Summer of Shortages

![]() Election-Year Price Controls?

Election-Year Price Controls?

We don’t want to be alarmist and say food shortages are in America’s immediate future.

We don’t want to be alarmist and say food shortages are in America’s immediate future.

All the same, we aim to keep you ahead of the curve — in your investments, yes, but also in the logistics of day-to-day living. If shortages come to pass, you can’t say we didn’t warn you.

Begin with the latest presidential polling data from the six “battleground states” where the Electoral College will be decided this November.

Among “likely voters,” Donald Trump is leading in five of them, says The New York Times — which commissioned the survey. The Gray Lady chalks up Trump’s lead to “a yearning for change and discontent over the economy and the war in Gaza among young, Black and Hispanic voters” — which threatens “to unravel the president’s Democratic coalition.”

What’s the Biden administration to do to regain an edge?

“A group of Democratic lawmakers are calling on President Joe Biden to investigate grocery store chains for price manipulation,” reports Time.

“A group of Democratic lawmakers are calling on President Joe Biden to investigate grocery store chains for price manipulation,” reports Time.

A group of six senators and 35 representatives sent a letter to the White House yesterday. As Time says, the letter asserts that the president “should use executive authority to take additional enforcement action to address rising food prices without the help of Congress.”

The letter is the brainchild of Sen. Elizabeth Warren (D-Massachusetts) — who accuses the major grocery chains of “price gouging,” seizing on the COVID supply chain snags of 2020–2022 to keep prices elevated.

“Big food companies want to keep these huge profits and they're hiring plenty of lobbyists to keep Congress from acting,” Warren tells Time. “Congress has stalled out on doing work that it could do to help families lower costs… and the president has the tools to fight back.”

Both this year and two years ago, Warren tried to push a Price Gouging Prevention Act through Congress, to no avail. The measure would have made it generally unlawful “to sell or offer for sale a good or service at an unconscionably excessive price during an exceptional market shock.”

“Unconscionably excessive”? “Exceptional”? The language was squishy but the penalties for violations were not — fines totaling 5% of the parent company’s revenue.

During the worst of the inflationary spike of 2022, a midterm election year, we mused now and then about the possibility the White House would impose price controls.

During the worst of the inflationary spike of 2022, a midterm election year, we mused now and then about the possibility the White House would impose price controls.

It never came to that, but inflation is persisting (see Bullet No. 2) — and now it’s a presidential election year.

Typically, price controls lead to shortages. If you remember the gas lines of the 1970s, they didn’t occur because the OPEC nations were jacking up the price of crude oil. They occurred because refiners and retailers couldn’t jack up their prices to compensate.

As economists like to say, prices convey information. Higher prices mean supplies are tight; the price conveys information that encourages people to dial back their consumption until the supply squeeze eases.

But that information was lacking amid the 1973 oil shock. Better to have something available at a high price than nothing at any price.

To be sure, food price controls in 2024 remain squarely in the realm of speculation. But a trial balloon is being floated this week. We pass along the word as a public service.

![]() Ooh, Inflation Is SO Hot

Ooh, Inflation Is SO Hot

Another day, another hotter-than-expected inflation number.

Another day, another hotter-than-expected inflation number.

The Labor Department is out with the wholesale inflation figures for April. The producer price index registers a month-over-month increase of 0.5% — higher than the highest guess among dozens of Wall Street economists polled by Econoday.

Even if you strip out food and energy prices — the statisticians justify that on the grounds that those prices are “volatile” — the jump is higher than any of the alleged experts forecast.

Year-over-year, wholesale inflation is now running 2.2% — the highest in 12 months.

Ninety minutes after those numbers came out, Federal Reserve chair Jerome Powell spoke at a confab of the Foreign Bankers’ Association in Amsterdam. “We did not expect this to be a smooth road,” he said. “But these [inflation readings] were higher than I think anybody expected.”

Anybody? Speak for yourself, pal. You’re the guy who insisted throughout 2021 that inflation would prove to be “transitory”... only to embark in 2022 on the most aggressive cycle of interest rate hikes in 40-plus years… and even now inflation remains well above your 2% target.

Speaking of inflation and its impact…

“Cost pressures remain the top issue for small-business owners, including historically high levels of owners raising compensation to keep and attract employees,” says Bill Dunkelberg, chief economist for the National Federation of Independent Business.

“Cost pressures remain the top issue for small-business owners, including historically high levels of owners raising compensation to keep and attract employees,” says Bill Dunkelberg, chief economist for the National Federation of Independent Business.

The NFIB is out today with its monthly Small Business Optimism index — up 1.2 points in April to 89.7.

It’s the first time the number has risen this year — but for the 28th-straight month, the number is mired below its long-term average going back to 1973.

On the portion of the survey where respondents are asked to identify their single-most important problem, inflation remains tops at 22%.

But judging by this month’s responses, the labor shortage isn’t over yet — with 19% citing “quality of labor” (good help is hard to find) and another 11% citing the cost of labor.

Taxes — a perennial favorite — is cited by 15%. Everything else is in single digits.

Mr. Market is shrugging off those higher-than-expected wholesale inflation numbers.

Mr. Market is shrugging off those higher-than-expected wholesale inflation numbers.

The major U.S. stock indexes are either flat or, in the case of the Nasdaq, modestly higher. At 5,224 the S&P 500 remains about 0.6% below its record close set in late March. It will be interesting to see whether traders retain this what-me-worry attitude if the consumer inflation figures register hot tomorrow.

The meme stocks continue to attract capital after yesterday’s big ramp higher — GameStop up 65% at last check, and the movie-theater chain AMC Entertainment up 55%.

Gold is recovering some of the mojo it gave up yesterday, the bid up nearly 15 bucks to $2,350. Silver is solidly in the green at $28.44.

Crude has shed nearly a buck to $78.19. Bitcoin continues to struggle for traction at $61,682.

![]() Power Struggle

Power Struggle

For the second day in a row, we have a looming red-state dispute with the Biden administration over the power grid.

For the second day in a row, we have a looming red-state dispute with the Biden administration over the power grid.

Yesterday we told you how Republican attorneys general in 25 states are suing the EPA — which is trying to rush through new rules that aim to shut down coal-fired power plants.

Today, the same group might be looking to sue the Federal Energy Regulatory Commission — the body that oversees the interstate transmission and wholesaling of electricity and natural gas.

Yesterday, FERC “finalized rules designed to speed up building the power grid of the future” as Bloomberg spun the news — “approving the biggest reforms in at least a decade to enable the energy transition, meet soaring demand and offer protection from extreme weather.”

FERC chair Willie Phillips portrayed the decision as coming at a “make or break moment.” Without dramatic action, “we won’t be able to keep the lights on.”

The vote was 2-1, with FERC’s lone Republican commissioner Mark Christie dissenting. He objects to rules giving regional grid operators the authority to override state-level officials.

“This rule is a pretext to enact a sweeping policy agenda that Congress never passed,” says Christie. As he sees it, the result will be “a massive transfer of wealth from consumers to for-profit special interests” — namely solar and wind operators.

Nothing official yet, but it wouldn’t be at all surprising to see GOP attorneys general banding together once again to challenge these rules in court. To be continued…

![]() Copper: This Almost Never Happens, but It’s Happening Now

Copper: This Almost Never Happens, but It’s Happening Now

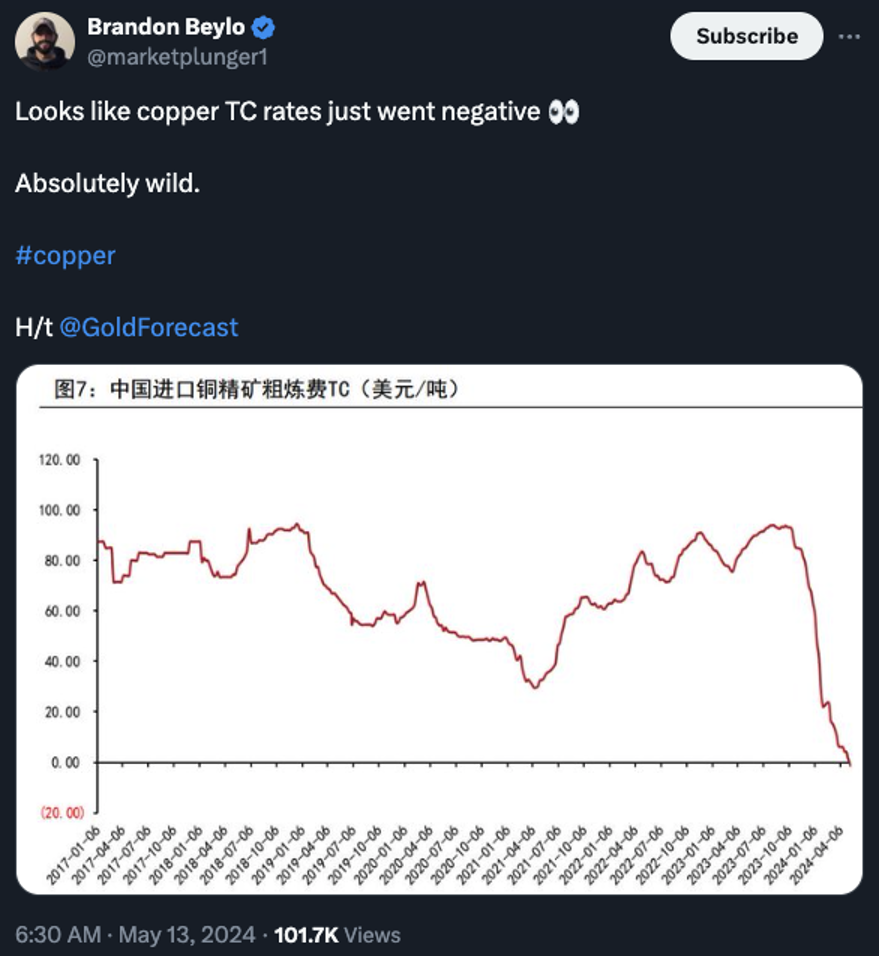

Copper prices remain elevated at over $4.50 a pound — not far off 2022’s record levels — and it appears a supply squeeze is in progress.

Copper prices remain elevated at over $4.50 a pound — not far off 2022’s record levels — and it appears a supply squeeze is in progress.

“TC” is short for “treatment and refining charges.” In normal times, smelters collect a fee from miners for processing copper concentrate.

But these are not normal times: Supply is so tight that smelters are willing to pay the miners to collect the miners’ product.

“In such a scenario,” writes one industry observer on Xwitter, “smelters may accept a negative TC rate to ensure they have enough concentrate to keep their operations running at full capacity. This situation is typically driven by a combination of factors, including strong demand for copper, limited new concentrate supply and potential disruptions in concentrate production or transportation.”

Result: Some miners are selling their product forward — that is, they’re selling stuff they haven’t yet produced — as much as three or four years into the future.

“We were inundated with offers. People were very aggressive with their bids,” one miner tells the Fastmarkets website. “Opportunities like this don’t last long,”

Or will they? “Fastmarkets heard of multiple deals signed at negative TCs for 2025,” the website reports, “with market sources saying that traders expected concentrate supply to be tight for a long time. ‘It seems inevitable,’ one trader said.”

Little wonder, perhaps, in light of the chart we shared with you last week — along with a brief exploration of two leading copper-miner ETFs for your consideration.

![]() Climbing High to Steal Copper

Climbing High to Steal Copper

Staying with the subject of high copper prices…

Staying with the subject of high copper prices…

Presumably it’s a nationwide phenomenon — but Houston’s KPRC-TV reports that in the last six months alone, the city’s police force has investigated at least 20 cases of copper wire thefts from… high atop mobile phone towers.

Sounds dangerous, you say? Yes. “They’re free climbing,” says Carey McGrew of South Texas Cellular Services — meaning they’re not bothering with the usual safety harnesses, etc. “So it’s like you’re putting your life at risk, climbing this to get not much at all.”

Climbing up high enables a thief to steal hundreds of feet of wire in one fell swoop. Still, the payoff can be meager.

“I know that we had one, and he only got 180 bucks at the scrapyard,” McGrew tells the NBC affiliate. “But, I mean, just depending on what they steal, they could get a couple thousand [or a] couple hundred. Just depends on what they’re stealing.”

Unscrupulous scrapyard operators frequently know when they’re buying stolen goods. They know the sellers are desperate for cash — so they can often buy for pennies on the dollar.

Meanwhile, damage to a single cable at one tower can knock out service to several nearby towers. “Sometimes the towers work as a hub,” says McGrew. “If they take out one, it takes out like a ring of towers. It would take out seven, eight, maybe even more at a time.”

Bad news if one of those towers is the closest to you and you need 911. And even if you don’t, repairs can cost between $10,000–25,000 a pop. Just one more reason behind your rising wireless bill…

Sorry to end today’s edition on a downer. On the one hand, this story falls under the category of Would you believe THIS? On the other hand, it also falls under the category of In the present day and age, YES.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets