Chinese Squeeze Play

![]() Chinese Squeeze Play

Chinese Squeeze Play

The news doesn’t stop just because we’re convening our Paradigm Shift conference for the first time in two years.

The news doesn’t stop just because we’re convening our Paradigm Shift conference for the first time in two years.

More than 700 of your fellow readers have converged on the Renaissance Hotel in Nashville this morning. Today’s agenda includes all of our biggest names — including trading pro Enrique Abeyta, macroeconomics authority Jim Rickards and our AI-and-crypto maven James Altucher. Look for highlights from today’s sessions in tomorrow’s 5 Bullets.

Appropriately enough, Rude Awakening editor Sean Ring got the day off to a rollicking start with a talk called “6 Impossibly Rude Things Before Breakfast.”

Not long after checking into the hotel last night, our mining-and-metals expert Byron King shot out an email — one that commands our attention for today’s Bullet No. 1…

“China has levied a raft of new export controls related to rare earth materials, expanding the scope of restrictions well beyond those previously imposed, as it looks to cement its near-monopoly status in the sector and fend off attempts by the United States to gain a foothold in the critical minerals supply chain.”

“China has levied a raft of new export controls related to rare earth materials, expanding the scope of restrictions well beyond those previously imposed, as it looks to cement its near-monopoly status in the sector and fend off attempts by the United States to gain a foothold in the critical minerals supply chain.”

So reports Hong Kong’s newspaper of record, the South China Morning Post.

China imports almost everything it needs to keep its modern economy running, from crude oil to iron ore — with one crucial exception.

The one natural resource where it holds an effective world monopoly is rare earth elements — used in everything from your smartphone to guided missile systems. China controls about…

- 70% of rare earth mining

- 90% of separation and processing

- 93% of magnet manufacturing.

“Under the new rules,” says the Financial Times, “foreign companies will need Beijing’s approval to export magnets that contain even trace amounts of Chinese-sourced rare earth materials, or that were produced using the country’s extraction methods, refining or magnet-making technology.”

Beijing’s new rules on the export of rare earths effectively mirror Washington’s rules on the export of semiconductors. Leverage.

[As it happens, Byron’s topic for his talk this morning at the Paradigm Shift Summit is “Military Metals. China’s Check or Checkmate?”]

To be sure, this is not the first time Beijing has played the rare-earth card.

To be sure, this is not the first time Beijing has played the rare-earth card.

As we chronicled last spring, the Chinese government slapped limits on rare earth exports to retaliate against the Trump administration’s tariff regime. The flow of rare earths to U.S. automakers was quickly choked off. The threat of factory shutdowns brought Washington back to the bargaining table.

With this new announcement, timing is everything: Donald Trump meets with Chinese president Xi Jinping on Oct. 30 in Gyeongju, South Korea. The current trade truce between Washington and Beijing expires on Nov. 10.

Yes, there could be another 90-day pause on top of the previous two — but by now, Trump is probably getting touchy about the TACO accusations (“Trump always chickens out”).

And as you learned here on Monday, the fate of Trump’s entire trade policy is riding on the outcome of U.S.-China trade talks: He says he wants foreign companies to invest in the United States… but does he want Chinese companies investing in the United States?

“Even if we eventually have a deal with China regarding rare earths, their dominance of the area will always exist as a threat to the USA,” says Paradigm’s Enrique Abeyta.

“Even if we eventually have a deal with China regarding rare earths, their dominance of the area will always exist as a threat to the USA,” says Paradigm’s Enrique Abeyta.

On Tuesday, Enrique urged readers of The Maverick to take 151% gains on USA Rare Earth (USAR). This was an options trade he laid on in June. Not a long time horizon at work on this one.

But he’s still keen on the sector as a whole: America’s vulnerability to China’s control of the space is bullish for the handful of American players getting a toehold.

“This is why the opportunity in these stocks — like USAR — is not just over a few months but over years and likely decades.”

Today too, for that matter: USAR shares are still a hold in the Paradigm Mastermind Group portfolio and they’re up another 16% today after China’s announcement.

Today too, for that matter: USAR shares are still a hold in the Paradigm Mastermind Group portfolio and they’re up another 16% today after China’s announcement.

Even non-rare earth names are rallying like the metallurgical coal producer Ramaco Resources (up 11%) and Trilogy Metals — a Byron King pick spotlighted in Tuesday’s edition (up 5%).

![]() Silver Milestone

Silver Milestone

Silver has blasted past the $50 level — and decades of history.

Silver has blasted past the $50 level — and decades of history.

At last check, the white metal is up over $2 on the day — the spot price now a record $50.83.

The $50 level isn’t just a round number — it’s also the previous high notched in 2011, as well as way back in 1980.

If you take that $50 price in 2011 and adjust for inflation, that sets a new target of $71.64.

The 1980 high was a crazy outlier — made possible by the Hunt brothers of Texas trying to corner the silver market, only to get the rug pulled out from under them when the Comex changed the margin requirements on silver futures.

But just for the sake of intellectual exercise… $50 silver in 1980 translates to $195.53 today. And that’s going by the official U.S. government inflation numbers — which vastly understate the true cost of living. Just sayin’.

For its part, gold is retreating from yesterday’s record high — but still holding the line on $4,000.

Elsewhere in the commodity complex, crude is down nearly 1% and back below $62. But the spot price of copper has rallied to $4.92, the highest since late July.

Copper has rallied big this week since the mining giant Freeport revealed that a cave-in at its Grasberg mine in Indonesia is much worse than first thought. Not only were seven workers killed but about 800,000 metric tons of sludge poured into the mine. The world’s sixth-largest copper project will be out of service for a long, long time.

![]() This Will End Badly — but Not Yet

This Will End Badly — but Not Yet

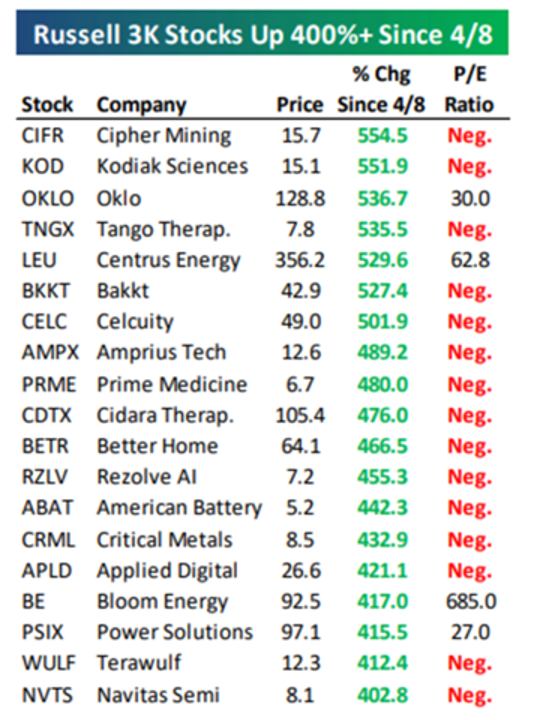

“Here is a table that shows that we have absolutely entered into the most speculative phase of the BULL market,” says the aforementioned Enrique Abeyta.

“Here is a table that shows that we have absolutely entered into the most speculative phase of the BULL market,” says the aforementioned Enrique Abeyta.

Even though Enrique is front-and-center today at the Paradigm Shift Summit, he’s still peppering users of the Paradigm Press mobile app with insights in the “Daily Feed” section. Check this out…

This table courtesy of Bespoke Research “shows the stocks in the Russell 3000 that are up the most and whether they have earnings or not,” Enrique explains. “Most do NOT!”

The Russell 3000, if you’re wondering, is an index that seeks to capture almost all of the U.S. stock market — incorporating both the small-cap Russell 2000 and the large-cap Russell 1000.

“Nothing wrong with trading these stocks,” Enrique says — “but THIS. DOES. END. BADLY.”

In other words, few of these companies are long-term holds. You don’t want retirement money in these names. They’re speculations. Something you can take a flier on if the chart looks right. (Enrique is really good at that, by the way: His topic today at the Paradigm Shift Summit is “Plan the Trade, Trade the Plan.”)

That’s how it goes in the most heady phase of a bull market. But as Enrique says, sooner or later it ends in tears.

While the rare-earth names are rallying today, they’re an exception to the market as a whole.

While the rare-earth names are rallying today, they’re an exception to the market as a whole.

All the major indexes are down between a quarter and a third of a percent. The S&P 500 sits at 6,734. It’s up 14.5% year to date.

Congratulations are in order to members of Paradigm’s new 10X Trade Club. Yesterday Chris Cimorelli urged them to sell their call options on XBI, the big biotech ETF — good for a 531% gain in only 22 days. (Chris just wowed the crowd in Nashville with a talk called “The 10X Blitz: 3 Asymmetric Trades for America’s Semiquincentennial.”)

![]() Shutdown Theater

Shutdown Theater

“Partial government shutdown” notwithstanding, the IRS has issued its tax brackets for the 2026 filing year.

“Partial government shutdown” notwithstanding, the IRS has issued its tax brackets for the 2026 filing year.

We won’t hash through all of it now — you can see the IRS’ announcement here if you like. Suffice to say that if you’re in the 24% tax bracket and want to avoid the huge bump up to 32%, you’ll need to keep your taxable income under $201,775 (single) or $403,550 (married filing jointly).

Meanwhile, the standard deduction jumps from $15,750 to $16,100 (single) or $31,500 to $32,200 (married filing jointly).

As mentioned here last summer, folks over 65 get an additional standard deduction of $6,000 under the “One Big Beautiful Bill Act.” But there are income limits and the deduction expires after tax year 2028.

For what it’s worth, the IRS announced yesterday it’s furloughing nearly half its workforce under the shutdown — but don’t even think about skipping out if you owe estimated taxes this month.

For what it’s worth, the IRS announced yesterday it’s furloughing nearly half its workforce under the shutdown — but don’t even think about skipping out if you owe estimated taxes this month.

"Taxpayers should continue to file, deposit and pay federal income taxes as they normally would; the lapse in appropriations does not change federal income tax responsibilities,” an IRS flack tells CBS News.

Then again… how much of an enforcement mechanism do they have at the moment?

No, that’s not tax advice!

Meanwhile, we’ll remind you once more that it could be a while before Social Security recipients learn what their cost of living adjustment will be next year.

Meanwhile, we’ll remind you once more that it could be a while before Social Security recipients learn what their cost of living adjustment will be next year.

Usually the Social Security Administration announces the annual COLA in October, on the same morning that the Labor Department issues the monthly inflation numbers.

Ordinarily those numbers would be coming out next Wednesday. But they’re on hold during the shutdown.

We’re assuming the Centers for Medicare and Medicaid Services will also be stymied in announcing next year’s Medicare Part B premiums until the inflation numbers get sorted out…

![]() Mailbag: Maxwell Apartment, Trump Dollar

Mailbag: Maxwell Apartment, Trump Dollar

Another longtime reader wishes to weigh in on the Maxwell House rebrand to “Maxwell Apartment”...

Another longtime reader wishes to weigh in on the Maxwell House rebrand to “Maxwell Apartment”...

“Dave, my first reaction to the ‘name change’ was similar to Tuesday’s letter writer’s. But it turns out that the name change is only temporary and intended to gather attention to use of their product by so many apartment dwellers. The distribution will be through limited sources too and Amazon. Seems like clever advertising to me.

“I don’t drink Maxwell House coffee (I grind my own beans each morning), but I also haven’t even thought of them in a long time. They got my attention and certainly many others’.

“Great gimmick for free attention and advertising without really changing their product. Time to curb our knee-jerk reactions, however justified for many issues.”

On the subject of a prospective Trump dollar coin, a reader writes…

On the subject of a prospective Trump dollar coin, a reader writes…

“Has anyone considered the difficulty of converting vending machines to accept the new dollar coins? Or will the vendors just raise the prices of all their products to five dollars?”

Dave responds: More likely the makers of vending machines just won’t bother. For one thing, most vending machines nowadays are equipped for electronic payments and many don’t accept cash at all.

For another thing, vending machine manufacturers got burned with the Susan B. Anthony dollar introduction in 1979.

According to a CoinWeek story published in 2019, many makers of vending machines spent between $100–500 per machine on retrofits to accommodate the new dollar coins. “The manufacture of these new parts began in 1977 before the legislation had even been passed,” says the article.

But as anyone who was around at the time remembers, acceptance of the coins never materialized.

They were smaller than the Eisenhower dollar produced earlier in the 1970s — and thus cheaper for the Mint to produce — but the size was so similar to a quarter that everyday folks balked.

One more postscript to our item from Monday: There is one historical instance of a living president appearing on U.S. coinage.

One more postscript to our item from Monday: There is one historical instance of a living president appearing on U.S. coinage.

In 1926 the U.S. Mint issued a special 50-cent piece to mark the nation’s sesquicentennial. It was a “commemorative” issue, not for general circulation. The coins were sold to the public at a premium to face value, with proceeds going toward a “Sesquicentennial International Exposition” held that year in Philadelphia.

The front of the coins featured the heads of George Washington and the sitting president at that time, Calvin Coolidge.

Near as we can tell, this was not Coolidge’s idea — which would have seemed a little presumptuous, no?

If Wikipedia is to be believed, design of the coin was a fraught affair, with members of the National Sesquicentennial Exhibition Commission unable to come to an agreement. The two-headed thing was the result of a compromise. (And a historically inaccurate one. George Washington was not president of the Continental Congress in 1776.)

There’s a long history of the Mint issuing commemorative coinage, never meant to be jingling in anyone’s pocket. Leafing through an old coin guide on my shelf, there’ve been commemorative one-dollar coins issued this century for everything from the Salt Lake City Olympics (2002) to the 230th anniversary of the Marine Corps (2005) to the 400th anniversary of settlement at Jamestown (2007).

Given the decades-long history of the public rejecting dollar coins for everyday use, it wouldn’t be surprising if the Trump dollar turns out to be just one more commemorative issue…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets