The Fabulous Fed Reducing Diet

![]() The Fabulous Fed Reducing Diet

The Fabulous Fed Reducing Diet

“Anyone want to volunteer to live life as ‘supercore inflation’ for a week?” said the inquiry on our e-chat this morning from Paradigm Press publisher Matt Insley. “You’re homeless, you don’t have gas in your car, can’t drink coffee — any takers?”

“Anyone want to volunteer to live life as ‘supercore inflation’ for a week?” said the inquiry on our e-chat this morning from Paradigm Press publisher Matt Insley. “You’re homeless, you don’t have gas in your car, can’t drink coffee — any takers?”

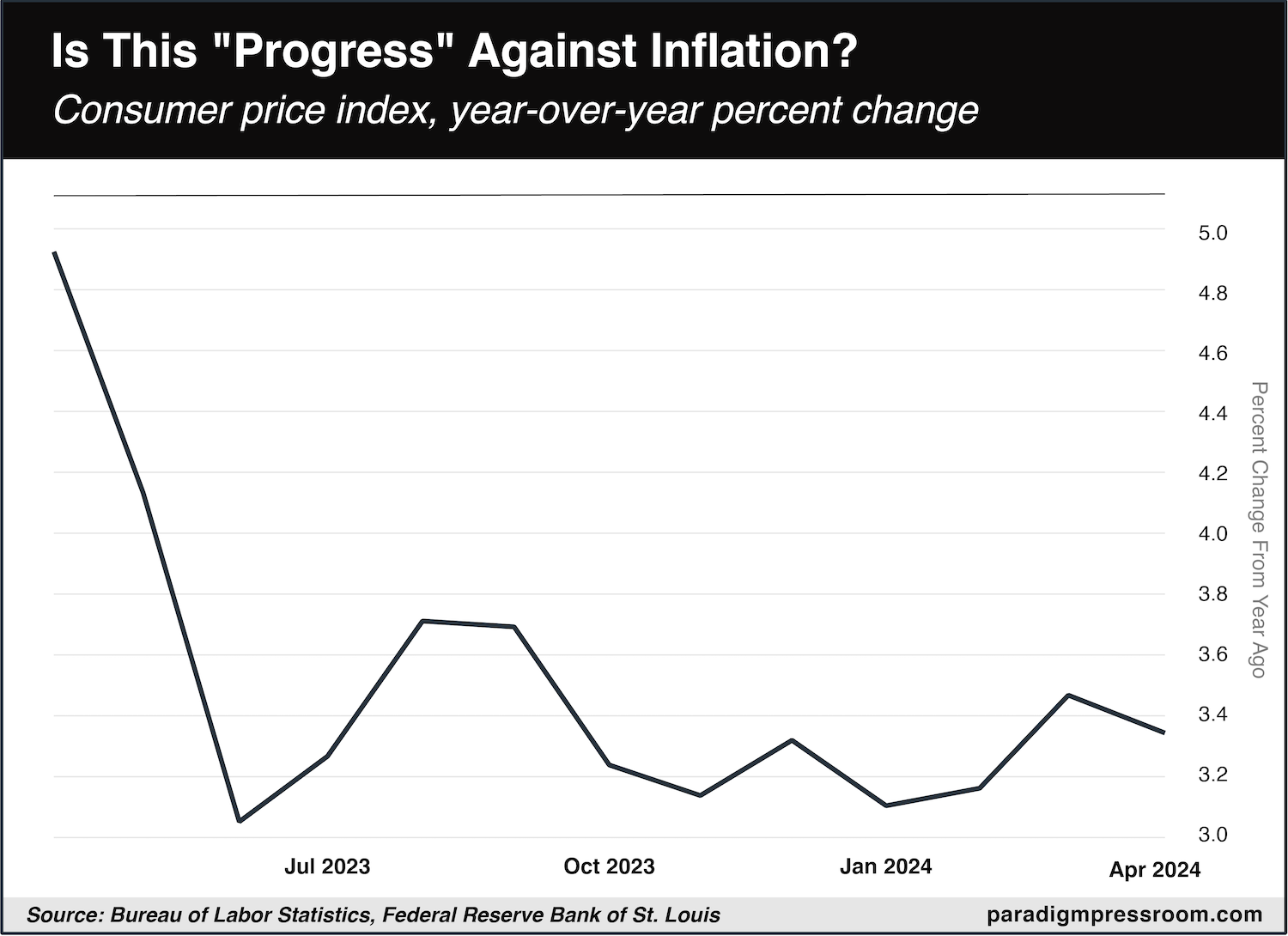

The Labor Department is out today with the April inflation numbers. Compared with the guess of the typical Wall Street economist, this is the first “cooler than expected” inflation figure we’ve seen in weeks.

That said, the official inflation rate is still 3.4% year-over-year — nowhere near the Federal Reserve’s 2% target. And for that matter, it’s still higher than it was nine months earlier.

Really, does this chart look like “progress” in the battle against inflation?

Major contributors to inflation during April include housing, health care and auto insurance.

If you scan through the corporate media, the universal spin is that inflation is looking peachy-keen for people who don’t eat or drive.

If you scan through the corporate media, the universal spin is that inflation is looking peachy-keen for people who don’t eat or drive.

Bloomberg: “A measure of underlying U.S. inflation cooled in April for the first time in six months, a small step in the right direction for Federal Reserve officials looking to start cutting interest rates this year.”

The number under discussion here is “core” inflation — that is, inflation excluding food and energy. Economists like to play with this number on the theory that food and energy prices are volatile month-to-month; taking them out of the equation allegedly gives better insight to inflation’s overall trajectory.

Back when inflation was racing higher in the months leading up to the 2008 financial crisis, the government and the Fed were keen to emphasize the core number — simply because it wasn’t as bad as the headline number. The blogosphere of that day frequently referred to core inflation as, well, inflation for people who don’t eat or drive.

That’s not the case here; core inflation is running 3.6% year-over-year, more than the 3.4% headline figure. But mainstream economists and media are zeroing in on the fact that the core rate is falling.

In theory, that makes the Fed more likely to cut interest rates sometime in the next four months. But one month does not constitute a trend. As Paradigm macro maven Jim Rickards has said for weeks now, the Fed will want to see a proven trend of falling inflation rates before cutting rates. We’re not there. Nowhere near.

But the economists and the reporters keep trying. In the last year, they’ve settled on something called “supercore inflation.”

But the economists and the reporters keep trying. In the last year, they’ve settled on something called “supercore inflation.”

This number excludes food, energy and shelter. Convenient, given sky-high housing prices, right? (Shelter is up 5.5% year-over-year.)

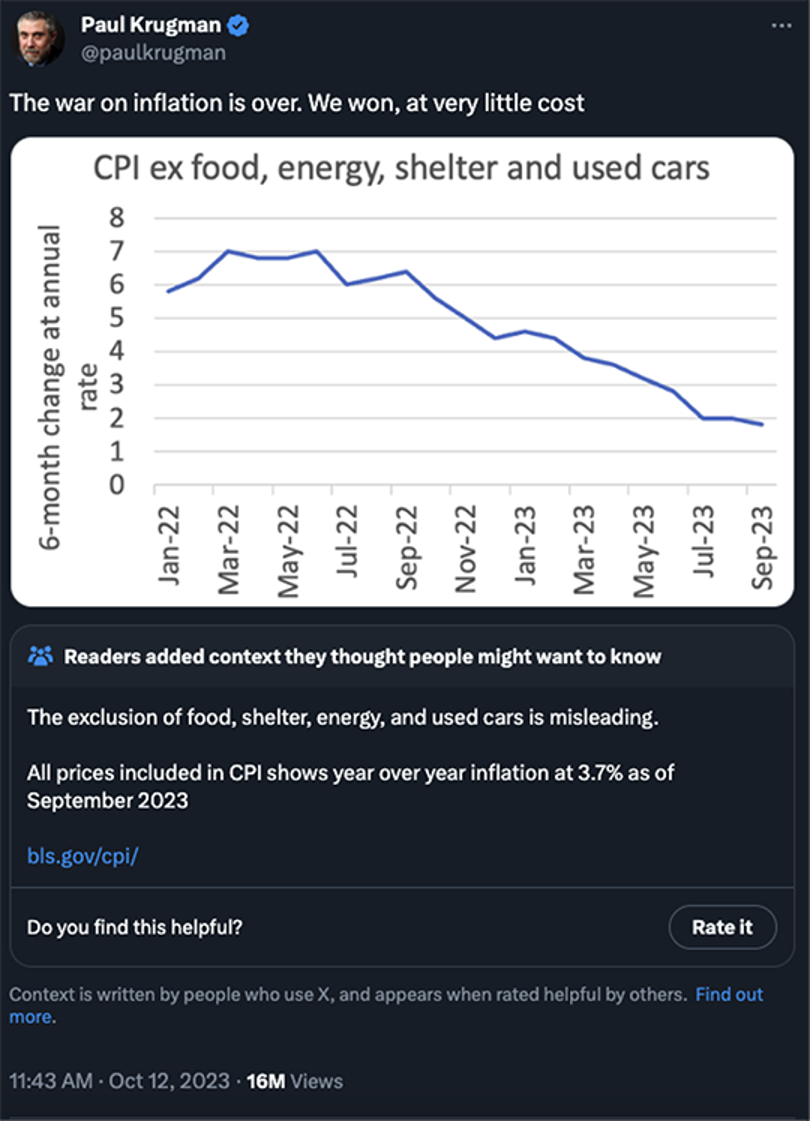

Throw enough things out of the inflation rate, and eventually it looks just swell! Indeed that’s what The New York Times’ resident Nobel-prize winning economist did when he beclowned himself last fall…

Actually, there’s a dizzying array of inflation measures, our own Jim Rickards points out: “The eggheads at the Fed and Wall Street have devised ‘core CPI’ (excluding food and energy), ‘supercore CPI’ (excluding food, energy and housing), ‘core PCE’ (a completely different index that the Fed prefers and also excludes food and energy), ‘trimmed mean CPI’ (this measure disregards the highest and lowest figures as ‘outliers’), and so on.

“These measures are devised by economists who must not have enough to do. I understand them all, but I also understand that they’re abstractions that don’t sync up with what people actually pay. Show me someone who does not spend money on food, gas, home heating and rent and maybe I’ll pay attention but not sooner.”

In any event, no one took up publisher Matt Insley on his challenge today. No roof over your head, no fuel for heat or transportation, and a week-long fast.

Call it the fabulous Fed reducing diet. It takes the concept of dieting to the utmost: The results are out of this world… but no one can stick to it.

![]() Rallies All Around Today (Except Meme Stocks)

Rallies All Around Today (Except Meme Stocks)

Wall Street likes the inflation numbers — but that’s just one of many cross-currents in the markets today.

Wall Street likes the inflation numbers — but that’s just one of many cross-currents in the markets today.

All the major U.S. stock indexes are solidly in the green: At 5,293 the S&P 500 is on track to set a record close for the first time in over six weeks. The Nasdaq already set a record close yesterday and it’s up another 1% today at 16,686.

Not sharing in the celebration are the meme stocks that took off like a rocket Monday and yesterday. GameStop is down nearly 33%, AMC Entertainment down 24%.

Yesterday, the meme stocks’ gains were crypto’s losses — with speculative money finding a new home for the moment. But attention spans are short and today the trend has reversed — Bitcoin is back within striking distance of $65,000 for the first time in three weeks. (More about crypto shortly in Bullet no. 3…)

“It’s crazy to see these meme stocks back in the spotlight,” writes Greg Guenthner at The Trading Desk. “If you asked me late last year if GME and AMC would ever post runs like we saw during the COVID bubble ever again, I would have called you crazy. Yet here we are… the irrational (even psychotic) speculator is back at it once again.

“I won’t sit here and tell you how long this move will last. The only thing I know is how it all ends. The squeeze will eventually sputter and these stocks will fall back to earth. The X factor is when…”

For his part, Greg prefers to apply a trading strategy with way fewer stomach-churning moments than you get trading meme stocks. He transformed a model portfolio of $40,000 into $266,894 over the space of two years. Best of all, you don’t need any trading experience to put his system to work — as he shows you when you follow this link.

![]() And Don’t Forget Precious Metals

And Don’t Forget Precious Metals

Meanwhile, precious metals are screaming higher.

Meanwhile, precious metals are screaming higher.

As conventional wisdom has it, gold and silver are more attractive at times of low or falling interest rates. If the Fed is going to “pivot” to lower rates sooner than expected, that’s good for precious metals.

Never mind that today’s inflation numbers will do nothing to change the Fed’s mind about rates yet: Gold is up $27 to record territory at $2,385 and silver is up 79 cents, back above $29 and testing its year-to-date highs.

“This is a huge area for silver,” says the aforementioned Greg Guenthner. “A breakout here would take silver to prices we haven't seen in over a decade. The environment is quickly changing in favor of an extended run in precious metals. Silver and miners have been a little slow to catch on as gold got its footing above $2K, but they're really starting to move now.”

Copper poked its nose over $5 a pound this morning; Greg says it’s time for the red metal to take a rest, at least for a few days.

Crude is up a tad to $78.45 after the Energy Department’s weekly inventory numbers.

In addition to the inflation figures, there’s another economic number worth noting: April retail sales came in way below expectations — ruler-flat, in contrast with the typical Wall Street economist’s guess of a 0.4% jump.

In addition to the inflation figures, there’s another economic number worth noting: April retail sales came in way below expectations — ruler-flat, in contrast with the typical Wall Street economist’s guess of a 0.4% jump.

If you factor out auto sales (volatile month-to-month) and gasoline sales (rising gas prices can skew the number), you end up with a 0.1% decline — versus a consensus guess of a 0.1% bump.

![]() Was the Halving Really a Nothingburger?

Was the Halving Really a Nothingburger?

As mentioned above, Bitcoin is rallying today — but there’s an air of disappointment in some corners of cryptoland.

As mentioned above, Bitcoin is rallying today — but there’s an air of disappointment in some corners of cryptoland.

“It’s been almost a month since the Bitcoin halving — the quadrennial event that reduces the rewards for miners by half,” says Paradigm senior crypto analyst Chris Campbell.

Bitcoin’s price is no higher now than it was at the time of the halving on April 20. But Chris counsels patience.

“One month after 2016’s halving event, Bitcoin's price was down 10%,” he says — a drop that closely resembles the drop to the late-April lows. But patience paid off: “One year later, the price was up 285%.

“The 2020 halving followed a similar pattern. One month after the event, Bitcoin's price had dipped by 6%. But true to form, one year later, the price had surged by an impressive 548%.”

And consider this: Chris has sought out the most authoritative estimates he can find — and concluded crypto adoption is growing at least 40% a year.

Here’s the thing — that’s double the adoption rate of the smartphone during the decade after the iPhone’s introduction in 2007. Faster than the internet too — and on par with the growth rate of social media during the 2010s.

Bottom line: “Short-term volatility is to be expected, but the long-term trend has been positive.”

![]() Mailbag: “Officious Intermeddlers” and New Mexico Chile

Mailbag: “Officious Intermeddlers” and New Mexico Chile

On the subject of Sen. Elizabeth Warren’s proposal for a White House crackdown on grocers, a reader writes…

On the subject of Sen. Elizabeth Warren’s proposal for a White House crackdown on grocers, a reader writes…

“Fauxcahontas is what we called in law school torts class ‘an officious intermeddler.’

“But I think that C.S. Lewis said it best in this quote:

"‘Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies. The robber baron's cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience.’"

Dave responds: Nice one. The ethos of this e-letter is deeply suspicious of for-your-own-good schemes — whether it’s as prosaic as brokerages that refuse to make Bitcoin ETFs available or as pernicious as government agencies colluding with the social media giants to shield you from “misinformation.”

One more reader wishes to weigh in on the subject of New Mexico Hatch chile…

One more reader wishes to weigh in on the subject of New Mexico Hatch chile…

“Although my wife and I are not planning to relocate to New Mexico, we have visited there several times. We agree that the New Mexico Hatch chile is a phenomenon and have bought large bags of them every time we have visited.

“If you happen to visit there don't miss La Mesilla on the Rio Grande not far from Las Cruces. Also the White Sands and Santa Fe.”

Dave: Adding them to the list!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets