Wall Street’s Check Engine Light

![]() Warning From the Auto Parts Aisle

Warning From the Auto Parts Aisle

Sometimes the most important financial warnings come from the less glamorous corners of the economy. That’s why the bankruptcy of privately held U.S. auto parts maker First Brands Group is more than just another corporate failure — it’s a flashing red light for investors.

Sometimes the most important financial warnings come from the less glamorous corners of the economy. That’s why the bankruptcy of privately held U.S. auto parts maker First Brands Group is more than just another corporate failure — it’s a flashing red light for investors.

First Brands filed for Chapter 11 bankruptcy this week, listing liabilities between $10–50 billion. The company, known for aftermarket staples like Fram filters, Trico wiper blades and Raybestos brakes, gorged on debt-fueled acquisitions in recent years. When credit markets were loose, that strategy worked. Once confidence evaporated, it unraveled fast.

Behind the headlines, the accounting looks shady. According to court filings and a statement from Charles Moore, First Brands’ new chief restructuring officer, investigators are probing “whether receivables may have been factored more than once” — meaning the same invoice could have been pledged multiple times to raise cash, Financial Times reports.

- This “double pledging” is a serious red flag, suggesting the company was essentially borrowing against phantom assets

- Moore also disclosed that inventory collateral may have been “commingled” across different loans — another troubling sign.

Put simply, lenders may not have clear claims to the assets they thought they owned. One creditor, SouthState Bank, even seized $27 million in what it called the “last remaining liquidity” of First Brands’ subsidiaries before the bankruptcy filing.

The result: a multibillion-dollar hole in Wall Street balance sheets, with creditors ranging from UBS-backed hedge funds to regional banks. More than a dozen affiliates tied to First Brands, including Carnaby Capital Holdings, also filed for bankruptcy.

Analysts at S&P Global warn: “We believe Carnaby was a material source of off-balance sheet financing that First Brands used to fund its working capital.”

This isn’t just sloppy management. It’s a collapse built on aggressive financial engineering — and it comes at a dangerous time for credit markets.

The timing of First Brands’ bankruptcy — on the heels of subprime auto lender Tricolor Holdings’ liquidation — has bond investors looking over their shoulders.

The timing of First Brands’ bankruptcy — on the heels of subprime auto lender Tricolor Holdings’ liquidation — has bond investors looking over their shoulders.

The corporate bond market is, by many measures, running hot. Investors are snapping up debt at record pace, even though the “spread” — the extra yield above Treasuries they receive for taking on risk — is at its lowest in decades.

For instance, the spread on investment-grade bonds recently hit just 0.74% point, the narrowest since 1998. That means investors are taking on more risk while getting paid less for it. For junk bonds? The spread hovers around 2.75 points, near pre-2008 levels.

This is exactly the type of environment where small shocks can cascade. With debt piling up in both public and private credit markets, it doesn’t take much to spark fear. (Barclays analysts compare today’s market to the Star Wars scene where Han Solo and Princess Leia are trapped in a garbage chute, “the walls compressing on all sides.”)

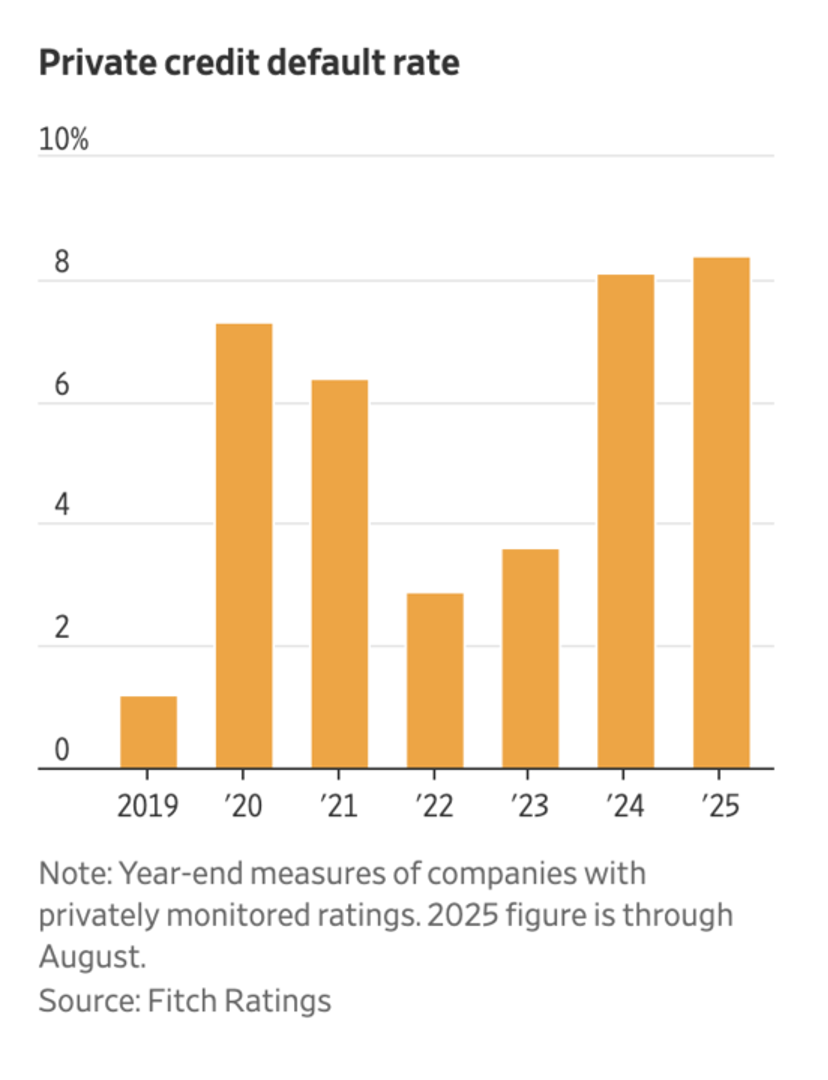

So far, defaults remain limited, but cracks are forming. More companies are paying creditors with IOUs instead of cash (so-called payment-in-kind, or PIK, loans), defaults in private credit are ticking higher and sudden bankruptcies like Tricolor and First Brands are rattling confidence.

Source: Fitch Ratings, WSJ

Consider the scale: Private credit — lending that happens outside traditional banks — has ballooned to nearly $2 trillion, up from almost zero a decade ago. Private equity firms, which rely heavily on corporate bonds and private credit to fund buyouts, are sitting on another $4 trillion-plus in assets worldwide.

When this much money is tied up in debt-heavy deals, even a small shock can ripple through markets.

Paradigm’s market analyst Dan Amoss warns of this exact dynamic: a market held together by confidence, but vulnerable to a single spark. “The match to light the fuse on this generation’s version of financial engineering is very hard to identify in advance,” he says.

Paradigm’s market analyst Dan Amoss warns of this exact dynamic: a market held together by confidence, but vulnerable to a single spark. “The match to light the fuse on this generation’s version of financial engineering is very hard to identify in advance,” he says.

“Example: In 2008, the match with Lehman Bros. was the pressure to refinance many questionable assets on its balance sheet overnight in the commercial paper markets” — short-term, unsecured debt that companies issue to cover expenses.

“When commercial paper investors finally realized they didn’t want to be a bagholder of overmarked Lehman collateral, from there it was a desperate call to Bernanke and Hank Paulson… And it was all over.”

But Dan — who, by the way, recommended put options on Lehman Bros. in the summer of 2008 for 462% gains — argues that today’s “fuse” is likely in the private equity (PE) and private credit markets.

The real test will come, he says, “when the pension-endowment-high net worth clients who ultimately funded the private equity ecosystem finally ask tougher questions.”

But because institutional capital is “so bureaucratic and consensus-driven,” the adjustment may take time — leaving a window where risk builds unseen.

First Brands may be just one company, but its collapse — built on mountains of debt and questionable accounting — is a warning shot.

For years, cheap money papered over risks in corporate debt. Now with interest rates still elevated and defaults ticking higher, those risks are coming due. Investors who think today’s bond market is “safe” may want to think again.

As Dan reminds, the system always looks stable — until it doesn’t. And when the fuse is finally lit, the explosion will not be contained to a single company’s balance sheet.

![]() Labor Market Loses Steam

Labor Market Loses Steam

In light of the government shutdown — meaning, no official jobs report on Friday — the ADP private payroll number is taking on outsized significance.

In light of the government shutdown — meaning, no official jobs report on Friday — the ADP private payroll number is taking on outsized significance.

U.S. private employers shed 32,000 jobs in September, totally contrary to economists’ expectation of a 51,000 gain. August figures were also revised downward to a loss of 3,000 jobs from an initially reported 54,000 gain.

Most weakness was concentrated in small- and medium-sized firms, while large companies (500+ employees) actually added 33,000 jobs. Service industry jobs lost 28,000 positions, with notable declines in leisure, hospitality and business services.

Pay growth also cooled: Job-changers saw annual wage gains slow to 6.6% from 7.1% in August, while job-stayers’ pay growth remained steady at 4.5% year-over-year.

The ISM Manufacturing PMI inched up to 49.1 in September, a touch above expectations (49.0) and August’s 48.7. Any reading below 50 still signals contraction, making this the seventh-straight month of decline for the sector.

The slight improvement was driven mainly by stronger production, which rose 3.2 points. But that strength was undercut by sharp drops in both new orders and inventories, suggesting weak demand.

Manufacturing employment, meanwhile, improved modestly to 45.3 from 43.8, while input prices eased to 61.9 from 63.7, indicating some relief on the cost side.

Takeaway: The ADP report shows hiring is stalling, and the ISM data confirms factory output is still shrinking. Put together, it’s a clear sign the job market is cooling and U.S. manufacturing hasn’t found its footing.

Taking a look at the stock market today, the three major U.S. indexes are in the green — government shutdown be damned.

Taking a look at the stock market today, the three major U.S. indexes are in the green — government shutdown be damned.

The tech-heavy Nasdaq is faring best, up 0.15% to 22,700. At the same time, the Dow and S&P 500 are neck and neck: both up about 0.10% to 46,450 and 6,695 respectively.

Crude, meanwhile, is slumping; a barrel of WTI is down 0.75%, priced just under $62. But gold is hitting a fresh high-water mark at $3,894.63 per ounce, and silver’s up almost 2% to $47.58. Next stop, $50?

Crypto, in sympathy with stocks, is in the green. Bitcoin’s up 3.10% to $117,790; Ethereum’s up 4.70% to $4,335.

![]() Trump Fights the Fed

Trump Fights the Fed

The legal battle over Federal Reserve Governor Lisa Cook is headed to the Supreme Court, and it’s shaping up to be a pivotal test of presidential authority.

The legal battle over Federal Reserve Governor Lisa Cook is headed to the Supreme Court, and it’s shaping up to be a pivotal test of presidential authority.

“Federal Reserve watchers may have thought the Lisa Cook fight was over when she appeared at the Fed meeting on Sept. 17 and voted with Chair Jay Powell in favor of an interest rate cut,” says Paradigm’s macro expert Jim Rickards. “Trump had fired her several weeks ago, but she claimed this was illegal and stayed in her position.”

Cook sued in federal court and won an order allowing her to remain at her post until the case is resolved. The appeals court agreed, but Trump has now petitioned the Supreme Court. At stake is whether the president can remove Fed officials for “cause” — and what qualifies as cause in the first place.

Trump argues Cook engaged in mortgage fraud by listing multiple properties as her “primary residence” on loan applications. “The statute allows Fed officials to be fired for cause,” Jim explains. “Trump claims he has cause because of alleged mortgage fraud… The lower courts held Cook’s action happened before her confirmation under the Biden administration and the Senate vote effectively cleansed the record.”

The broader constitutional issue looms even larger. “By pushing the Lisa Cook case, they may end up with a decision that says the president can fire any bureaucrat at any time for any reason,” Jim warns. “Trump’s legal enemies should be careful what they wish for.”

As Jim concludes: “I’ve hired and fired a lot of people in my career. Somehow, those decisions never made it to the Supreme Court. This one will.”

[This just in: The Supreme Court is allowing Cook to stay on the job while the court prepares to hear oral arguments in January.]

![]() JPMorgan’s Rotten Rolodex

JPMorgan’s Rotten Rolodex

Charlie Javice, founder of student-aid startup Frank, was sentenced Monday to just over seven years in prison for defrauding JPMorgan Chase in its $175 million acquisition of her company.

Charlie Javice, founder of student-aid startup Frank, was sentenced Monday to just over seven years in prison for defrauding JPMorgan Chase in its $175 million acquisition of her company.

Prosecutors showed Javice fabricated millions of fake customer accounts to make Frank look bigger than it was. In reality, the platform had fewer than 300,000 users. In court, Javice cried and begged forgiveness, saying she would “spend my entire life regretting these errors.”

Judge Alvin Hellerstein acknowledged her remorse but didn’t hold back. “I sentence people not because they’re bad, but because they do bad things,” he said, prosecution adding that JPMorgan had essentially bought a “crime scene.”

The real embarrassment, in other words, was JPMorgan’s. The bank rushed to close the deal without basic due diligence. Hellerstein’s and prosecution’s remarks underscored the sheer recklessness of a Wall Street giant that should have known better.

Of course, this isn’t JPM’s first run-in with the court system. Over the years, the bank’s been fined or censured for manipulating energy markets, failing to stop the Madoff Ponzi scheme, rigging foreign-exchange trades, misleading mortgage investors, servicing Jeffrey Epstein and enabling money laundering. The list goes on and on.

In chasing hot fintech deals, JPMorgan once again proved that it isn’t as smart — or as careful — as it purports to be. This time, it got played by a 30-something founder with a slide deck.

![]() Wireless Taxes: All Over the Map

Wireless Taxes: All Over the Map

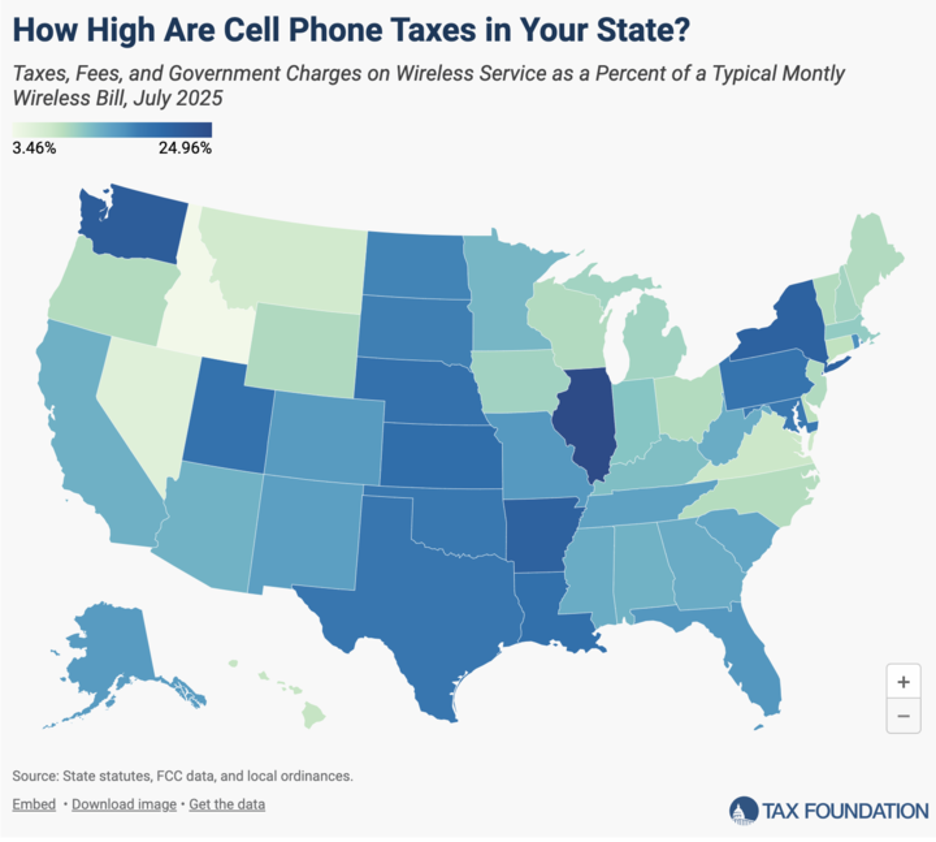

Wireless taxes in the United States have hit record highs in 2025, with average taxes, fees and surcharges amounting to 27.6% of a typical monthly cellphone bill — over $330 annually for a standard family plan.

Wireless taxes in the United States have hit record highs in 2025, with average taxes, fees and surcharges amounting to 27.6% of a typical monthly cellphone bill — over $330 annually for a standard family plan.

The state-by-state breakdown is, well, all over the map…

At almost 25%, Illinois tops the list of state tax rates. Washington, Nebraska, New York and Pennsylvania also levy state and local taxes far above the national average. Residents in Idaho, meanwhile, incur the lowest state-tax burden at just 3.46%.

Unlike general sales taxes, which apply to most goods and services, wireless taxes in at least 17 states are double the sales tax. Localities pile on even more, with cities like Chicago charging $5 per line per month, further hitting families with multiple lines

So the next time you inspect your cellphone bill, remember this: While your “talk and text” might be unlimited… taxes, fees and surcharges are unlimited too.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets