Gold: It’s Not All About Trump

![]() Gold: It’s Not All About Trump

Gold: It’s Not All About Trump

The spot price of gold has followed gold futures over $4,000 for the first time. To hear the mainstream tell it, it’s all about Trumpy-Trump-Trump and how he ruined everything.

The spot price of gold has followed gold futures over $4,000 for the first time. To hear the mainstream tell it, it’s all about Trumpy-Trump-Trump and how he ruined everything.

It’s loud and proud in today’s Wall Street Journal — front page, above the fold…

… gold has rocketed higher due in part to anxiety that President Trump could upend the postwar economic order underpinned by the U.S. dollar…

Trump’s attempt to reorder global trade has buoyed prices and upended growth forecasts. White House pressure on the Federal Reserve to lower interest rates is threatening the independence of one of the financial system’s bulwarks.

The international media get a little closer to the truth.

The international media get a little closer to the truth.

“Trump’s tariffs and battles against the Federal Reserve are not the only factors driving gold’s continued upward trajectory,” says an article at Al Jazeera’s website.

For starters, Japan’s ruling party has a new leader: Sanae Takaichi is on track to become the country’s first woman prime minister. She’s campaigning on a platform of big deficits, tax cuts and “stimulus” payments to households.

“Her victory,” Al Jazeera’s Erin Hale writes, “upset markets as the yen — another ‘safe haven asset’ for some investors — dropped to a 13-month low on Tuesday, according to the Reuters news agency. Gold, it appears, became a go-to alternative.”

And then there’s the turmoil in France — where a never-ending budget crisis has taken down yet another prime minister, this one after only 26 days. France will likely face nonstop turmoil until President Emmanuel Macron’s second term is up — and that’s still 18 months away.

France and Germany form the twin pillars of the euro currency — and Germany’s economy has been in the tank for nearly three years. So the euro is no viable alternative to the dollar: Gold wins again.

But this isn’t just a 2025 story: Gold’s run-up has been years in the making.

But this isn’t just a 2025 story: Gold’s run-up has been years in the making.

Looking back, the logical starting point is February 2022 — when Russia invaded Ukraine and the Biden administration responded with unprecedented sanctions, freezing the dollar-based assets of Russia’s central bank.

At that moment, every government on less-than-friendly terms with Washington came to the same realization: If it can happen to the Russians, it can happen to us too.

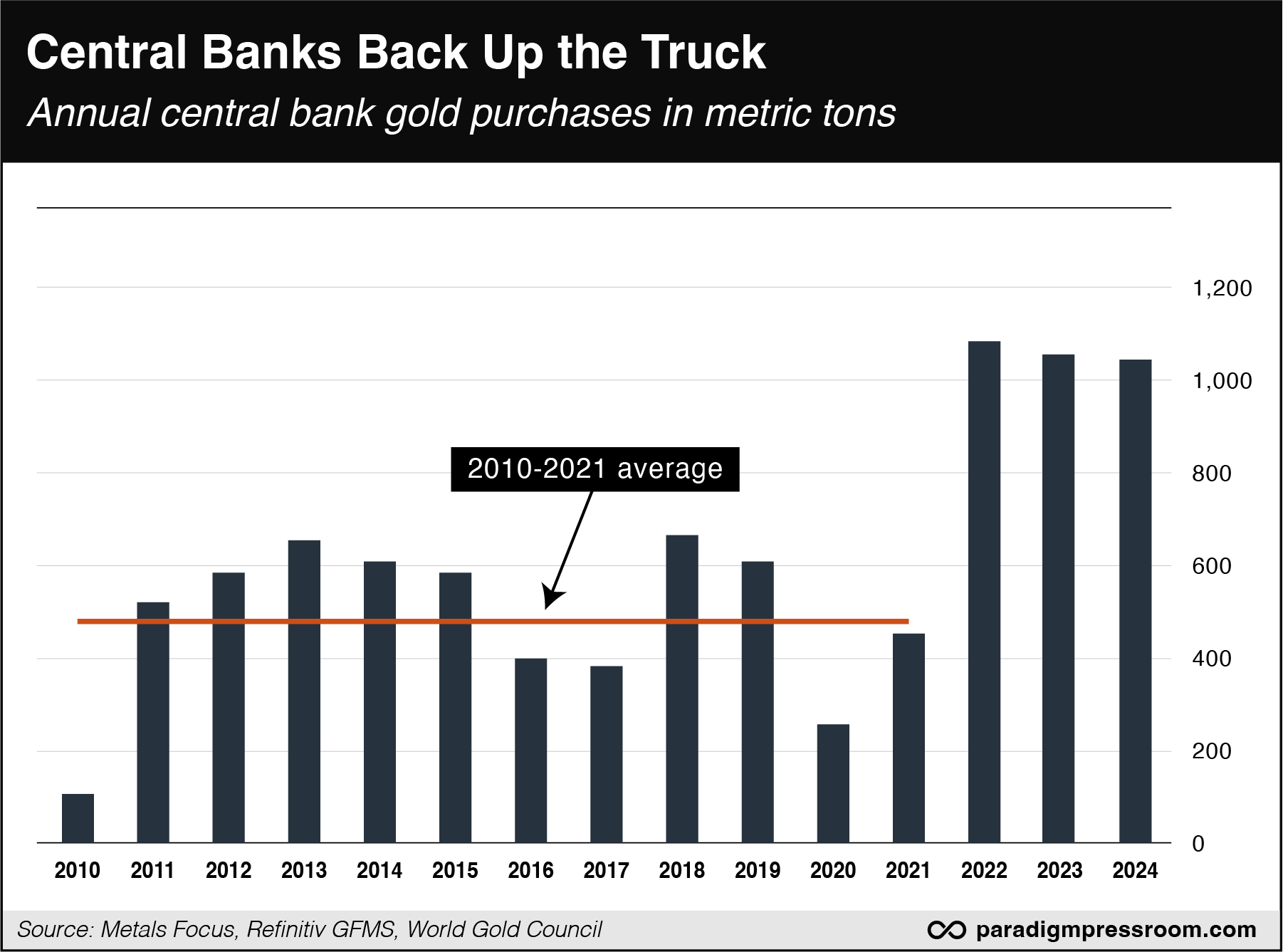

It is no coincidence that central bank accumulation of gold leaped to record levels in 2022. The furious pace of buying has continued ever since.

That’s because gold has a unique advantage over other assets, as our Jim Rickards has reminded readers for years: “Gold is a physical nondigital asset that cannot be stolen, frozen or seized provided it is in safe storage.”

And the gold story is about more than just Washington’s adversaries looking out for their own interests since 2022.

And the gold story is about more than just Washington’s adversaries looking out for their own interests since 2022.

Going into the election last year… your editor ruffled a lot of partisan feathers by saying that no matter who won, the trajectory would be similar: More war, more dollar debasement.

Neither Donald Trump nor Kamala Harris uttered the term “federal spending” once during their debate last year.

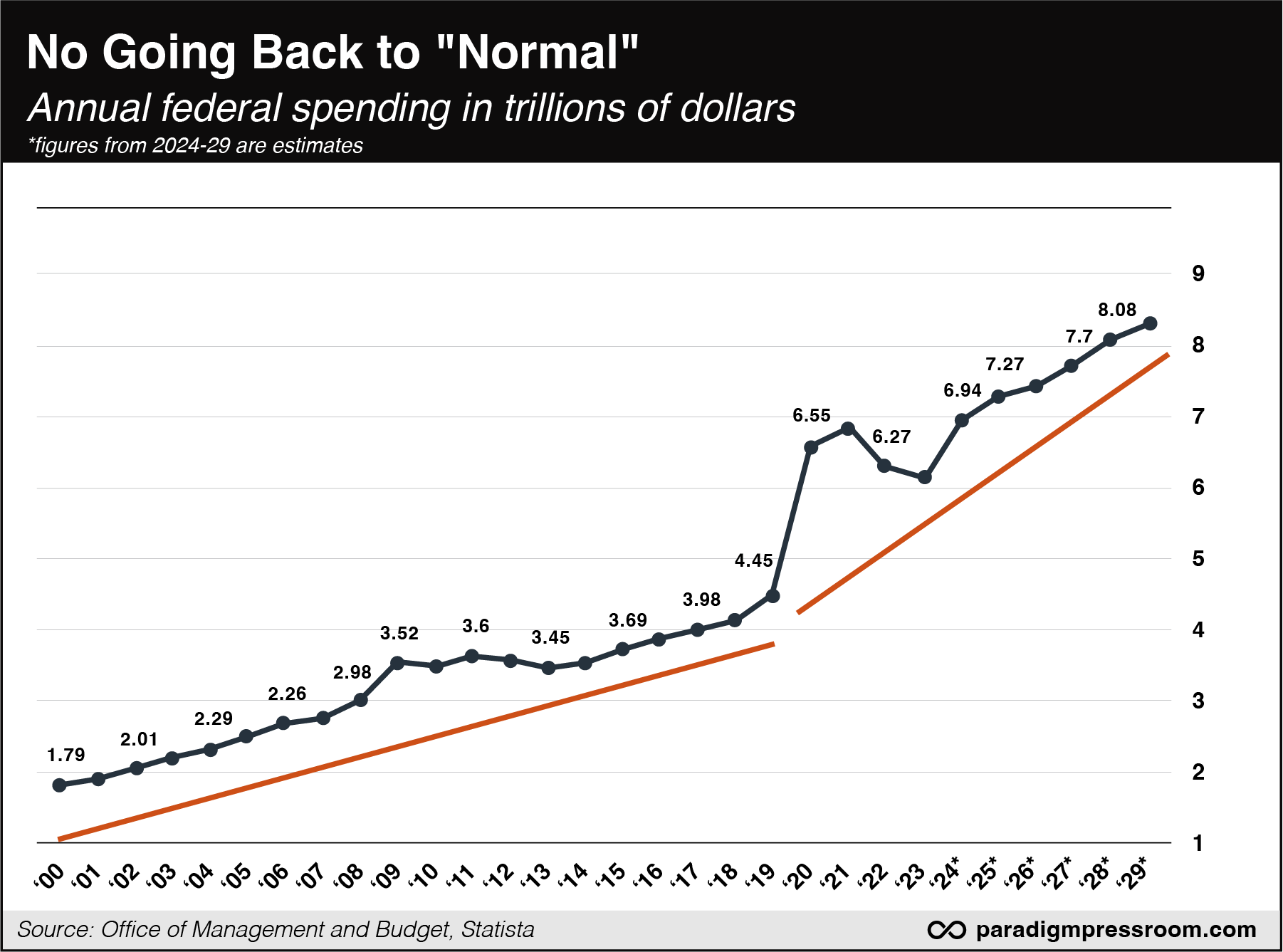

The burst of spending during the last year of the Trump 45 administration and the first year of the Biden administration was not a one-time response to COVID, after which we went back to “normal.”

Instead, federal spending was put onto a permanently higher trajectory…

The explosion of spending and debt since 2020 resulted in vicious consumer price inflation — the kind unseen since the 1970s.

The mild inflation we experienced during the 2010s is now a distant memory. And as we can’t remind you often enough, once inflation sails past 5% — as it did in 2022 — it typically takes a decade to get back to “normal” 2% inflation.

Gold experienced a stupendous rally during the inflationary 1970s — starting at $35 an ounce in 1971, climaxing in a blow-off top over $800 in January 1980.

As the saying goes, history never repeats exactly — but it does tend to rhyme. That’s why projections of a $15,000 gold price and even Jim Rickards’ math-driven scenario of $27,533 are not only plausible but probable.

All that said… in the short term, “silver and gold have blown through any and all reasonable levels,” our Greg Guenthner advises his Trading Desk readers. “To say the metals are ‘overextended’ is a massive understatement.

All that said… in the short term, “silver and gold have blown through any and all reasonable levels,” our Greg Guenthner advises his Trading Desk readers. “To say the metals are ‘overextended’ is a massive understatement.

“So we have a situation where silver and gold are desperately in need of a pullback. On the other hand, the inflation and debasement narratives are only growing.

“In my mind, both can be true.

“I think we'll see gold and silver higher in the longer term. I don't think it’s the blow-off top yet! But from a trading perspective, I need to wait for a better entry. Some form of pullback needs to materialize to allow me to get involved.”

But today is not the day. Checking our screens, the spot price of gold has shot up $58 to another record of $4,041. And silver is up an eye-popping $1.47 to $49.22. The 2011 high of $50 is within reach.

![]() Stocks: A November (and December) to Remember

Stocks: A November (and December) to Remember

As for the stock market, “There is an extremely high probability that we finish 2025 strong,” says our hedge fund veteran Enrique Abeyta.

As for the stock market, “There is an extremely high probability that we finish 2025 strong,” says our hedge fund veteran Enrique Abeyta.

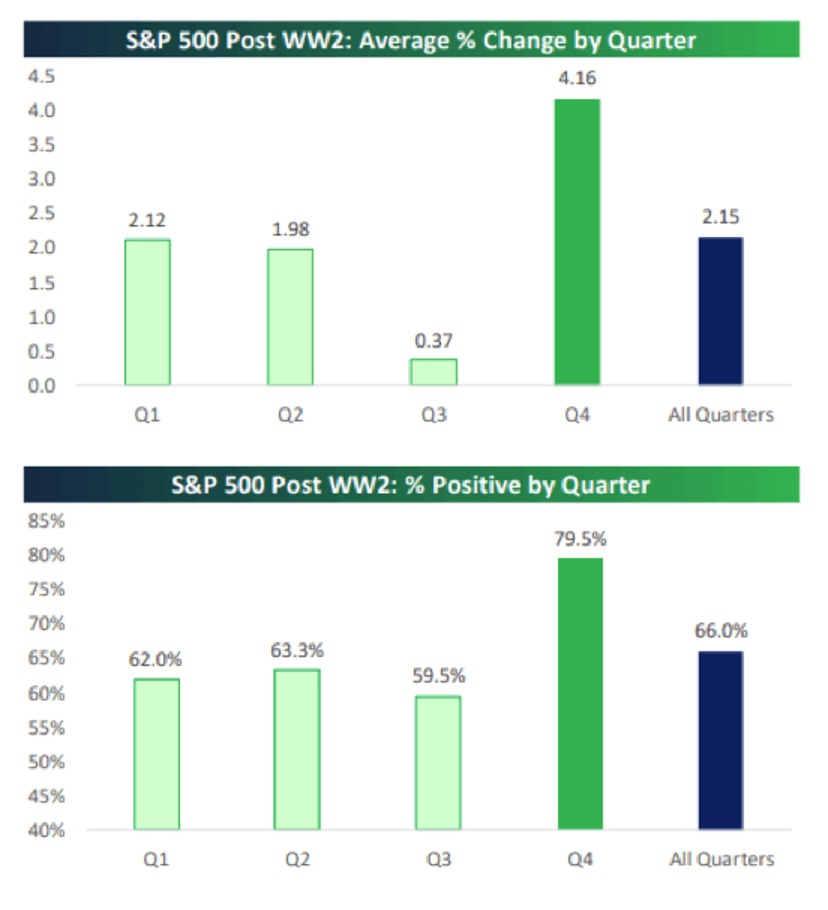

Yes, stocks are stretched right now and he expects some near-term turbulence… but history points to strength during the fourth quarter. Check out these charts from Bespoke Investment Group, going back 80 years…

“You can see that since World War II, the S&P 500 has been up almost double the average for all quarters and positive almost 80% of the time,” says Enrique. “Those are both strong returns and a high probability of a positive outcome.”

Another fact to chew on: Whenever the stock market notches a new all-time high in October — as it’s done a handful of times this month — the S&P 500 ends the fourth quarter in the green 90% of the time.

And the average jump for the quarter is almost 5%. That’s according to figures from Carson Investment Research going back to 1950.

What’s behind the pattern? Consider this: “Most professional money managers are compensated based on their performance at the end of the calendar year,” Enrique says.

“So they will do everything they can to see the market go higher by year-end.

“If a money manager is flat (or down) going into year-end, then they probably won’t be aggressive. A money manager who’s up double digits, on the other hand, will buy every dip.”

Which seems to be what’s going on today.

Which seems to be what’s going on today.

After a down day yesterday the S&P 500 is up over half a percent as we write — in record territory once more at 6,753. The Dow’s gain is weaker, the Nasdaq’s stronger.

Among the big movers is AST SpaceMobile — up 10.2% on news that it will partner with Verizon to provide wireless service via satellite. ASTS is a workhorse holding in James Altucher’s entry-level newsletter Altucher’s Investment Network — now up 426% from its original recommendation in January 2021.

➢ Economic number of note: Curiously, the “partial government shutdown” is not affecting the weekly oil inventory figures from the Energy Department. This week’s numbers show a drawdown in gasoline and distillates (diesel, fuel oil). With that, a barrel of West Texas Intermediate is up over a buck to $62.85.

![]() Follow-Up: Swimming Naked With First Brands

Follow-Up: Swimming Naked With First Brands

If there’s a potential catalyst for short-term turbulence in the stock market, it’s the continuing fallout from the bankruptcy of the auto parts maker First Brands.

If there’s a potential catalyst for short-term turbulence in the stock market, it’s the continuing fallout from the bankruptcy of the auto parts maker First Brands.

Since we waved the caution flag a week ago today, large players in the finance sector have started disclosing their exposure to First Brands.

The Swiss banking giant UBS was up first. Funds operated by UBS are swimming naked to the tune of $500 million. If The Wall Street Journal is to be believed, much of that exposure is to customers that owe money to First Brands.

Then today Jefferies Financial Group disclosed that funds run by its Point Bonita Capital unit are owed an even bigger sum — $715 million — from companies that bought First Brands parts. (The news has sent JEF shares down 1.3% as we write.)

Both companies promise they’ll act to enforce investors’ rights. But considering that First Brands evidently pledged the same invoices more than once as collateral on the company’s borrowed money… that could prove to be an uphill climb.

Look for more confessions in the days to come. One of them might be enough to make the stock market stumble a bit.

Wide-scale systemic risk, you ask? Probably not in the near term — but Jim Rickards’ top analyst Dan Amoss is on the lookout for any tremors that might herald a major earthquake.

![]() Comic Relief

Comic Relief

A reader passes along today’s edition of government-shutdown memeage — which serves as a valuable reality check.

A reader passes along today’s edition of government-shutdown memeage — which serves as a valuable reality check.

![]() Mailbag: Kimmel, Again

Mailbag: Kimmel, Again

“I had to give you a dislike on your email,” says a late-arriving note from a reader after your editor took on the Disney-Jimmy Kimmel story.

“I had to give you a dislike on your email,” says a late-arriving note from a reader after your editor took on the Disney-Jimmy Kimmel story.

“The point of the FCC getting after Jimmy Kimmel is for his lying accusation regarding Charlie Kirk's assassination.

“It's one thing to disparage MAGA, but to directly accuse MAGA of shooting Charlie Kirk should not be supported on FCC taxpayer-funded airwaves. Assassination is a serious criminal offense and to accuse a people of that would equate to Hitler blaming the Jews for Germany's problems; therefore it's OK to final solution them.

“I think [FCC chair Brendan] Carr was addressing the blasphemous LIE and false accusation. How do you think Mr Trump is winning in court? He's winning because they LIED and defamed him.

“It used to be that a news organisation had to tell the truth. Now lies and false accusations are considered free speech AND normal. Those men that you cited should know better.”

Dave responds: The issue is not whether Jimmy Kimmel lied. The issue is whether government has a role as the arbiter of truth. The Founders would be appalled at the suggestion it does.

But don’t take it from me. Take it from conservative talk-radio host Clay Travis. He partners every weekday on the airwaves with Buck Sexton, editor of the Paradigm newsletter Money & Power.

Mr. Travis says it was wrong a few years ago when Disney cancelled Roseanne Barr’s ABC sitcom and when Disney dumped Gina Carano from the streaming series The Mandalorian — and he says it was wrong for Disney to suspend Kimmel.

“I don’t like the concept — as someone who talks for a living — of any person in any creative industry losing their job for any one thing they say — Roseanne, Gina or Jimmy,” Travis tweeted last month. “I think we all lose in creative spaces that sometimes require pushing the speech envelope and taking risks when that standard is applied, right, left or independent politically.

“But you can’t only notice the issue when it happens to people on the same side of your own politics. Especially since the left created the cancel culture universe — which I’ve consistently opposed my entire career — and now is upset because they are being held to the standards they created…

“This will probably make me the only person on social media to defend Roseanne, Gina and Jimmy. As someone who people have tried to cancel more than almost anyone in media for having ‘unpopular’ opinions, I’m proud of that.

“If your principle shifts based on who has power, you actually have no principles.”

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Mr. Travis and Mr. Sexton are scheduled to appear together tomorrow afternoon during the 2025 Paradigm Shift Summit in Nashville. And Buck Sexton is set to join our rollicking Whiskey Bar roundtable.

Look for highlights from tomorrow’s sessions during Friday’s 5 Bullets.