California Can’t Kill AI

![]() Even California Lawmakers Can’t Kill AI

Even California Lawmakers Can’t Kill AI

We begin a new week with something that falls under the broad category of Stupid California Tricks.

We begin a new week with something that falls under the broad category of Stupid California Tricks.

A bill in the Golden State legislature aims to “impose a whole bunch of safety requirements on companies building foundational models,” writes economist Noah Smith at his Noahpinion site. “If the models are found to cause major havoc, the bill would hold companies liable for some portion of the costs.”

There’s a fundamental problem here and it’s this: The bill “demands that AI companies know all sorts of things that their model can and can't do before the model is trained on the data,” Smith says.

“As far as I know, that's not even possible; you don't really know what a model can do before it's trained.

“In fact, even after a model like ChatGPT is trained, it seems impossible to really know what dangerous stuff it could be used to do. Does anyone think we know, right now, whether GPT-4 is actually capable of causing catastrophic harm, in the hands of the right villain? I don’t think so. And GPT-4 has been out for over a year now; when we’re talking about new models, we’ll have even less knowledge to go on.”

The good news is that the bill is so sloppily written that Smith anticipates it will have little impact in slowing down AI innovation. If only every law could be like that!

Speaking of AI innovation, millions of people with no previous exposure to AI are starting to get a taste this month.

Speaking of AI innovation, millions of people with no previous exposure to AI are starting to get a taste this month.

That’s because Meta has started rolling out its Llama 3 AI model to 4 billion users of Facebook, Instagram, WhatsApp and Messenger. “For many,” says Paradigm AI authority James Altucher, “it will be their first interaction with generative AI.

“To help familiarize new users with the technology, Meta has taken a page out of Google Search's autocomplete playbook by providing users with suggestions for how to use it.”

James says this newest iteration of Llama’s large-language model is “a beast. With over 400 billion parameters Meta’s latest model has seven times more data than Llama 2, allowing it to outperform competing models on key benchmarks and tasks like coding.”

And Llama 3 is set for continuous upgrades: The company just set aside $30 billion to buy Nvidia chips, the better to amp up Llama 3’s training.

But perhaps the most “disruptive” thing about Llama is that it will give Meta a toehold in the lucrative field of search.

But perhaps the most “disruptive” thing about Llama is that it will give Meta a toehold in the lucrative field of search.

“With the new tool,” says James, “Meta's AI assistant is pulling real-time search results from both Bing and Google.

“While Meta is relying on external search engines at the moment, it's conceivable they could eventually build search capabilities in-house.”

Given how badly the quality of Google’s search results has deteriorated over the last five years, that would be a welcome development indeed!

“Of course,” James points out, “Google is unlikely to allow Meta to steal their cash cow.

Google is expected to announce its own set of new AI functionalities at its annual I/O conference” — which happens to get underway tomorrow.

It’s still exciting times in the AI space — and James says it’s not too late to get in.

In fact, he tells us the next six weeks are an ideal opportunity to get started. That’s because excitement is building toward the global AI event of the summer — unleashing several new profit catalysts. For James’ updated introduction to AI’s investment possibilities, look no further than this link.

![]() Inflation Retreating to 2%? Forget It

Inflation Retreating to 2%? Forget It

Even mainstream economists are starting to acknowledge that inflation is not under control.

Even mainstream economists are starting to acknowledge that inflation is not under control.

Paradigm’s income-investing ace Zach Scheidt spent much of last week at the MoneyShow in San Francisco. You run into a lot of conventional wisdom about both economics and investing at this event — but for Zach, there’s still plenty of worthwhile insight if you know where to look.

One presentation that stood out was from Lindsey Piegza, chief economist at Stifel Financial. “She believes that we are NOT on a sustainable path back towards 2% inflation levels,” Zach says.

“We all know that the Fed faces significant challenges in trying to get the inflation rate back to 2% and because we’ve sort of leveled off and we’re no longer tracking back toward that 2% target, Piegza believes that we’re in for a reckoning of sorts.”

Just what that reckoning looks like, it’s too soon to say: Does the Fed resume rate hikes or does it adjust its 2% inflation target higher?

On that question, another speaker offered insight — Jose Torres, senior economist at Interactive Brokers.

On that question, another speaker offered insight — Jose Torres, senior economist at Interactive Brokers.

“He said that the Fed has implicitly accepted inflation above their 2% target,” Zach tells us — because “it’s impossible to get inflation back to 2% if wages are growing by 4% or more. And we really are seeing wage growth outstrip inflation in some areas. This is helping give consumers more money to spend.

“The Fed certainly does not want to hurt jobs or cause the economy to go into a recession, which is why Torres explained that the actions of the Fed right now are showing that they do not have the strength or the gumption to get back to that 2% inflation level.”

Which lines up perfectly with the historical research we told you about last year: Once inflation sails past the 5% level, it typically takes a decade to bring it back to a “normal” 2%. Thus, inflation hedges like gold and natural-resource stocks are likely to outperform through the rest of the 2020s.

Speaking of inflation, the big economic report today is another survey showing that everyday folks expect inflation to persist.

Speaking of inflation, the big economic report today is another survey showing that everyday folks expect inflation to persist.

On the heels of the University of Michigan consumer-sentiment figures we mentioned Friday, the Federal Reserve Bank of New York is out with its own survey: The typical respondent to this survey believes inflation a year from now will be running 3.3%, up from 3.0% a month ago. Five years out, the expectation is for 2.8% inflation, up from 2.6% a month ago.

The survey results come two days before the next market-moving economic number — the official April inflation figures.

In the meantime, the major U.S. stock indexes are inching higher — the S&P 500 at 5,224, about 30 points shy of its record close in late March.

In the meantime, the major U.S. stock indexes are inching higher — the S&P 500 at 5,224, about 30 points shy of its record close in late March.

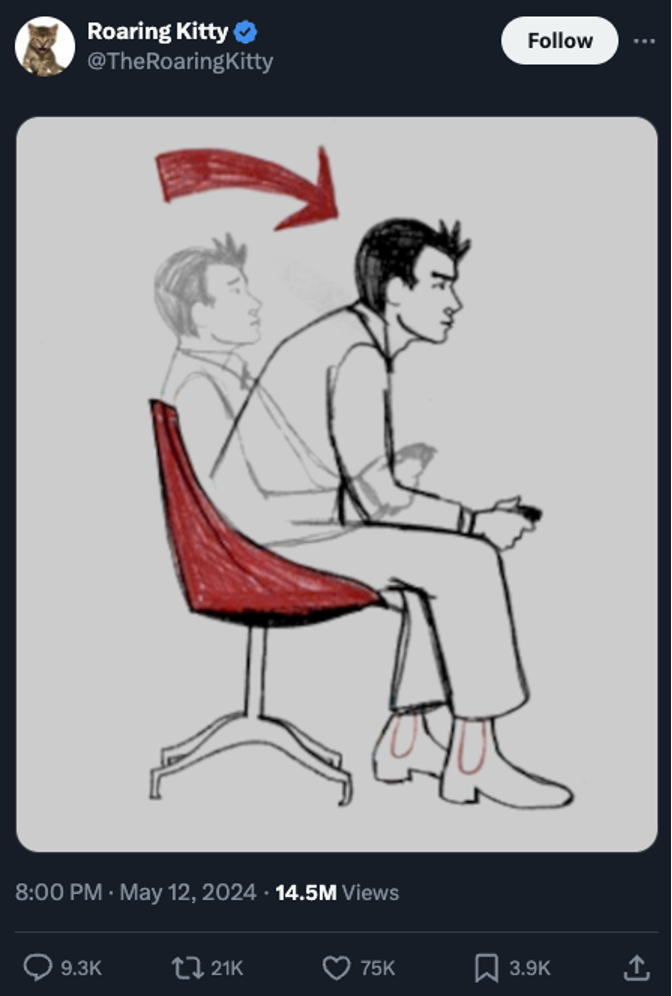

The big movers today include GameStop Corp. the darling of the “meme stock” craze in early 2021. It seems “Roaring Kitty” — the former insurance marketer behind the short squeeze in GME shares back then — resurfaced on social media last night for the first time in three years with this cryptic post suggesting he’s “back in the game”…

No, he didn’t actually disclose a new position in GME or anything like that. Nonetheless, GME is up 70% on the day.

And the excitement is spilling over to other bro-tastic names like Robinhood (up 6.6% on the day) and Reddit (up 9.6% today after its IPO in late March).

Sorry, we don’t have any brilliant insights about why this is happening now. But we did think the meme-stock frenzy of early 2021 was a social and cultural phenomenon, as well as a financial one. As we spelled out in detail back then, it was a generation’s revenge on their elders for the 2008 financial crisis.

Elsewhere, “Mr. Slammy” did not take down gold on Friday afternoon as we feared, but he did take down gold when Asian trading opened for a new week. At last check the bid is down $27 to $2,332. But silver is hanging tough, down only 6 cents and still holding the line on $28.

Crude is up over 50 cents to $78.83; Bitcoin hovers a little below $63,000.

![]() “Trump-Proofing” — Here Comes the Counterstrike

“Trump-Proofing” — Here Comes the Counterstrike

A coalition of attorneys general from “red states” is suing to stop the EPA’s new rules targeting emissions from coal-fired power plants.

A coalition of attorneys general from “red states” is suing to stop the EPA’s new rules targeting emissions from coal-fired power plants.

Led by West Virginia Attorney General Patrick Morrissey, 25 states are challenging the Biden administration’s Clean Power Plan 2.0.

“This rule strips the states of important discretion while using technologies that don’t work in the real world,” he says. “This administration packaged this rule with several other rules aimed at destroying traditional energy providers.”

As Politico’s E&E News site reports, “The lawsuit filed in the U.S. Court of Appeals for the District of Columbia Circuit sets up a familiar rematch between the nation’s leading environmental regulator and a host of red states that have challenged Biden initiatives and scored a major win at the Supreme Court in 2022 that limited EPA’s climate authority.”

Of course, we take an interest in this case in light of the continued alarms we’ve sounded the last couple of years about the stability and capacity of the power grid. There’s not enough new wind and solar capacity to replace the coal and nuke plants that are being shut down — especially with all these power-hungry AI data centers coming online.

But the timing of the suit also makes us sit up and take notice.

But the timing of the suit also makes us sit up and take notice.

The suit was filed last Thursday, as soon as the rules were published in the Federal Register.

Recall how we told you last week that the Biden administration is rushing to implement scads of new regulations affecting a host of industries before the end of this month. If they take effect any later, there’s the potential they could be easily nixed by a second Trump administration with the help of congressional Republicans.

“Trump-proofing” is what this current White House effort is called — a term our own Jim Rickards helped to go viral last month.

Here’s the thing: If the courts issue a temporary stay of the Clean Power Plan 2.0 rules, that pauses the clock on their implementation. If the case remains unresolved after this month, the rules become much more vulnerable to being undone under Trump. Stay tuned…

![]() Five Years After a Tesla Stunt…

Five Years After a Tesla Stunt…

Behold, the gift for people who have more money than sense…

Behold, the gift for people who have more money than sense…

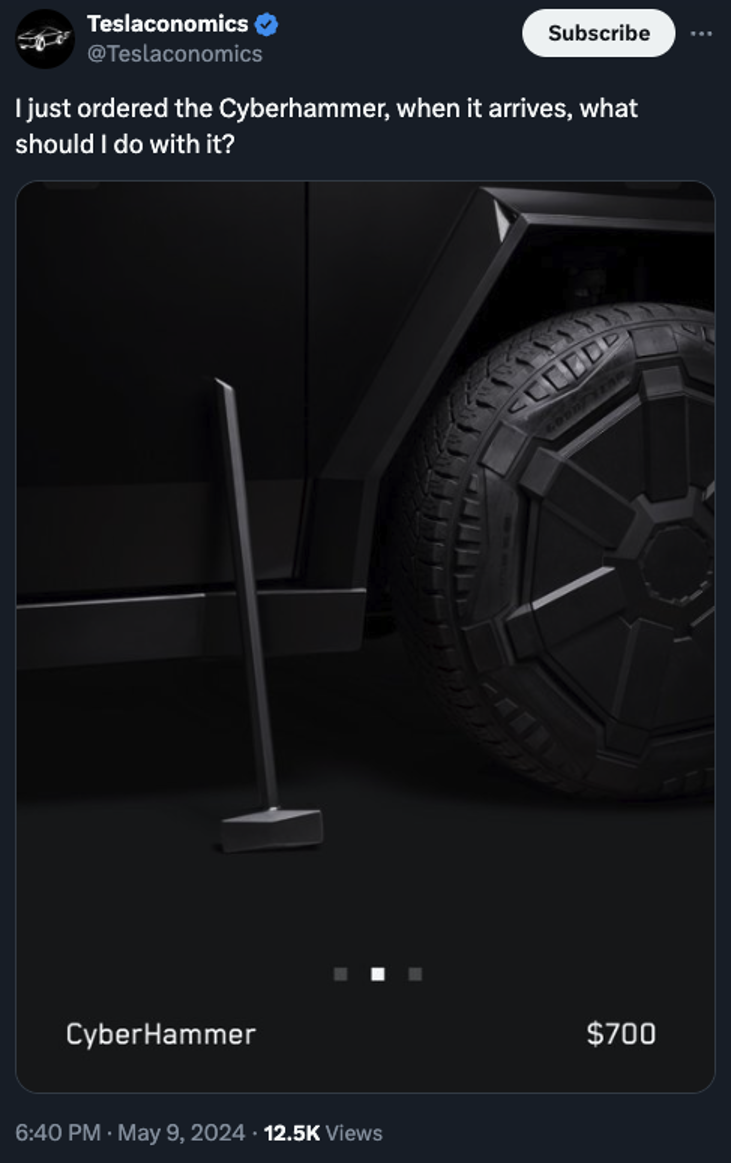

We need to hark back to 2019 for this one — when Tesla designer Franz von Holzhousen demonstrated the durability of the company’s prototype Cybertruck by bashing the doors with a sledgehammer.

Earlier this year, Tesla made a limited-edition series of “CyberHammers” with a “Franz” signature on its head. You could get them only through Tesla’s referral program — “which gives owners a code to share with a prospective buyer,” explained The Truth About Cars site. “If the buyer moves forward with their purchase, the referring Tesla owner gets credits that can be used for rewards like free charging or a CyberHammer.”

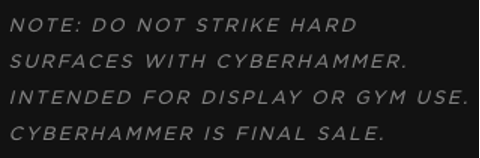

Evidently, the swag was such a hit that a few days ago the company opted to offer the CyberHammer as a stand-alone purchase — for $700. The disclaimer was amusing…

Only 800 were made, and they’re now sold out.

Have to say, it’ll be interesting to see what they fetch in resale/collectible value on eBay a few years hence…

![]() About the Chile Pepper Institute at New Mexico State…

About the Chile Pepper Institute at New Mexico State…

“I just wanted to let you know why there is a Chile Pepper Institute in New Mexico that might be of interest to you and your readers,” says a note that landed in our inbox after our item in Friday’s edition about an impending sriracha shortage.

“I just wanted to let you know why there is a Chile Pepper Institute in New Mexico that might be of interest to you and your readers,” says a note that landed in our inbox after our item in Friday’s edition about an impending sriracha shortage.

“New Mexico Hatch chile is a certain type of chile specific to New Mexico. It's not a huge crop so it is not something known internationally or even across the country. Green and red chiles to New Mexicans are as apple pie and Fourth of July are to Americans. It provides the state with a sizable income. Not to mention that red, green or Christmas (red and green) is served on almost anything you can think of.

“The New Mexico State Chile Pepper Institute provides research for better chile crops, yield prevention of farming disease and a general global view of chile production. So yeah, the New Mexico State Chile Pepper Institute is a legit thing.

“I invite you and all of your readers to come to New Mexico. The land is beautiful, there is a laidback atmosphere here and a lot of historical sites to see and the chili is phenomenal. New Mexican food is not Mexican food. It is not Tex-Mex. It is its own genre of food that is not replicated anywhere else in the country. Come try it. You might find yourself to become what New Mexicans happily call ourselves, chile addicts!

“Love The 5 and all of your work that you put out.”

Dave responds: My wife and I have long had a hankering to see the Southwest, which neither of us ever have. (The 48 hours I dropped into Las Vegas for the Paradigm Shift Summit last fall doesn’t count.) Now you’ve really whetted our appetite, as it were!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets