The Musk (Military) Industrial Complex

![]() SpaceX’s $2 Billion Windfall

SpaceX’s $2 Billion Windfall

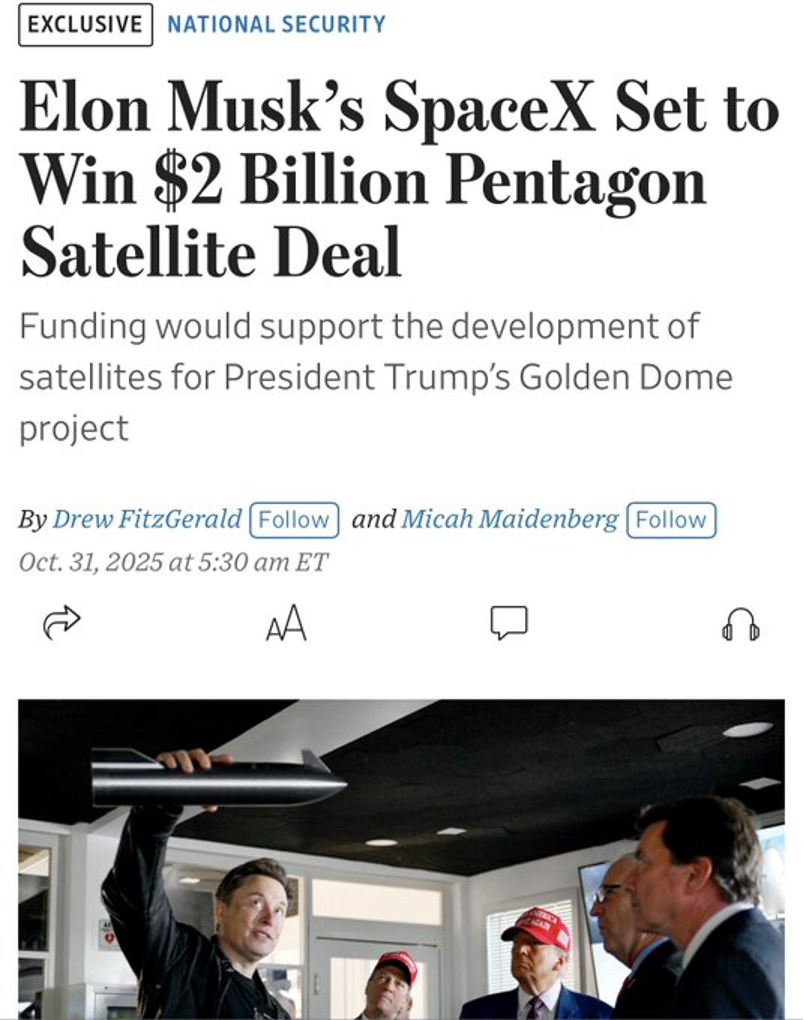

SpaceX is poised to receive about $2 billion to help build a new layer of America’s missile-tracking architecture.

SpaceX is poised to receive about $2 billion to help build a new layer of America’s missile-tracking architecture.

According to The Wall Street Journal, the funding — neatly folded into the “One Big Beautiful Bill” President Trump signed in July — is part of his “Golden Dome” missile-defense initiative.

Source: WSJ, X

The money wasn’t publicly linked to a contractor at the time, but unnamed WSJ sources say it will go to SpaceX to develop satellites that can detect and track missiles and aircraft in flight.

Golden Dome is envisioned as a complex network of satellites and other technologies capable of intercepting missiles before they hit their targets. The Pentagon hasn’t disclosed many details of how the shield would work and has yet to award most major contracts.

Here’s what we do know: The plan calls for as many as 600 satellites in what’s being described as an “air-moving target indicator” system. It’s one piece of a much larger project that Trump has said could cost $175 billion, though analysts believe the total could run much higher.

For SpaceX, the deal underscores how deeply the company has embedded itself in U.S. national security.

For SpaceX, the deal underscores how deeply the company has embedded itself in U.S. national security.

The Elon Musk-led private firm, best known for rocket launches and its Starlink internet network, has become an indispensable contractor for the Defense Department and the intelligence community.

Officials praise SpaceX’s ability to build and launch satellites quickly — an advantage in an era when the military wants to refresh orbital technology at commercial speed.

“What we’re relying on is industry to help us innovate by showing us the art of the possible — bringing ideas to us,” said U.S. Space Force (USSF) Gen. Chance Saltzman at an industry event last year.

SpaceX is also positioned to play a major role in two other Pentagon satellite constellations, WSJ reports.

One, called MILNET, is a planned low-Earth-orbit (LEO) satellite communications constellation intended to provide global communications for the U.S. military and intelligence community.

The other, known as the Ground Moving Target Indicator (GMTI) — being developed by the USSF together with the National Reconnaissance Office (NRO) — will enable satellites to track vehicles and ships from space.

SpaceX has now launched more than 10,000 Starlink satellites, by far the largest fleet ever assembled, and has built a record for mass-manufacturing satellites on tight timelines.

SpaceX has now launched more than 10,000 Starlink satellites, by far the largest fleet ever assembled, and has built a record for mass-manufacturing satellites on tight timelines.

That production capacity could prove crucial as the Trump administration pushes to get Golden Dome operational before the end of his term.

Not everyone is comfortable with SpaceX’s growing dominance. Lawmakers and defense officials have warned against “vendor lock,” where the government becomes overly dependent on a single supplier. “I don’t want to end up where we pick one company and we go down a path,” Sen. Rick Scott (R-FL) said recently.

The Defense Science Board made a similar point last year, noting that dependence on one firm can “negate the strengths of the market by stifling innovation and inflating prices.”

Musk’s erratic relationship with government agencies has also fueled caution. He’s publicly threatened to withdraw services, for instance, such as hinting at ending SpaceX’s Dragon spacecraft mission with NASA — a threat he later walked back.

Still, the government continues to rely on the company. As SpaceX President Gwynne Shotwell said at the end of an investor event last year: “The government will get what they need — just like always.”

The Pentagon says details of Golden Dome’s architecture remain under review. But if timelines hold, and funding flows as expected, the company could soon become the backbone of America’s next missile-detection system — an arrangement that would cement SpaceX as a central pillar of U.S. defense.

[BREAKING: One ticker symbol lets you grab a pre-IPO stake in Elon Musk’s biggest, most ambitious project of his lifetime: SpaceX.

When you consider…

➔ First, Elon bet it all on PayPal and made millions...

➔ Then he bet it all on Tesla and made billions...

➔ Now, with the help of SpaceX, he’s set to make trillions…

This is one of the only chances you’ll ever have to own a pre-IPO stake in an Elon Musk company — before it goes public.

There’s no paywall. No subscription. No credit card required to get this ticker symbol.

I urge you: Watch the video and get the ticker now… Before this presentation goes offline!]

![]() The Return of Money-Printing

The Return of Money-Printing

The Fed did exactly what Jim Rickards expected — it cut the target range for the federal funds rate by 0.25% to 4.00%.

The Fed did exactly what Jim Rickards expected — it cut the target range for the federal funds rate by 0.25% to 4.00%.

“The rate cut was widely expected,” Jim says. “The Fed does not like to produce surprises if they can possibly avoid it.”

The vote was 10–2, but what made it unusual was the split. One dissenter wanted a larger cut; another wanted none at all. “Opposite dissents inside the FOMC,” Jim notes, “are a clear sign that Jay Powell is losing his grip on the committee.”

In his press conference, Fed chair Jay Powell leaned heavily toward the employment side of the Fed’s dual mandate. “Conditions in the labor market appear to be gradually cooling,” Powell emphasized. “Job gains have slowed significantly since earlier in the year.”

Jim interprets this as signalling the Fed’s focus. “The Fed is clearly more concerned about rising unemployment than lingering inflation,” he says. “That tells you which way policy is headed.”

With unemployment creeping higher — and private payroll data already showing job losses — Powell’s balancing act is breaking down. The Fed is choosing to fight job losses now and hope inflation cooperates later.

“Expect another cut before year-end,” Jim forecasts. “The Fed is following the markets, not leading them — and that’s never good news for investors.”

This meeting went beyond the headline cut, Jim adds. The Fed also ended quantitative tightening (QT) — a quiet but powerful shift. “Ending QT means the Fed will start reinvesting the proceeds of maturing Treasuries and mortgage securities,” he explains. “That’s another way of saying the Fed is printing money again.”

![]() Big Tech’s Big Picture

Big Tech’s Big Picture

“With five of the Mag 7 stocks delivering results… this is the kind of week that tests portfolio positioning,” says Paradigm’s pro trader Enrique Abeyta.

“With five of the Mag 7 stocks delivering results… this is the kind of week that tests portfolio positioning,” says Paradigm’s pro trader Enrique Abeyta.

“Apple, Amazon, Alphabet, Meta and Microsoft together represent trillions in market capitalization and a massive share of the S&P 500’s performance.”

Yesterday, we reported Alphabet, Meta and Microsoft earnings — almost universally solid earnings beats with one caveat. “Meta blamed the EPS miss on ever-increasing AI capital expenditures during their earnings call,” Enrique notes.

On Thursday, two more Mag 7 stocks announced earnings:

- Amazon (AMZN) delivered a strong Q3 2025 showing, with its cloud arm Amazon Web Services (AWS) posting a year-over-year revenue increase of 20%, a pace the company says is the fastest since 2022. Moreover, Amazon issued guidance for Q4 net sales between $206–213 billion

- Apple (AAPL) reported its fiscal Q4 2025 (ended Sept. 27) earnings per share of $1.85, up 13% year-over-year and beating estimates, on revenue of $102.5 billion, up 8%. Apple also highlighted record revenues for its iPhone and Services segments, and CEO Tim Cook said he expects December to net “the best ever” for iPhone sales.

“Their earnings don’t just move their own stocks,” says Enrique, “they shape the direction of the entire market, set the tone for tech sentiment and even influence Fed policy expectations.

“Now, what does all of this mean for [your] investing strategy?” he asks.

“Now, what does all of this mean for [your] investing strategy?” he asks.

“For investors, this cluster of reports is a readout on the health of global digital spending, cloud demand, advertising trends, AI investment and more.

“Strong results from Alphabet and Microsoft reinforce the dominance of digital infrastructure and AI momentum,” Enrique notes.

“This suggests that growth-oriented investors can remain tilted toward mega-caps and Cloud/AI exposures. However, Meta’s warning flags emphasize that costs still matter, even if they are AI buildout-related.

“In the big picture,” Enrique concludes, “when five of the sector’s heavyweights post in the same week, the market is laser-focused on their results

“They give us investors not just a snapshot of today, but a template of what the next multiyear cycle might look like.”

As if on cue, stocks are mostly in the green today. The tech-heavy Nasdaq’s up almost 1% to 23,800; at the same time, the S&P 500 is up 0.35% to 6,845. But the Big Board’s just slipped into red territory, down to 47,515.

As if on cue, stocks are mostly in the green today. The tech-heavy Nasdaq’s up almost 1% to 23,800; at the same time, the S&P 500 is up 0.35% to 6,845. But the Big Board’s just slipped into red territory, down to 47,515.

Just for kicks, shares of our most recent Mag 7 reporters, AMZN and APPL, are respectively up over 11%... and down 0.15%. MSFT, META and GOOG have also pulled back so far today.

Turning to commodities, oil’s up 0.30% to $60.60 for a barrel of West Texas Intermediate. Gold, meanwhile, is up 0.30% to $4,027.80 per ounce. But silver’s down 0.15% to $48.55.

As for the crypto market, Bitcoin’s up 3.15% to $110,140. And Ethereum’s rallying: up 4% to $3,860.

![]() From Telegrams to Tokens

From Telegrams to Tokens

Western Union has filed a U.S. trademark application for “WUUSD,” signalling a major move into the stablecoin/digital-asset space by the 175-year-old payments giant.

Western Union has filed a U.S. trademark application for “WUUSD,” signalling a major move into the stablecoin/digital-asset space by the 175-year-old payments giant.

This filing comes on the heels of Western Union’s announcement of the planned launch of a stablecoin — the U.S. Dollar Payment Token (USDPT) on the Solana blockchain — with rollout expected in the first half of 2026.

As for the WUUSD trademark application, it covers a broad spectrum of potential crypto-related services: digital wallet software, stablecoin payment processing, cryptocurrency trading, lending and brokerage or securities/derivatives exchange functions.

Western Union confirms it has partnered with Anchorage Digital Bank to build a “digital asset network” (DAN). This network is intended to enable customers to convert stablecoins into cash via Western Union’s agent locations — bridging the digital-token world with traditional fiat off-ramps.

While the precise distinction between WUUSD and USDPT isn’t fully clear (for example, whether WUUSD is a consumer-brand, a token symbol or a broader platform name), this step marks the company’s strongest public signal yet toward transforming global payments with blockchain technology.

![]() Spooky Season

Spooky Season

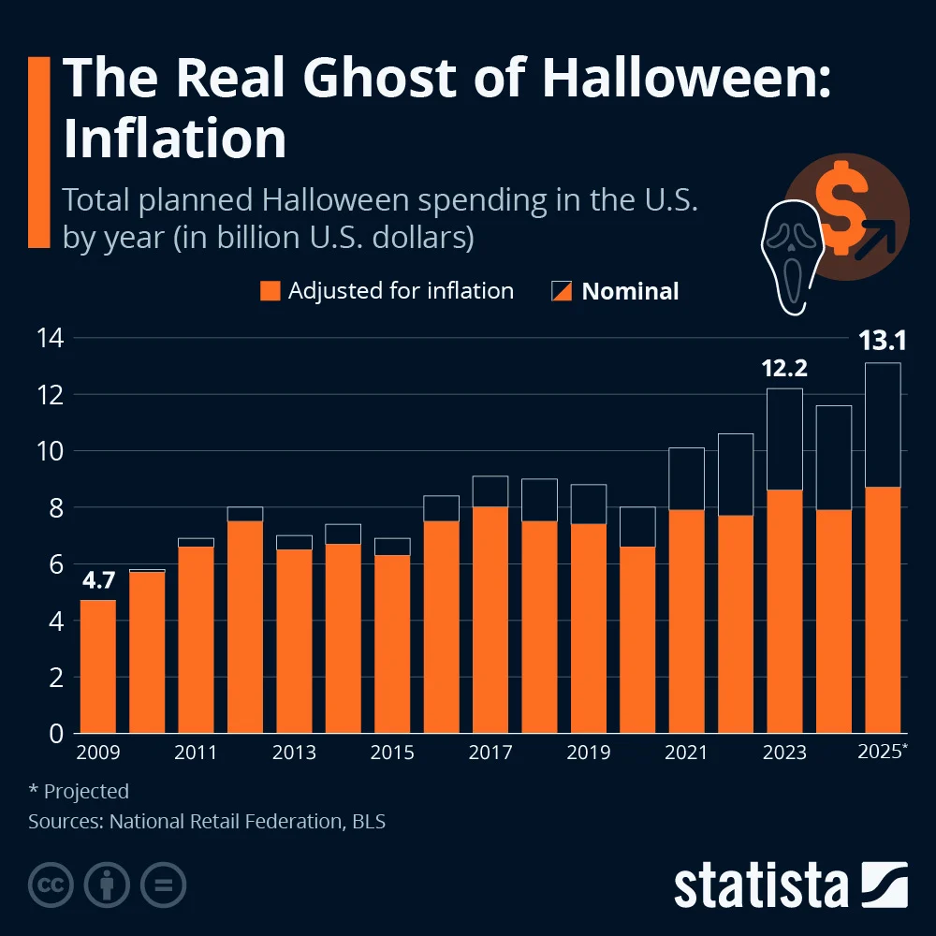

Halloween 2025 is about scary prices…

Halloween 2025 is about scary prices…

Americans are expected to spend a bone-chilling $13.1 billion this year, with the average celebrant shelling out a record $114.45 for costumes, candy and decorations.

Overall, candy will gobble up nearly $4 billion, while costumes have crept past $4.3 billion.

Thanks to inflation, tariffs and even hard-hit cocoa harvests, you’ll get fewer treats for every trick — so brace for “shrinkflation” in your candy haul.

Be that as it may, reader, embrace the spooky spirit, share a laugh and make the day a memorable one for family, friends and neighbors. Happy Halloween!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets