The Path to $10K Gold

![]() The Path to $10K Gold

The Path to $10K Gold

“The frenzy stage for gold has not yet begun,” Jim Rickards declared yesterday before a crowd of 700-plus at the 2025 Paradigm Shift Summit in Nashville.

“The frenzy stage for gold has not yet begun,” Jim Rickards declared yesterday before a crowd of 700-plus at the 2025 Paradigm Shift Summit in Nashville.

Precious metals were the object of much buzz among the crowd. Many in the audience found their attention divided — watching the speakers and taking notes, but at the same time checking their phones to monitor the wild action in gold and silver.

Gold exceeded $4,050 as attendees took their seats… only to watch it sink more than $100 by midafternoon. (This morning it’s back to $3,997.)

Silver pushed past its 1980 and 2011 records, exceeding $51 briefly — only to plunge below $49. (Now it’s approaching $50 again. Life comes at you fast.)

Jim’s talk covered much territory — tariffs and the rumored Mar-a-Lago Accord among other topics — but the crowd was rapt as he laid out eight factors that will drive gold prices much higher from present levels.

One of those factors we’ll spotlight here: It’s part mathematics, part psychology. Jim’s laid it out to his readership before, but it’s worth a revisit today.

One of those factors we’ll spotlight here: It’s part mathematics, part psychology. Jim’s laid it out to his readership before, but it’s worth a revisit today.

“Investors naturally focus on dollar gains in the price of gold,” he explains. “When gold goes from $1,000 per ounce to $2,000 per ounce, investors cheer the $1,000 gain. The same is true when gold goes from $2,000 per ounce to $3,000 per ounce. Again, investors pat themselves on the back for another $1,000 per ounce gain.

“What investors don’t realize (at least initially) is that each $1,000 per ounce gain is easier than the one before.”

It comes down to a psychological phenomenon called anchoring. “The investor anchors on the amount $1,000 as a fixed gain and treats each such gain the same,” says Jim. “In pure dollars, they are the same. You make $1,000 per ounce as each benchmark is passed.”

But the percentage gain is progressively smaller. Gold moving from $1,000 to $2,000 is a 100% gain — but gold moving from $3,000 to $4,000 is only a 33% gain.

“Because each $1,000 per ounce gain begins from a higher level, the percentage gain associated with each dollar gain is less. The increase from $1,000 to $2,000 per ounce is a heavy lift. The increase from $9,000 to $10,000 per ounce is not much more than a good month” — that is, an 11% jump.

Between the math and the psychology, “this combination could propel gold prices to the $10,000 per ounce level in far less time than most analysts believe.”

![]() Spooky Synchronicity

Spooky Synchronicity

There was a spooky synchronicity to our energy-and-mining specialist Byron King’s talk yesterday.

There was a spooky synchronicity to our energy-and-mining specialist Byron King’s talk yesterday.

For weeks he’d been planning to discuss the shortages of minerals that are essential in the eyes of Pentagon planners.

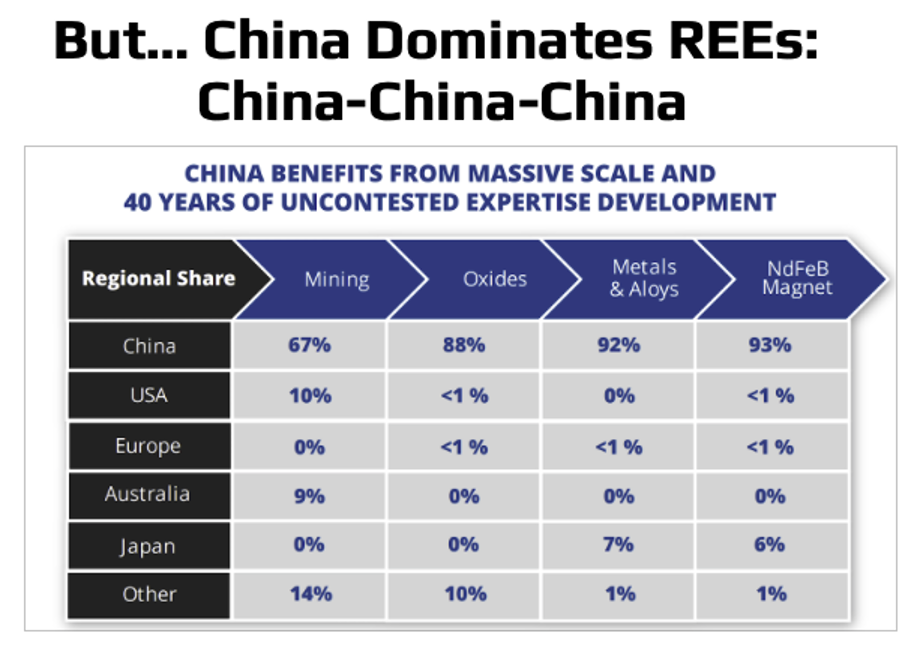

Then came the news we mentioned off the top of yesterday’s 5 Bullets: The Chinese government imposed steep new export controls on rare-earth elements — used in everything from smartphones to fighter jets.

Rare earths are the one natural resource China doesn’t have to import — and as Byron showed in this presentation slide, China’s dominance of the rare-earth space is “uncontested.”

As yesterday wore on, the scope of China’s new export restrictions came into sharp focus: Any company around the world that wants to sell a product with Chinese rare earths — even if those rare earths make up as little as 0.1% of the product’s value — must get permission from Beijing.

That’s going to be mighty tough sledding for the makers of semiconductors — which is probably what Beijing had in mind, given Washington’s export controls on chips.

Turnabout may or may not be fair play, but turnabout it is.

On this day after Byron’s talk, China’s rare-earth restrictions have gotten Donald Trump’s back up — and Mr. Market is freaking out.

On this day after Byron’s talk, China’s rare-earth restrictions have gotten Donald Trump’s back up — and Mr. Market is freaking out.

On social media, Trump threatened a “massive increase” in tariffs on Chinese goods — with the current tariff truce between Washington and Beijing set to expire one month from today.

China is “becoming very hostile,” he posted. “I was to meet President Xi in two weeks, at APEC, in South Korea, but now there seems to be no reason to do so.”

With that, a stock market that began the day mildly in the green has sunk deep into the red. At last check the S&P 500 is down 1.25% to 6,650. The Dow’s losses are narrower, the Nasdaq’s steeper. (In contrast, the rare-earth names are ripping higher once again — USA Rare Earth, for instance, up 18%.)

The market’s chill has spread into crude oil as well: A barrel of West Texas Intermediate is down over two bucks to $59.27 — a five-month low.

Crypto is catching cold, too — Bitcoin sinking toward $119,000 and Ethereum approaching $4,100.

The big economic number of the day isn’t helping matters.

The big economic number of the day isn’t helping matters.

The University of Michigan consumer-sentiment index is still in the dumps at 55.0, far below its over-70 levels at the start of the year.

Often this number is simply a reflection of how well the stock market is doing — and it’s been doing very well until today — but that’s not the case with this month’s report. “Pocketbook issues like high prices and weakening job prospects remain at the forefront of consumers’ minds,” says the Michigan survey team.

➢ Just in: The Bureau of Labor Statistics plans to release the September inflation numbers on Oct. 24, “partial government shutdown” notwithstanding. Maybe someone read our mention yesterday that without those numbers, the Social Security Administration can’t set next year’s cost-of-living adjustment for Social Security recipients.

Today’s sell-off was bound to happen sooner or later. The market had gone up too far, too fast. Our hedge fund veteran Enrique Abeyta would tell you that Trump’s pique with China isn’t the reason for today’s drop, it’s the excuse.

And with that in mind, we move on to Enrique’s presentation in Nashville…

![]() Party Like It’s 1999

Party Like It’s 1999

“Be aggressive,” our trading pro Enrique Abeyta told the crowd yesterday about the AI bubble. “This could last weeks, months, even years.”

“Be aggressive,” our trading pro Enrique Abeyta told the crowd yesterday about the AI bubble. “This could last weeks, months, even years.”

Late last year, Enrique earned some notoriety for forecasting that Nvidia would lose $1 trillion in market cap — and in short order, too.

Sure enough, that’s exactly what happened between early January and early March — with more than half of that plunge coming on one day, Jan. 27 amid the freakout over the Chinese AI engine DeepSeek. (Remember that?)

As 2025 wore on, he began warning about an overbuild in AI infrastructure — an explosion of hardware capacity that will come into use one day, but not right away. He likened it to the overbuild of fiber-optic cable for the internet during the dot-com bubble in the late 1990s.

But while the story is destined to end in tears, the end is not nigh. Enrique says it’s time to party like it’s 1999.

But while the story is destined to end in tears, the end is not nigh. Enrique says it’s time to party like it’s 1999.

Here in October 2025, NVDA has rebounded to a record share price and a stupendous $4.75 trillion market cap. As the old Wall Street saying goes, “Don’t fight the tape.”

True to his trader’s mentality, Enrique urged the crowd to ride the wave instead. Go for growth and not value: The market is chockablock with companies that can 10X their earnings.

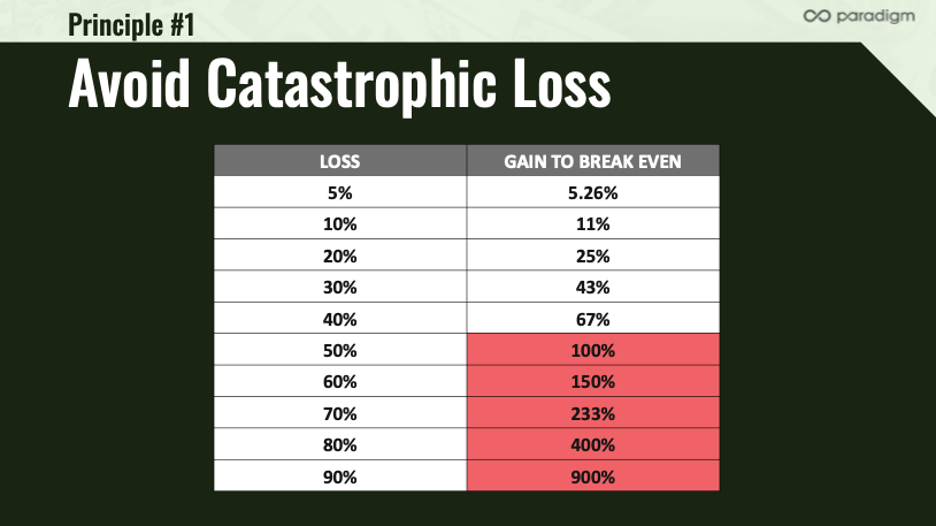

And stay disciplined: Avoid big losses because they’ll make you gun-shy, depriving yourself of the chance at big gains. Here’s an eye-opening table from his slide deck…

He shared several names for the audience’s consideration. We’ll share one of them here: Coinbase. COIN is sure to prosper as digital assets rally alongside all things tech.

And his overarching guidance: “It’s not how much you make, it’s how much you keep. Plan your trade and trade your plan.”

![]() “But Wait, There’s More…”

“But Wait, There’s More…”

Really, we’ve only scratched the surface with yesterday’s presentations at the Paradigm Shift Summit.

Really, we’ve only scratched the surface with yesterday’s presentations at the Paradigm Shift Summit.

Of course our AI and crypto authority James Altucher was a huge draw — slamming the banks for their outrageous fees and invasions of privacy. For him, the advent of stablecoins can’t come soon enough. (And it will.)

“Mr. 10X,” Chris Cimorelli, laid out three picks with the potential to make 10 times your money over the next 12 months.

The sui generis Mason Sexton described an eerie recurring 36-year pattern in both the markets and global events. As he sees it, 2026 could turn out to be much like 1882 — a “new Gilded Age.”

Today’s presentations promise to be just as compelling — capped off with a reprise of our 2018 “Bitcoin versus gold” debate. Once more Jim Rickards will take up the cause of the Midas metal while James Altucher makes the case for Bitcoin.

Today’s crowd is smaller — because Day 2 of the Summit is limited to an inner circle of our readership.

They’re an unusual group, really. They took advantage of a customer service loophole that allows them to access some of our most premium research for free. This loophole allows them access to a host of perks — including attendance at today’s Summit sessions.

Curious? Give this a look.

[Editor’s note: If you already subscribe to at least one of our high-end publications, this offer will be of special interest to you.]

![]() Mailbag: Gold Rally, Gold Reserves, IRS Enforcement

Mailbag: Gold Rally, Gold Reserves, IRS Enforcement

“Gold’s run-up sure has been years in the making!” a reader affirms after Wednesday’s edition.

“Gold’s run-up sure has been years in the making!” a reader affirms after Wednesday’s edition.

“The central banks’ furious pace of buying gold is one more milepost in a long trend.

“We are 11-plus decades into this dollar debasement scheme known as the ‘Federal Reserve Note.’ It’s amazing that it has taken so long to start blinking red on every level, but here we are.

“Escalating debt, prices and spending — as well as big gold/silver corrections — are baked into fiat currency regimes from the beginning. The inflection points are just a matter of time.

“From a technical analysis viewpoint, the current dollar prices of precious metals may have blown through reasonable levels. But considering how badly they have been manipulated, are they really overextended?

“Or are they deeply undervalued assets that are finally doing an accounting as they seek their level?

“BTW I don’t think you get enough credit for the job you have done in past issues of The 5 explaining price suppression of gold and silver. Kudos for that.”

Dave responds: Thank you. It was Jim Rickards who opened my eyes to it. I haven’t really had occasion to revisit the issue for a long time. The most recent definitive take in our archives goes back six years now — but it does stand the test of time.

“Dave, you and others have reported on more than a few occasions that countries around the globe have looked upon the U.S. government's freezing Russian assets with such dismay as to dump American paper in favor of gold and other securities,” writes one of our regulars.

“Dave, you and others have reported on more than a few occasions that countries around the globe have looked upon the U.S. government's freezing Russian assets with such dismay as to dump American paper in favor of gold and other securities,” writes one of our regulars.

“What evidence can you cite to support this? Are there any allies or central banks on record as having stated such?

“(And please do not conflate our massive federal debt with your forthcoming explanation, for I believe that is the real reason.)

“Still a 5 Fan.”

Dave: No, there’s no documented instance of, say, the finance minister of East Borkistan telling a press conference, “These people in Washington are bats*** crazy with their economic warfare measures. We’re dumping our Treasuries and getting more gold.”

Then again, if that were to happen, East Borkistan would immediately become a target for regime change, or at least one of those “color-coded revolutions,” no? Better to keep it all on the QT.

This much is certain: The sudden leap in accumulation of central bank gold reserves occurred in the spring and summer of 2022 after Washington ramped up the sanctions on Russia to an unprecedented degree.

Admittedly, Jim Rickards and I (and many others outside the Paradigm stable) are operating from inference. But I daresay it’s informed inference.

On the subject of relaxed IRS enforcement during the “partial government shutdown,” we heard from an expat reader…

On the subject of relaxed IRS enforcement during the “partial government shutdown,” we heard from an expat reader…

“Dave, you wrote: ‘Then again… how much of an enforcement mechanism do they have at the moment?’

“The key words in this phrase are ‘at the moment.’ Almost certainly, if you fail to file your quarterly payment, nothing will happen immediately, but as the agents return to the office and begin to catch up on all that happened while they were out, you will get a notice, and not only will they demand what they consider their due, but will demand penalties on top of that. Not worth it.”

Dave: No doubt. Ditto for accidentally lowballing one’s quarterly estimated taxes. Hopefully your wise counsel is not derived from personal experience!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets