Government Creeps

![]() Government Creep: In Real-Time

Government Creep: In Real-Time

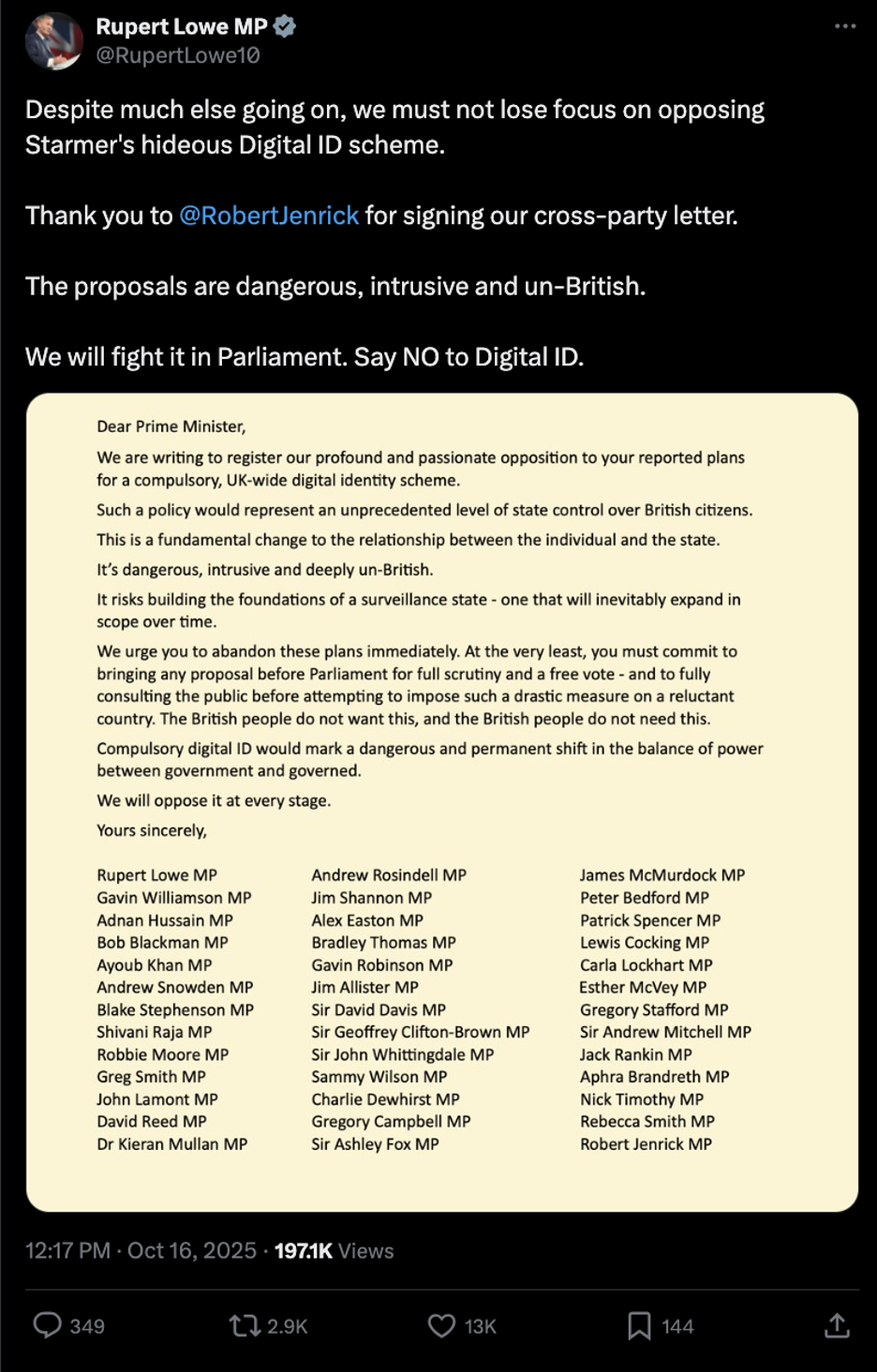

Britain quietly launched its digital ID scheme today, using 1.8 million veterans as the first test group. The new “smartphone-based veteran card” is the pilot for a national system meant to replace physical IDs — part of a plan Labour leader Keir Starmer wants to make standard for all adults in the U.K.

Britain quietly launched its digital ID scheme today, using 1.8 million veterans as the first test group. The new “smartphone-based veteran card” is the pilot for a national system meant to replace physical IDs — part of a plan Labour leader Keir Starmer wants to make standard for all adults in the U.K.

In fact, by 2027, the government plans to move most official credentials — from driver’s licences to background checks — into the Gov.uk One Login app.

Officials say it’s about “reducing red tape,” but critics warn it’s the first step toward a centralized ID system Britain has resisted since Tony Blair’s administration. And still resisting…

Plus, a 2.9 million-signature petition opposes the rollout as civil liberties advocates warn it could morph into a digital tracking tool. Meanwhile, many veterans are bristling at being used as “guinea pigs” for this scheme.

“But the technology secretary, Liz Kendall, this week complained of ‘scaremongering,’” The Guardian reports, “and said digital IDs would not be used to track citizens and ‘there will be no pooling of people’s private information into a single, central dataset.’”

Although government ministers insist the program is voluntary, a digital ID will be mandatory to prove the “right to work” by the end of the current parliament (no later than 2029).

“Privacy is on the ropes,” warns Paradigm’s geopolitics authority Jim Rickards. “And governments are working [to] make sure that we have no privacy at all.”

“Privacy is on the ropes,” warns Paradigm’s geopolitics authority Jim Rickards. “And governments are working [to] make sure that we have no privacy at all.”

What once sounded like dystopian fiction, Jim says, is now public policy, unfolding step by step under the banner of convenience, security or crisis management.

Jim points to one glaring Trojan horse — central bank digital currencies (CBDCs). Governments claim they will make payments faster and cheaper, but “that’s just a facade for the real purpose,” he says.

Once every transaction is logged in a centralized system, “they will know how you spend your money — what books you buy, what charities you support, what candidates you donate to.” With AI monitoring spending patterns, Jim says it becomes easy to “profile you and determine if you are an ‘enemy of the people.’”

He also points to the Quiet Skies program, which “was supposed to be an anti-terrorist watch list.” But under Biden’s administration, Jim says, “it morphed into a way to punish political enemies by putting them on watch lists even though there was no indication of any terrorist activity.”

And then there’s the abuse of state of emergency declarations. “Some emergencies are real,” Jim concedes, “but others are invented to give politicians an excuse to intervene in markets.” Declaring an “energy emergency” could allow officials to impose price controls — something that’s on the agenda in New Jersey, for instance.

“Emergencies are being declared,” Jim cautions, “to give unwarranted power to politicians.”

Together, these systems form what Jim calls “the architecture of total surveillance” — one that can easily be turned against dissenters or anyone who resists official narratives.

Together, these systems form what Jim calls “the architecture of total surveillance” — one that can easily be turned against dissenters or anyone who resists official narratives.

While Jim stresses that escaping the digital dragnet completely “is not possible,” you can make yourself harder to track:

- Use cash. “It’s one way out of digital tracking”

- Use Faraday sacks. They block GPS and cell signals from your phone and laptop

- Drive old cars. “New cars are loaded with digital signaling devices,” Jim notes

- Avoid interstate highways. They’re “lined with toll cameras and surveillance checkpoints”

- Reduce license plate exposure. Cover or remove your front plate where legal

- Reject cookies, limit apps and skip ride-sharing. The fewer digital footprints, the better.

Each step, Jim says, “makes it harder for the AI [surveillance] systems to complete your profile…

“This is not a new state of affairs,” he adds. “Governments have always wanted to control the opinions of their citizens and the availability of information to the public. Total surveillance at all times seems to be the short-term goal,” he observes. “Enslavement to the government’s wishes is the end game.

“The First Amendment to the U.S. Constitution is intended to prevent this abuse but the fact that the amendment was considered necessary shows that the censorship impulse was not far below the surface even in the early days of the United States.

“The key for individuals is to explore ways to preserve privacy and avoid the government net,” Jim concludes. “That may be one of the most important crisis survival techniques in the years ahead.”

![]() Bank Crises Are Like “Cockroaches”

Bank Crises Are Like “Cockroaches”

After the collapses of private auto parts companies First Brands Group and Tricolor Holdings, banks are now admitting losses tied to loan fraud.

After the collapses of private auto parts companies First Brands Group and Tricolor Holdings, banks are now admitting losses tied to loan fraud.

Regional bank Zions Bancorp disclosed it will take a $50 million charge-off linked to two commercial loans that now appear fraudulent. Meanwhile, Western Alliance Bancorp said it has filed suit against a borrower it accuses of fraud.

On the surface, tens of millions may sound small in banking terms; yet shares of regional banks plunged across the board on Thursday. As one risk analyst puts it, investors in financial stocks “sell first and ask questions later.”

Even Jamie Dimon — the billionaire CEO of the notoriously bulletproof JPMorgan Chase — felt the need to sound the alarm. “When you see one cockroach, there are probably more,” he warns after revealing JPM’s $170 million hit tied to Tricolor Holdings.

This all feels familiar, no? It echoes the unraveling of FTX, Sam Bankman-Fried’s crypto empire that collapsed in November 2022. Within months, a string of California-based banks — Silvergate Bank, Silicon Valley Bank and First Republic — fell in rapid succession between March–May 2023.

While a full-blown crisis isn’t guaranteed, even a small shock can ripple through markets.

![]() The Case for More Gold Gains

The Case for More Gold Gains

Gold’s historic rally has caught even seasoned investors off guard, but the precious metal may still have plenty of room to run.

Gold’s historic rally has caught even seasoned investors off guard, but the precious metal may still have plenty of room to run.

According to Evy Hambro, global head of Thematic and Sector Investing at BlackRock, gold’s rise above $4,200 per ounce doesn’t mean it’s overpriced — and mining equities might offer even more upside.

“Are gold companies earning a lot of money right now? Absolutely,” Hambro says. “The margins are as fantastic as I've ever seen in my career.” He acknowledges that miners may be “overearning” in the short term, but that doesn’t mean gold itself is overvalued.

To determine that, Hambro urges investors to look at gold’s purchasing power over time. “You can buy more low-value goods with gold today than you could in the past, but you can buy less Manhattan property,” he explains. “So gold has preserved its purchasing power for some items, not for all.”

Hambro stresses that momentum matters…

“The trend is probably your friend in this environment,” he says, noting that currency skepticism could keep driving gold higher. If the world is truly “repricing paper currency relative to real assets,” Hambro believes the metal could still “go a lot higher.”

“The trend is probably your friend in this environment,” he says, noting that currency skepticism could keep driving gold higher. If the world is truly “repricing paper currency relative to real assets,” Hambro believes the metal could still “go a lot higher.”

What excites Hambro most is miners’ profitability. “At these prices, these companies are earning enormous margins — absolutely fabulous margins,” he says. Despite these stocks doubling this year, Hambro insists they’re still undervalued.

That’s because many analysts still model long-term gold prices at $2,200–2,400 per ounce, “a 50% discount to today’s futures curve.” If prices stay elevated for another year or two, Hambro adds, “these companies will way overearn relative to expectations.”

To Hambro, this is more than a passing boom. “What we’re in right now is probably bigger than a cycle,” he summarizes. “We’ve been overprinting paper currency since the 1950s. Eventually, you reach a tipping point — and maybe we’re seeing it now in real assets.”

Gold is pulling back today — down 1.15% to $4,256.50 per ounce. At the same time, the price of silver pulled back bigly: down 4.85% to $50.75.

Gold is pulling back today — down 1.15% to $4,256.50 per ounce. At the same time, the price of silver pulled back bigly: down 4.85% to $50.75.

But Mr. Market seems to be shaking off any bank-crisis concerns. The three major U.S. stock indexes are in the green with the DJIA up almost 200 points to 46,145. The S&P 500 (+0.30%) and tech-loving Nasdaq (+0.20%) are up to 6,645 and 22,610 respectively.

Oil, meanwhile, is struggling to stay in green territory. Crude is up 0.20% to $57.55 for a barrel of West Texas Intermediate.

Finally, the crypto market continues to slide. Bitcoin’s down 0.90% to $107,175, and Ethereum is down 0.85% to $3,835.

![]() INTC: Forged in Its Foundry

INTC: Forged in Its Foundry

“This week, Intel (INTC) achieved what I’ve been waiting for: Their 18A manufacturing process entered high-volume production at Fab 52 in Arizona,” says Paradigm’s science-and-tech investor Ray Blanco.

“This week, Intel (INTC) achieved what I’ve been waiting for: Their 18A manufacturing process entered high-volume production at Fab 52 in Arizona,” says Paradigm’s science-and-tech investor Ray Blanco.

“Intel’s 18A node represents 1.8 nanometer-class technology — the most advanced semiconductor manufacturing happening on American soil,” he says.

“It's the first process node in production anywhere that combines gate-all-around transistors with backside power delivery.

“These aren't incremental improvements. They're architectural changes that enable better performance and power efficiency.

“Panther Lake, Intel's first processor built on 18A, is shipping in Q4 2025,” adds Ray. “This chip will power next year's AI PCs.

“Even better, Intel manufactures 70% of the components in-house rather than outsourcing to Taiwan Semiconductor Manufacturing Co. Ltd (TSM). That significantly improves margins if execution holds.

“The foundry business remains the question mark. Intel needs external customers to justify the massive capital expenditure required for these advanced fabs,” says Ray.

“The foundry business remains the question mark. Intel needs external customers to justify the massive capital expenditure required for these advanced fabs,” says Ray.

“Microsoft (MSFT) and Amazon (AMZN) are confirmed customers. Talks with Advanced Micro Devices (AMD) continue. Nvidia has bought a stake, as has the U.S. government and SoftBank, the majority owner of ARM Holdings.

“But external revenue remains minimal so far. Intel's CFO admits ‘committed volume is not significant right now’ for 18A,” Ray says.

“Intel could struggle if the foundry business doesn't materialize. But the company is starting to show us that it can execute on advanced manufacturing.

“The bottom line: The 18A node hitting volume production, after years of delays on previous nodes, suggests the technical turnaround is finally materializing.

“As for the foundry business model,” Ray emphasizes, “it depends on winning customers.”

![]() Day 17 of Government Shutdown

Day 17 of Government Shutdown

Is this the bipartisan solution America’s been waiting for?

Is this the bipartisan solution America’s been waiting for?

Hard to say if this would count as discretionary spending or public service…

Take care, reader, and enjoy the weekend!

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets