Don’t Count out the “Mag 7”

![]() “As Always, Price Trumps Narrative”

“As Always, Price Trumps Narrative”

Life comes at you fast.

Life comes at you fast.

From Bloomberg: “The rally that has powered stocks this month is putting the market on the brink of a record, with traders betting that a potential Federal Reserve pivot this year will bolster the outlook for corporate profits.”

That story was posted last night and updated this morning at 9:55 a.m. EDT.

Five minutes later, the narrative fell apart. The University of Michigan issued its latest consumer sentiment numbers. The headline number came in way below what Wall Street analysts were counting on.

Worse, the “inflation expectations” portion of the survey shows that the typical American consumer expects inflation to run 3.5% over the next 12 months — up from 3.2% a month ago, indeed the highest level since November.

Federal Reserve policymakers pay close attention to this inflation expectations number. Inflation has a nasty way of feeding on itself if people get into a mindset of “better buy stuff now before the price goes up again.”

So much for an imminent “pivot” to lower interest rates.

Here’s the thing: The narrative fell apart, but the market did not.

Here’s the thing: The narrative fell apart, but the market did not.

Yes, the major U.S. stock indexes gave up some of their early gains. But it wasn’t a sudden, sharp reversal deep into the red. At last check, the S&P 500 is flat on the day, less than three-quarters of a percent below its all-time closing high set in late March.

“While we were all expecting a bigger correction in April, stocks have reversed higher and have repaired much of the damage,” says Paradigm trading pro Greg “Gunner” Guenthner.

“As always, price trumps narrative.”

Which brings us back to the counterintuitive reactions we’ve seen during this earnings season.

Which brings us back to the counterintuitive reactions we’ve seen during this earnings season.

Earlier this year, folks were ready to write off the “Magnificent 7” tech-adjacent names — downgrading them to “Fabulous 4” or even a “Dynamic Duo” of only Nvidia and Meta.

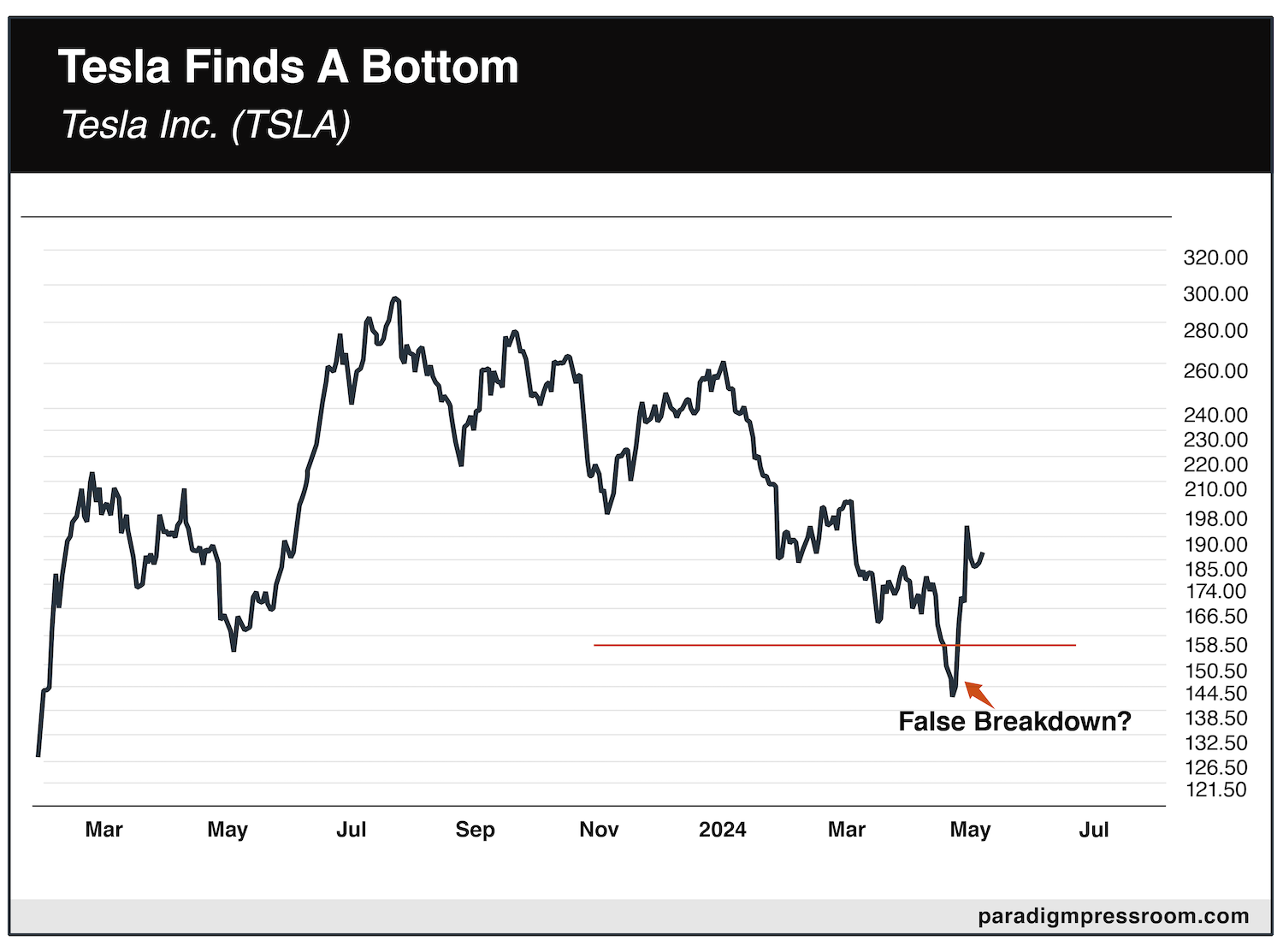

But go figure: “Apple and Tesla finally found traction and pushed higher after failing to participate in the first-quarter melt-up rally,” says Gunner.

“Perhaps more importantly, both stocks rallied on ‘bad’ earnings, according to the financial media and Wall Street analysts. Apple beat top- and bottom-line estimates, yet reported a 10% year-over-year drop in iPhone sales and offered lackluster guidance. Meanwhile, Tesla reported quarterly profits sinking to three-year lows” — and sales sliding the most in over a decade.

“One of our main concerns heading into spring trading was how some mega-caps like AAPL and TSLA were decoupling from the melt-up. But I think it’s time to cross that worry off the list. Unless we see these two names completely fill those earnings gaps and move lower, our bias should remain to the upside.”

As for today’s action… “Consumer sentiment falling/inflation rising is obviously a bad combo. That was the 10 a.m. gut-punch,” Gunner tells his Trading Desk readers. “Semiconductors and software are still somehow holding it together, but everything is fading from its highs.”

[Through this weekend only, we’re offering discounted access to Gunner’s Trading Desk recommendations.

They’ll position you for success in any market — up, down or sideways. Readers like you have booked gains like 200% in 10 days… 224% in 12 days… and 439% in three weeks. Follow this link and Gunner will walk you through his one-of-a-kind strategy.]

![]() Precious Metals on the Edge

Precious Metals on the Edge

Meanwhile, precious metals are on a knife edge as the week winds down.

Meanwhile, precious metals are on a knife edge as the week winds down.

Prices zoomed higher through much of yesterday. But now that momentum is waning, gold at $2,364 and silver at $28.20. The ever-present “Mr. Slammy” — the shadowy forces that slam down precious metals prices and snuff the life out of rallies — tends to make an appearance shortly before the Friday close.

And longer-term?

Paradigm’s recovering investment banker Sean Ring is more certain. As he writes in today’s Rude Awakening, “I’m loath to sound like other newsletter writers who tell their readers, ‘You must act now! If you don’t, you’ll lose out forever!’

“But I genuinely believe it’s the time of the precious metals and their miners.”

The miners especially. Even with gold prices trading over $2,300 for the last five weeks, the miners are truly unloved — trading far below their 2010–11 highs, and for that matter still 20% below their 2020 levels. Whenever gold and silver prices begin the next leg higher, expect the miners to massively outperform.

Elsewhere in the markets, Bitcoin is plunging below $61,000, giving up all its gains from the previous 24 hours. Crude has slipped back below $79.

![]() Dystopia Watch

Dystopia Watch

The IRS is out with the latest edition of its Internal Revenue Manual. It seems the agency has expanded its remit beyond just tax collection.

The IRS is out with the latest edition of its Internal Revenue Manual. It seems the agency has expanded its remit beyond just tax collection.

Independent reporter Ken Klippenstein — now on his own after a long stint at The Intercept — has been digging into the manual’s contents.

“Buried in the fine print,” he writes, “is the revelation that the IRS is pivoting away from its post-9/11 focus on financing of foreign terror groups like al-Qaida and criminal money laundering to a much broader and ill-defined ‘national security’ threat.”

Indeed, IRS task forces that used to be designated as “narcotics and terrorism” are now designated “national security.”

The IRS defines national security as “The national defense or foreign relations of the U.S. and includes, within a Treasury context, U.S. economic vitality, global competitiveness, market sensitivity and tracking terrorist assets/financial crimes.”

Talk about broad and ill-defined: Among other things, the IRS now presumes the authority to investigate individuals and organizations that “conduct or facilitate cyber or other activities that threaten to destabilize the U.S. critical infrastructure, key resources or ability to govern.”

“Ability to govern”?

As Klippenstein sums up, “The IRS is casting a wide net that could entangle anyone from Americans protesting their government’s ‘foreign relations’ to day traders.

Remember that trite slogan from the early days of the Patriot Act? “If you’ve got nothing to hide, you’ve got nothing to fear.”

Yeah, it wasn’t true then and it sure as hell isn’t true now.

On a related note, the feds have resumed their strong-arm tactics with the social media companies — pushing them to censor content that runs afoul of official narratives.

On a related note, the feds have resumed their strong-arm tactics with the social media companies — pushing them to censor content that runs afoul of official narratives.

Not that the NextGov website puts it in those terms exactly: “Key federal agencies have resumed discussions with social media companies over removing disinformation on their sites as the November presidential election nears, a stark reversal after the Biden administration for months froze communications with social platforms amid a pending First Amendment case in the Supreme Court, a top senator said Monday.”

We’ve written about this case more than once — and about the broader “censorship industrial complex” that’s arisen since around 2018. A case called Murthy v. Missouri (previously Missouri v. Biden) is challenging the FBI and other three-letter agencies that “flag” and “report” offending posts about COVID jabs and other topics to executives at Facebook, YouTube and so on.

As the case made its way through the courts, it seemed those agencies had backed off. But according to Sen. Mark Warner (D-Virginia), the head of the Senate Intelligence Committee, the feds have resumed their contacts with Big Tech.

What changed? The Supreme Court heard the case in March — and as we chronicled at the time, it appears a majority of the Justices are inclined to give the feds free rein.

As Warner puts it, “There seemed to be a lot of sympathy that the government ought to have at least voluntary communications with [the companies].”

Yeah, the word voluntary is doing some heavy lifting there.

In any event, expect the Supreme Court to rule in late June.

![]() A New Supply Chain Snag

A New Supply Chain Snag

Beware a summer sriracha shortage…

Beware a summer sriracha shortage…

“Huy Fong Foods, maker of the sriracha sauce that comes in rooster-adorned, green-capped bottles, says it has halted production until after Labor Day,” reports USA Today — which got its hands on a letter the company sent to wholesale buyers.

“After reevaluating our supply of chili, we have determined that it is too green to proceed with production as it is affecting the color of the product,” says the letter. And that’s not just a cosmetic issue — it’s only after the jalapeno chile peppers turn red that they deliver that tangy sweet heat.

While some corporate media outlets blame the situation on drought in Mexico — the better to reinforce the CLIMATE CRISIS narrative — that doesn’t account for the fact that Huy Fong’s competitors have ample supply.

Turns out Huy Fong had a falling-out with a California supplier a few years ago. “I’ve been hearing third hand that they have tried to enlist new growers so they would have a reliable stream of jalapenos and it sounds like they haven't been entirely successful yet,” says Stephanie Walker, co-director of the Chile Pepper Institute at New Mexico State. (In other news, there’s a Chile Pepper Institute at New Mexico State.)

But for some sriracha aficionados, it’s Huy Fong or nothing. And it’s the third year running in which the company has had one or another supply disruption. Previous shortages caused “widespread panic by frenzied consumers who stockpiled the condiment and swiped bottles from local restaurants,” says the New York Post.

![]() Mailbag: “For Your Own Good”

Mailbag: “For Your Own Good”

After revisiting the matter of Bitcoin ETFs in yesterday’s mailbag, we heard from one of our longtimers…

After revisiting the matter of Bitcoin ETFs in yesterday’s mailbag, we heard from one of our longtimers…

“Hey Dave, just an FYI — Merrill Edge will not let customers invest in the new Bitcoin ETFs,

“They have about a paragraph long spiel of blah, blah, blah basically stating that they are ‘too speculative’ when trying to add to my IRA and Roth accounts.”

“What a racket! Errrrrrr!”

Dave responds: If it’s any comfort at all, you’re not alone.

When the Bitcoin ETFs launched in January, Vanguard refused to offer them — not in retirement accounts and not even in plain-vanilla brokerage accounts. The ETFs don’t belong in “a well-balanced, long-term investment portfolio,” said a company statement.

As we mentioned at the time, this for-your-own-good attitude is not new with Vanguard — which stopped offering many leveraged and inverse ETFs in 2019. But competitors naturally seized on the opportunity, Robinhood offering a 1% bonus on brokerage transfers.

Good luck deciding whether the lack of access to Bitcoin ETFs is worth the hassle of moving your account elsewhere!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets