Blue Screens of Death (BSOD)

![]() The 9/11 of IT

The 9/11 of IT

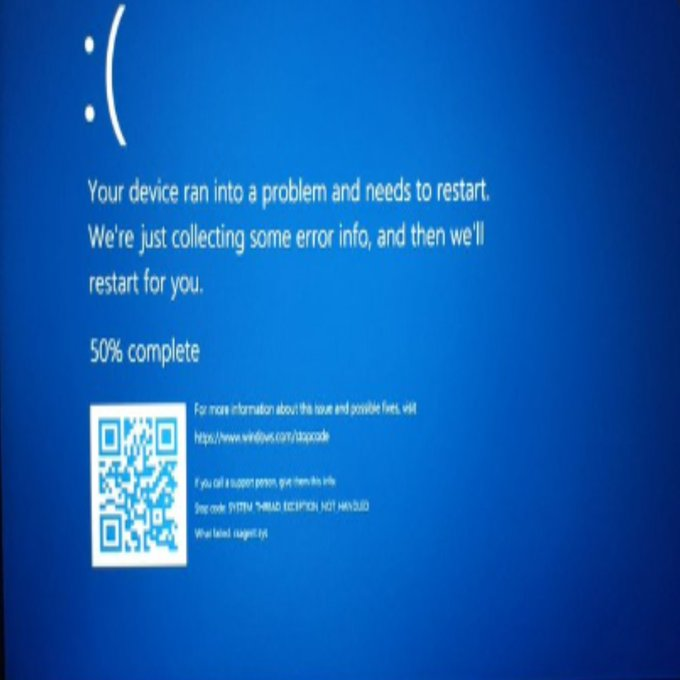

Here’s the so-called Blue Screen of Death (BSOD) that greeted me when I attempted to fire up my computer this morning…

Here’s the so-called Blue Screen of Death (BSOD) that greeted me when I attempted to fire up my computer this morning…

It took about four tries before I could actually log on. (In the interim, I texted my husband: “I might not be working today. Microsoft! *scream emoji*”).

For better or worse, as you can see, the fifth try was the charm. And in case you’re unaware…

“Widespread Windows outages have been linked to a software update from cybersecurity giant CrowdStrike,” says an article at Wired.

“Widespread Windows outages have been linked to a software update from cybersecurity giant CrowdStrike,” says an article at Wired.

Dan Amoss — Paradigm analyst and Jim Rickards’ right-hand man — wrote about the company at Strategic Intelligence in 2020.

“We stop breaches is CrowdStrike’s corporate mission,” Dan mentioned at the time. “Its products and services address endpoint security, vulnerability management and threat intelligence.

- CrowdStrike (CRWD) offers cloud modules on its Falcon platform through a software-as-a-service subscription model

- The company went public in June 2019 amidst strong demand from investors excited about its future. CRWD quickly spiked above $100 per share

- Many investors are excited to own this stock because its revenue and earnings growth potential is enormous. CrowdStrike is capable of growing revenue at a compound annual rate of 40–50% over the next decade.

“Management estimates that the total addressable market is $29.2 billion and getting larger with each passing year.”

Currently? CrowdStrike is a $76.2 billion company.

“CrowdStrike’s business model has a valuable network effect which ties into its use of artificial intelligence,” Dan continues.

“CrowdStrike’s business model has a valuable network effect which ties into its use of artificial intelligence,” Dan continues.

“Its Threat Graph database processes, correlates and analyzes over 2.5 trillion endpoint-related events per week in real-time. It maintains an index of these events for future use.

“Threat Graph continuously looks for malicious activity by applying graph analytics and artificial intelligence algorithms to the data streamed from endpoints.

“In other words,” says Dan, “CrowdStrike collects data at a massive scale, centrally stores this data and trains its algorithms on this data.

“The more data that gets fed into the Falcon platform, the more intelligent Threat Graph becomes and the more CrowdStrike’s customers benefit.

“As more new customers join the Falcon platform, new sources of data automatically improve the capability and intelligence of Threat Graph.

“CrowdStrike’s powerful network effect is driving blistering revenue growth and high customer renewal rates,” Dan concludes.

But CrowdStrike’s widespread adoption discloses a vulnerability today…

“The incident, so far, appears to only be impacting devices running Windows and not other operating systems,”Wired says.

“The incident, so far, appears to only be impacting devices running Windows and not other operating systems,”Wired says.

Yes, but how many businesses and services rely on Microsoft Windows? (That’s a rhetorical question.)

“Hours after the issues started to emerge, CrowdStrike CEO George Kurtz issued a statement about the outages, saying the company has found a ‘defect’ in an update for Windows that it issued.”

“The issue has been identified, isolated, and a fix has been deployed,” Kurtz says. “This is not a security incident or cyberattack.” Hmm…

“At the same time as the CrowdStrike issues emerged, Microsoft was also dealing with its own, apparently unrelated, outage of its Azure cloud services,” says Wired.

According to a statement from Microsoft:

Starting at approximately 21:56 UTC on 18 Jul 2024, a subset of customers may experience issues with multiple Azure services in the central U.S. region including failures with service management operations and connectivity or availability of services.

Holy jargon!

“[Microsoft] revealed customers in its central U.S. region had been experiencing multiple issues with Azure services and Microsoft 365 apps,” TechRadar translates

In the wake of this cyber CF?

“Banks, airports, TV stations, health care organizations, hotels and countless other businesses are all facing widespread IT outages, leaving flights grounded and causing widespread disruption, after Windows machines have displayed errors worldwide,” Wired recounts.

“Banks, airports, TV stations, health care organizations, hotels and countless other businesses are all facing widespread IT outages, leaving flights grounded and causing widespread disruption, after Windows machines have displayed errors worldwide,” Wired recounts.

Australia was the first to report the BSOD early this morning. “Shortly after, reports of disruptions started flooding in from around the world, including from the U.K., India, Germany, the Netherlands and the U.S.”

Thereafter, United, Delta and American airlines each issued a “global ground stop” on their flights — which was more than a little reminiscent of 9/11.

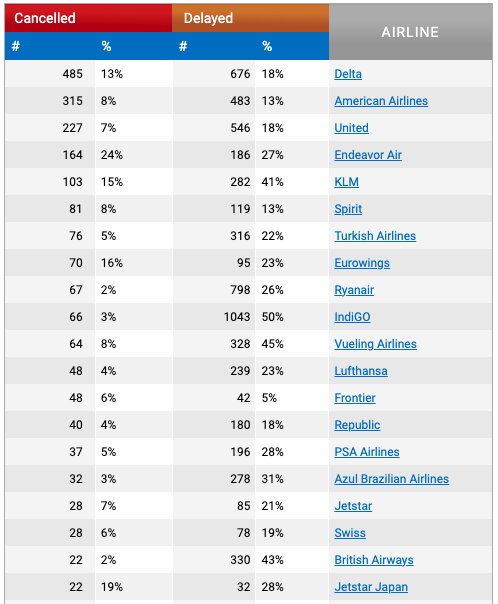

At the time of writing, according to FlightAware, there have been 2,534 flight cancellations today and 25,536 delays.

Courtesy: FlightAware

For whatever reason, waaay down on the list, Southwest has a 0% cancellation rate. (Notwithstanding, over 500 delays.)

Which seems appropriate for the CrowdStrike IT bros (or bro-ettes) who will undoubtedly be left holding the proverbial bag…

Wanna get away?

![]() Red Alert (CRWD and Copper)

Red Alert (CRWD and Copper)

“CRWD stock is taking some punishment following the outage, with shares almost down double-digits so far,” says Paradigm’s pro trader Greg “Gunner” Guenthner.

“CRWD stock is taking some punishment following the outage, with shares almost down double-digits so far,” says Paradigm’s pro trader Greg “Gunner” Guenthner.

“The major averages are red today as planes, trains and entire companies are disrupted by a CRWD update that went awry,” he adds.

Indeed, all the major U.S. indexes are getting hammered today. Down the worst? The Dow’s lost almost 1% market cap, slumping in at 40,280. Meanwhile, the S&P 500 and Nasdaq are both down about 0.6% to 5,500 and 17,730 respectively.

“Today, we’re also seeing a sharp reset in precious metals,” Gunner notes. “Gold is down about 2% to $2,400, while silver is down just under 3%.” In sympathy with precious metals, oil is down almost 3% to $80.41 for a barrel of WTI.

But what’s bad for stocks and commodities is apparently good for crypto. The market’s rallying today with Bitcoin up almost 5% to $66,640 and Ethereum up 2.7%, just under $3,500.

As for the overall state of the market, Gunner wonders: “Is this just some volatility following a big run? Or is a bigger drop afoot? We’ll have to wait and see.”

“The world is suffering from a shortage of copper metal,” says Robert Friedland, founder of Ivanhoe Mines.

“The world is suffering from a shortage of copper metal,” says Robert Friedland, founder of Ivanhoe Mines.

“We see a crisis coming in physical markets and a requirement for much higher prices to enable most of the copper projects that are in development to have a prayer coming in.”

In May, copper posted a record high $5.11 per pound. With the price of copper at $4.23 today, the price falls “woefully short,” Friedland says, of supporting R&D among miners.

“Recent copper mine builds in Chile and Peru, jurisdictions once credited for having among the biggest and cheapest copper mines, have seen costs soar to about $45,000 per tonne… due to inflation, steadily falling grades and dropping output,” says Mining.com.

“BMO Capital Markets and Citigroup analysts said copper prices may rise past the $10,000-per-tonne ($4.54 per pound) mark again in the near term due to a Chinese smelter supply shortage and grid investments in China.” (More on America’s aging grid in a moment.)

Finally, here’s an eye-popping stat: “Humanity would have to mine more copper in the next 20 years than we have in human history to meet surging global demand on the back of the energy transition,” Mining.com concludes.

![]() “Buffering” (Not What You Think)

“Buffering” (Not What You Think)

“Buffered ETFs are designed to capture a large portion of the overall market’s return, while still hedging (or buffering) against a potential pullback in the broad market,” says Paradigm’s income-and-retirement specialist Zach Scheidt.

“Buffered ETFs are designed to capture a large portion of the overall market’s return, while still hedging (or buffering) against a potential pullback in the broad market,” says Paradigm’s income-and-retirement specialist Zach Scheidt.

“These funds usually invest most of their capital in broad indexes like the S&P 500 or Nasdaq-100, and then use a smaller portion to buy futures contracts that protect against downside risk.

“There are a handful of different ways these funds can be set up,” he notes. “But typically the fund’s management team guarantees that the fund will match the returns of the underlying index (like the S&P 500 or Nasdaq-100) up to a certain cap.

“In exchange for giving up some of the upside potential, the fund also guarantees that investors will be protected against a certain portion of the market’s downside for a given period.

“This type of approach can be very helpful in an environment like we have today where the market is still trending higher, but risks are emerging on the horizon,” Zach says.

“Investing in a fund like this can allow you to capture most of the upside the market could give over the next year, while also protecting you in the first stages of a potential bear market.

“One downside of a fund like this is that it charges higher fees and expenses than would typically be present in a more traditional ETF,” he says.

“But in today’s environment, those fees seem reasonable given the ability to offset losses in the event of a market pullback.”

![]() AI Burnout

AI Burnout

The success of large language models like ChatGPT — which launched in 2022 — has supercharged energy consumption.

The success of large language models like ChatGPT — which launched in 2022 — has supercharged energy consumption.

If you’ve been following the 5 Bullets, you know that our antiquated electrical grid — plus the “green” chokehold on fossil fuels — has been a running theme.

Just yesterday, for instance, we touched on the new Silicon Valley in Virginia — the data-center capital of the world. And Dominion Energy’s warning that, barring building out natgas-powered “reliability centers,” residents of the region could expect blackouts.

But now a study from Palo Alto-based research firm EPRI puts AI’s electricity suck into perspective…

“Early [AI] applications were estimated to require about 10 times the electricity — from 0.3 watt-hours for a traditional Google search to 2.9 watt-hours for a ChatGPT query.” [Emphasis mine]

“With 5.3 billion global internet users, widespread adoption of these tools could potentially lead to a step change in power requirements,” EPRI notes.

“On the other hand, history has shown that demand for increased processing has largely been offset by data center efficiency gains.”

That’s all well and good, but can our grid system innovate fast enough? If recent history is any indication, the answer is clearly no.

![]() Mailbag: Flying Cars and Inflation Fantasies

Mailbag: Flying Cars and Inflation Fantasies

“The practical and purchasable current flying car is the PAL-V International Liberty Pioneer Edition,” a new contributor writes, bursting our “flying car” premise about the dearth of real progress.

“The practical and purchasable current flying car is the PAL-V International Liberty Pioneer Edition,” a new contributor writes, bursting our “flying car” premise about the dearth of real progress.

“It is a two-seat twin-engine Rotax 912-powered tri-wheel land vehicle that easily transforms to an autogyro. It's produced in the Netherlands. The sticker price is $600,000 not including taxes and fees.

Courtesy: Pal-V.com

“It fits in my garage thus no hangar fee either. You can fill up at any gas station as it burns gasoline, not requiring low-lead 100 octane aviation fuel. ($12 per gallon in California.)

“It’s part of an ultimate ‘go bag.’”

“An aspect of the slowing of progress in our material well-being and standard of living that you did not address are the hedonic adjustments made to inflation figures,” says a longtime contributor — also responding to our flying car issue

“An aspect of the slowing of progress in our material well-being and standard of living that you did not address are the hedonic adjustments made to inflation figures,” says a longtime contributor — also responding to our flying car issue

“As things have gotten better, cheaper and faster, these improvements have been counted as deflationary, and have been used to reduce the official inflation rate. Thus, while we have been told that inflation has been very low for the last 30-plus years, hedonic adjustments show that our overall standard of living has not improved.

“One example: A new car cost a typical worker about four months salary in 1970, whereas a new car now costs a typical worker closer to eight–12 months salary, but we are told that this is not inflation; rather, a new car today is so much better than a new car then.

“The cars are better today, yes, but inflationary wage erosion is still in play.”

Emily responds: To see just how eroded, compare the average American’s personal income today, $63,795, to the cost of a flying car! (See above.)

We’re giving the last word today to a new reader: “Please continue the 5 Bullets,” he writes. “Love your take on many subjects, and it’s a welcome part of my daily reading.”

On that note, we’ll be back at it Monday. Take care!