to explore areas of interest in Arizona, New Mexico and Utah,” says an article at Investing News Network.

It remains to be seen whether recycling, substitutions and new mining technologies can backfill the copper supply gap. As it stands today, we’re not convinced.

![]() [Follow-up] Transformers’ Moment of Truth

[Follow-up] Transformers’ Moment of Truth

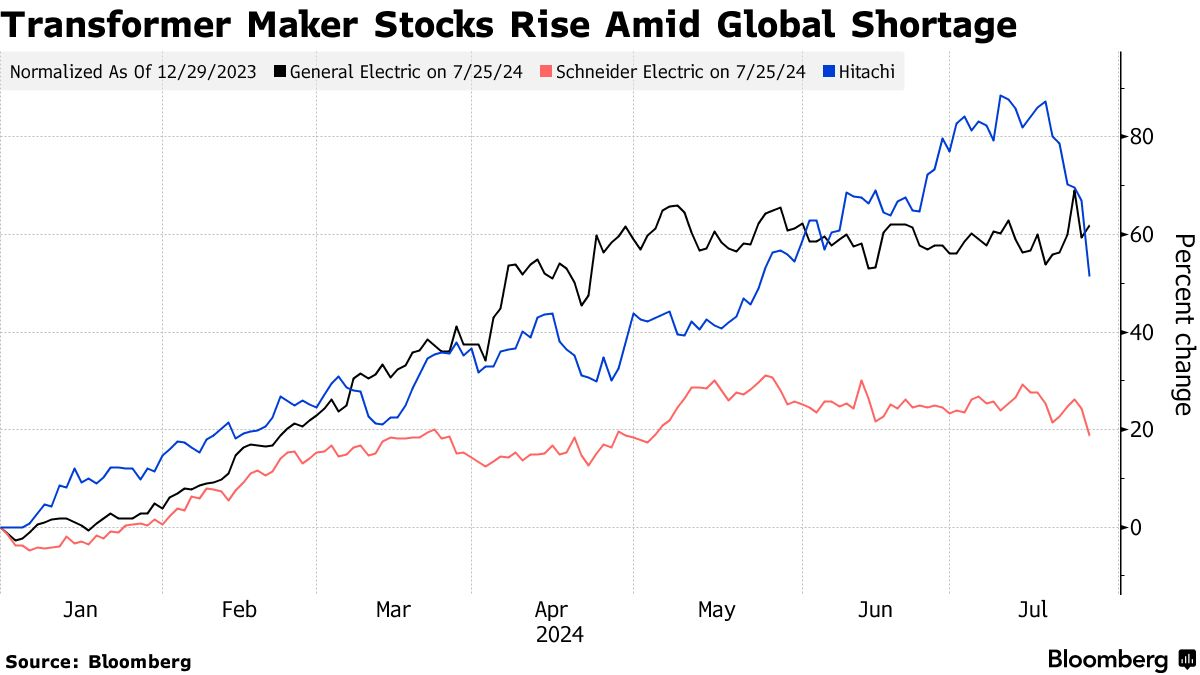

“Transformers — equipment that help deliver electricity from the generator to the user — are in such shortage that if you order one today, you will be lucky to receive it in 2028,” Bloomberg says.

“Transformers — equipment that help deliver electricity from the generator to the user — are in such shortage that if you order one today, you will be lucky to receive it in 2028,” Bloomberg says.

Add to that: “Transformer prices have risen 60–80% on average since January 2020,” says a report from data firm Woods Mackenzie.

It’s a potentially catastrophic shortage we first warned readers about in 2022. For reference, electrical transformers are these things…

Wikimedia Commons photo by Glogger

At the time, we noted that electric utilities were hard-pressed to figure out what brought about the shortage. Finding qualified workers? Sure, it’s a problem shared across many industries.

Not to mention, the production of transformers relies on a specific type of steel, which is manufactured by just one company in the United States — Cleveland-Cliffs. Compounding these issues, Team Biden chose to uphold Trump’s 2018 imported-steel tariffs.

As one might expect, the shortage has “boosted shares of top transformer makers this year, including General Electric Co., France’s Schneider Electric SE and Japan’s Hitachi Ltd.,” Bloomberg says.

As one might expect, the shortage has “boosted shares of top transformer makers this year, including General Electric Co., France’s Schneider Electric SE and Japan’s Hitachi Ltd.,” Bloomberg says.

Source: Bloomberg

“Energy infrastructure will be a very big theme, and that was even before artificial intelligence, which only adds to the need for more energy consumption,” says CIO Philipp Baertschi of Bank J. Safra Sarasin AG.

“Yet one needs to know that these are very cyclical, and there’s a lot of volatility,” he cautions. Still? “There will be very good opportunities.”

We’ll stay on top of this story… And opportunities as they present themselves.

![]() The Big Stink in Paris

The Big Stink in Paris

In order to host the Olympic Games in Paris, the French government spent €1.5 billion — $1.63 billion — to clean up the Seine river.

In order to host the Olympic Games in Paris, the French government spent €1.5 billion — $1.63 billion — to clean up the Seine river.

“For 50 years, the Seine received untreated sewage, leading to a ban on swimming in it since 1923,” notes the website Inside the Games. And for decades, a clean-up has been something Parisians have been clamoring for.

Now? The government’s costly efforts seem to be too little, too late. Plus, downright performative..

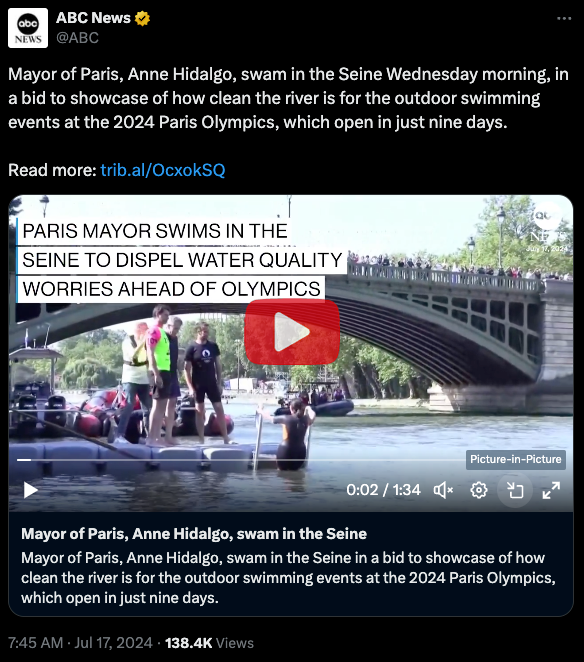

Last week, the mayor of Paris, donned a wetsuit and took the plunge into the still murky brown water, presumably to signal how safe the water quality is.

Notwithstanding: “Doubts about the water quality persist. E. coli tests carried out in June showed worrying levels during the week of the 22nd to the 30th. In fact, although the latest analyses conclude that levels have improved in July, experts warn that germs may still pose a problem for the athletes.”

Thus, there’s a growing, er, movement…

“Under the hashtag #JeChieDansLaSeine, which translates to ‘I poop in the Seine,’” — oh mon Dieu! — “a group of citizens has threatened to relieve themselves in the Seine,” Inside the Games adds.

“This is a form of protest against the poor quality of the river's water, which will host events such as the marathon swimming and triathlon stages.”

If these world-class athletes do contract E. coli from the filthy Seine water, I imagine the, umm, movement will spread.

Will you be watching the opening ceremonies this evening?