Still the AI Leader

![]() Still the AI Leader

Still the AI Leader

So what’s up with the buzziest company on the planet?

So what’s up with the buzziest company on the planet?

On the day after CEO Jensen Huang did his latest Steve Jobs-ian razzle-dazzle at the Consumer Electronics Show in Las Vegas… NVDA shares tumbled 6.2%.

To hear the corporate media tell it, the reaction to Huang’s presentation was “Is that all there is?”

Paradigm’s own Davis Wilson, on location in Vegas, has no idea what the media’s talking about.

Paradigm’s own Davis Wilson, on location in Vegas, has no idea what the media’s talking about.

Of course the crowd on hand for Huang’s presentation wasn’t exactly skeptical. But even taking that into account, Davis came away impressed.

“First off, Nvidia’s latest Blackwell AI chip is in full production after (wrongful) delay/malfunction rumors. In other words, the race to build bigger, faster, better AI models is only gaining steam.

“Here’s another big takeaway: AI is making GPUs cheaper and more efficient, and it’s giving Nvidia an even bigger moat over its competition.”

GPUs are “graphics processing units.” They’re NVDA’s bread and butter.

“During his keynote address,” says Davis, “Huang used the company’s new, updated gaming GPUs as an example: Previous models were being sold for $1,599. The new model is $549, and that cheaper price tag is all thanks to the efficiency created by AI in the design and manufacturing process.”

“Nvidia is also hyper-focused on creating the world’s first physical AI model for robotics and industrial AI called Nvidia Cosmos,” Davis continues.

“Nvidia is also hyper-focused on creating the world’s first physical AI model for robotics and industrial AI called Nvidia Cosmos,” Davis continues.

What does that mean, exactly?

“If you think large language models like ChatGPT or Grok take a lot of data, compute and training, now apply all that to the physical world.

“Nvidia is going to lead this buildout, too, which analysts expect could create another $1 trillion opportunity for the company. Jensen even stated that: ‘The ChatGPT moment for general robotics is just around the corner.’”

And there’s more. Advances in AI agents that can streamline mundane business tasks… advances in autonomous vehicle technology (already in use by Mercedes-Benz and Volvo)... and something called Project DIGITS. Davis says that’s “the company’s effort to put an AI supercomputer into the hands of individuals with just a PC.

“The bottom line is that AI is advancing across the board and a whole new crop of exciting innovations are coming down the line in the near future, thanks to the leader in AI — Nvidia.

“NVDA is still at the top of my high-quality list.”

It’s at this point we’ll remind you of what we’ve been saying for a few weeks, most recently Monday: NVDA’s share price is in line for a 25%-or-better scalping this year.

It’s at this point we’ll remind you of what we’ve been saying for a few weeks, most recently Monday: NVDA’s share price is in line for a 25%-or-better scalping this year.

That’s the outlook of Paradigm trading pro Enrique Abeyta. He says NVDA will see $1 trillion slashed from its market cap.

As Enrique sees it, the company is priced to perfection at a time when the buildout of AI infrastructure is getting ahead of itself. He compares it with the excess buildout of rail lines in the 19th century and fiber-optic lines for the internet at the turn of the 21st.

Yes, all that capacity came into use over time — but there was a wicked shakeout in the interim. (Remember the dot-com bust?)

Lo and behold, at its worst yesterday NVDA’s market cap was down $275 billion — more than a quarter of the way toward Enrique’s audacious $1 trillion forecast.

As goes NVDA, so goes the market?

As goes NVDA, so goes the market?

It sure seemed that way yesterday. NVDA’s 6.2% slide helped drag down the Nasdaq by 1.9%... and the S&P 500 by 1.1%.

The Dow was not spared, but because it’s a price-weighted index NVDA had less of an impact — sending the Big Board down 0.4%. (NVDA became one of the 30 Dow stocks last November, replacing Intel.)

We’ll reiterate what we said Monday: Enrique believes after NVDA’s $1 trillion drawdown, it will roar back to at least double its current market cap. Davis will use any drawdown to add to his NVDA position.

That said, NVDA wasn’t the only market story yesterday or today…

![]() Inflation Jitters

Inflation Jitters

The mainstream attributes yesterday’s sell-off to inflation jitters — and for once the mainstream might be onto something.

The mainstream attributes yesterday’s sell-off to inflation jitters — and for once the mainstream might be onto something.

The ISM Services Index came out yesterday. Ordinarily we pay no nevermind to this number. The service sector of the economy has been robust for months now — and yesterday’s headline number of 54.1 was further confirmation. (Anything above 50 suggests growth; below 50, contraction.)

But the internals of the survey are cause for concern. The “prices paid” sub-index blew out from 58.2 to 64.4. Here, higher numbers are bad; service-oriented businesses are seeing their costs explode.

Either they’ll have to eat those costs… or they’ll have to pass them onto their customers.

As we mentioned yesterday, the bond market is definitely sniffing out a continued resurgence of inflation during 2025.

As we mentioned yesterday, the bond market is definitely sniffing out a continued resurgence of inflation during 2025.

The official inflation rate bottomed in September at 2.4% It rose in October to 2.6% and in November to 2.7%. The next read on this number is due a week from today.

Three weeks from today the Federal Reserve will issue its next proclamation on interest rates.

At this time the betting in the futures market is that the Fed will stand pat — leaving the benchmark fed funds rate at 4.5%. If that’s what happens, the Fed’s rate-cutting cycle will be put on hold only 4½ months after it began.

That’s unprecedented — at least so far in this century. It would confirm that inflation is not “contained” — and perhaps that it was a mistake for the Fed to start cutting rates in the first place.

Amid that backdrop, the major U.S. stock indexes are in the red again today.

Amid that backdrop, the major U.S. stock indexes are in the red again today.

Now it’s the Dow’s turn to take the bigger hit — down 0.4% as we check our screens. The S&P 500 and the Nasdaq are both down about a third of a percent, the S&P back under 5,900. Nvidia is slightly in the green, up a third of a percent.

A resurgent dollar isn’t helping stocks; the U.S. dollar index is back above 109.

Inflation continues to spook the bond market, too — pushing yields higher. The 10-year Treasury is *this* close to 4.7% — which would equal a peak set nearly nine months ago.

Dollar strength isn’t hurting precious metals, however. Gold is up to $2,664 and silver $30.17. Crude is flat at $74.19.

No joy in crypto-land — with Bitcoin under $95,000 for the first time in nearly a week.

![]() De-Dollarization Update

De-Dollarization Update

By one measure, the dollar’s status as the world’s reserve currency sits at a three-decade low.

By one measure, the dollar’s status as the world’s reserve currency sits at a three-decade low.

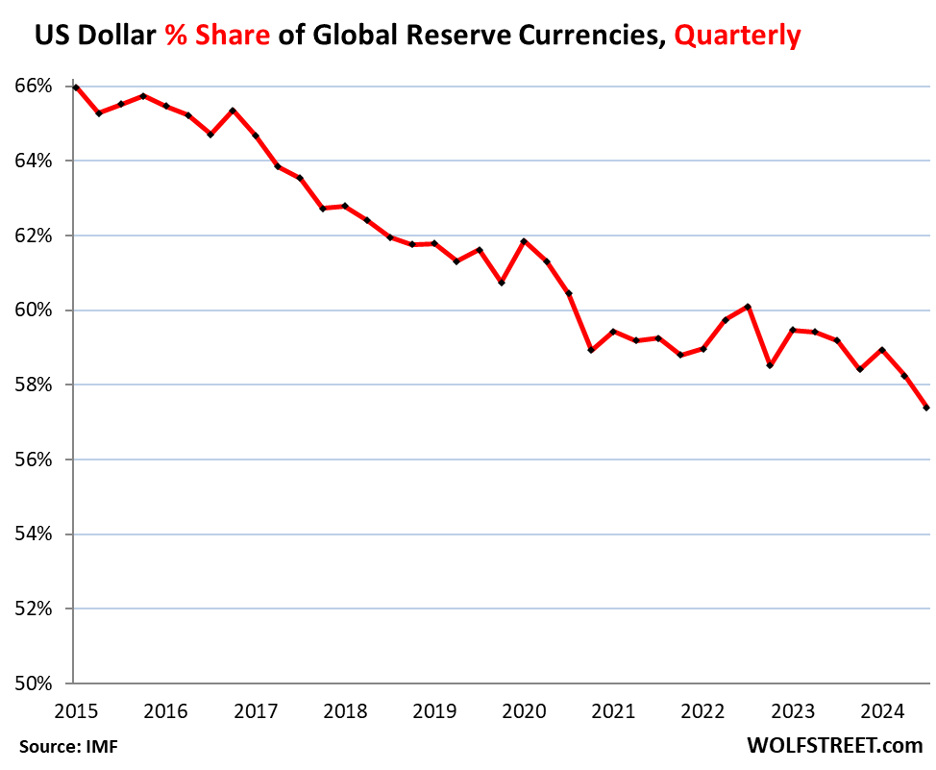

New figures from the International Monetary Fund reveal that dollar-denominated foreign exchange reserves make up 57.4% of total forex reserves worldwide.

That’s down from 66% a decade ago.

Note that there was a bit of a recovery going into 2022 — and then came Russia’s invasion of Ukraine and Washington’s unprecedented sanctions on Russia.

The Global South has collectively accelerated its exodus from dollar reserves since. Many of those dollars have flooded back stateside, fueling the inflation of recent years.

At this pace, financial blogger Wolf Richter says the dollar’s share of forex reserves will fall to 50% by 2034.

On a related note, the BRICS grouping of countries has expanded from nine members to 10.

On a related note, the BRICS grouping of countries has expanded from nine members to 10.

Indonesia is the fourth most populous country in the world, right behind the United States. Its economy is the seventh largest.

As a reminder, the original BRICS grouping of Brazil, Russia, India and China was joined by South Africa in 2010… and expanded last year to include Egypt, Ethiopia, the United Arab Emirates and Iran.

At his Geopolitical Economy Report page on Substack, independent journalist Ben Norton notes that Indonesia is the world’s biggest producer of nickel — essential to EV batteries and solar panels.

Reminder: During Tesla’s conference call in July 2020, Elon Musk pleaded: “Any mining companies out there, please mine more nickel.” Wanna bet China gets dibs on Indonesia’s nickel now? China is already Indonesia’s No. 1 trading partner.

BRICS present the most credible threat to the dollar’s status as the globe’s reserve currency — although we caution that toppling a reserve currency is a decades-long process. It took 30 years for the dollar to supplant the British pound — a process that came to a head with the Bretton Woods agreement of 1944.

![]() Seems to Be Taking a Long Time…

Seems to Be Taking a Long Time…

Headlines abound this week about Costco’s plans to stack apartments on top of a store in Los Angeles.

Headlines abound this week about Costco’s plans to stack apartments on top of a store in Los Angeles.

Which is bizarre because we first mentioned it in this space nearly two years ago.

A developer called Thrive Living aimed to build a mixed-use complex on five acres that used to be the site of a hospital. Here’s the artist rendering we shared on Feb. 2, 2023…

Yeah, but does your rent come with a Costco membership?

[Artist rendition by Thrive Living]

The same drawing shows up in a Wall Street Journal article published on New Year’s Day that spells out a few more details about the first-of-its-kind project.

“Thrive Living is planning to begin construction in early 2025 on an 800-unit affordable-housing complex with the megaretailer on the ground floor in the Baldwin Village neighborhood of South Los Angeles. The project, which includes a rooftop pool and fitness center, would have 184 apartments for low-income households.”

OK, fine, but what’s the news here? What actually changed in the last 23 months?

Also unanswered are the cheeky answers we first posed at the time: Will the elevators be big enough to accommodate one of those flatbed carts? Will the giant jars of mayonnaise fit in the kitchen cabinets?

And most important… What if you come home one day and find they moved your apartment to a different part of the building?

![]() A Reader Is Triggered

A Reader Is Triggered

“Find another job,” a reader writes after Monday’s edition.

“Find another job,” a reader writes after Monday’s edition.

“I made the mistake of reading your gibberish today! Usually I delete and forget when it’s your turn to comment.

“It’s humorous that you have anything to pontificate about Elon Musk. Back to deleting. You’re not worth getting worked up over.”

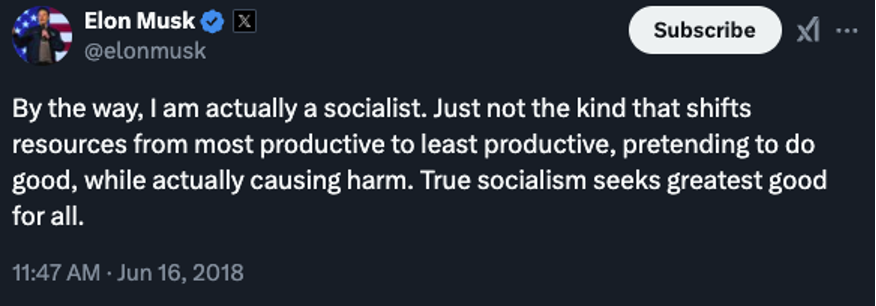

Dave responds: Which suggests you did get worked up over something originally. But what? And what did I say about Elon that set you off Monday?

Anyway, I stumbled across something else this morning you might find triggering. Enjoy!

Whatever that was supposed to mean, right?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets