NVDA’s Blackwell Bummer

![]() Less Than Earth-Shaking

Less Than Earth-Shaking

Well, that was underwhelming. Nvidia’s quarterly numbers did not bring on nirvana… nor did they bring on the apocalypse.

Well, that was underwhelming. Nvidia’s quarterly numbers did not bring on nirvana… nor did they bring on the apocalypse.

Not that we expected either outcome — although we did hear from an irritated reader.

“Looks like Jim Rickards missed his ‘world is falling’ prediction with Nvidia. I'm sure we'll never see any apologies for sending us followers into panic mode.”

Panic mode?

Jim was not projecting an IMMINENT CRASH in the event of a Nvidia disappointment. He did say the potential is there for a swift downdraft in the broad market — 10–15% over the course of weeks.

Guess what? That potential is still there. His recommended way to play it in Rickards’ Crisis Trader has until January to play out.

Jim issued two prior warnings along these lines in 2022 — which you’ll recall was the worst year for the stock market since the 2008 financial crisis. Those two warnings resulted in gains of 75% in a few weeks and 130% in a month.

So what are we to make of NVDA’s numbers — and the immediate reaction?

So what are we to make of NVDA’s numbers — and the immediate reaction?

Sales and profits more than doubled during the second quarter. The company will buy back $50 billion of its shares — a substantial total, though less than half the record set by Apple earlier this summer.

But gross profit margins narrowed from the previous quarter — in part because of a production glitch with Nvidia’s next-generation Blackwell chips, the ones CEO Jensen Huang touted on stage, Steve Jobs-style, back in March.

With that, NVDA shares are down 5% at last check — but for the moment they’re not dragging down the stock market as a whole.

The company is promising to step up Blackwell production in the fourth quarter of this year and book “several billion dollars” in Blackwell revenue.

But even if it comes through on that promise, NVDA’s gross margins might continue to get squeezed for two reasons…

- Stiffer competition

- Selling less capable chips to China to avoid running afoul of U.S. sanctions.

“That’s probably why institutions are selling on this earnings beat,” ventures Jim Rickards’ senior analyst Dan Amoss.

Outside of Paradigm, one knock on Nvidia we’ve encountered is the fact that its business is heavily reliant on “vendor financing.”

Outside of Paradigm, one knock on Nvidia we’ve encountered is the fact that its business is heavily reliant on “vendor financing.”

That is, if you want to buy Nvidia chips and don’t have a pile of cash on hand, Nvidia will be happy to lend you the money.

The history of the 2000 dot-com bust and the 2008 financial crisis is littered with companies that got into trouble with vendor financing. Amid the 2008 crisis, General Electric’s finance arm needed a $139 billion federal backstop for its debt. GE also borrowed $16 billion from the Federal Reserve.

No, we’re not saying Nvidia will be begging for a taxpayer bailout anytime soon. We’re not even saying its best days are necessarily behind it.

But after 18 months of nonstop hype and a share price that’s soared from $20 (split-adjusted) to over $120 even with today’s sell-off… it should be no surprise if NVDA shares will take a breather for a while.

➢ Trivia aside: Not that it means anything, but Nvidia became a part of the S&P 500 index in November 2001. The company it replaced was the scandal-wrecked failure called Enron.

![]() The Not-So-Mighty Consumer

The Not-So-Mighty Consumer

If Nvidia doesn’t signal a new downdraft in the stock market, maybe Dollar General does?

If Nvidia doesn’t signal a new downdraft in the stock market, maybe Dollar General does?

DG just disappointed the Wall Street analyst consensus on both sales and earnings. Shares are down 25% on the day.

Some of that is the company’s own fault. “Dollar General has said that it needs to improve its stores and how it handles inventory to curb losses,” says CNBC.

All the same, “the softer sales trends are partially attributable to a core customer who feels financially constrained,” says CEO Todd Vasos.

Perhaps the top 20% of wealth holders and income earners in this country are still feeling flush and secure in the summer of 2024. That’s not DG’s core customer.

Zooming out to get a better handle on how the mighty American consumer is faring…

Zooming out to get a better handle on how the mighty American consumer is faring…

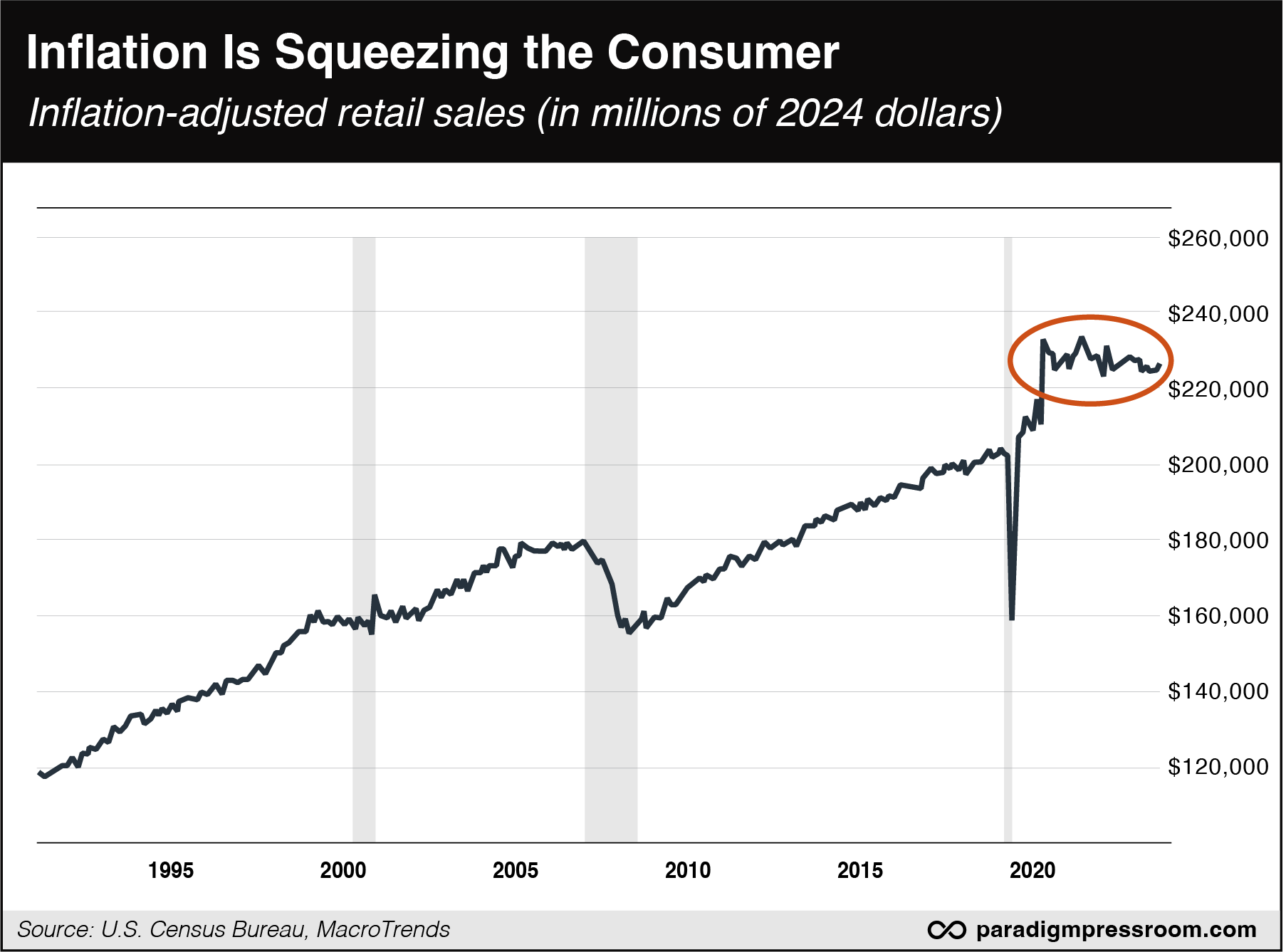

It’s worth noting the monthly retail sales numbers from the government are not inflation adjusted. If you adjust for a rising cost of living, retail sales are flat or even down compared with three years ago — when inflation really started to bite.

Something to think about whenever you see headlines about “robust consumer spending.” Eventually, those numbers translate to less-than-robust earnings for corporate America.

But on this day, neither NVDA nor DG is having a material impact on the stock market.

But on this day, neither NVDA nor DG is having a material impact on the stock market.

All the major U.S. averages are comfortably in the green. At 5,634 the S&P 500 is up three-quarters of a percent and barely 30 points off its all-time high notched in mid-July.

Precious metals are rebounding, gold at $2,520 and silver at $29.47. Crude’s August gyrations continue, a barrel of West Texas Intermediate up nearly a buck today to $75.47.

Amid much drama, Bitcoin sits a hair under $61,000.

Amid much drama, Bitcoin sits a hair under $61,000.

“An abrupt sell-off appeared out of the blue” on Tuesday night, says Paradigm chart hound Greg Guenthner. “I just so happened to see the fall in real-time, so I poked around to see what the experts were saying. It turns out that BTC and ETH were dropped due to a liquidation event which partially had to do with Russia testing Bitcoin framework (the idea began that the U.S. gov’t wouldn’t like this and impose some sort of anti-Bitcoin regulations).”

Is it true? Who knows? It’s not the news that matters, it’s the reaction. (See Nvidia above.)

“The big question here,” says Greg, “is whether that ‘selling event’ was isolated... or if it killed all the momentum that was building up on Friday.” Stay tuned…

![]() The Rural Recession

The Rural Recession

Rural America might well be in a recession already.

Rural America might well be in a recession already.

More than half of economists specializing in agriculture say the U.S. farm economy is in recession right now. That’s according to the Ag Economists’ Monthly Monitor compiled by the publication Farm Journal and the University of Missouri.

“That's a big change from where we were just 16–24 months ago, and it shows a lot of folks are worried about where we sit today,” says Mizzou economist Scott Brown.

It hurts that U.S. corn prices sit at a four-year low. If it weren’t for strong cattle prices, the overall picture would be worse.

“We know crop receipts are going to be lower than what they would have said back at the start of the year, cattle probably higher, hogs probably higher and dairy probably higher,” Brown continues.

Can it get worse? Yes, one economist responded in the anonymous survey. “If we have an economy-wide recession, what happens to beef demand?”

A further gloomy picture emerges from the Rural Mainstreet Index.

A further gloomy picture emerges from the Rural Mainstreet Index.

Every month, Creighton University economist Ernie Goss conducts a survey of bank CEOs in rural sections of Illinois, Iowa, Missouri, Minnesota, the Dakotas, Nebraska, Kansas, Colorado and Wyoming — areas dependent on agriculture, energy or both.

Goss then compiles an index in which readings above 50 indicate a growing rural economy, and numbers below 50 suggest contraction.

The August number comes in at 40.9, the weakest reading since last November. It’s been under 50 for 12 straight months.

One of the respondents to Goss’ survey is Jim Eckert, CEO of Anchor State Bank in central Illinois. “The sad part” he says, “is that most of our farmers will lose money or just break even due to poor commodity prices.”

About 100 miles to the west, Havana National Bank CEO Jeff Bonnett describes his small-business customers as “struggling.”

“The overall increase to inflation since pre-COVID days is taking a toll on rural America,” says Bonnett. “By the time working folks in our area pay their utilities, groceries and fill the tank up as needed each month, there is little disposable income left for dining out, entertainment and small business and crafts shopping.”

Nor is the outlook likely to improve soon.

Nor is the outlook likely to improve soon.

Crop prices probably won’t start recovering until 2026, economist Ben Ayers tells the Axios site.

Thus, the U.S. Department of Agriculture is forecasting the steepest decline in farm income in history this year — after touching records in 2022.

With farm income depressed, “companies like John Deere and Bridgestone have laid off thousands of Iowa workers who build farm equipment over the last year,” Axios reports — “leaving deep cuts in urban and rural workforces statewide.”

![]() Great Moments in New York Governance

Great Moments in New York Governance

Wait, isn’t cannabis legal in New York?

Wait, isn’t cannabis legal in New York?

Yes, it is legal. As we’ve chronicled previously, it became legal only after the prohibition-minded former Gov. Andrew Cuomo realized how much tax revenue legal weed would raise.

But, no surprise, New York City imposed taxes on legal cannabis that are so high, there’s still a thriving black market. Thus, the mayor crows about a seizure of illegal pot. Amazing.

The politicos never learn. New York City imposes the highest cigarette taxes in the country — which is why there’s a thriving black market for smokes smuggled in from lower-tax jurisdictions like North Carolina.

Let’s just hope that enforcement of the pot taxes don’t result in another Eric Garner.

![]() Mailbag: “The Policy”

Mailbag: “The Policy”

“With you rescinding your self-censoring policy, can we hear what you have to say about J.D. Vance as follow-up to your Cat Lady article?” a reader writes. “We’re dying to know.”

“With you rescinding your self-censoring policy, can we hear what you have to say about J.D. Vance as follow-up to your Cat Lady article?” a reader writes. “We’re dying to know.”

Dave responds: In the first place, I think “self-censoring policy” is a little harsh.

The only guideline was that we wouldn’t spend hundreds of words bashing either a single presidential or vice-presidential candidate in a single day, the better to discourage new readers from jumping to conclusions.

That said, it was a dumb policy for me to adopt. As I said the other day, the atmosphere now is sufficiently toxic that people are looking for reasons to be outraged and they’ll find them no matter what.

As for your inquiry… I’m not sure what there is to follow up on. The original write-up speaks for itself — or it should for anyone without partisan blinders.

In particular, anyone who believes in the values of individual liberty and small government should be deeply troubled by Vance’s willingness to use government as a tool to “reward the things that we think are good” and “punish the things we think are bad.”

Time was when Republicans at least gave lip service to those values even if they didn’t mean it. I guess it’s better that the mask is off now?