NVDA: Sell Now or Hold?

![]() Watch out for That Rotation!

Watch out for That Rotation!

“Please kindly tell me if I should sell NVDA now or hold?” says a recent reader inquiry.

“Please kindly tell me if I should sell NVDA now or hold?” says a recent reader inquiry.

We mentioned it a month ago: James Altucher and his team urged their Altucher’s Investment Network readers to sell half their position in Nvidia. That was good for a 183% gain in a little over nine months.

As many of the Paradigm editors do, James will often advise readers to sell half their position once they’ve garnered a 100% gain.

In the unlikely event the other half of the position goes to zero, you still break even. But as a practical matter, once you sell half for 100%, you’re “playing with house money.”

From the vantage point of one month after that recommendation, it looks wise: NVDA is down 6.9% amid a lot of sideways chop. Nothing goes up in a straight line.

Even the most wildly optimistic forecasts of NVDA’s future performance don’t hold a candle to its stellar past.

Even the most wildly optimistic forecasts of NVDA’s future performance don’t hold a candle to its stellar past.

As we mentioned last month, a $100 investment in NVDA 25 years ago would be worth over $300,000. And a $100 investment in NVDA five years ago would be worth nearly $3,000 now.

A few days ago, James Anderson — an early investor in Tesla and Amazon — projected that over the next decade, Nvidia would become a $50 trillion company.

Given that its market cap hovers around $3 trillion right now, a $100 investment would become $1,667. Nice if it pans out — but even if it does, that pales in comparison with NVDA’s performance up to now.

Even the mainstream is starting to wake up to the “rotation” out of NVDA and other high-flying tech stocks and into other sectors.

Even the mainstream is starting to wake up to the “rotation” out of NVDA and other high-flying tech stocks and into other sectors.

From yesterday’s Wall Street Journal: “The Russell 2000 index of smaller stocks beat the S&P 500 over the seven days through last Wednesday by the largest margin during a period of that length in data going back to 1986, according to Dow Jones Market Data.”

Which sounds attractive, right? Plunk some money into IWM, the Russell 2000 ETF, and let it ride for a few weeks.

But be careful: As at least two Paradigm editors are keen to point out, the Russell is packed with problematic sectors — starting with the regional banks, which are still vulnerable to the crash in commercial real estate (specifically, office space).

![]() Welcome to Myanmar

Welcome to Myanmar

So this must be what it’s like to be an investor in a developing country.

So this must be what it’s like to be an investor in a developing country.

“Investors Seem to Want Uncertainty,” says a Yahoo Finance headline — suggesting Mr. Market is unfazed by the dizzying political headlines of the last four weeks, the major stock averages still within spitting distance of all-time highs.

“If it happened in Belarus, Burundi or Myanmar, Joe Biden’s blitzkrieg withdrawal from the presidential race would have inspired eye rolls,” writes the independent journalist Matt Taibbi. “We jettisoned an incumbent president’s re-election campaign with all the pomp of an NFL practice squad transition, announcing the move via a blip of a social media post.”

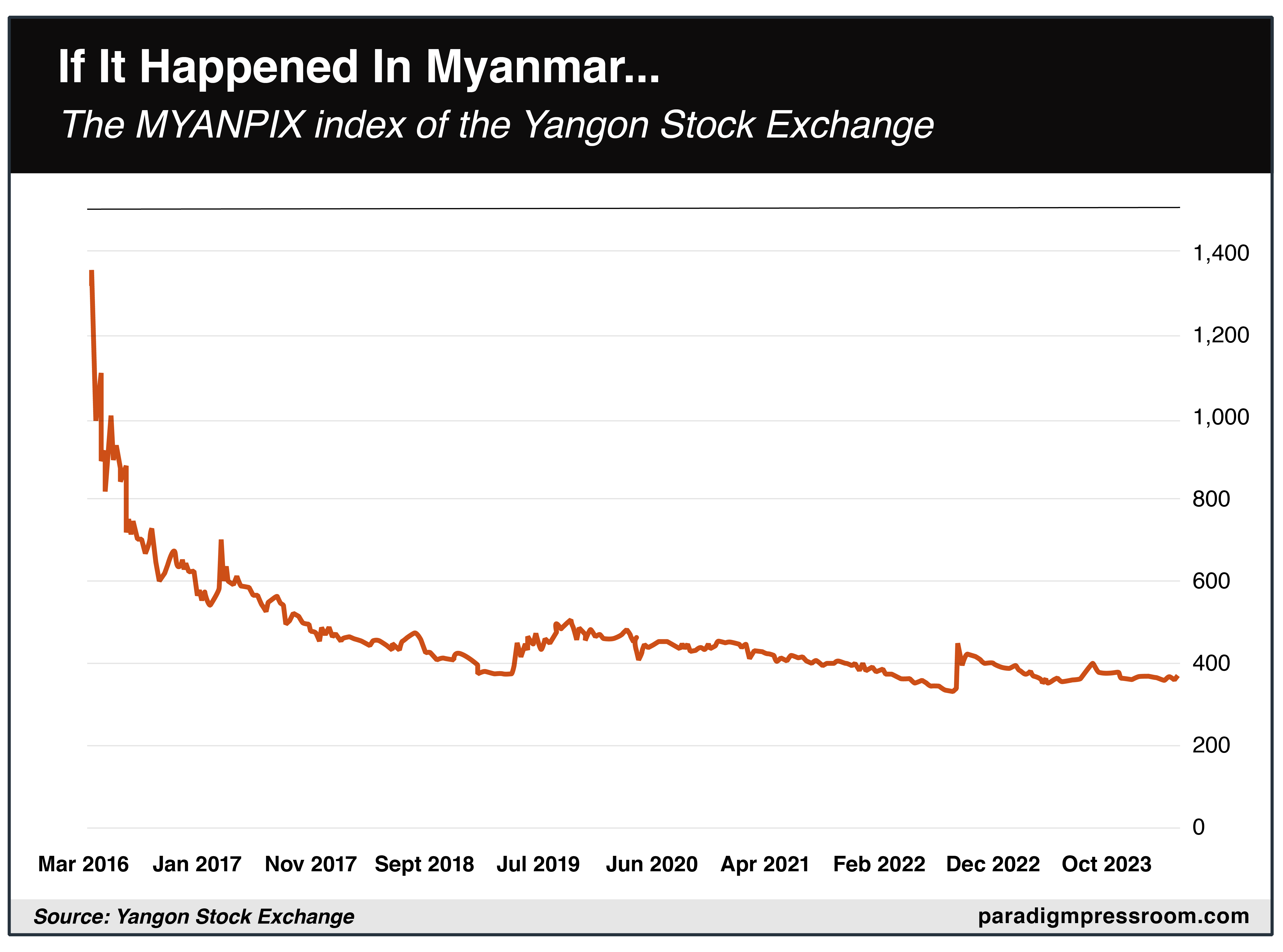

Did he say Myanmar? As it happens, I remember former colleague Chris Mayer venturing to Myanmar (formerly Burma) in search of investment opportunities way back in 2012 — even before the Yangon Stock Exchange opened in 2015.

The ensuing decade was eventful to say the least. A military junta gave way to a partial democracy led by the once-imprisoned dissident Aung San Suu Kyi. Then in 2021 she was deposed in a coup — arrested and thrown back in prison. A civil war has raged since.

Throughout, the Yangon Stock Exchange keeps on keepin’ on.

No, the chart of the exchange’s MYANPIX index is nothing to write home about. It came out of the gate way too hot — but by the same token there’ve been no catastrophic downdrafts since 2017.

Impressive when you consider only eight companies are listed on the exchange! A savvy stock-picker could have made bank with good research and well-timed entries and exits. If the Burmese can get by, why not us?

Anyway, Joe Biden is supposedly on his way from Delaware back to the White House as we write. Tomorrow night he’s supposedly going on TV to finally tell the American public in his own voice why he’s giving up his run for re-election. But before that he’ll meet with Israel’s Prime Minister Benjamin Netanyahu. Priorities.

With that as the backdrop, most of the market action today is like watching paint dry: The S&P 500 is up a quarter percent at 5,579.

With that as the backdrop, most of the market action today is like watching paint dry: The S&P 500 is up a quarter percent at 5,579.

Gold has inched back above $2,400, silver likewise over $29 again. Bitcoin’s breakout over $68,000 had no staying power; at last check it’s trading at $66,645.

The lone economic number of the day shows a housing market still frozen in formaldehyde: Existing home sales fell 5.4% from May to June, more than even the most pessimistic guess among dozens of Wall Street economists. The year-over-year drop is also 5.4%. The median price of an existing home is $426,900, up 4.1% from a year ago.

![]() Mideast War Expands, Oil Traders Yawn

Mideast War Expands, Oil Traders Yawn

The real market excitement is in crude — down over 2% to $76.79, a six-week low — despite a massive escalation in the proberial geopolitical tensions.

The real market excitement is in crude — down over 2% to $76.79, a six-week low — despite a massive escalation in the proberial geopolitical tensions.

As mentioned in passing yesterday, Israel is now in direct conflict with the Houthi faction that effectively rules Yemen.

For months the Houthis have been harassing Israeli-, U.S.- and U.K.-linked merchant ships transiting the Red Sea — an act of solidarity with Palestinians under Israeli attack in Gaza.

Result: Ships that used to use the Suez Canal to get from Asia to Europe and vice versa are now taking the long way around the Horn of Africa.

The Houthis have been extremely effective with drone warfare targeting shipping. They were less effective targeting Israel itself — until a drone strike on Tel Aviv a few days ago.

Israel hit back, hard, with airstrikes that hit oil terminals and ports in the city of Hodeida — infrastructure necessary to supply a civilian population devastated after a seven-year war waged by Saudi Arabia with Washington’s help.

“The Israeli strikes in Yemen will make it harder for the Biden administration to pretend that Houthi attacks on Red Sea commercial shipping have nothing to do with the war in Gaza,” writes Daniel Larison at the Responsible Statecraft website. “The administration wants to keep these conflicts in separate boxes to maintain the illusion that it has prevented the war in Gaza from destabilizing the region, but they are all obviously connected.”

For the moment, oil traders are unconcerned. But we’d be remiss not to put this development on your radar…

![]() Update: The Russian Yachts

Update: The Russian Yachts

Oy, again with the Russian yachts…

Oy, again with the Russian yachts…

Let’s briefly rewind: At the outset of the Russia-Ukraine war, the yachts of Russian oligarchs were perhaps the most visible and symbolic manifestations of Vladimir Putin’s perfidy — the ill-gotten gains of all his rich cronies. Seizing them was an easy PR win for Western governments to placate the woke hordes on Twitter.

But because it’s governments we’re talking about, no one bothered to ask, “And then what?”

Every few months since late 2022, a mainstream media article pops up with the exact same theme — aw, gee, those yacht seizures aren’t having the desired effect and Western taxpayers have to fork over for the upkeep.

The latest entry comes from the Financial Times — telling the story of the 192-foot yacht Phi, seized in London’s Canary Wharf five weeks after Russia’s invasion.

“Its once-feted ‘infinite wine cellar’ and seven-meter swimming pool lie unused. A lonely sun lounger sits out on deck, and the yacht’s Maltese maritime flag droops. Pink paint has been applied to its roof to protect it from the risk of dust from nearby building sites.”

There’s nothing really new about the FT’s story. It’s one more admission that “for Western governments, resolving the fate of these superyachts will be a high-stakes test of the effectiveness of economic sanctions.”

Memo to the FT and everyone else: The sanctions have already flunked the test. Russia’s economic growth is outstripping America’s. Russia continues to export oil and gas — just to different customers. And through the BRICS grouping of countries, Russia is forging an alternative economic bloc that’s attractive to much of the Global South.

But because it’s governments we’re talking about, the most likely response by the West is to double down.

![]() Mailbag: Co-President Obama?

Mailbag: Co-President Obama?

We got an earful from readers after yesterday’s edition contemplating a “co-presidency” comprising President Kamala Harris and Vice President Barack Obama.

We got an earful from readers after yesterday’s edition contemplating a “co-presidency” comprising President Kamala Harris and Vice President Barack Obama.

“I understand Jim Rickards' reasoning about the 22nd Amendment allowing Obama to be elected VP, but what about the 12th Amendment?: ‘No person constitutionally ineligible to the office of President shall be eligible to that of Vice-President of the United States.’ If he's ineligible to the office of president, doesn't that mean he's also ineligible to be VP?

“(And anyway, he'd probably prefer the whole dictate-from-the-basement-via-earpiece gig over the spotlight duties of VP.)

“Thanks for any clarity you can provide!”

Another reader is more pithy: “Please read the last line of the 12th Amendment for the Constitution's answer.”

“VP Obama on a Harris ticket can’t happen,” asserts a third.

Dave responds: It’s not quite that simple — at least to hear the mainstream tell it.

“Constitutional scholars disagree,” says USA Today — which dug up some relevant commentary from years past.

Back in 2000 there was chatter about the sitting president, Bill Clinton, being Al Gore’s running mate — the two swapping positions, essentially.

“The 12th Amendment would allow a Clinton vice presidency,” argued Cornell law prof Michael Dorf in a FindLaw column. “Its language only bars from the vice presidency those persons who are ‘ineligible to the office’ of president. Clinton is not ineligible to the office of president, however. He is only disqualified (by the 22nd Amendment) from being elected to that office.”

Not so, said George Washington University’s Gary Nordlinger in 2016. “If anyone tried this,” he told Washington’s CBS affiliate, “it would for sure end up at the Supreme Court. Because that’s who decides conflicts within the Constitution.”

Perhaps that’s why, if the Financial Times is to be believed, Harris is already zeroing in on three running mates not named Obama — all of them either governors or senators from swing states.

We’ll leave it there today. We’ll also sidestep the Article II question of whether Kamala Harris is a “natural born Citizen” as the term was understood in the 1780s. Heh…

“Full disclosure, I'm 58 and have been reading and listening to investment and political ‘soothsayers’ for literally decades,” a reader writes. “Jim Rickards has some political biases that I feel creep into his writing. I am not judging these biases, just observing.

“Full disclosure, I'm 58 and have been reading and listening to investment and political ‘soothsayers’ for literally decades,” a reader writes. “Jim Rickards has some political biases that I feel creep into his writing. I am not judging these biases, just observing.

“While Mr. Rickards may have his biases, his analysis is impeccable. I can think of no economist, political observer or social scientist who has the amount of on-the-record, on-the-nose predictions that Mr. Rickards has. He predicted Trump's presidential victory (when no one else was) and now nailing Biden's stepping down from the race.

“There are a number of other notable prognostications but my memory and disposition to review your archives limit me from naming all of them (but I'm hoping you'll air some more).

“Some may take issue with Jim's political views but you eschew his analysis at your peril.”

Dave: Jim called Trump in 2016 and Brexit a few months earlier — the twin earthquakes that shook the establishment on both sides of the Atlantic.

As I said a few days ago, Jim has characterized himself in the past as “ultra-MAGA,” but he takes care not to let his biases get in the way of formulating an objective and detached forecast. Not much more that a financial publishing firm can ask of an editor…