Trump’s $8.5B Bet on Australia

![]() Rare Earth Resolution

Rare Earth Resolution

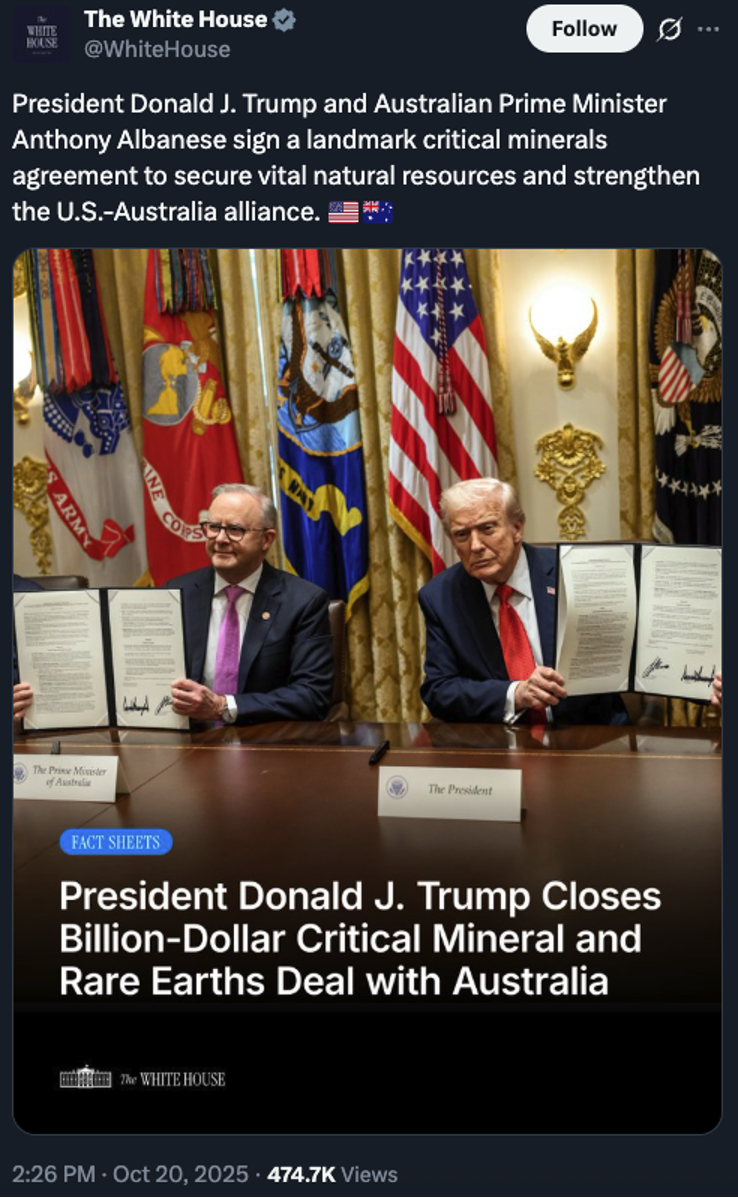

Donald Trump has a handshake deal to start weaning the United States off imports of Chinese rare earths. Sort of. OK, just barely.

Donald Trump has a handshake deal to start weaning the United States off imports of Chinese rare earths. Sort of. OK, just barely.

As you might recall, rare earths became a flashpoint in the U.S.-China trade standoff earlier this month — when Beijing imposed sweeping new export controls on rare earth elements. REEs are used in everything from your smartphone to fighter jets.

China has a near-lock on the world REE market, the result of a strategy going back more than 30 years. As China’s late-20th century leader Deng Xiaoping put it in 1992, “The Middle East has its oil, China has rare earths.”

Yesterday, Australia’s Prime Minister Anthony Albanese came calling on the White House. He and Trump announced their two governments would commit $8.5 billion to expand Australia’s capacity to mine and process rare earths.

Australia has a substantial mining sector. It also holds at least 5% of the world’s rare-earth deposits and accounts for about 8% of global production.

As with many of these announcements, Trump’s boasts are big — “We’ll have so much critical minerals and rare earths that you won’t know what to do with them” — but the details are thin.

The problem is that much of Australia’s rare earth production ends up being processed and turned into useful materials… in China.

The problem is that much of Australia’s rare earth production ends up being processed and turned into useful materials… in China.

For instance… the big Australian producer is Lynas Rare Earths — a company that’s been on the radar of Paradigm’s natural-resources authority Byron King for many years.

About a quarter of its output is processed in China. And most of the rest is processed in Malaysia — a country whose government is on very friendly terms with China.

Investment implications, you ask? During his appearance with Albanese, Trump swaggered about how deals like these could collapse the prices of rare earths — which would not be good for producers of rare earths.

But that’s potentially years down the road. Paradigm readers who’ve thrived this year from American rare-earth names like MP Materials and USA Rare Earth have little to worry about at the moment.

That said, “While I do think the stocks could go higher in the near term, the upside is absolutely not unlimited,” says Paradigm trading pro Enrique Abeyta. “In five years, I wouldn’t be surprised to see many of them lower than they are today.”

[Editor’s note: If you’re looking for an opportunity to leverage Trump’s “American Birthright” agenda in your portfolio right now, Jim Rickards directs your attention to his top Alaskan mining play. “This is a massive opportunity,” Jim says — “both for American mineral production and for individual investors who know exactly where to park their cash before mining begins.”

In a newly updated presentation, Jim gives away the name and ticker symbol of the company for FREE. Follow this link and get ready to take notes, because you’ll get the critical details within just three minutes.]

![]() Precious Metals Pounded

Precious Metals Pounded

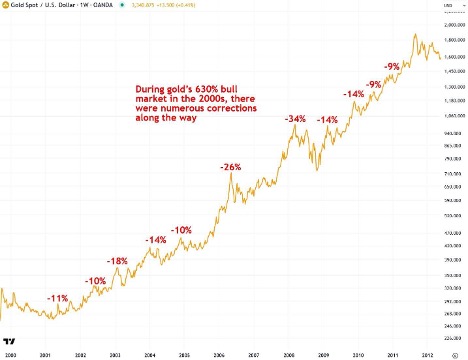

Friday’s precious metals beatdown was bad. Today’s is much worse.

Friday’s precious metals beatdown was bad. Today’s is much worse.

At midmorning, gold was down $225 to $4,130. Silver was down nearly four bucks to $48.34. The HUI index of mining stocks was down 8%, barely above the 600 level.

But this is not the end of the precious metals rally. It’s not even the beginning of the end.

On the Paradigm Press mobile app, colleague Sean Ring shared a chart he spied on Substack, showing gold’s performance during its magnificent 2000–2011 rally.

“If you’re feeling sick to your stomach watching the metals and miners get taken out behind the woodshed, it’s good to review the last bull market,” says Sean.

“Gold got caned all the way up to a new record. This sucks, but keep your eyes on the future.”

Word. As Jim Rickards reminded his Strategic Intelligence readers only yesterday, none of the factors propelling gold higher in recent years have changed: “Central banks are still net buyers; gold output is still flat with no major discoveries on the horizon, and interest from new players is growing stronger by the day.”

Meanwhile, the major U.S. stock indexes are treading water after booking gains yesterday.

Meanwhile, the major U.S. stock indexes are treading water after booking gains yesterday.

At last check, the S&P 500 was pancake-flat at 6,736. The Nasdaq is down about a quarter-percent while the Dow is up a half percent. Earnings season is in full swing, although most of the “Magnificent 7” names won’t report until next week. In the meantime, Amazon is up 2.2% on the day now that the AWS outage is over.

“On the surface, it looks as if this bull market will never take a break. When in fact, it already has,” Greg Guenthner writes his Trading Desk readers.

“More stocks on the NYSE are trading below their respective 50-day moving averages than not. Plus, half of the tech stocks in the S&P 500 are churning below their intermediate-term averages. The tech-led rally off the April lows has cooled. It’s simply not visible at the cap-weighted index level.

“The averages will inevitably shed 10% at some point, maybe more, but it doesn’t necessarily have to be anytime soon.”

Elsewhere, crypto is losing ground compared with yesterday — Bitcoin still holding the line on $110,000 but Ethereum surrendering the $4,000 level.

Crude continues to sink toward new lows last seen in early May, a barrel of West Texas Intermediate now $57.20.

![]() America’s Tax System: How Does It Compare?

America’s Tax System: How Does It Compare?

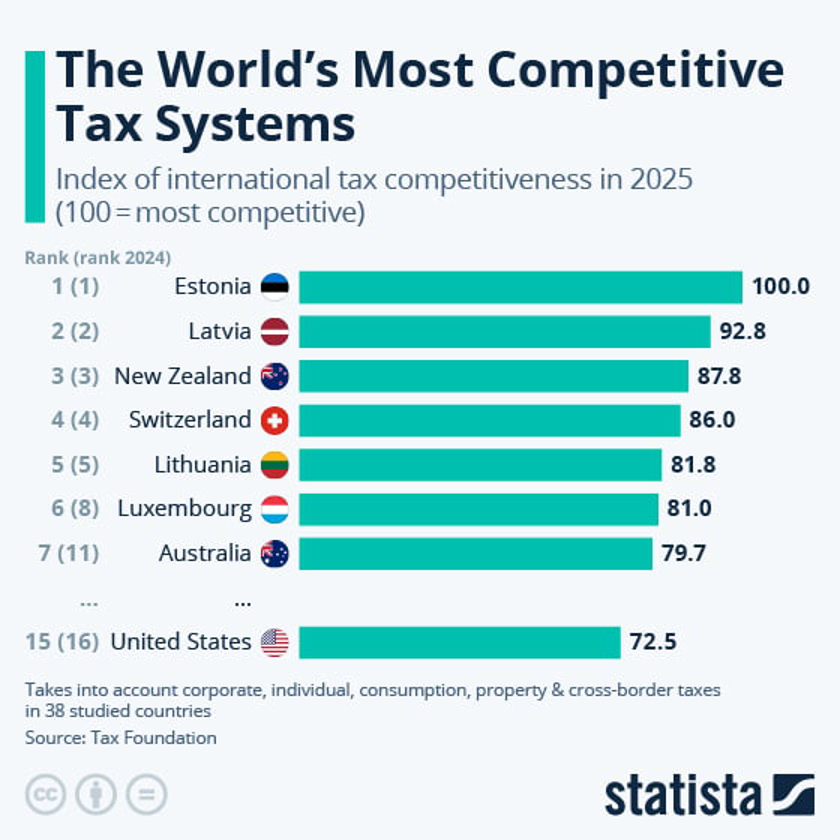

Compared with most of the world’s other major economies, the U.S. tax system is… squarely in the middle of the pack.

Compared with most of the world’s other major economies, the U.S. tax system is… squarely in the middle of the pack.

The nonpartisan Tax Foundation is out with its 2025 International Tax Competitiveness Index — comparing the tax burden of all 38 nations belonging to the Organization for Economic Cooperation and Development.

“A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities,” say the researchers.

“In contrast, poorly structured tax systems can be costly, distort economic decision-making and harm domestic economies.”

Using that yardstick, the researchers say the most competitive tax systems in the OECD are two of the Baltic republics that once belonged to the Soviet Union — Estonia with a perfect score of 100 and Latvia with a score of 92.8.

The least competitive? Italy at 50.3 and France at 45.8.

The United States scores 72.5, or 15th overall among the 38 OECD countries.

When it comes to specific kinds of taxes, America ranks…

- 17 in individual taxes

- 4 in consumption taxes (no “value-added tax” for us, thank you very much)

- 9 in corporate taxes

- 30 in property taxes

- 35 in “cross-border tax rules” (U.S. companies are taxed on income earned abroad, and the rules are more complicated than elsewhere.)

America’s overall No. 15 ranking is up one spot from last year. The researchers say the biggest plus is a change that turns up in the “One Big Beautiful Bill Act” passed over the summer: “The U.S. reinstated full expensing for plants and equipment and extended the policy to selected industrial buildings and structures.”

![]() Comic Relief

Comic Relief

Today’s installment of Shutdown Theater…

Today’s installment of Shutdown Theater…

![]() “The War Rages On”

“The War Rages On”

Don’t get the wrong idea from yesterday’s mailbag: The reaction to last Wednesday’s “Avoidable Armageddon” issue wasn’t 100% positive.

Don’t get the wrong idea from yesterday’s mailbag: The reaction to last Wednesday’s “Avoidable Armageddon” issue wasn’t 100% positive.

“Glad that you are aware of the ‘rest of the story’ concerning the Cuban Missile Crisis,” a reader writes — teeing up the inevitable but that I’ve come to expect after doing this daily e-letter thing for 15 years.

“One most important point, however, differentiates the then and the now. You equate that crisis then to now between Ukraine and Russia, but don't mention the one, obvious difference.

“Russia is now actually invading another sovereign country whereas there was no invasion back then. Then it was just an existential threat. Now this is a unilateral real military offensive threat in addition to the nuclear threat.

“This changes the dynamic, because standing down no longer solves the problem. Taking your missiles home no longer creates a peace. The war rages on.”

Dave responds: On the contrary, the presence of NATO missile bases on Russia’s doorstep — Poland and Romania — was one Moscow’s pain points in the years running up to the February 2022 invasion.

In late 2021, Vladimir Putin laid out two main demands to avert all-out war — a guarantee Ukraine would never join NATO and a guarantee Ukraine would never host NATO missile batteries that could be used to attack Russia. Joe Biden rejected the first demand and blew off the other one without even addressing it.

The war would be over very quickly without U.S. support for Ukraine. Why Donald Trump refused to wash his hands of the war upon returning to office is one of the great mysteries of the age. He blustered about his negotiating prowess and ending the war in a day. Unable to do so, he now careens back and forth between berating Ukraine’s leader Zelenskyy one day and haranguing Putin the next.

As deadline approaches, a White House official is saying there are “no plans” for another Trump-Putin meeting “in the immediate future” — days after Trump said the two would meet in Budapest.

As deadline approaches, a White House official is saying there are “no plans” for another Trump-Putin meeting “in the immediate future” — days after Trump said the two would meet in Budapest.

The scuttlebutt is that talks in recent days between Secretary of State Marco Rubio and Russian Foreign Minister Sergei Lavrov didn’t net the results that Trump desired — whatever they were.

How much longer before Trump reverts to threats of “bad things happening” if Putin doesn’t start “playing ball”? Or resumes his threats to send Tomahawks to Ukraine?

On that score, the BBC had an excellent infographic the other day…

One way or another, Moscow is dead-set on achieving its ultimate objective — ensuring Ukraine’s army can never again be leveraged by Western leaders to threaten Russia.

The only question is how Moscow gets there — and how recklessly Western leaders will act in the interim.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets