The Bailout Buddy System

![]() The Bailout Buddy System

The Bailout Buddy System

When Treasury Secretary Scott Bessent approved U.S. support for Argentina’s collapsing peso, headlines framed it as confidence in “market reform.” But when you line up the actual events, the story gets much murkier.

When Treasury Secretary Scott Bessent approved U.S. support for Argentina’s collapsing peso, headlines framed it as confidence in “market reform.” But when you line up the actual events, the story gets much murkier.

Argentina’s crisis has been building all year — inflation above 30%, foreign reserves nearly gone and an IMF rescue from April that didn’t stick.

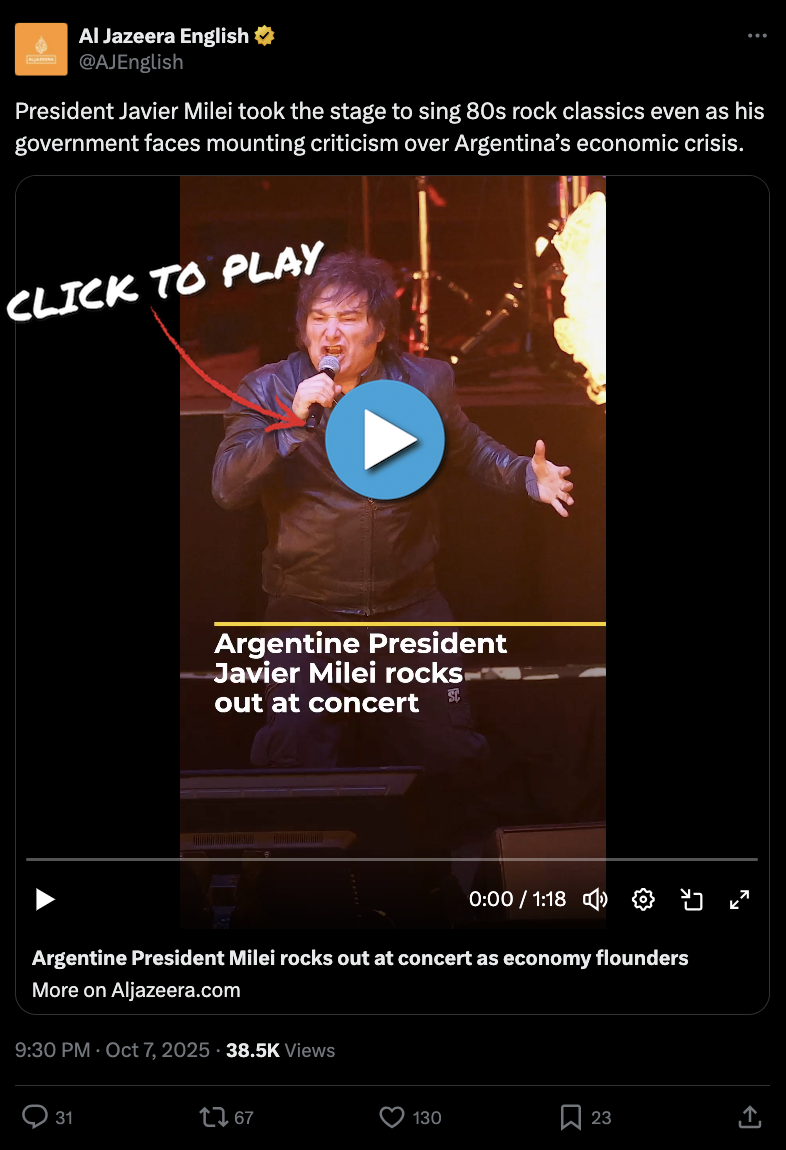

By early September, local elections in Buenos Aires province dealt President Javier Milei’s party a blow. Investors panicked, the peso plunged and capital fled the country. But that didn’t stop Milei from partying like it was 1989…

Everything about that hairdo just clicked into place…

Days later — on Oct. 9 — Bessent’s Treasury announced a $20 billion currency-swap deal with Argentina.

Using the Exchange Stabilization Fund, Washington provided dollar liquidity in exchange for pesos, hoping to halt the free fall. It marked the first time in decades that the U.S. directly intervened in an emerging-market currency.

Behind the scenes, Economy Minister Luis “Toto” Caputo — a former Wall Street trader who spent years at JPMorgan and Deutsche Bank before running Argentina’s central bank — helped broker the deal. Without him, the $20 billion rescue likely wouldn’t have happened.

That same week, reports surfaced that hedge-fund billionaire Rob Citrone — founder of Discovery Capital and Bessent’s longtime acquaintance from their Soros Fund Management days — had been buying Argentine debt at deep discounts.

That same week, reports surfaced that hedge-fund billionaire Rob Citrone — founder of Discovery Capital and Bessent’s longtime acquaintance from their Soros Fund Management days — had been buying Argentine debt at deep discounts.

Several media outlets report Citrone privately urged officials to support Milei’s reform agenda. There’s no proof of a direct quid pro quo, but the timing certainly raises eyebrows: Citrone was adding to his positions just before the Treasury stepped in.

Bessent defends the move as “strategic,” saying it would stabilize markets and counter Chinese influence in Latin America. Yet Argentina isn’t even among America’s top-25 trading partners. The deal instead exposes U.S. taxpayers to currency risk with little visible gain.

Critics from both parties have piled on. Sen. Chuck Grassley calls it a betrayal of “America First,” while Democrats accuse the administration of finding billions for foreign bailouts even as U.S. families battle inflation.

Then on Tuesday, President Trump welcomed Milei to the White House — a symbolic show of support with strings attached.

Then on Tuesday, President Trump welcomed Milei to the White House — a symbolic show of support with strings attached.

“The election is coming up very soon,” Trump told reporters. “Our approvals are somewhat subject to who wins.” If Milei’s party loses the midterms, he added, “we won’t waste our time.”

Markets wobbled as investors absorbed Trump’s message. What began as a financial rescue now looks like political leverage.

In the end, this isn’t about reform or diplomacy. It’s about who takes the risk and who gets rescued. In other words, taxpayers carry the downside. Insiders enjoy the upside.

Bill Bonner calls it the “corruption cycle” — the slide from rule of law to “rule of men,” where the well-connected grow richer by steering the system. The Caputo-Bessent-Citrone chain fits that pattern perfectly.

And while Argentina may seem distant, the precedent isn’t. Every time Washington props up a foreign currency with your tax dollars, it normalizes bailouts.

![]() Is the Rally Running a Fever?

Is the Rally Running a Fever?

The stock market wobbled last week after Trump threatened steep new tariffs on China. Stocks fell hard Friday — the biggest one-day drop since April’s “Liberation Day” sell-off — before bouncing back when Trump downplayed tension via social media.

The stock market wobbled last week after Trump threatened steep new tariffs on China. Stocks fell hard Friday — the biggest one-day drop since April’s “Liberation Day” sell-off — before bouncing back when Trump downplayed tension via social media.

Paradigm’s trading pro Enrique Abeyta says investors shouldn’t obsess over every tweet, but the episode raises a deeper question: “If one post can rattle the market, how strong is this rally really?”

He points to several cracks beneath the surface. First, the McClellan Summation Index — a measure of market breadth — has been drifting lower even as major indexes set new highs. “That means fewer stocks are doing the heavy lifting,” Enrique says.

Quality stocks are also lagging. Enrique notes that the S&P Quality ETF has underperformed the broader market over the past month — a sign investors are speculating instead of following fundamentals.

Among small-cap stocks, only 57% of Russell 2000 companies are profitable. “Since April’s lows,” he says, “the profitable group has gained 22%, while the unprofitable stocks have surged 53%.”

Enrique’s takeaway: “This kind of narrow, speculative rally can keep going for a while,” Enrique says, “but it rarely ends well.”

He’s not sounding the alarm yet — just a warning. “Stay disciplined,” he adds. “In the end, it’s not about how much you make, it’s how much you keep.”

Taking a look at stocks today, the three major indexes are in the green. The tech-heavy Nasdaq is faring best (+0.40%) to 22,775. At the same time, the S&P 500 is up 0.25% to 6,685 while the Big Board is up 0.15% to 46,315.

Taking a look at stocks today, the three major indexes are in the green. The tech-heavy Nasdaq is faring best (+0.40%) to 22,775. At the same time, the S&P 500 is up 0.25% to 6,685 while the Big Board is up 0.15% to 46,315.

As for commodities, crude is up 0.30% to $58.45 for a barrel of WTI. Precious metals continue rocking: Gold is up 2% to $4,285.20 per ounce, and silver is up 3.70% to $53.25.

And we have a couple economic numbers to report today…

- Mid-Atlantic manufacturing: The closely watched Philly Fed index plunged to -12.8 in October — a collapse of 36 points from September’s 23.2 — and seriously below the consensus forecast of 8.6. Any reading below zero signals contraction in the region; it’s the lowest reading since April

- Homebuilder sentiment: The National Association of Home Builders/Wells Fargo index rose to 37 in October, up from 32 in September and beating forecasts for 33. All three components — current single-family sales, future sales expectations and prospective buyer traffic — improved. Still, readings remain below the 50 mark that signals optimism. NAHB Chair Buddy Hughes says mortgage rates slipping toward 6.3% have helped, but “most home buyers are still on the sidelines, waiting for rates to move lower.”

Finally, at the time of writing, crypto is cratering. Bitcoin’s down 1.20%, just under $110K, and Ethereum’s down 0.45%, just under $4K.

![]() “True Supply Chain Security”

“True Supply Chain Security”

At the recent London Metal Exchange seminar, Trafigura CEO Richard Holtum delivered a provocative thesis: “Mining is not critical. Processing is.”

At the recent London Metal Exchange seminar, Trafigura CEO Richard Holtum delivered a provocative thesis: “Mining is not critical. Processing is.”

Holtum’s warning was aimed squarely at the West. “We’re fighting the wrong battle,” he says, arguing that governments obsess over new mining permits while China and Indonesia dominate the midstream — the refining and processing steps that turn ore into usable metals.

“True supply chain security,” he adds, “comes from processing investment, not just extraction.”

The numbers bear him out. According to the International Energy Agency, China refines more than 65% of global copper, over 70% of lithium and more than 90% of rare earth elements. Those percentages reveal real leverage — in the smelters, chemical plants and cathode facilities that sit between mine and market.

Meanwhile, rival energy-and-commodties company Mercuria has shown where profits are flowing. Its metals division has booked about $300 million in 2025 profits, driven by copper arbitrage trades, opportunistic imports of refined cathodes into U.S. ports and a 150-person expansion under former Trafigura executive Kostas Bintas.

Holtum’s message reframes the critical-minerals debate: Owning the mine is no longer enough. Without its own refineries, smelters and chemical plants, the West’s so-called “energy independence” could end up powered by someone else’s infrastructure.

![]() The Flat Tax Revolution

The Flat Tax Revolution

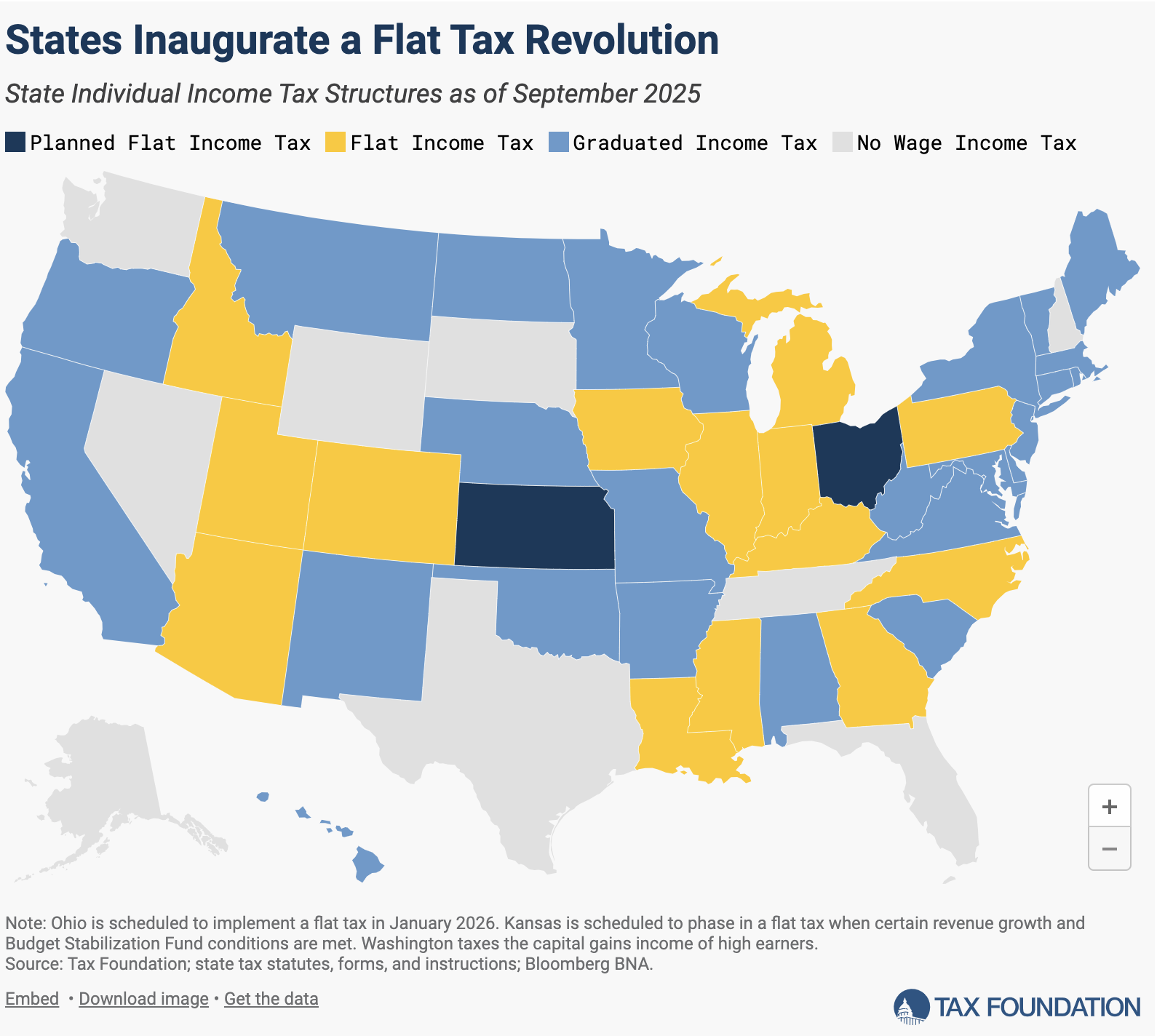

From 2021–2025, more states switched to a “one-rate fits all” income tax system than in the entire prior century of tax reform.

From 2021–2025, more states switched to a “one-rate fits all” income tax system than in the entire prior century of tax reform.

Between July 2021 and June 2025, eight states enacted laws to move from graduated income taxes toward flat rates, with six already in effect and two (Kansas and Ohio) scheduled for future rollout.

Arizona led the charge in July 2021. Iowa followed in March 2022; Mississippi and Georgia in April 2022; Idaho in September 2022; Louisiana in December 2024; and Kansas and Ohio adopted their laws in April and June 2025, respectively.

Ohio’s flat rate of 2.75% begins January 2026, while Kansas will phase in a 4% rate when revenue and reserve thresholds are met.

Currently, 14 states use a single rate on individual income, and nine states levy no individual income tax on wage income at all. Most states still use multiple tax brackets.

But proponents argue flat taxes bring revenue clarity, discourage politically driven bracket tinkering and even match people’s intuitive sense of (more) fair taxation.

“A major element of the tax reform debate is the desire for a more simple tax system,” the Tax Foundation finds, “and the reduced compliance costs that will accompany greater simplicity.”

Here’s hoping these eight states dare others to abandon complexity and embrace transparency.

![]() Peak Foliage, Peak Frustration

Peak Foliage, Peak Frustration

Every year, excited visitors descend on Vermont’s countryside, brimming with hopes of witnessing the riotous colors of maples and birches.

Every year, excited visitors descend on Vermont’s countryside, brimming with hopes of witnessing the riotous colors of maples and birches.

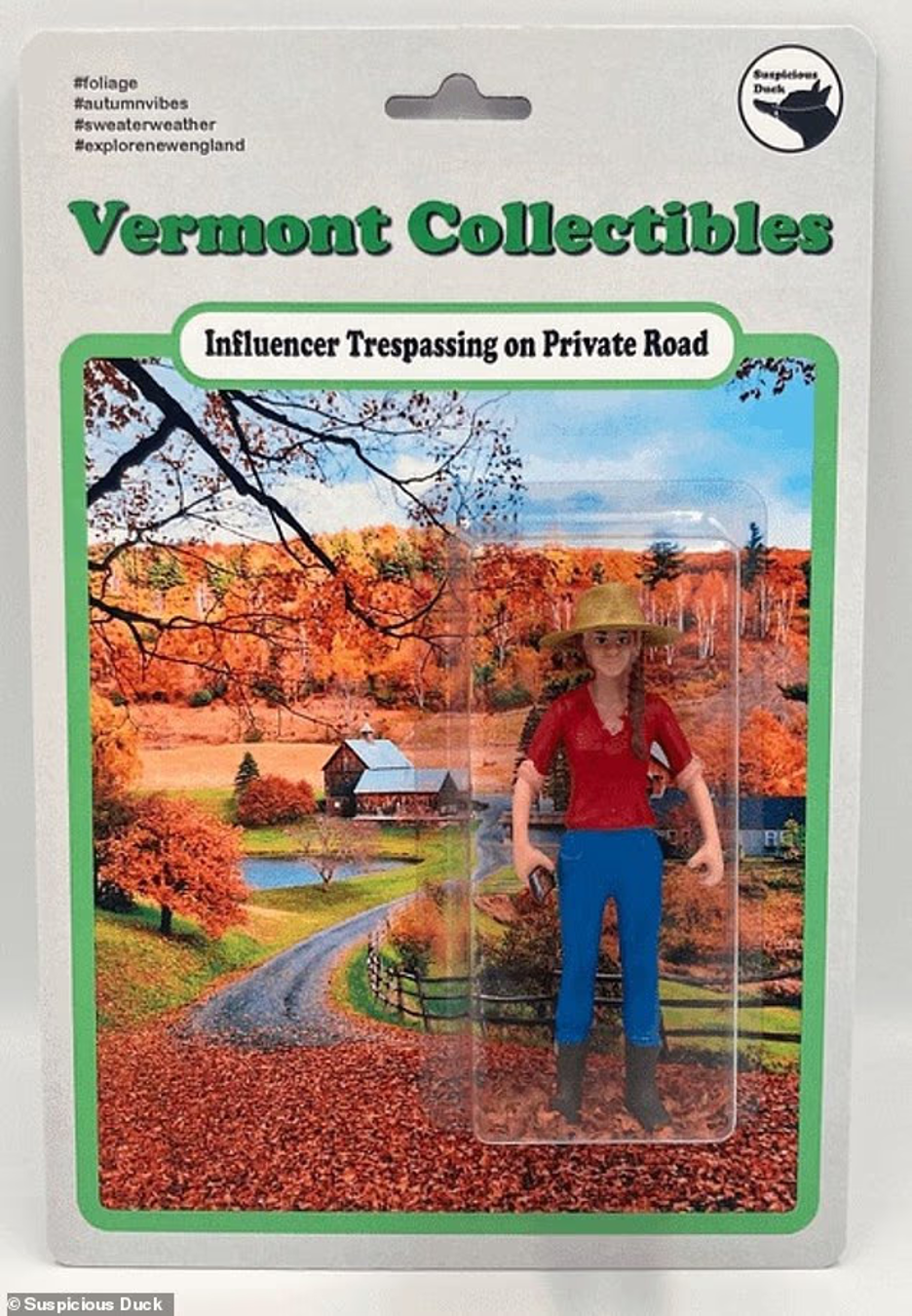

At first, it seemed harmless. Then the selfie-obsessed influencers rolled in — blocking narrow roads, wandering into driveways, clogging scenic spots — and suddenly it felt like leaf season ushered in traffic jams, not serenity.

In response, residents in some towns have voted to close scenic backroads during peak weeks — rural roads that often lead to farms already being overrun. The message: Cars stay out, viewers stay back.

One Vermont artisan is even making cheeky action figures, mocking influencers and donating part of his proceeds to help pay sheriff’s deputies to staff road closures.

Source: suspiciousduckvt.com

But here’s the thing: New England’s economy depends on this beautiful chaos. The U.S. Forest Service estimates that foliage tourism generates about $8 billion in the region each year. So even as locals gripe about clogged dirt roads and trespassers, tourist dollars keep small towns alive.

It’s a fine line. Close too many roads and you risk choking off the very lifeblood of local businesses. Leave them open and you’ll be waving traffic around your mailbox until Thanksgiving.

This fall? Leaf peepers might get the breathtaking views — but locals hope they get the message, too.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets

P.S. Congratulations to James Altucher’s True Alpha subscribers who bagged a 562% gain yesterday on a quantum computing play — on top of a 587% win booked last week! That’s two 500%-plus hits in just nine days, thanks to James’ Blue Spike signal nailing that setup… You’ll be among the first to know when James’ service opens to new subscribers.