Earnings Psychodrama

![]() Beyond the NVDA Hype

Beyond the NVDA Hype

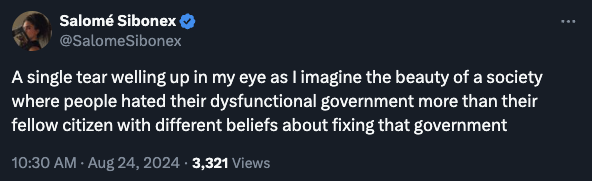

The most-hyped earnings report of the quarter arrives Wednesday afternoon after the market closes.

The most-hyped earnings report of the quarter arrives Wednesday afternoon after the market closes.

To date, over 90% of S&P 500 companies have reported their numbers, including six of the mega cap, tech-adjacent “Magnificent 7” names — Apple, Microsoft, Google, Amazon, Meta and Tesla.

But as far as the media is concerned, all of that is a sideshow compared with what’s coming in just over 48 hours from… Nvidia.

The “triple play,” by the way, is a reference to whether Nvidia can beat the estimates of Wall Street analysts on revenue as well as guidance for the current quarter and guidance for the next quarter.

For novice investors and traders, “the most frustrating part about earnings season is that stocks don’t react appropriately once the numbers hit the wire,” says Paradigm chart hound Greg “Gunner” Guenthner.

For novice investors and traders, “the most frustrating part about earnings season is that stocks don’t react appropriately once the numbers hit the wire,” says Paradigm chart hound Greg “Gunner” Guenthner.

“More often than not, a stock will behave differently than one might logically expect, even when earnings perfectly adhere to analyst expectations.”

➢ Which reminds me yet again: The most dangerous word in all of investing is should. Tattoo it into your brain.

“As long as you’re involved in markets,” says Gunner, “you’ll have to deal with the occasional earnings shenanigans. So it’s best if you learn to embrace the madness.”

Yes, there’s a healthier approach you can take to earnings season — as he illustrates with the reaction when two Mag 7 companies reported their numbers last spring.

In late April, Tesla reported a monster earnings miss — and shares rallied almost 34% over the next four trading days.

In late April, Tesla reported a monster earnings miss — and shares rallied almost 34% over the next four trading days.

“The Tesla news alone unleashed more than its fair share of angry comments across social media,” Gunner reminds us: Demand for EVs is falling off a cliff! Tesla’s free cash flow flipped negative! Profits are hitting three-year lows!

“But none of these facts prevented Tesla shares from rocketing off their lows as traders appeared blissfully unaware that anything could be wrong with the company’s business prospects.”

So what gives?

Recall that TSLA shares broke away from their Mag 7 compatriots late last year — falling, falling, falling while the rest were relentlessly rising.

So when first-quarter earnings season rolled around, “Most investors expected the worst,” says Gunner. “In fact, sentiment couldn’t have been more bearish heading into the announcement.

“Combine that with the strong downtrend and breakdown to fresh lows and you have a recipe for a big bounce on mediocre results. Tesla only needed a report that was slightly better than apocalyptic to spark a short-covering rally. And that’s exactly what happened!”

The day after Tesla reported its numbers, it was the turn of Facebook parent Meta. The numbers were great — and shares tumbled 10.5% the following day.

The day after Tesla reported its numbers, it was the turn of Facebook parent Meta. The numbers were great — and shares tumbled 10.5% the following day.

The contrast couldn’t be more stark: “While Tesla’s financials were a mess,” Gunner recalls, “Meta actually posted some impressive numbers. The company beat earnings and revenue expectations for the quarter, extending its fiscal comeback from the dark days of its metaverse pivot in late 2021–early 2022.

“But slightly lower second-quarter expectations stuck out to investors despite the strong Q1 showing.”

It’s as if traders were looking for an excuse to sell after a historic run-up. “Shares were up 450% from their 2022 lows ahead of its earnings announcement,” says Gunner. “The stock was also up 40% year-to-date ahead of earnings — the opposite action we had seen from Tesla during the first quarter.

“This strong uptrend plus the fact that Meta shares extended to new all-time highs following its previous earnings beat left little room for error. Anything less than a ‘perfect’ earnings report would of course entice investors to take profits — which is exactly what happened.”

Gunner’s bottom line: “Earnings reactions are all about expectations — just not the expectations everyone talks about. You have to separate the financials from how the herd feels about a stock. The best way to do that is to analyze prices and trends.”

What does Gunner think going into NVDA’s earnings this week?

Here, he sees no obvious chart setup on either the upside or the downside — not with NVDA shares range-bound between $99–130 the last three months.

“Too noisy,” he tells me. He sees better opportunities in other sectors of the market right now.

It’s at this time we remind you once more that Paradigm Press does not enforce a “company line” among its editors.

It’s at this time we remind you once more that Paradigm Press does not enforce a “company line” among its editors.

We insist that our editors share their unvarnished analysis with their paying readership — no self-censorship or second-guessing. If their opinions come into conflict with those of their fellow editors, we respect your intelligence enough to weigh those opinions and reach your own conclusions.

James Altucher recommended NVDA in his flagship newsletter Altucher’s Investment Network as a long-term hold last September. In June, he recommended selling half of that position for a gain of 183% — and letting the rest ride.

(We’ll hear more from James later this week about his view of NVDA’s prospects going forward.)

But in the meantime, our macro maven Jim Rickards has every expectation of a negative reaction to NVDA’s numbers on Wednesday — no matter what they turn out to be.

![]() A Canadian Precedent for a U.S. Strike?

A Canadian Precedent for a U.S. Strike?

It’s now 35 days before East Coast and Gulf Coast dockworkers might go on strike — and both sides in the dispute are looking nervously north of the border.

It’s now 35 days before East Coast and Gulf Coast dockworkers might go on strike — and both sides in the dispute are looking nervously north of the border.

When we left you on Friday, the Canadian government had stepped in to put a quick end to a lockout at the country’s two big railroads. The labor minister ordered the two sides to binding arbitration.

The Teamsters union objected mightily, threatening to go on strike today. But on Saturday, the Canada Industrial Relations Board ordered both companies and their workers to resume business as usual. The Teamsters are complying, albeit grudgingly — they promise a court challenge.

Quite the power move from Canada’s Liberal Party, which you’d think would sympathize with organized labor.

Then again, the Democrats did much the same here in the United States two years ago when freight rail workers threatened to strike — which would have snarled 40% of U.S. long-distance cargo.

The White House and a Democrat-controlled Congress imposed a settlement — over the objection of several unions.

We mention all of this as prologue to a threatened longshoremen’s strike on the East and Gulf Coasts. The current contract expires Sept. 30. Talks are not going well.

A strike would snarl supply chains only weeks before Election Day. And the Democrats don’t want anything of the sort spoiling Kamala Harris’ coming-out party. Just sayin’...

The big mover in the markets today is oil — a barrel of West Texas Intermediate up 3% at last check, back above $77.

The big mover in the markets today is oil — a barrel of West Texas Intermediate up 3% at last check, back above $77.

Crude has been a real yo-yo this month — bottoming below $72, surging above $80, tumbling back below $72 again, now just over $77.

The proximate event for today’s jump is an exchange of fire between Israel and Lebanon’s Hezbollah faction over the weekend — the biggest since an all-out war between the two in 2006. For the moment, both sides are telegraphing that the hostilities are over — but for how long?

The major U.S. stock indexes are starting a new week on a down note: The Dow is barely in the green, the S&P 500 is down about a third of a percent at 5,615 and the tech-intense Nasdaq is down over three-quarters of a percent.

Precious metals are holding onto their gains from last week, gold at $2,513 and silver at $29.76. Bitcoin is hanging tough at $63,480.

One economic number of note: July durable goods orders smashed Wall Street’s expectations — jumping 9.9%.

But that was heavily skewed by a surge in orders for commercial aircraft. If you back that out along with military hardware (another number that’s very noisy from month-to-month)... you get a figure called “core capital goods.”

And core capital goods fell 0.1% in contrast with Wall Street’s expectations for a 0.1% increase. Worse, the June number was revised lower. None of that describes a “robust” manufacturing sector.

![]() Fed-Fueled Caffeine Inflation

Fed-Fueled Caffeine Inflation

Sometimes you get interesting and worthwhile information from The New York Times…

Sometimes you get interesting and worthwhile information from The New York Times…

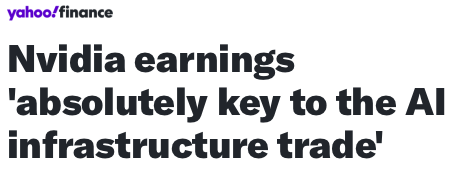

Here is a report on coffee prices at the Kansas City Federal Reserve’s annual confab in Jackson Hole, Wyoming — held last Thursday and Friday.

Oh, excuse me — it appears this reporter has moved on to the Axios online outlet. Same difference.

![]() Busybody Bureaucrats Shut Down Kid’s Ice Cream Stand

Busybody Bureaucrats Shut Down Kid’s Ice Cream Stand

It wouldn’t be summer if our 5 Bullets didn’t feature a depressing example of lemonade-stand law enforcement — or in this case, an ice cream stand.

It wouldn’t be summer if our 5 Bullets didn’t feature a depressing example of lemonade-stand law enforcement — or in this case, an ice cream stand.

It all started when summertime boredom set in for 12-year-old Danny Doherty of Norwood, Massachusetts. He wanted a job. “A lemonade stand seemed too ordinary,” mom Nancy tells the Foundation for Economic Education.

So she suggested he sell some of her homemade ice cream. He came up with a name and a logo; Mom helped design an Instagram page. Danny intended for at least half the proceeds to go to the Boston Bear Cubs — a special-needs hockey team on which his brother plays.

Then a neighborhood snitch notified the city health department — which shut the operation down after it had raised about $60.

“It’s disappointing,” Danny tells Boston’s NBC outlet.

That said, the publicity in Boston-area media has resulted in over $10,000 of donations to the Boston Bear Cubs — some from an ice cream shop that graciously hosted a fundraiser.

Meanwhile, bureaucracy can’t keep a good entrepreneur down: Nancy Doherty says Danny is scheming on his next moneymaking venture. “He thinks he might start sharpening skates to earn some extra cash,” she says — “but Boston Bear Cubs players and volunteers will always get complimentary sharpening.”

![]() Mailbag: Somehow I Touched a Nerve

Mailbag: Somehow I Touched a Nerve

“Keep touching nerves!” writes one of our longtime regulars after Friday’s edition.

“Keep touching nerves!” writes one of our longtime regulars after Friday’s edition.

“Hopefully the negative/butthurt feedback from readers is limited — and doesn’t get to you too much. It’s probably just battle fatigue being vented.

“The establishment’s ongoing divisiveness and assault on liberty is no joke. That takes its toll, even with folks as educated as your subscribers.

“Every day, you and Emily navigate the intersection of economics and politics remarkably well.

“It’s amazing that you still digest such a menu of news and keep it together while sorting things out after so many years. That is why The 5 is the best.”

“OK, I’ll bite,” writes another longtimer.

“OK, I’ll bite,” writes another longtimer.

“I usually just skim past the ALL-CAPS-SHOUTING, ad hominem attacks and enough !!!!!!!!!! marks that the only explanation is a sticking keyboard (or the inability to make an effective reasoned argument).

“I’m disappointed that you have decided to self-censor because of the vitriol, however. As you’ve said many times, the only reason you need free speech is when it’s controversial.

“So it appears you’ve acquiesced to being shouted down and cowering away from contentious subjects rather than seeing this as a need to lean in further.

“Also, it seems at odds with your annual missive about the threat of censorship by Big Brother. Eventually, if you continue shying away from contentious commentary, there will be nothing left for Big Brother to censor.

“Be bold!!!!!!!! And STICK TO YOUR GUNS!”

Dave responds: Well, I wasn’t going to mention this for a few more days… but with the encouragement of the Paradigm Press brain trust, I have rescinded the policy.

I mean, I effectively rescinded it with the publication of Thursday’s edition — which it’s safe to say criticized the Democrats more than the Republicans. And as I said on Friday, the reaction was quite reasonable. There was one individual who insisted that fascism (as personified to him by Donald Trump) was a far greater danger than socialism — but at least he didn’t attack me personally.

Alas, whatever I said on Friday set him over the edge. “PLEASE DON’T EVEN THINK ABOUT RENEWING MY SUBSCRIPTION.”

What can I say? If people want to see a criticism of Kamala Harris as an implicit endorsement of Donald Trump, there’s nothing I can do to alter that perception. And vice versa.

(And I will have something to offend Trump partisans tomorrow in the wake of the RFK Jr. endorsement…)

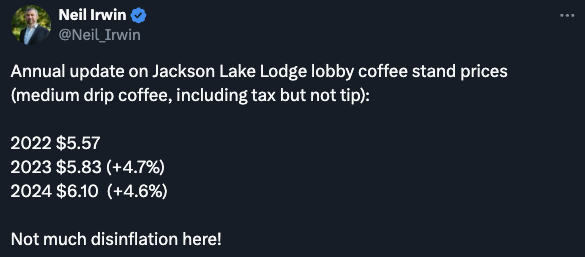

“Not quite sure how reassuring it is for me to say this,” writes our final correspondent, “but I'll give my unpopular opinion on it; It is not a battle of red versus blue or right versus left in America. It is a fight of insiders versus outsiders.

“Not quite sure how reassuring it is for me to say this,” writes our final correspondent, “but I'll give my unpopular opinion on it; It is not a battle of red versus blue or right versus left in America. It is a fight of insiders versus outsiders.

“All the social issues people fight over — racism, sexism, LGBT++ — etc. are all smokescreens meant to divide the American people and prevent them from coming together. It is why grassroots movements always seem to get stomped out, from the tea party to OWS (Occupy Wall Street). OWS especially touched a nerve with the establishment since after that started, the media began to call everything 'racist' and every other sort of '-ist' or '-phobe.' Then the movement fell apart.

“So when you see people who seem to lose their self-control at a particular issue, just remember it's not necessarily something wrong with them or wrong with the topic. There are a very large number of resources devoted to turning people against one another and keeping them from learning things like how the central bank works or how many FDA employees are from large pharma companies, or always seem to retire into cushy positions in large pharma companies.

“Of course, don't just take my word for it. I've seen some people on the XTwitter putting up graphics of the efforts to keep people divided against each other and never seeking serious foreign policy or spending changes.”

Dave: Eloquently said. Someone else put it this way over the weekend…