Is Nvidia the Next Amazon?

![]() The Biggest Financial Story of 2025

The Biggest Financial Story of 2025

It will be the most talked-about financial story of 2025. And you’re reading about it today — weeks or months before it becomes headline news.

It will be the most talked-about financial story of 2025. And you’re reading about it today — weeks or months before it becomes headline news.

Welcome to the latest installment of the Paradigm Press editors’ 2025 predictions. Today we’re revisiting a forecast that our hedge fund veteran and trading pro Enrique Abeyta first shared in this space last month.

The forecast is this: AI darling Nvidia will shed $1 trillion from its $3.5 trillion market cap. Probably in a single day.

We’ll spare you the trouble of doing the math. That’s a 28.6% plunge in NVDA’s share price.

It wouldn’t take much to push Nvidia over the edge. The most likely catalyst, Enrique says, is an earnings-season disappointment.

And by that he means something as mundane as, say, revenue growth of “only” 65% when the Wall Street consensus was looking for 82%.

Why is Enrique so certain? Because AI is in the same place now that the internet was a generation ago… and where railroads were in the 19th century.

Why is Enrique so certain? Because AI is in the same place now that the internet was a generation ago… and where railroads were in the 19th century.

In both of those instances, there was a massive overbuild of infrastructure — be it rail lines back in the day or fiber-optic lines more recently.

Yes, all that excess capacity was put into use eventually. But in the interim, there was a vicious shakeout.

If you’re old enough, you remember the internet example well — perhaps too well. The dot-com bust took down the price of Amazon, for instance, by 90%... before it rebounded and became a world-beating colossus.

Enrique says AI is at the same pivot point: “We’re moving from the network-building phase of the AI boom to the implementation and harvesting phase,” he says in today’s edition of our sister e-letter Truth & Trends. “So investment will shift from hardware to software.

“The shift could set Nvidia up for disappointment, especially after two tremendous years that have set extremely high expectations.”

Long term, Enrique is confident that Nvidia will recover the losses he’s forecasting — and go on to double or triple or even 10X from today’s valuation.

But shorter term, he says NVDA is set for a great fall — one that will catch nearly everyone by surprise. Not you, though. Not now.

How should you position yourself in light of this forecast, you ask?

How should you position yourself in light of this forecast, you ask?

Well, if you’re a long-term buy-and-hold kind of person, you simply hold on for dear life through the downdraft in NVDA shares — confident that it’s a strong company, that the share price will roar back and that you’ll be rewarded for your patience. (Not everyone has that patience. Part of good investing is knowing how much pain you’re willing to endure.)

Enrique recommends out-of-the-money put options on NVDA. Alternatively, colleague Davis Wilson figures whenever the sell-off comes, he’ll simply add to his NVDA position — scooping up even more shares at a bargain price.

But it’s our AI authority James Altucher who has the most intriguing way to hedge the risk from NVDA right now.

If you’re a member of his premium advisory True Alpha, you’re already hip to it. If you’re not, it has to do with an announcement James expects Nvidia CEO Jensen Huang to make tonight at the Consumer Electronics Show in Las Vegas.

James anticipates the profit potential coming out of this announcement will run as high as 2,350% or 5,133% even 7,100% — in a matter of days. (Those aren’t numbers we pulled out of the air; those are actual returns after announcements of similar magnitude.)

As might expect, you won’t achieve these gains buying NVDA shares. Also as you might expect, time is of the essence if you want to seize the moment. Huang takes the stage tonight at 6:20 p.m. in Las Vegas, 9:20 p.m. on the East Coast. Follow this link and James will walk you through this one-of-a-kind opportunity.

![]() A Rising Tide Lifts SOME Boats

A Rising Tide Lifts SOME Boats

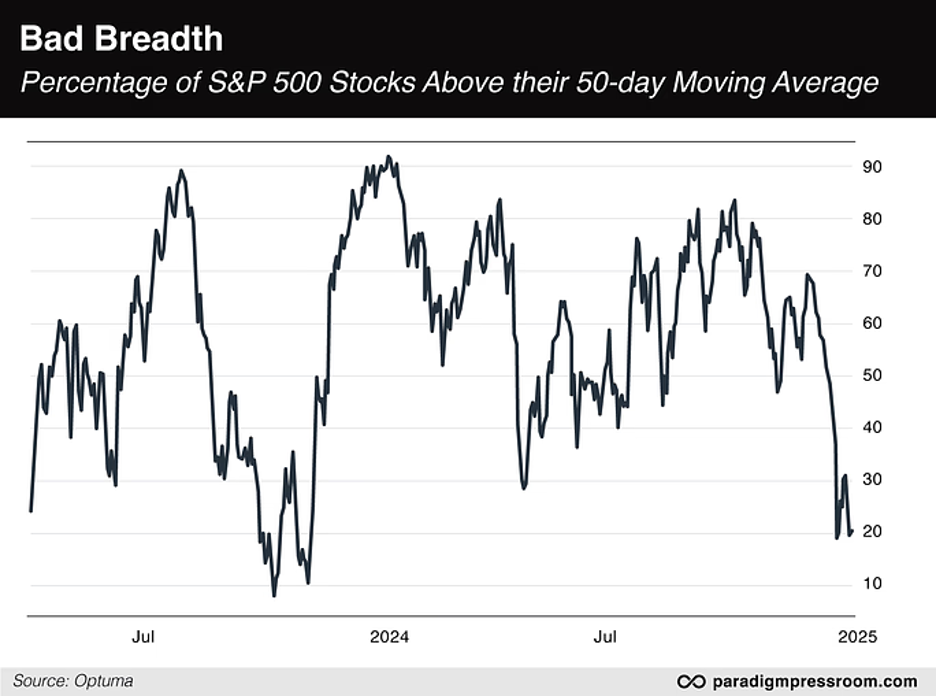

Rarely have the major U.S. stock averages been this high… while so many companies comprising the index are underperforming.

Rarely have the major U.S. stock averages been this high… while so many companies comprising the index are underperforming.

As a new week begins, the S&P 500 is back above 6,000. Not bad at all — only 1.4% below its record close notched one month ago today.

But beneath the surface? Paradigm chart hound Greg Guenthner points us to this statistic from Bank of America: “The percentage of stocks outperforming the S&P 500 is at an all-time low. That’s right, never in the stock market's history have so many issues lagged their benchmark.

“Here’s another breadth measure that caught our attention: A mere 20% of S&P stocks are trading above their 50-day moving average…

“We use a stock’s 50-day average to measure its intermediate trend,” Greg explains.

“Based on the chart, four out of five S&P 500 components are failing to keep pace with the bull market. That jibes with the BofA stat and the handful of failed breakouts in the market's small-cap, biotech and speculative growth areas.

“I doubt stock market bulls envisioned such a precarious start to the year. More individual names must kick into gear and head higher. If they don’t, watch out for the stock market averages to catch lower with most of the market.”

For the moment, however, the disconnect is widening further.

For the moment, however, the disconnect is widening further.

As mentioned a few moments ago, the S&P 500 is back above 6,000 — that’s a 1.1% gain on the day. But at last check the small caps are lagging (up 0.75%) and biotechs are lagging worse (up 0.23%). It’s the chip stocks, including Nvidia, that are doing well on the back of a strong earnings report from Foxconn — the big Taiwanese supplier to both Nvidia and Apple.

Elsewhere gold is flat at $2,633 — but silver has recovered a $30 handle for the first time since before Christmas. Crude is up again to $74.43, another high last seen in mid-October.

The crypto complex is solidly in the green, with Bitcoin reclaiming $100,000 for the first time since Dec. 19. In fact, checking our screens, it’s over $102,000.

![]() The Year of the Biotech Takeover

The Year of the Biotech Takeover

The current weakness in biotech stocks could easily be erased with a couple of takeover announcements — and Paradigm biotech specialist Ray Blanco expects just that.

The current weakness in biotech stocks could easily be erased with a couple of takeover announcements — and Paradigm biotech specialist Ray Blanco expects just that.

On Friday, Ray told us he expects the biotech sector to get a lift starting next week when several companies will break news at the J.P. Morgan Healthcare Conference in San Francisco.

But apart from the scientific breakthroughs, Ray is also eyeing the potential for buyout activity.

“Big Pharma's massive patent cliff issue isn't going away,” he tells his Catalyst Trader readers. “They're staring down hundreds of billions in revenue at risk through the end of the decade as top-selling drugs lose their market exclusivity to generics.”

And the reality of pharma is that internal research and development is a lot harder than simply buying out smaller developers of promising new treatments.

Buyout activity in 2024 was sluggish. “But we started seeing a small surge in biotech IPOs late last year,” Ray says — “plus venture money is flowing again.

“The deal landscape is also shifting. Instead of waiting for late-stage assets, pharma's getting comfortable betting earlier. We're seeing more Phase 1 and 2 deals.

“Hot areas include immunology and autoimmune diseases, while antibody-drug conjugates (ADCs), radioligand therapies and brain disorder treatments remain in high demand.

“To top it off, we’re now past the election and clarity is setting in on the regulatory front. I expect the dealmaking pace to pick up significantly as we get a better look at the new administration’s policies.”

![]() Once More, for Old Times’ Sake

Once More, for Old Times’ Sake

With Congress about to certify Donald Trump’s election as the 47th president today, the establishment media are hauling out this chestnut one more time…

With Congress about to certify Donald Trump’s election as the 47th president today, the establishment media are hauling out this chestnut one more time…

That’s The New York Times, by the way.

“Jobs are up, wages are rising and the economy is growing as fast as it did during Mr. Trump’s presidency,” says the Times. “Unemployment is as low as it was just before the COVID-19 pandemic and near its historic best. Domestic energy production is higher than it has ever been…

“Those positive trends were not enough to swing a sour electorate behind Vice President Kamala Harris in the November election, reflecting a substantial gap between what statistics say and what ordinary Americans appear to feel about the state of the country…”

And on and on. You get the idea.

As far back as the spring of 2022, we noticed how mainstream media adopted a running theme to the effect of: The economic numbers are good! Why don’t the rubes appreciate how good they’ve got it?

By last year, the media was fretting over a “vibecession.” The Wall Street Journal ran with this headline: “What’s Wrong With the Economy? It’s You, Not the Data.” (I tore apart the article at the time.)

We mention this not to take Donald Trump’s side; your editor has every expectation Trump will find entirely new ways to foul things up. It’s just amusing how the media seems hell-bent to take one more whack at a dead horse…

![]() The H-1B Commotion… and X Censorship

The H-1B Commotion… and X Censorship

“As much as I hate to agree with Bernie Sanders, he is right,” writes a reader on the ongoing H-1B visa commotion.

“As much as I hate to agree with Bernie Sanders, he is right,” writes a reader on the ongoing H-1B visa commotion.

“I have personally seen H-1B engineers treated like slave labor, or indentured servants as Bernie called them.

“They are locked into working for the sponsoring employer often in less than desirable conditions or environment and certainly half the pay that American counterparts make and have no freedom to escape except by going home.

“It is all so the hiring manager can save money for the firm, look good and earn a bigger bonus or promotion. It is simply greed.

“The quantity of H-1B visas needs to be cut back to a much smaller number

and the qualifying criteria should be enforced.”

Dave responds: It’s been fascinating to watch this commotion unfold — especially Elon Musk’s involvement.

As John Robb writes on his Substack site, Musk made two unforced errors over the holidays. First, he labeled people with an opposing opinion “subtards” (shades of Hillary Clinton’s “deplorables” slur)... and then he implicitly threatened to censor them on X. (“I will go to war on this issue the likes of which you cannot possibly comprehend.”)

Eventually he relented — acknowledging “that the program is broken and needs major reform.”

Coincidentally or not, Musk has announced a new and extremely vague policy on X in which posts with a “negative” tone will reach fewer users.

Several well-known users have put Musk’s Grok AI tool to work… to see if their content will run afoul of the new standards. The results are equal parts amusing and disturbing.

Or maybe the new policy doesn’t stem from the H-1B controversy at all.

That’s because other folks point out the crackdown on “negativity” comes shortly after Musk’s xAI artificial-intelligence venture got a $6 billion infusion from several institutional investors including BlackRock — the one-time advocate of corporate “wokeism” until CEO Larry Fink decided it was bad for business.

Whatever the case, the meme-o-verse sees the writing on the wall — and is not posting it on X!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets