Caveat MEME-Tor

![]() Caveat MEME-Tor

Caveat MEME-Tor

“Following a three-year hiatus, ‘Roaring Kitty’ suddenly reappeared on Twitter/X late Sunday,” recounts Paradigm’s trading expert Greg “Gunner” Guenthner.

“Following a three-year hiatus, ‘Roaring Kitty’ suddenly reappeared on Twitter/X late Sunday,” recounts Paradigm’s trading expert Greg “Gunner” Guenthner.

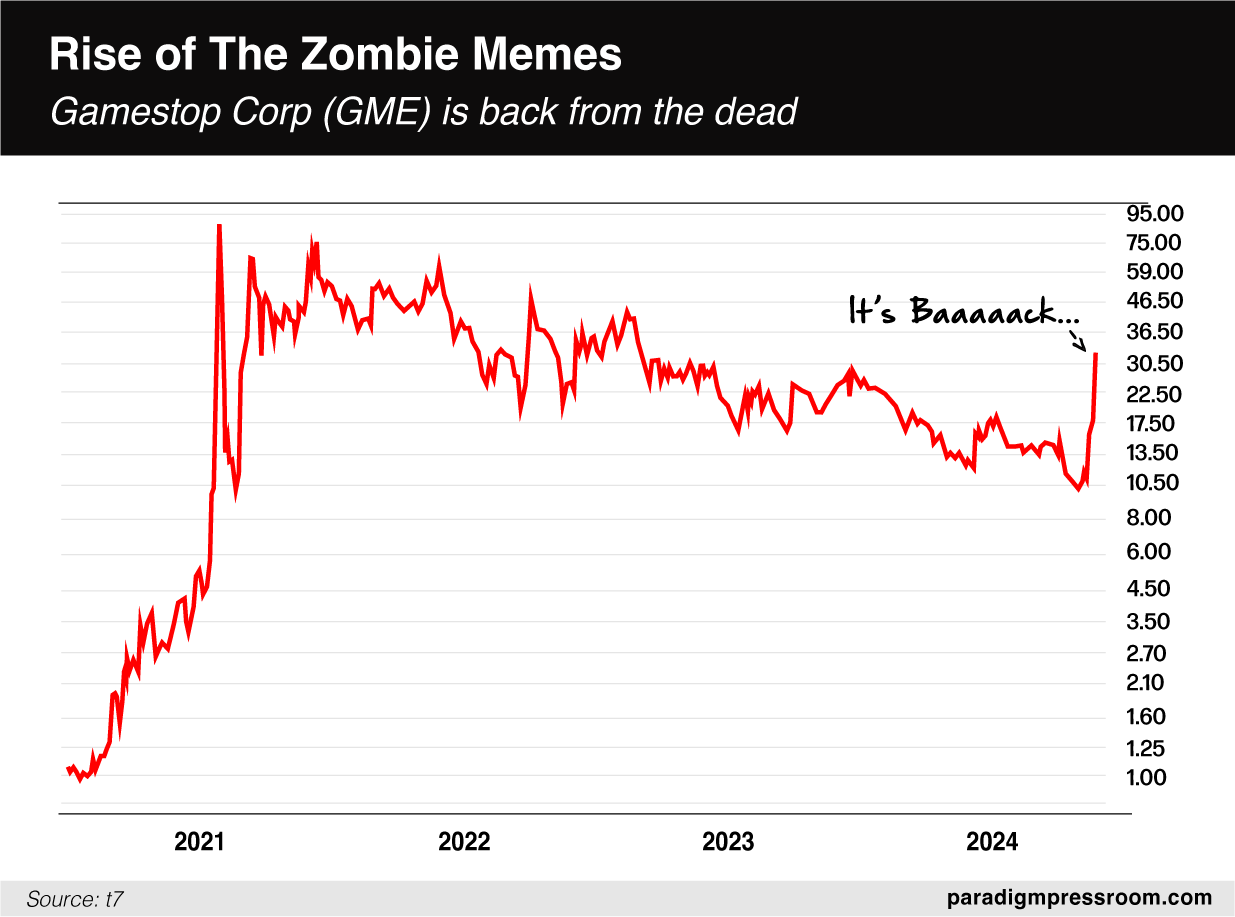

In case the pandemic era is little more than a fever dream, Keith Gill (aka Roaring Kitty) gained traction on YouTube and on Reddit’s WallStreetBets where he developed quite the following.

So much so, that in 2021 Congress accused the then 30-something of being a GameStop-frenzy ringleader…

“I am not a cat,” Gill clarified for Congress

According to Mr. Gill’s written testimony: “The idea that I used social media to promote GameStop stock to unwitting investors and influence the market is preposterous. My posts did not cause the movement of billions of dollars into GameStop shares,” he said.

Gunner disagrees: “The infamous trader made a killing by starting the grassroots short-squeeze movement that gave birth to some of the wildest runs in stock market history.”

Then, on Sunday evening? “He sparked another run on his beloved GameStop Corp. (GME)

“GME exploded higher in 24-hour trading on Robinhood,” notes Gunner. “The stock promptly doubled Monday morning before getting hit with a midmorning volatility halt. When the dust finally settled, GME closed with a gain of 75% on the day.” (This morning? GME shares have pulled back 18.5%)

“GME exploded higher in 24-hour trading on Robinhood,” notes Gunner. “The stock promptly doubled Monday morning before getting hit with a midmorning volatility halt. When the dust finally settled, GME closed with a gain of 75% on the day.” (This morning? GME shares have pulled back 18.5%)

“The Kitty didn’t post anything of substance to spark this furious rally — just a quick meme that made no mention of GME by name. But anyone who was even remotely in tune with the underbelly of the meme market knew exactly what he meant.

“For starters, GME shares were already on the move last week,” says Gunner. “The stock jumped 70% in just three trading days leading up to this week’s explosive move. The fuse was lit — and Roaring Kitty pounced, inspiring an army of speculators to follow his lead…

“Some of the other also-ran meme names were moving, but GME got most of the attention.

“If you asked me late last year if GME would ever post runs like we saw during the COVID bubble ever again, I would have called you crazy. Yet here we are… the irrational (even psychotic) speculator is back at it once again.

“It can be nearly impossible to maintain sanity and objectivity as these short squeezes unfold,” Gunner says.

“It can be nearly impossible to maintain sanity and objectivity as these short squeezes unfold,” Gunner says.

“Imagine practicing sound trading techniques for years, only to watch some kid with a Robinhood account book a six-figure gain YOLO-ing out-of-the-money weeklies. It’s enough to drive a trader completely nuts.

“One of the main mistakes I see when I venture onto the message boards is inexperienced traders putting way too much money into a single play — almost as a ‘get rich or go broke trying’ strategy,” Gunner adds.

“But when you’re dealing with these extreme stock moves, you don’t have to risk a ton of capital to get involved and put up some impressive gains. Why bet the farm on what amounts to a spin of the roulette wheel?

“I’m not sure that any ‘advice’ is useful when it comes to meme trades. But if you are going to venture into these shark-infested waters, try not to get sucked into the hype. These are not long-term investments. Don’t sweat perfect entries. Take what you can get with tiny positions.

“And pack your bags early,” Gunner concludes. “When that last plane takes off, you don’t want to be left standing on the runway.”

Unlike the volatility associated with meme stocks, Gunner's trading strategy offers a smoother ride to profitability. For instance, using his proven strategy, Gunner turned a modest $40,000 portfolio into an impressive $266,894 in only 48 months.

The best part? No prior trading experience is required. Gunner will guide you through every step, empowering you to replicate his success. Follow this link to unlock a sustainable way to trade.

![]() Gold and “Great” Inflation

Gold and “Great” Inflation

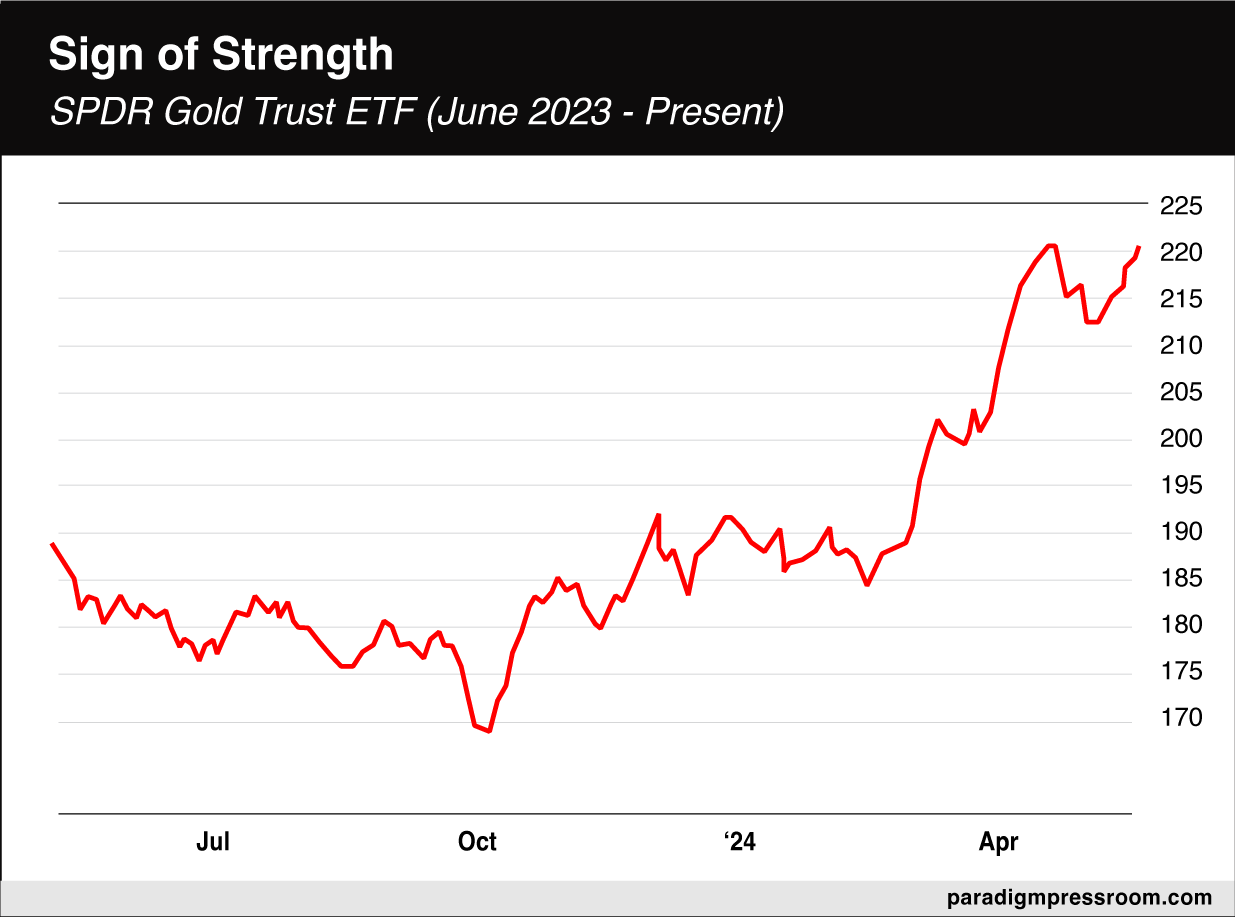

“After years of stubborn readings that remain above the Fed’s 2% target, gold is finally catching up to past inflation levels,” says our income-investing ace Zach Scheidt.

“After years of stubborn readings that remain above the Fed’s 2% target, gold is finally catching up to past inflation levels,” says our income-investing ace Zach Scheidt.

“And after years of consolidation, the yellow metal has plenty of room to run before becoming overvalued compared with the past few years of inflation data.

“Also, professional investors continue to be a big source of demand,” he says, “as their high-net-worth customers request more exposure from their advisers.

“Here’s a quick look at the price action for the SPDR Gold Trust (GLD), which tracks the price for spot gold. And GLD’s recent pullback didn’t even touch the fund’s 50-day moving average before starting its rebound…

“This is a sign of strong demand for gold and should lead to much higher prices over the next several weeks,” Zach says.

“After breaking multiyear resistance levels, the price of gold is now free to appreciate,” he says. “Given the significance of the long-term breakout and the momentum we’re seeing in the market right now, I expect gold to continue its strong run.”

On Thursday, Walmart beat earnings expectations, citing particularly strong performance from its online and grocery businesses. The bellwether retailer says it’s attracting wealthier shoppers looking for bargains.

On Thursday, Walmart beat earnings expectations, citing particularly strong performance from its online and grocery businesses. The bellwether retailer says it’s attracting wealthier shoppers looking for bargains.

As for the three major U.S. stock indexes, they’re all in the green today, with the Dow leading the way, up 20% and just shy of 40,000. (To give you some perspective, as of today, I’ve been working at The 5 for seven years. When I first started, all the talk was about Dow 25,000.) Meanwhile, the S&P 500 and Nasdaq are both up about 10% to 5,315 and 17,760 respectively.

Most commodities are also hanging out in positive territory. The price of crude is up 0.70% to $79.16 for a barrel of WTI. Gold, however, has pulled back 0.35% to $2,386 per ounce. But silver? The precious metal is up 0.60%, just a hair below $30. Wow.

Checking briefly on crypto, Bitcoin is down 1% to $65,300. And Ethereum’s lost 2%, about $50 under $3,000.

We also have a few noteworthy economic numbers to report today:

- Mid-Atlantic manufacturing: The closely watched Philly Fed index came in at 4.5 for the month of May — a steep decline from April’s 15.5. Still, any reading above zero indicates expansion in the region; it’s the sixth-straight month in positive territory

- Industrial production: April’s headline reading was flat from the month before, and slightly less than economists expected. All told, 78.4% of America’s industrial capacity was in use during April, still stuck below the 50-year average of 79.7%.

Finally, housing starts were 5.7% higher in April over March, but housing permits were down 3% over the same time period.

![]() Nuclear Industry: It’s All Political

Nuclear Industry: It’s All Political

“Nuclear power [has] been stifled for decades based on one deeply flawed scientific model: the linear no-threshold (LNT) model,” says an article at Reason.

“Nuclear power [has] been stifled for decades based on one deeply flawed scientific model: the linear no-threshold (LNT) model,” says an article at Reason.

The LNT model can be traced to the work of geneticist Hermann Muller. In the 1920s and 1930s, Muller's research on fruit flies suggested that radiation exposure causes genetic mutations — which can be passed down to offspring — and he claimed that there is no safe level of radiation that does not carry this risk.

There is evidence, however, that Muller omitted key information from his research. “Human studies of the offspring of Japanese atomic bomb survivors found no significant evidence of genetic damage,” Reason says.

“Muller helped convince the National Academy of Sciences (NAS) to exclude this inconvenient data when it convened an expert panel to assess fallout risks, opting instead to rely on his research using fruit flies and newer studies involving mice.”

Later, NAS “panelists openly strategized about how conclusions from their report could increase funding for their research,” says Reason.

“This conflict of interest resulted in a biased final report that exaggerated health risks from fallout and omitted lower estimates to create a false veneer of consensus.”

All of which “catalyzed a major shift in government policy toward reliance on LNT for radiation regulations and risk assessment,” Reason continues. And any research that contradicted the LNT model was ordinarily suppressed.

All of which “catalyzed a major shift in government policy toward reliance on LNT for radiation regulations and risk assessment,” Reason continues. And any research that contradicted the LNT model was ordinarily suppressed.

When, for example, geneticists William and Liane Russell discovered the body’s DNA repair mechanisms in the late 1950s, the NAS first attempted to “bury” the research.

“Only after several members protested — including, to his credit, Herman Muller — was the information added,” Reason says. “Yet the committee still endorsed LNT.

“More recently, the debate over LNT reignited within the Health Physics Society following the launch of a video series in April 2022 that detailed the checkered history of LNT.”

Through Freedom of Information Act requests, a series of emails came to light which reveal a concerted attempt to undermine the credibility of the video series and suppress further discussion.

Reason concludes: “The sordid history of LNT is a cautionary tale of how flawed science, ideological bias and political motives can distort the search for truth.

“LNT shapes onerous radiation regulations that dictate [radiation] risk, leading to exaggerated fears, higher energy costs, and perennially thwarted progress in the nuclear industry.”

![]() Good as Gold

Good as Gold

Chocolate chip cookies… with a side of gold bullion? Yes, please!

Chocolate chip cookies… with a side of gold bullion? Yes, please!

Austin-based cookie delivery company Tiff's Treats is really diversifying…

Courtesy: Tiff’s Treats

Why pay $21 for a dozen cookies to be delivered to your loved one when you can send cookies plus a 1-ounce gold bar? (Sorta.)

According to the company’s website: “The 1-ounce bar of gold will arrive within two–five business days of the cookies' arrival.” (Tiff’s Treats emphasizes their delivery drivers do not deliver gold and the company does not store gold on its premises. Subtext: Don’t get any ideas.)

Prices vary, of course, but the company says: “We’ve always believed that the gift of our cookies is ‘good as gold’ but we wanted to go one step further and bundle them with REAL gold.”

Yeah, it’s gimmicky, but… gold.

![]() Lies, Damn Lies and Statistics

Lies, Damn Lies and Statistics

“Core, supercore, hedonic adjustment and all the rest of government statistics are just a way to fool the useful idiots who believe them (the statistics and the government),” a reader writes about yesterday’s inflation-centric 5 Bullets.

“Core, supercore, hedonic adjustment and all the rest of government statistics are just a way to fool the useful idiots who believe them (the statistics and the government),” a reader writes about yesterday’s inflation-centric 5 Bullets.

“An easy way to resolve the ‘volatility’ argument on food and energy being excluded is to use a somewhat cyclically adjusted measure similar to the CAPE ratio for P/E (1 year not 10) thereby removing the volatility while capturing the very real costs of luxuries and eating, buying gas and having shelter.

“Clearly, the reason those prices are not included is because it drives up the annual COLA adjustments on Social Security payments and accelerates the date of insolvency. (I know, it’s already insolvent.) It is the chosen method to default on our debt whilst destroying the savings of its citizens.

“The only thing growing faster than government debt is the mendacity of those who twist, distort, massage and torture every statistic to palatable levels assisted by the MSM and their official experts on such matters, like Krugman.

“Even if one were foolish enough to believe their inflation ‘data,’ inflation of 3.5% versus the target of 2% — 3.5% will cut the value of any dollars you have saved over the years in half in just 20.5 years versus taking 36 years at 2%.

“And then I read that Biden and Trump will ‘debate’ on The Howard Stern Show! Oy!

“Reminds me of the Nietzsche line about ‘that which is about to fall deserves to be pushed.’”

Emily: For what it’s worth, I believe the president told the OG shock jock that he’d be “happy” to debate Trump. Not, to clarify, on The Howard Stern Show. But, with these clowns, who knows?

And — hey, now — considering the advanced ages of our 2024 presidential candidates, we should probably avoid any talk of sudden falls. Or pushes. (Subtext: Don’t get any ideas.)

Take care! We’ll be back tomorrow.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets