NVDA Comes to D.C.

![]() Mr. Huang Goes to Washington

Mr. Huang Goes to Washington

Nvidia is doing something today that it’s never done before.

Nvidia is doing something today that it’s never done before.

Today begins another one of the company’s GTC events. GTC is short for “GPU Technology Conference” — focusing on the graphics processing units that are Nvidia’s bread-and-butter.

Sounds humdrum unless you’re a tech geek — but this event, first held in 2009, has come to be known as the “Super Bowl of AI.”

“Nvidia’s GTC has grown from a niche developer conference to the premier global stage for artificial intelligence and computing innovation,” says the Perplexity AI engine — “influencing trends and technology strategies across diverse industries.”

This week, for the first time, GTC is being held in the nation’s capital — “signaling how central Washington has become to the chip giant’s ambitions,” says the Axios site.

This week, for the first time, GTC is being held in the nation’s capital — “signaling how central Washington has become to the chip giant’s ambitions,” says the Axios site.

The main event is still held each year in San Jose. But this auxiliary conference at the Walter E. Washington Convention Center “showcases Nvidia’s deepening ties with the federal government…

“The impact of AI on the workforce is top-of-mind for politicians in Washington, whose constituents worry about job displacement.”

With that in mind, Nvidia CEO Jensen Huang will announce a “Task Force on AI and the Future of Work” — made up of people from industry, academia and government. It will deliver a final report a year from now.

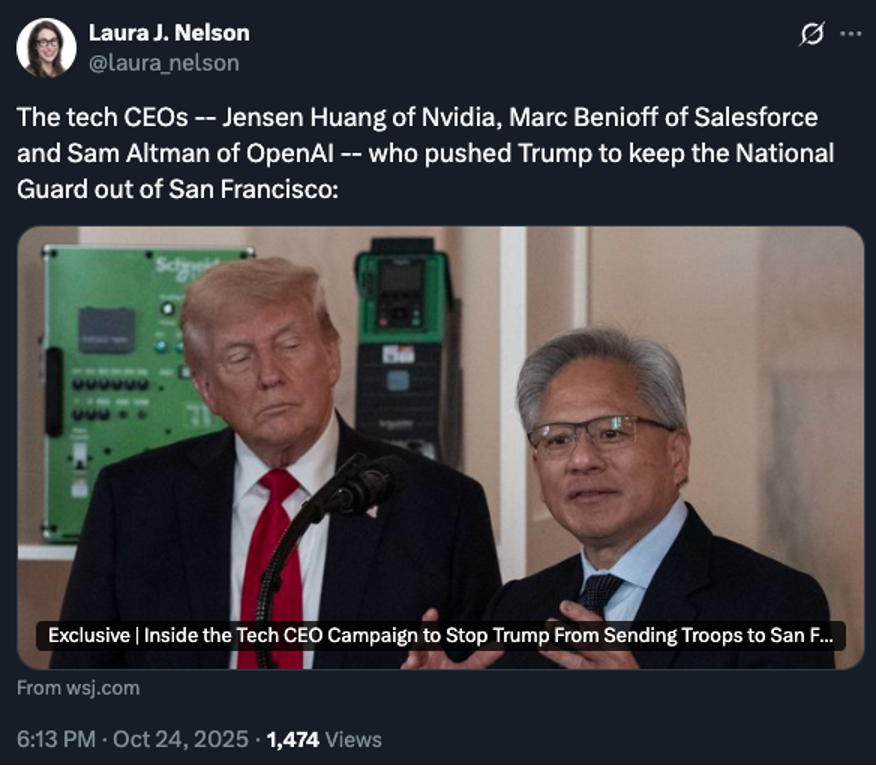

Not mentioned in the Axios story is the relationship Huang personally is forging with the Trump administration — which surely looms even larger than the job issue.

Not mentioned in the Axios story is the relationship Huang personally is forging with the Trump administration — which surely looms even larger than the job issue.

In July, Donald Trump said in a speech that he returned to office this year with a mind to break up Nvidia.

“I figured we could go in, and we could sort of break them up a little bit, get them a little competition, and I found out it’s not easy in that business … Then I got to know Jensen, and now I see why.”

Huang was in the audience. Trump asked him to stand up.

That same month, Huang made the case to Trump to allow the company to resume sales of AI chips to China — arguing that limits on Nvidia’s chip exports would harm U.S. tech leadership and ultimately boost Chinese competitors. Trump eventually agreed to lift those limits — on the condition that the U.S. government collect a 15% cut of the sales.

The relationship is strong enough now that according to The Wall Street Journal, Huang helped persuade the president last week to change his mind about deploying troops to San Francisco.

Every GTC event features a keynote address by Huang — who, as we mentioned last year, has achieved a rock-star status akin to that of the late Steve Jobs.

Every GTC event features a keynote address by Huang — who, as we mentioned last year, has achieved a rock-star status akin to that of the late Steve Jobs.

Axios is very proud of getting a “sneak peek” at Huang’s keynote, set for tomorrow at noon EDT.

"AI is the most transformative technology in human history — and the race is on," he will say.

"GTC D.C. brings together researchers, developers, business leaders and policymakers in the heart of our nation's capital to explore breakthroughs in AI, robotics, life sciences, energy, quantum and 6G — advancing innovations vital to America's technological leadership."

Scintillating, huh?

Well, we didn’t expect Nvidia would release the good stuff to Axios ahead of time. And the good stuff could prove to be enormously lucrative, says Paradigm’s AI authority James Altucher.

“I predict Huang is about to announce Nvidia’s next buyout target,” James tells us.

“Since 2008, Nvidia has acquired 25 companies. And just days before some of their biggest buyouts, this AI system flagged something called a ‘blue spike.’

“Well, a brand-new blue spike has just been detected. Which means it’s time to move.”

Profit potential? Previous blue spikes have preceded money-multiplying gains of 25X… 52X… even 72X in only six days.

Altucher’s True Alpha readers have already made their move ahead of tomorrow’s address. It’s still not too late for you to do likewise. Click here and James will show you how to take advantage of “a potentially life-changing opportunity.”

![]() The “Imminent China Deal” Rally

The “Imminent China Deal” Rally

“The S&P 500 rises almost 1% as hopes of a U.S.-China trade deal lifted the riskier corners of the market,” says a Bloomberg alert on your editor’s iPad.

“The S&P 500 rises almost 1% as hopes of a U.S.-China trade deal lifted the riskier corners of the market,” says a Bloomberg alert on your editor’s iPad.

“Dow opens 300 points higher on potential China trade truce,” CNBC concurs. Everyone got the memo.

Donald Trump has embarked on the first Asian visit of his second term as president. He’ll meet on Thursday in South Korea with China’s President Xi Jinping.

Yesterday, U.S. and Chinese negotiators meeting in Malaysia came to terms on what Treasury Secretary Scott Bessent calls “a substantial framework for the two leaders.” He added, “The tariffs will be averted.”

And that’s not all. Bessent promised a final deal on the sale of TikTok to U.S. investors… along with progress on everything from fentanyl to U.S. soybeans to those all-important Chinese rare earths.

As you’ll recall, Beijing expanded its export controls on rare earth elements earlier this month — prompting Trump to threaten 100% tariffs on U.S. imports from China. On the Sunday talk-show circuit yesterday, Bessent said the Chinese government will “delay that for a year while they re-examine it.”

Just one thing, though: There’s no such level of detail in the statements from Chinese officials, or news coverage in Chinese state media.

Just one thing, though: There’s no such level of detail in the statements from Chinese officials, or news coverage in Chinese state media.

A statement from the government says both negotiating teams “reached a basic consensus on arrangements to address their respective concerns” and that “both sides agreed to further finalize specific details.”

That glaring lack of specificity also showed up in the coverage on China’s English-language news channel, CGTN.

Watching the prepared statement from Beijing’s lead negotiator? It was like watching paint dry. And sound bites with Bessent were conspicuous by their absence.

All of which is to say there’s potential for stocks to take a spill between now and Thursday — if one side suddenly says the other has violated expectations.

All of which is to say there’s potential for stocks to take a spill between now and Thursday — if one side suddenly says the other has violated expectations.

But as noted above, that’s not the story today. The S&P 500 is sailing higher into record territory — up 0.9% at last check to 6,852. The Dow’s gain is weaker, the Nasdaq’s stronger.

“Every week of earnings season, the media screams how it is a big week for earnings. This week it’s actually true!” says Paradigm trading pro Enrique Abeyta on the Paradigm mobile app. “36% of S&P 500 companies and 45% (!) of market capitalization” will report this week.

That includes five of the “Magnificent 7” names. Google’s parent Alphabet, Microsoft and Meta report on Wednesday, Apple and Amazon on Thursday.

It seems the narrative about a U.S.-China deal is also the excuse for a big precious metals sell-off.

It seems the narrative about a U.S.-China deal is also the excuse for a big precious metals sell-off.

At last check, gold is down $132 on the day to $3,979. Silver’s gotten clobbered even worse, down $2.23 to $46.29.

But digital assets are hanging in there — Bitcoin approaching $115,000 and Ethereum at $4,161.

![]() Rickards on the Russian Oil Sanctions

Rickards on the Russian Oil Sanctions

“Will President Trump’s new sanctions on Russia’s two biggest oil producers make a difference for negotiations in the Ukraine war?” a reader writes Jim Rickards.

“Will President Trump’s new sanctions on Russia’s two biggest oil producers make a difference for negotiations in the Ukraine war?” a reader writes Jim Rickards.

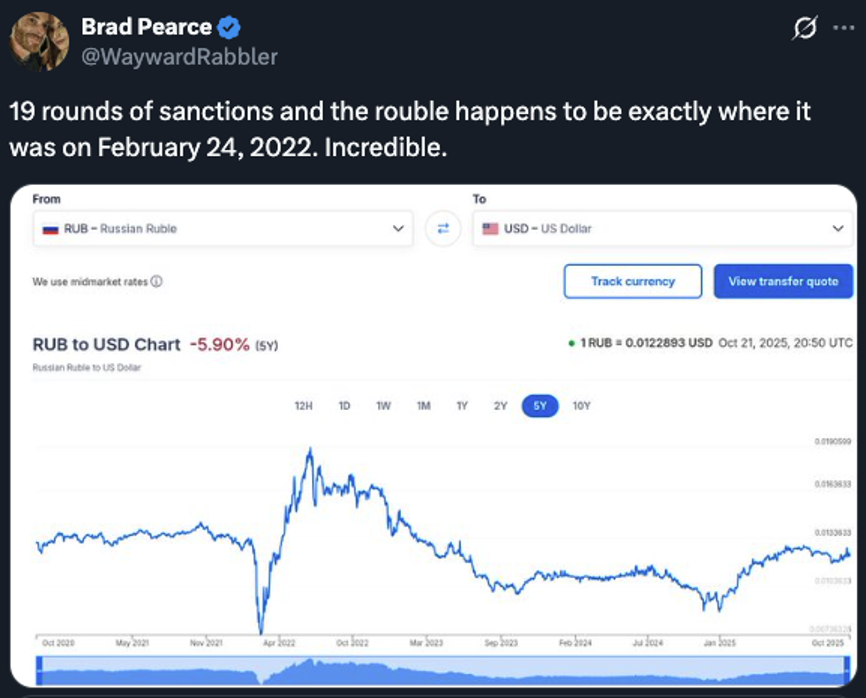

“No. Sanctions won’t work,” Jim replied Friday in his weekly Q-and-A email for Strategic Intelligence subscribers. “The Europeans have had 18 rounds of economic sanctions and none of them has worked. [That’s not stopping them from working on a 19th round, by the way.]

“The sanctions put on by the U.S. haven’t worked either.

“Russia got through the entire Cold War with almost no commerce with the United States. The fact is Russia has not missed a shipment of oil. All the oil that Europe doesn’t want to buy, they’re shipping to China and India. India’s running refineries. They’re buying Russian oil. China is selling refined product. China needs all the energy they can get.

“Nobody else is joining in the sanctions,” he goes on. “Brazil, China, India, Malaysia and many other countries, none of these countries has joined the sanctions. Russia’s not isolated. They might be isolated from France and Germany, and the U.S. to some extent, but not the rest of the world.

“And they have huge reserve positions [in Russia]. They were very smart. They put over 25% of the reserves in physical gold bullion, which you cannot seize or freeze. These reserve positions are being bolstered by the higher price of gold, and they have a ton of trading partners. So this will all fail, and why anyone in the White House thinks otherwise is a mystery to me.”

But there was the aforementioned Treasury Secretary Scott Bessent yesterday — insisting India and China will stop buying Russian oil. Maybe that will trip up the China trade talks this week?

In the meantime, crude is up modestly to start the week at $61.64.

Oh, and here’s one more facet of Russian resilience. Remember when Joe Biden said he’d reduced the ruble to rubble?

![]() Sign of the Times

Sign of the Times

File this one under “discouraging, yet also hopeful”...

File this one under “discouraging, yet also hopeful”...

![]() Mailbag: Debt and Extraction

Mailbag: Debt and Extraction

“Dave, you’re right to sound the alarm about our $38 trillion debt and the economy heading south,” writes one of our regulars after Friday’s edition.

“Dave, you’re right to sound the alarm about our $38 trillion debt and the economy heading south,” writes one of our regulars after Friday’s edition.

“The real story, however, isn’t fiscal irresponsibility — it’s systemic extraction.

“The assumption that politicians or the elites behind them are concerned about ballooning debt is the most incredible illusion of all. They’re not worried; they’re winning. The game isn’t about balancing budgets or saving the republic. It’s about siphoning as much as possible from the productive economy — taxpayers, savers, workers — into the hands of those who own and control the machinery of finance and government.

“Government is the perfect conduit. Trillions flow through it annually. Complaining about ‘spending’ misses the point — spending is the point. Extraction disguised as governance. The identical dynamic drives Wall Street, private equity, real estate and even crime. The method differs, the motive doesn’t: Convert everything into owned assets, consolidate power and keep the public chasing slogans about prosperity and patriotism.

“No one in power is trying to ‘make America great.’ They’re busy making themselves untouchable. The game isn’t mismanaged — it’s rigged by design. Until we name that truth, headlines about debt are just theater.”

Dave responds: “Extraction” is an excellent word — one I’ve invoked a few times over the years, probably not often enough.

Nothing changes until the health-care cartel and the military-industrial complex are broken.

The Treasury’s final statement for fiscal year 2025 shows that spending by the Centers for Medicare and Medicaid Services totaled $2.485 trillion — up 11.8% from the previous year. Uncle Sam spends an astonishing 35.4% of the federal budget on health care. Fifteen years ago, it was “only” 25%.

Meanwhile, the “One Big Beautiful Bill Act” pushed Pentagon spending up $150 billion annually so that Donald Trump could boast about the first $1 trillion military budget.

The real military budget is much higher once you account for the intelligence budget, Homeland Security, nuclear weapons under the auspices of the Energy Department, veterans’ health care… and of course, the national-security state’s share of interest on the debt. In 2022, Quincy Institute analyst William Hartung said total military spending by that yardstick already exceeded $1.4 trillion.

And here’s a stunning new development: The International Monetary Fund projects America’s debt burden will exceed those of Italy and Greece by 2030.

And here’s a stunning new development: The International Monetary Fund projects America’s debt burden will exceed those of Italy and Greece by 2030.

From the Financial Times: “General government gross debt in the U.S. will rise by more than 20 percentage points from now to reach 143.4% of the country’s GDP by the final year of the decade, IMF forecasts show, exceeding previous records set after the pandemic.”

If you have a long memory, you’ll recall Italy and Greece were at the center of a crisis in European government debt from 2010–2012.

That’s where we’re going — and no one on either side of the aisle in Washington intends to do anything about it.

It’ll be great for precious metals, which happen to be on sale today. Take advantage.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets