The Neighbor From Hell

![]() The Data Center Next Door

The Data Center Next Door

What once was a sleepy U.S. suburb or stretch of farmland has given rise to a new kind of neighborhood drama: the looming presence of data centers.

What once was a sleepy U.S. suburb or stretch of farmland has given rise to a new kind of neighborhood drama: the looming presence of data centers.

Take the case of Kay Richards, a homeowner who says the relentless thrum from the Amazon data center next door makes it hard to enjoy her own backyard.

Yet she’s not ready to give up her dream home. “Moving feels impossible,” she says. “But so does gardening with that racket.”

NIMBY — “Not in My Backyard” — is no longer about big chain stores, shipping warehouses or housing developments. Today, anger is squarely pointed at the rows of low-slung, windowless data centers that quietly power the world’s streaming movies, bank transactions and, increasingly, artificial intelligence.

Far from universally welcome, these server farms have become a flashpoint for grassroots activism across the U.S.

Residents’ complaints range from the practical to the existential: noise that drives them indoors, patchy power supply, disruptions to local water supplies and fears that property values might tank when a hulking digital fortress comes to town.

Industry trackers estimate that $64 billion worth of data center projects have been either delayed or blocked outright in the last two years due to local resistance.

Industry trackers estimate that $64 billion worth of data center projects have been either delayed or blocked outright in the last two years due to local resistance.

This opposition is waged by more than 140 grassroots groups in 28 states that are formally campaigning against new server farms.

In northern Virginia, the epicenter of “Data Center Alley,” there are more data centers than any other region in the world, and local campaigns have become both increasingly professional and tenacious.

Over 40 groups there have linked up under the Data Center Reform Coalition to demand tighter regulations and rethink development priorities.

Homeowner groups, conservationists and civic activists — Republicans and Democrats alike — agree that data centers, for all their invisible benefits, make troublesome neighbors when it comes to daily life.

Every data center requires enormous amounts of electricity and water, raising the specter of brownouts and ultra-high energy bills for those living nearby.

Every data center requires enormous amounts of electricity and water, raising the specter of brownouts and ultra-high energy bills for those living nearby.

“Wholesale electricity costs as much as 267% more than it did five years ago in areas near data centers,” Bloomberg reports. “That's being passed on to customers.”

Water consumption, especially in drought-prone areas, is another battle cry, and when the facilities rely on fossil-fuel energy, residents worry they’re undermining efforts for a greener power grid.

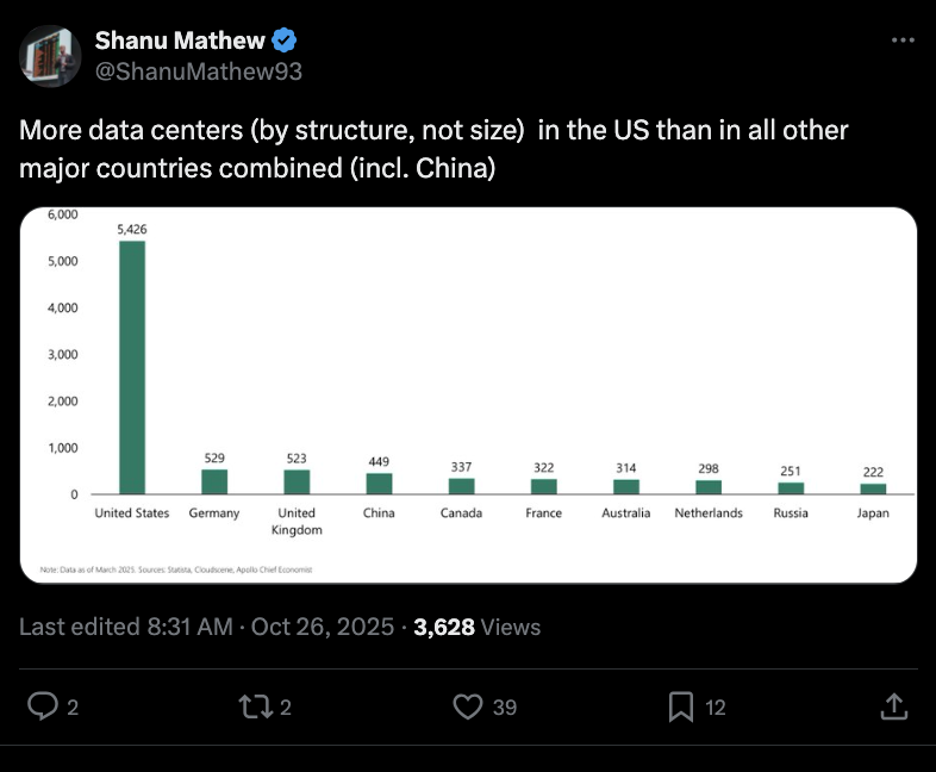

Albeit some industry voices offer a counterpoint. Lazard Asset Management analyst Shanu Mathew posted on X: “The AI data center buildout, if implemented correctly, can accelerate our effort to modernize and upgrade the grids as we electrify the economy.”

And clearly, the U.S. is going to need all hands on deck…

Meanwhile, some local governments are touting the jobs and tax revenue data centers may bring, but others push back, pointing out the bulk of employment is front-loaded during construction.

Once built, for instance, a typical data center often requires fewer than 50 permanent jobs — hardly a windfall for towns that may pay a price in added noise, stress to local utilities or loss of green space.

The friction has spurred a wave of political action. State legislatures, county zoning boards and even national politicians are now devising ways to rein in the industry’s rapid expansion.

The friction has spurred a wave of political action. State legislatures, county zoning boards and even national politicians are now devising ways to rein in the industry’s rapid expansion.

Some call for strict environmental reviews. Others debate taxing data centers at higher rates or demanding that tech giants invest directly in local power grids or water infrastructure.

One reality remains: Wherever people live, the debate over data centers is unlikely to quiet down.

As digital services grow — and with AI and cloud computing still rapidly scaling — the demand for places to stash the world’s data will only increase.

For many Americans, the question isn’t just what powers the internet, but at what cost to the places they call home.

![]() AI’s Moment of Truth

AI’s Moment of Truth

“Are we in an AI bubble?” asks Paradigm editor Davis Wilson. “We’ll find out this week.

“Are we in an AI bubble?” asks Paradigm editor Davis Wilson. “We’ll find out this week.

“Wednesday and Thursday will likely determine the direction of the entire U.S. stock market for the rest of the year,” he says. “That’s when Big Tech steps into the earnings spotlight.

“Microsoft, Alphabet and Meta report on Wednesday while Apple and Amazon follow on Thursday.

“These aren’t just the biggest companies in the S&P 500. They’re the core of the AI revolution. These are the firms building, training and deploying the world’s most advanced models.

“And their spending plans will likely dictate the direction of the market for the rest of the year,” says Davis.

“And their spending plans will likely dictate the direction of the market for the rest of the year,” says Davis.

“Here’s where we are: Four major tech firms — Microsoft, Alphabet, Meta and Amazon — are expected to invest over $300 billion this year in AI infrastructure, primarily on GPUs from Nvidia and the data-center capacity to host them.

“Here’s the breakdown:

- Microsoft said in July it expected to spend $30 billion in capital expenditures during the quarter, representing annual growth of more than 50%

- Alphabet raised its full-year capex outlook to $85 billion, up from $75 billion

- Meta boosted the midpoint of its 2025 capex forecast by $1 billion to $69 billion

- Amazon plans to spend over $100 billion this year, signaling capex of about $31 billion per quarter in the second half.

“It’s a staggering level of investment that shows no signs of slowing.

“Still, there’s an important caveat: This AI spending spree far outpaces the current revenue these companies are generating from AI today,” he notes.

“Investors are essentially front-running the payoff, assuming this massive investment will eventually translate into dominance once the technology matures.

“That level of upfront spending is making some investors uneasy,” Davis concludes, “evoking echoes of the dot-com era as the market waits to see if these bets will pay off.”

Nvidia (NVDA) just broke another record. The chipmaker’s market cap surged past $5 trillion, cementing its place as the world’s most valuable company.

Nvidia (NVDA) just broke another record. The chipmaker’s market cap surged past $5 trillion, cementing its place as the world’s most valuable company.

NVDA shares are already up 50% year-to-date as demand for its AI semiconductors continues to outpace supply. This as CEO Jensen Huang announces the company is preparing for as much as $500 billion in AI chip orders and is working with Washington to engineer as many as seven new supercomputers for the U.S. government.

At the time of writing, NVDA is up almost 4%. As for the rest of the stock market, the tech-heavy Nasdaq is leading the way: up 0.65% to 23,950. At the same time, the Big Board is up 0.50%, just under 48,000. In third place, the S&P 500 is up 0.30% to 6,910.

Oil’s getting a little love today; the price for a barrel of WTI is up 1.30% to $60.90. Precious metals, likewise, are enjoying some attention. Gold’s up 1% to $4,023.70 per ounce while silver’s up 1.65% to $48.10.

But the crypto market is staunchly in the red: Bitcoin’s lost 1.40% to $112,300, and Ethereum’s down 2% to $3,970.

![]() The Fed, Two Mandates, One Mess

The Fed, Two Mandates, One Mess

“Inflation is moving steadily away from the Fed’s 2.0% target,” Jim Rickards warns.

“Inflation is moving steadily away from the Fed’s 2.0% target,” Jim Rickards warns.

September’s 3.0% reading was the highest since January, and “it may go even higher in the months ahead as newly announced tariffs take hold in the supply chain,” he adds.

Some might shrug at 3% inflation. Jim doesn’t. “That rate will cut the value of the dollar in half in 24 years,” he notes, “and again in another 24 years.” Over a typical working career, he says, the dollar could lose “75% of its purchasing power.”

His takeaway for everyday Americans: “What are you working for unless wages are going up faster than inflation?” And as he often reminds readers, holding some gold can help “offset [toxic] dollar devaluation.”

But what’s really forcing the Fed’s hand at this week’s FOMC meeting isn’t inflation — it’s jobs.

Unemployment has been quietly climbing for months: 4.1% in June, 4.2% in July, 4.3% in August.

Unemployment has been quietly climbing for months: 4.1% in June, 4.2% in July, 4.3% in August.

Worse, revisions show the U.S. actually lost jobs in June — “the first job loss reported since 2020.” And private-sector data confirms the shift: ADP found employers cut 32,000 jobs in September.

Plus, Jim cites new data showing earlier job gains were massively overstated. In just the first quarter of 2025, the government “overstated job creation by 911,000 jobs.” Add late-2024 revisions and “over 1.7 million jobs… disappeared.”

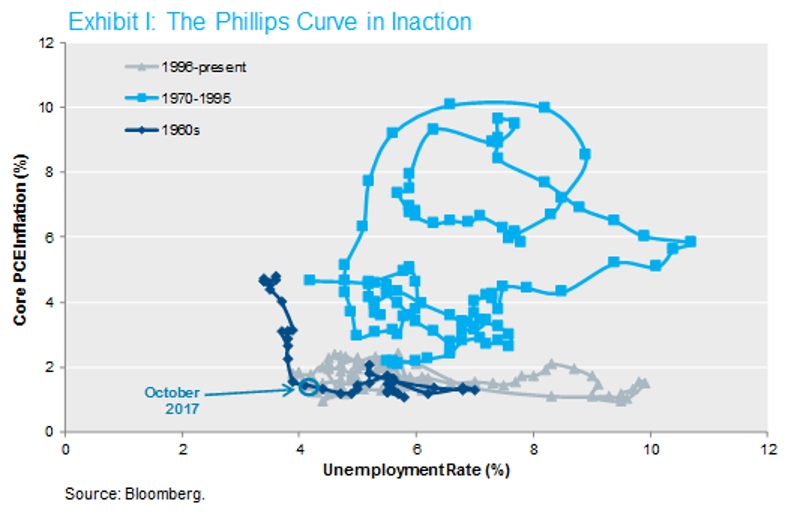

The Fed still clings to the Phillips Curve — the theory that inflation and unemployment move opposite each other — but Jim calls it “a joke.”

Source: Bloomberg, NISA

Irretrievably kinked: “A Phillips Curve on a graph [has] no predictive analytic power and offers no policy guidance,” says Jim.

History shows both inflation and unemployment can go wrong at once, and that’s exactly the risk today. So what will the Fed do? Simple, Jim says: “They can’t fight both battles at once.

“On Wednesday, the Fed will cut interest rates by 0.25%,” he forecasts. “That decision will lower the federal funds target to 4.00%.”

![]() Boeing’s $4.9 Billion Oops

Boeing’s $4.9 Billion Oops

Boeing (BA) just dropped a $4.9 billion accounting charge and pushed back the debut of its massive new wide-body jet, the 777X, until 2027 — seven years behind schedule.

Boeing (BA) just dropped a $4.9 billion accounting charge and pushed back the debut of its massive new wide-body jet, the 777X, until 2027 — seven years behind schedule.

The fallout hit its quarterly earnings hard: a loss of $7.47 per share, far worse than the $4.44 analysts expected. Meanwhile, revenue came in at $23.27 billion, beating estimates around $22.3 billion.

Why does the $4.9 billion charge matter? It shows Boeing’s still digging out of a deep hole. Yes, there’s more bad news — the company posted negative free cash flow this quarter ($238 million). Guess that’s better than a year ago when the company reported negative $1.34 billion…

Here’s the extra kicker: Airlines like Deutsche Lufthansa AG (the launch customer for the 777X) and Emirates (the biggest buyer) are already reshuffling their fleet plans and assuming the jet won’t drop before 2027.

The 777X, one of Boeing’s most important future jets, has been such a headache that the accounting losses tied to it have ballooned to almost $16 billion. That’s not pocket change — it’s a long-term financial weight that Boeing will keep carrying until the plane finally gets into service and starts making money.

Meanwhile, Boeing delivered 160 aircraft in the quarter — its strongest showing since 2018 — hinting that some parts of the business may be stabilizing.

Bottom line: Even if a few indicators are improving, a multibillion-dollar setback on a flagship project is a harsh reminder that Boeing’s turnaround isn’t a clean glide path yet. There’s still turbulence ahead.

![]() A Fridge Too Far?

A Fridge Too Far?

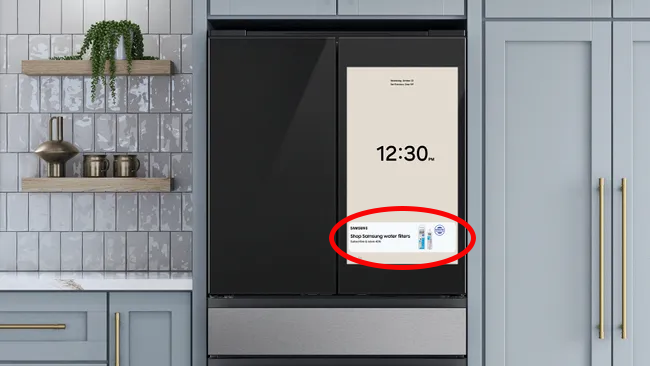

Samsung has begun rolling out a new software update in the U.S. for its Family Hub smart refrigerators.

Samsung has begun rolling out a new software update in the U.S. for its Family Hub smart refrigerators.

This pricey appliance — $3,398 on sale today at my local Home Depot — already connects to your Wi-Fi, organizes your shopping and (maybe) stares into your soul while you hunt for leftovers.

[Speaking of Home Depot, here’s a 1-star review of said refrigerator at HD’s website, courtesy of Junk Fridge: “I want to enjoy this fridge, but I’ve had it a little over a month and it's on its third repair. The Wi-Fi would not stay connected, which was the first service. They replaced the Wi-Fi module and now [it] still does not stay connected…

“The fridge works fine from a cooling perspective,” — heh — “but I could have gotten a much cheaper fridge if I wanted just a basic fridge.”]

The latest feature? Starting on Monday this week, “curated advertisements,” according to Samsung. Yes, your refrigerator can now suggest more ways to part you from your money.

To Samsung’s credit, you can disable the ads.

Courtesy: Samsung

Overall, we expect the reception to be chilly.

Take care, reader… Tomorrow, we hand the mic to a guest who’s been behind the doors of the most important company in the world. Don’t miss it!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets