Private Equity’s JV With the Pentagon

![]() Private Equity’s JV With the Pentagon

Private Equity’s JV With the Pentagon

Call it “American Birthright” Phase III.

Call it “American Birthright” Phase III.

Paradigm’s macroeconomics maven Jim Rickards turned heads last winter with a bold proposition — that the new Trump 47 administration was keen to tap into the vast mineral wealth under federal lands west of the Mississippi River. Potential value of this bounty: $150 trillion.

But even Jim was caught off-guard when the Birthright agenda moved into Phase II last summer — in which the federal government started taking ownership stakes in publicly traded companies.

The most notable name in this regard was the rare earth producer MP Materials. Many readers of Paradigm publications collected huge gains as a consequence. (One outlier collected 1,400%. “Best trade/investment of my four-year career,” this individual said.)

[There are still ample profit opportunities to be had from Phase II. Jim has a name and ticker symbol for your consideration, FREE when you watch this three-minute video.]

Now comes what looks like Phase III. The Financial Times calls it “an unprecedented effort to enlist some of Wall Street’s biggest investors directly in U.S. national security.”

“We are in a hole that we are not going to be able to dig out of without creative solutions coming in from outside parties,” says U.S. Army Secretary Daniel Driscoll.

“We are in a hole that we are not going to be able to dig out of without creative solutions coming in from outside parties,” says U.S. Army Secretary Daniel Driscoll.

The “hole” in question is the Army’s desire to upgrade its aging infrastructure. Cost over the next 10 years: $150 billion. Available funds from the federal budget: $15 billion.

And so last week, Driscoll along with Treasury Secretary Scott Bessent met with bigwigs from private equity giants like Apollo, Carlyle, KKR and Cerberus. From the FT story…

Driscoll told the Financial Times he gathered the private investors to say, “‘Hey, here are all the assets we have in our arsenals and our depots that we are underutilizing… What are those types of deals where we can work with you and invite you in?’”

The Army secretary, the service’s top civilian official, said he asked the groups to draw up “clever financing models or unique financing models” to help meet the Army’s infrastructure needs…

Driscoll added the projects could include data centers and rare earth processing facilities, and could involve the federal government swapping land for computer processing power or output from rare earth processing.

He described the proposal to the group as, “Instead of paying us with cash for the land, you pay us in compute”.

Sounds complicated. But the execs on hand seem to have an open mind, even if they don’t want to be quoted by name. “It was pretty clear Bessent and Driscoll are serious about working with private capital,” says one.

It doesn’t hurt that Driscoll comes to the task with an investment banking background — and he has the cachet of being Vice President Vance’s classmate at Yale Law.

We’ll keep tabs on the progress of this initiative — and whether it serves up any investment opportunities in publicly traded companies — in the months ahead.

In the meantime, Birthright Phase II is still in full swing, abounding with profit possibilities. Have you seen Jim Rickards’ revised and updated video? It includes a free stock pick he believes “has market-beating potential over the next 12 months.”

And no, you won’t have to watch for an hour or longer to see the pick. Click here and you’ll be in the know after only three minutes.

![]() The Beatings Will Continue Until…

The Beatings Will Continue Until…

The thrashing of the precious metals isn’t over yet.

The thrashing of the precious metals isn’t over yet.

When it was all over yesterday, gold had registered its worst one-day loss in 12 years — a 5.7% spill. Checking our screens this morning, it’s down another 1.1% at $4,078.

That’s the bad news. The good news is that gold hasn’t lost its grip on the $4,000 level.

The fact that $4,000 gold was a record high only two weeks ago illustrates the extent to which gold was “overbought” and due for a pullback.

“Both gold and silver were completely overcooked, and speculators took their chance,” colleague Sean Ring writes in today’s Rude Awakening as he surveys the most likely reasons behind the big drop.

Sean says sentiment could turn on a dime as the major gold miners start reporting their earnings — with the big dog Newmont (NEM) set to report tomorrow after the closing bell.

In the meantime, the HUI index of mining stocks is down another 1.6% on the day at 581. And silver has shed another 31 cents to $48.31.

Not much to say about digital nondollar assets — Bitcoin is mired beneath $110,000 and Ethereum has sunk below $3,900.

As for stocks, the major U.S. indexes are all in the red after a “meh” day yesterday.

As for stocks, the major U.S. indexes are all in the red after a “meh” day yesterday.

At last check the S&P 500 is down nearly three-quarters of a percent to 6,689. The Dow is down about a half percent while the Nasdaq is down more than 1%.

Wall Street’s thirst for economic data amid the “partial government shutdown” will be slaked on Friday when the Bureau of Labor Statistics cobbles together the official inflation numbers for September, about 10 days behind schedule.

![]() The Long, Long Refill

The Long, Long Refill

Oil prices are getting cheap enough for the Trump administration to start refilling the Strategic Petroleum Reserve — if only a teacup at a time.

Oil prices are getting cheap enough for the Trump administration to start refilling the Strategic Petroleum Reserve — if only a teacup at a time.

“The Trump administration is dipping its toe — barely — into refilling the U.S. Strategic Petroleum Reserve (SPR), announcing plans to purchase 1 million barrels of crude for delivery in December and January,” reports Julianne Geiger at the OilPrice website. “The move, while symbolically significant, amounts to little more than a rounding error in a reserve that once held 700 million barrels.”

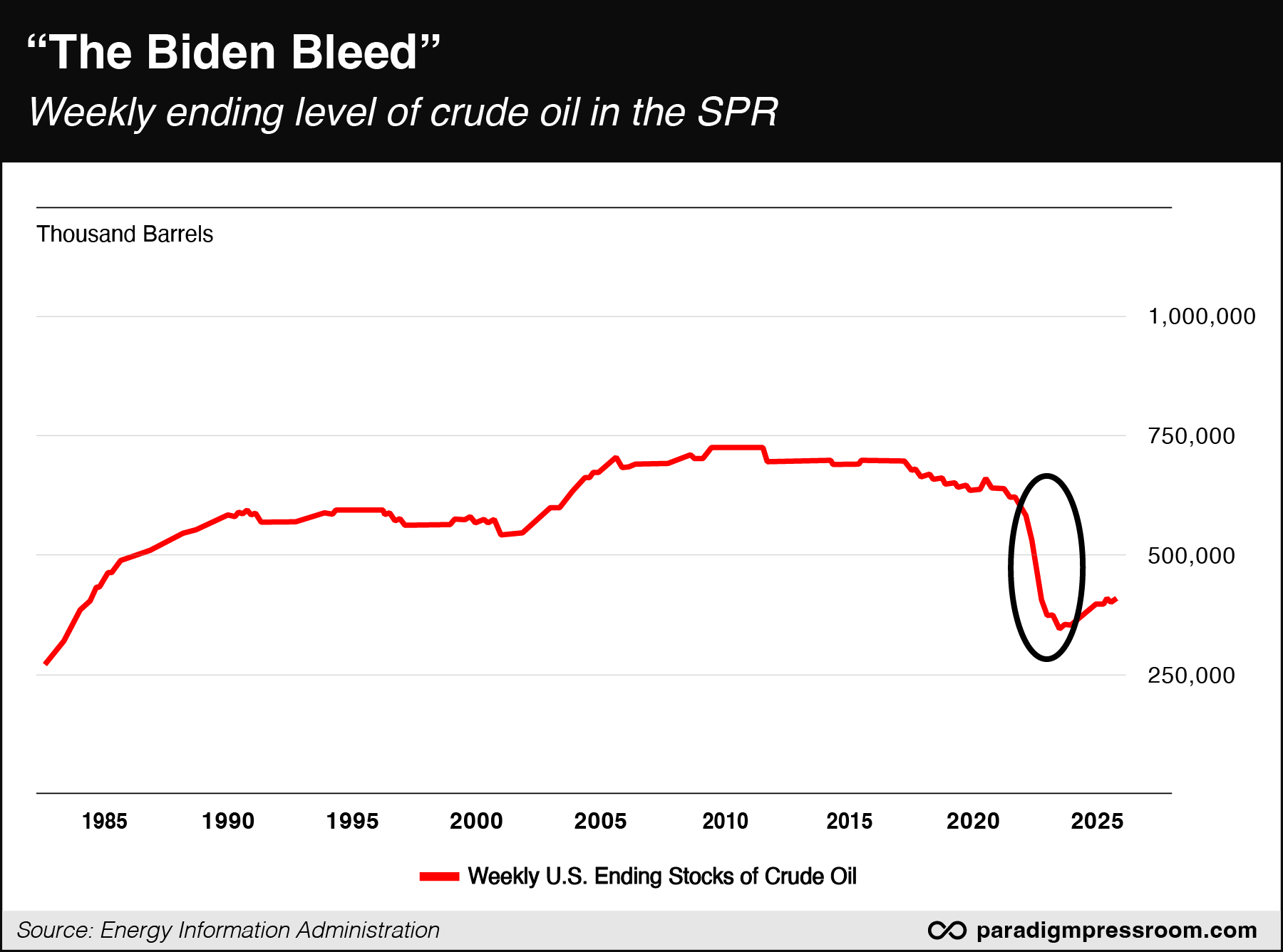

As we chronicled at the time, the Biden administration drained the SPR to an unprecedented degree throughout 2022 to keep a lid on gasoline prices ahead of that year’s midterm elections. Several of Biden’s predecessors tinkered with the SPR for political objectives — but never like this.

As you can see, the Biden team started sloooowwwwly refilling the SPR in mid-2023 and the Trump 47 team has continued that snail’s pace. Even so, the SPR is no more plentiful now than it was in 1984.

But it seems the pace is about to pick up with this new buy. As Geiger reports, “The Department of Energy will use $171 million from President Trump’s new tax and spending law to fund the purchase, issuing a solicitation for crude to be delivered to the Bayou Choctaw site in Louisiana. Bids are due by Oct. 28, with contracts tied to spot market prices.”

Still, Energy Secretary Chris Wright is on record saying that getting back to pre-2022 levels will take years and as much as $20 billion.

In the meantime, U.S. oil prices have rallied over a buck today after the weekly inventory numbers from the Energy Department (which are still coming out, shutdown notwithstanding.) A barrel of West Texas Intermediate fetches $58.32.

![]() Comic Relief

Comic Relief

Today’s giggle tees up our mailbag section…

Today’s giggle tees up our mailbag section…

![]() Mailbag: Crypto and the End of the World

Mailbag: Crypto and the End of the World

“WOW, what a way to start off the week. Monday’s 5 was packed with all sorts of stuff and I’ve just got to comment,” writes one of our regulars.

“WOW, what a way to start off the week. Monday’s 5 was packed with all sorts of stuff and I’ve just got to comment,” writes one of our regulars.

“Jim Rickards’ gold predictions just got a boost from all places silver price fixer Jamie Dimon, CEO of JP Morgan. What??? Anyway, to jump on you kids and memes, I’m riding his Strategic Intelligence writer’s gold/silver miner’s recommendations to the MOON! Thanks, guys!

“This gives me a great segue to Amazon’s AWS web outage. You’ve tried and tried to teach this old dog about crypto, quite eloquently by James Altucher et al., BUT I can’t for the life of me see the value of investing in a ‘computer program.’ Which as far as I can tell crypto is based on… a program? I would have literally s**t a brick if I were to wake up and find my crypto wallet, err, gone. I know this time they will get recovered but still…

“Last comment on the reader commenting on last week’s nuke war article. Yes, I would rather be vaporized like he stated should some of these dummies finally hit the button. On the other hand, if my family and I were to survive such stupidity, at least we would have some gold and silver to barter with, rather than a crypto wallet that may never come back.

“Just sayin’.

“Love the 5.”

Dave responds: So this is interesting to think about. If power and internet are both out — which can happen in many scenarios short of nuclear war! — what good is your crypto?

I guess it’s theoretically possible to transfer crypto from one cold wallet to another if you have 1) a backup power source and 2) a mesh network that can somehow reach an internet node from a distance, even if it doesn’t have a lot of throughput. Admittedly that’s a lot of ifs.

Hmmm… In that sense, an investment in crypto is ultimately an act of faith that civilization will continue functioning on one level or another!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets