“Big Boy” Bitcoin

![]() A Bitcoin Halving Like No Other

A Bitcoin Halving Like No Other

Gee, what was it that Paradigm crypto evangelist James Altucher was saying here just yesterday about institutional adoption of Bitcoin?

Gee, what was it that Paradigm crypto evangelist James Altucher was saying here just yesterday about institutional adoption of Bitcoin?

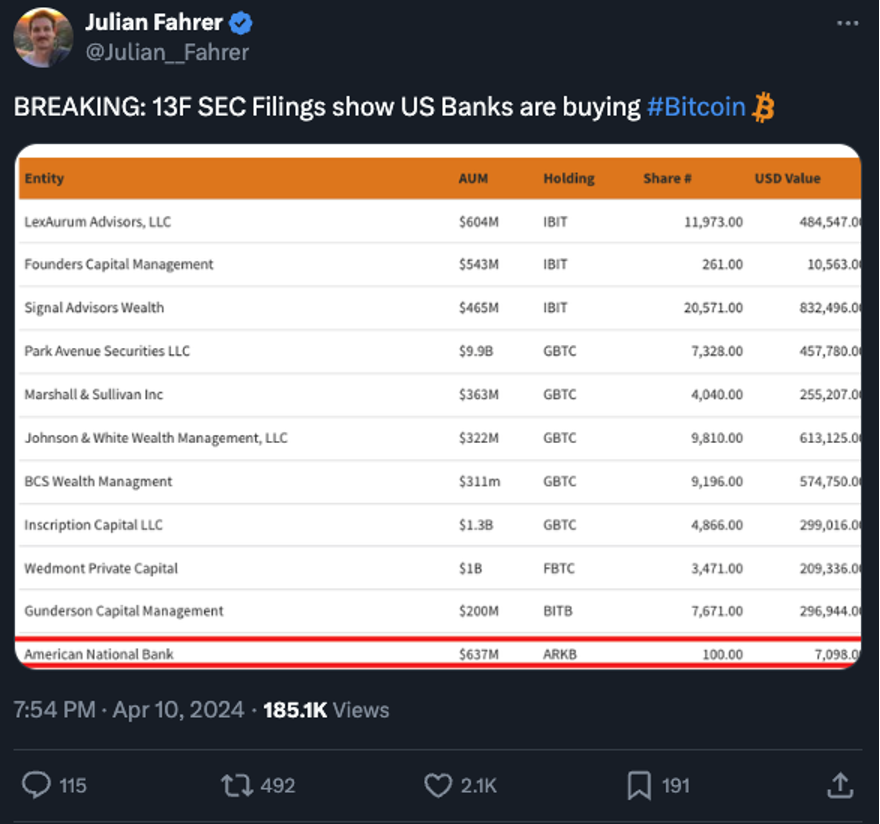

OK, the tweet overstates the case. On this list of institutional investors with a Bitcoin stake, there’s one bank buying Bitcoin via one of the new Bitcoin ETFs.

But… there are 10 hedge funds and private equity outfits — a couple of them with more than $1 billion in assets under management — that have substantial sums invested in a Bitcoin ETF.

This is the exact phenomenon our VP of publishing Doug Hill described yesterday in a dispatch for readers of Altucher’s Investment Network: “For the first time ever, institutional players and sovereign wealth funds with very deep pockets can buy Bitcoin through ETFs.”

Sure, they could have previously bought Bitcoin on an exchange. But for big institutional players, that’s easier said than done — not least because it’s still a regulatory gray area.

Or they could have bought an ETF linked to Bitcoin futures — but that’s not the same thing as an ETF linked to actual Bitcoin.

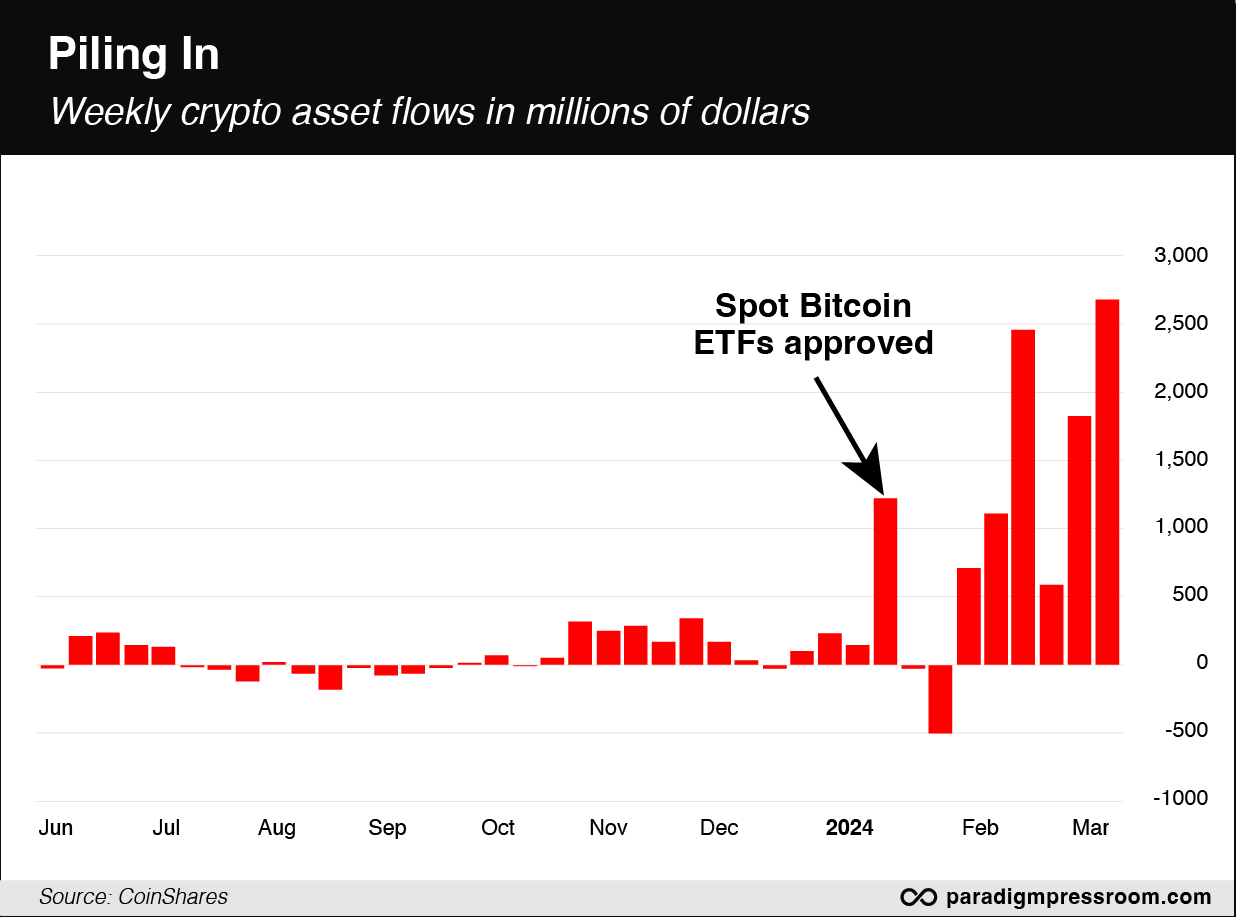

Only after federal approval of a “spot” Bitcoin ETF on Jan. 10 — an event James Altucher predicted to the day, by the way — did the floodgates open.

Only after federal approval of a “spot” Bitcoin ETF on Jan. 10 — an event James Altucher predicted to the day, by the way — did the floodgates open.

After a huge rush the first week, and a couple weeks’ hesitation after that… the momentum has been unstoppable.

But here’s the thing: According to Doug’s research, this huge flow into Bitcoin ETFs — $2.6 billion last week alone — has come mostly from retail investors.

So the inevitable surge in demand from institutional investors is still to come. “The big money will come from endowments, pension funds, mutual funds, hedge funds, sovereign wealth funds… and other wealth management businesses.”

No wonder that the impending Bitcoin “halving” — on or around the 20th of this month — will be unlike the three previous ones.

No wonder that the impending Bitcoin “halving” — on or around the 20th of this month — will be unlike the three previous ones.

As a reminder, every time Bitcoin goes through a halving, Bitcoin miners can generate only half as much Bitcoin for the same amount of effort. That keeps a strict cap on supply.

The most recent halving turned every $1,000 invested into $7,000 in less than 12 months.

But now? With supply capped again at the very time that institutional investors will be clamoring for Bitcoin via the new ETFs?

James Altucher’s conservative forecast is that Bitcoin will double to $140,000 by year-end.

And if you want to play it safe, you can certainly go the Bitcoin ETF route and make out very well for yourself.

But as I said yesterday, every Bitcoin halving has a halo effect on a handful of “alt coins” that can explode 100x.

This coming Sunday at 7:00 p.m. EDT, James will convene a webcast where he’ll discuss six micro coins with that very potential. One of them he’ll name for free.

“You might never see an explosive opportunity like this ever again,” says James. Even the next halving, sometime in 2028, won’t be like this.

So you’ll want to make a point of carving out the time to see what James has to say. We do ask that you register in advance. Fortunately, registration is as simple as clicking on this link.

![]() Rising Oil = Rising Inflation Rate

Rising Oil = Rising Inflation Rate

Not only is the inflation rate proving “stickier” than Wall Street was counting on — there’s worse to come.

Not only is the inflation rate proving “stickier” than Wall Street was counting on — there’s worse to come.

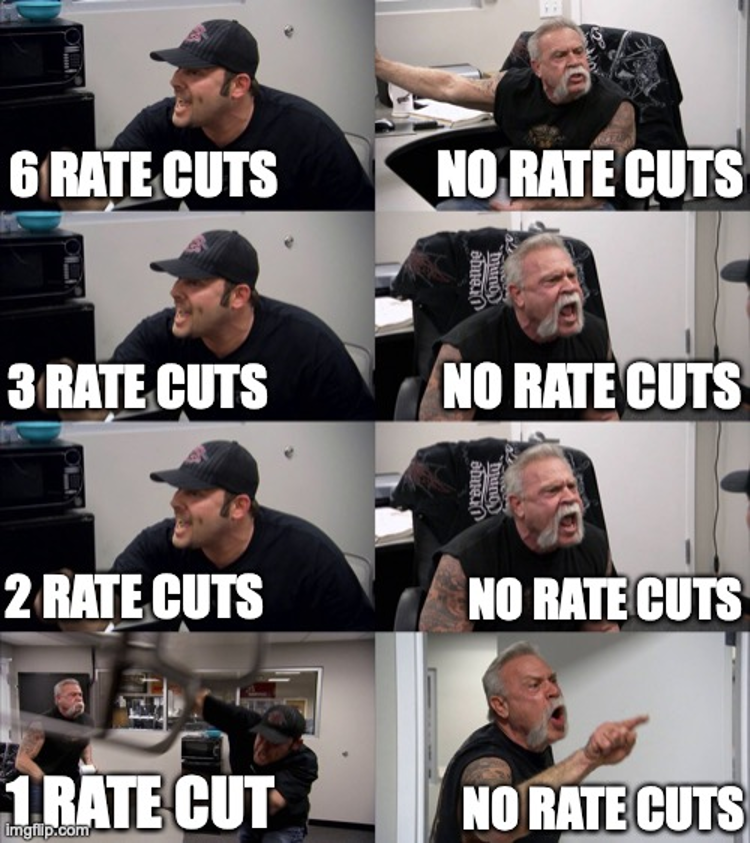

As we mentioned yesterday, the consumer price index rose 3.5% year-over-year in February. It’s been stuck over 3% for the last 10 months — well above the Federal Reserve’s 2% target. And so Wall Street is slowly abandoning its hopes for an aggressive “pivot” to interest rate cuts by the Fed.

But consider this: The price of oil has rallied nearly 25% in the last four months — from $68.50 in mid-December to over $85 today.

“That oil price shock has not worked its way through the supply chain yet,” Paradigm macro maven Jim Rickards warned his Situation Report readers yesterday.

“That oil price shock has not worked its way through the supply chain yet,” Paradigm macro maven Jim Rickards warned his Situation Report readers yesterday.

“It has resulted in some price increases, but more are in the pipeline. This oil price spike will keep inflation at current levels or higher in the months ahead. The Fed is looking for signs that inflation is coming down but they’re not going to get them.”

The national average price for a gallon of regular unleaded gasoline is $3.63 today — up 6 cents from a week ago, 23 cents from a month ago and 3 cents from a year ago.

“That gas price rise is not over,” says Jim, “because the wholesale price of oil is still on the rise. And oil prices affect far more than the price of gas at the pump. Higher oil prices mean higher transportation costs whether by truck, train, plane or ship since all goods have to be transported to market. That means the price of everything is going up.”

At this stage, the betting in the futures markets is that even after the next three Fed meetings, there’s a better than 50-50 probability that the fed funds rate will still be at the current 5.5%.

That means the first rate cut wouldn’t come until September — when it would look like an obvious ploy to goose the economy and help Joe Biden’s reelection bid.

Could get interesting…

In the meantime, the major U.S. stock indexes are treading water after the drubbing they took after the release of the inflation numbers yesterday.

In the meantime, the major U.S. stock indexes are treading water after the drubbing they took after the release of the inflation numbers yesterday.

The Nasdaq is up a third of a percent while the Dow is down a little over half a percent. The S&P 500 is down slightly to 5,152 — about 2% below its record close two weeks ago today.

Also treading water are the precious metals — gold at $2,337 and silver at $27.80. Crude hovers above $85. Bitcoin is a hair under $70,000.

The Commerce Department issued its wholesale inflation numbers this morning, and those came in a little cooler than expected. But the “core” rate excluding food and energy rang in more than expected. And as Jim Rickards just reminded us, the price of energy goes into the price of everything.

![]() How’s That Russian Oil Price Cap Working Out?

How’s That Russian Oil Price Cap Working Out?

Aw gee, say it ain’t so…

Aw gee, say it ain’t so…

“Russian oil is trading far in excess of a Group of Seven price cap that’s supposed to deprive Moscow of revenue for its war in Ukraine,” Bloomberg reports — “suggesting significant non-compliance with the measure.”

Well, we said from the get-go in late 2022 that the G7 nations’ scheme to cap Russian oil at $60 a barrel was harebrained. But please, Bloomberg, go on…

“The country’s flagship Urals grade is fetching about $75 a barrel at the point it leaves ports in the Baltic Sea and Black Sea, according to data from Argus Media, whose price assessments are followed by some G-7 nations involved in the cap. U.S. officials are tracking the price increase, which they attribute to broader geopolitical dynamics, according to a senior Treasury official.”

By last spring, we took note when Bloomberg reported that a “ghost fleet” of tanker ships with murky ownership was ferrying Russian crude to willing buyers, often turning off their GPS trackers while en route.

By last summer, the Financial Times acknowledged that some buyers were obeying the price cap but paying outrageous shipping costs to effectively make up the difference between the capped price and the market price.

By last fall, the FT reported that many buyers of Russian crude were forgoing Western insurance coverage.

So this story is just the latest in a long line of stories from the corporate media acknowledging that the price cap is a miserable failure. But according to this latest Bloomberg story, “the U.S. official said that cap is still having its intended effect.”

OK, whatever they want to tell themselves to feel better. But the reality, as Jim Rickards wrote his Strategic Intelligence readers last month, is that “the ruble is stable and only slightly lower against the dollar than it was in February 2022; this mostly due to weaker global demand for oil than any sanctions. The Russian economy is growing faster than the U.S. economy with only moderate inflation.”

![]() Costco’s Gold Bars: Lots of Revenue, Little Profit

Costco’s Gold Bars: Lots of Revenue, Little Profit

For the record: Costco’s revenue from selling 1-ounce gold bars might run as high as $200 million a month.

For the record: Costco’s revenue from selling 1-ounce gold bars might run as high as $200 million a month.

That’s according to a research note from Wells Fargo: “Our work suggests there has been significant interest given COST’s aggressive pricing and high level of customer trust.”

We perked up last fall as soon as Costco management mentioned the gold bars during their quarterly conference call with Wall Street analysts: “When we load them on the site,” said CFO Richard Galanti, “they’re typically gone within a few hours, and we limit two per member.”

That limit is up to five now. But new inventory continues to get cleaned out in a matter of hours, thanks in part to Reddit users who evidently hit the refresh button on their browsers several times a day to see if the bars are back in stock.

But as impressive as the revenue numbers are, the profit is slim to nonexistent: The premium over the spot price is usually about 2%, razor-thin by industry standards. And that’s before the 2% cash-back for “executive” members and an additional 2% cash-back for users of Citi’s Costco-branded credit card.

Gold bars and $5 rotisserie chickens as loss-leaders — whoda thunk it?

![]() Memecoin Mailbag

Memecoin Mailbag

On the subject of whether we should offer a premium trading advisory geared toward memecoins, not everyone among our readership is opposed…

On the subject of whether we should offer a premium trading advisory geared toward memecoins, not everyone among our readership is opposed…

“Paradigm offers many services to cater to different types of investors, whether it be blue chip dividend stocks, small-cap biotechs, options, crypto and more. If a subscriber has no interest in investing in meme coins or any other type of service, they are free to ignore it whether they have the subscription or not.

“It is just like when you recommend a stock such as Philip Morris or Raytheon (whose products or services can and do kill people); people are free to ignore stocks of companies they fundamentally disagree with. A meme coin service should be no different.

“Don't remove the opportunity due to a small minority of vocal people. Besides, we all know many of those same people will be rushing to subscribe once you mention the success of a few of the trades…”

Dave responds: Well said. You grok what this crazy newsletter biz is all about.

We haven’t ruled anything in or out — and you’ve made a compelling case in the affirmative!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets