DOD: $1B "Birthright" Metals Spree

![]() DOD: $1B “Birthright” Metals Spree

DOD: $1B “Birthright” Metals Spree

Judging by two headlines this morning, Birthright Phase II is moving into high gear.

Judging by two headlines this morning, Birthright Phase II is moving into high gear.

“The Pentagon has sought to procure up to $1 billion worth of critical minerals,” says the Financial Times — “as part of a global stockpiling spree to counter Chinese dominance of the metals that are essential to defense manufacturers.”

There was no grand announcement. Rather, the details emerged in dribs and drabs over the last few months in obscure filings by a Pentagon arm called the Defense Logistics Agency.

The DLA keeps a stockpile of strategic minerals, much like the Department of Energy maintains the U.S. Strategic Petroleum Reserve. Its assets in 2023 totaled $1.3 billion.

From the jump last January, the Trump 47 administration has been keen to beef up this stockpile. As Paradigm’s own Jim Rickards sees it, the scheme is part and parcel of the “American Birthright” agenda — in which the White House seeks to exploit the vast mineral bounty on federally owned land, a trove valued as high as $150 trillion.

Among the filings unearthed by the Financial Times — a potential plan to acquire as much as $245 million of antimony from U.S. Antimony Corp. (UAMY).

Antimony is a grayish metal used in everything from flame retardants to lead-acid batteries. The Pentagon values it for everything from explosives to night-vision goggles. The news has sent UAMY shares shooting 15% higher this morning.

The rare-earth names are also soaring once more after the FT’s scoop: USA Rare Earth (USAR) is up nearly 22% on the day. (Paradigm Mastermind Group members got an email this morning urging them to sell half their position for 191% gains.)

Not surprisingly, Washington’s competition with Beijing looms large: “China’s ability to turn off the supply of these critical minerals would have a direct, palpable and adverse effect on U.S. ability to field the kind of high-tech capabilities that we’re going to need for any kind of strategic competition or conflict,” says Stephanie Barna of the uber-connected D.C. law firm Covington & Burling.

Meanwhile, the biggest of the big banks wants a piece of the “Birthright” action.

Meanwhile, the biggest of the big banks wants a piece of the “Birthright” action.

“It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products and manufacturing — all of which are essential for our national security,” says a statement from JPMorgan Chase CEO Jamie Dimon.

And with that, JPM has launched a 10-year initiative “to help finance and take direct stakes in companies it considers crucial to U.S. interests,” reports CNBC.

JPM is targeting four sectors…

- “Defense and aerospace

- ‘Frontier’ technologies such as AI and quantum computing

- Energy technology including batteries

- Supply chains and advanced manufacturing.”

Within those four sectors are 27 industries where JPM plans to offer consulting, financing and investments — everything from robotics to space launches to nuclear power.

“This new initiative,” says Dimon, “includes efforts like ensuring reliable access to lifesaving medicines and critical minerals, defending our nation, building energy systems to meet AI-driven demand and advancing technologies like semiconductors and data centers.”

![]() Moving On

Moving On

Mr. Market is cautiously moving on from Friday’s trade freak-out.

Mr. Market is cautiously moving on from Friday’s trade freak-out.

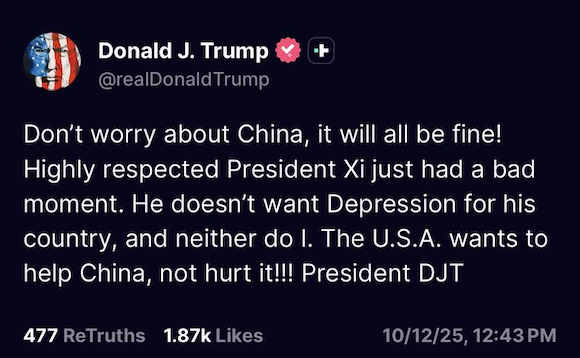

When we left you on Friday, Donald Trump rattled markets with a lengthy social media rant in response to China’s latest restrictions on the exports of rare earth elements.

He threatened a “massive increase” in tariffs on China and suggested he might call off his meeting later this month with China’s President Xi. The S&P 500 ended the day down 2.7%, the biggest one-day drop since April.

After the market closed, Trump upped the ante — threatening 100% tariffs on imports from China. In the finance corners of social media, the chatter was about a “limit down” day when the market opened today.

But then yesterday…

The Trump-Xi meeting? Treasury Secretary Scott Bessent says it’s still on.

As we write this morning, the S&P 500 has recovered nearly half of Friday’s losses — up 1.2% to 6,631. The Dow’s gain is weaker, the Nasdaq’s stronger.

Hats off to Paradigm’s Microcap Millionaire readers: Chris Cimorelli urged them this morning to take 247% gains on Energy Fuels Inc. (UUUU). Not bad for six months!

Why Trump’s change of heart? Who knows — maybe it’s the latest trade figures from China.

Why Trump’s change of heart? Who knows — maybe it’s the latest trade figures from China.

China’s September exports denominated in dollars rose 8.3% year-over-year, according to China’s customs agency. That’s despite a 27% drop in exports to the United States.

China seems to be getting along just fine even as its trade with the United States plummets.

And why not? By one estimate, China’s exports to America make up 1.5% of China’s annual economic output. If all those exports went away tomorrow, China’s economy could likely withstand the hit.

![]() Silver Squeeze

Silver Squeeze

Meanwhile in the precious metals space, a silver squeeze is underway — propelling the white metal’s spot price nearly $2 higher to a record $51.86.

Meanwhile in the precious metals space, a silver squeeze is underway — propelling the white metal’s spot price nearly $2 higher to a record $51.86.

“Benchmark prices in London have soared to near-unprecedented levels over New York, prompting some traders to book cargo slots on transatlantic flights for silver bars,” reports Bloomberg — “an expensive mode of transport typically reserved for gold — to profit off the massive premiums in London.

“Silver lease rates — which represent the annualized cost of borrowing metal in the London market — surged to more than 30% on a one-month basis on Friday, creating eye-watering costs for those looking to roll over short positions. Lease rates for gold and palladium also tightened, signaling a broadening pull on London’s bullion reserves, following a rush to ship metal to New York earlier this year.”

Not to be overlooked, gold is also in record territory — up $75 to $4,091.

It’s a different story for digital nondollar assets. Bitcoin took a dive Friday, coinciding with Trump’s China trade threats — from $122,000 to under $107,000 in a matter of hours. At last check, the flagship crypto has recovered to $114,494. Much of the rest of the crypto space moved in sympathy, Ethereum now $4,119.

Crude is bouncing from Friday’s steep sell-off — up $1.10 as we write to $60 on the nose.

![]() Eurocrats Gone Wild

Eurocrats Gone Wild

What is it about European busybody bureaucrats and their aversion to long hot showers?

What is it about European busybody bureaucrats and their aversion to long hot showers?

“Europeans are at risk of cold showers after materials critical to hot water tanks were not included on an EU list of authorized substances,” says the Financial Times — “which was revised as part of the bloc’s sprawling environmental legislation.”

A while back, the EU wrote up new rules for drinking water — listing a raft of substances considered safe for household use. Not included on that list are the elements hafnium and zirconium.

Problem: Hafnium and zirconium are wonderfully heat-resistant metals, which makes them essential to hot water storage tanks. And it seems the rules apply to bathing water as much as drinking water.

“[Hafnium] is absolutely safe to use” for bathing, says Paolo Falcioni of the appliance trade group APPLiA. He warns that if the rules aren’t adjusted, about 90% of hot water tanks would no longer be marketable in the EU.

Yes, manufacturers could substitute steel or copper — but only at four or five times the cost.

The EU is washing its hands of the matter (so to speak), saying it’s up to individual member states to raise an objection.

The industry counters by saying that going country-by-country “would take too long and they would be forced to make costly changes to their production lines in the interim,” according to the FT.

Then again… maybe the Eurocrats are doing it on purpose?

When European leaders swore off Russian natural gas after the invasion of Ukraine in 2022, the Dutch government implored citizens to limit their showers to five minutes and Germany’s economy minister claimed he’d “drastically reduced” his shower time.

On the other hand… as the saying goes, never attribute to malice what you could otherwise attribute to incompetence.

![]() Mailbag: The Socialist Playbook

Mailbag: The Socialist Playbook

One more reader email in the aftermath of the Jimmy Kimmel incident…

One more reader email in the aftermath of the Jimmy Kimmel incident…

“As an endangered libertarian,” writes one of our longtimers, “I understand and agree that the tit-for-tat FCC infringement on free speech is only going to degrade rights for all of us, left and right (libertarians don’t count because there are only about three of us that survive). The Patriot Act opened the door to this in my opinion.

“I do understand the ‘karma is a bitch’ rationale after the Obama and Biden years were unprecedented in so many dystopian ways from turning the IRS and FBI against conservative groups to arresting people for praying in silence outside an abortion clinic on a public sidewalk. For brevity’s sake I’ll end there, but the examples are as chilling as they are many.

“As a libertarian, though, I wonder if we haven’t reached the point where we are about to lose our republic (if you can keep it) to communist and socialist movements that have already taken over our universities and much of the media.

“Saul Alinsky’s book Rules for Radicals reflected the communist/socialist playbook well with its core tenet of defeating opponents from within by forcing them to adhere to their own laws.

“The signs are everywhere that we are slipping into socialism with many ‘stars’ of the Democratic Party openly praising it. New York is about to elect a socialist.

“Numerous assassinations, and attempts, that aim to shut down free speech are also ominous signs of how far our society has fallen. Even our strongest allies like the U.K. seem to be embracing socialist tendencies and are arresting those who say things they don’t agree with. I guess that’s more civilized than murdering them.

“Do we allow our republic to fall without putting up a fight?

“I’ll assume that all but the extremes of both parties would agree we fight to keep our republic and our rights that are left, but that leaves the all-important question of how.

“I have been with you since the days of Agora. I value the vestiges of that heritage that remain and hope for honest discourse on this idea in that tradition.”

Dave responds: I dunno. I guess at the moment I’m more concerned about Oracle’s Larry Ellison heralding the arrival of a surveillance state where “citizens will be on their best behavior because we’re constantly recording everything that’s going on.”

And this is the guy who will soon control TikTok, the social media platform used by half of all Americans.

Michael Shellenberger — the man who coined the term “censorship-industrial complex” — took note of Ellison’s remarks last month. And he followed them to their logical conclusion.

“And after the government combines your personal, banking and voting data under a single digital ID, it will add social media and vaccine information… The Censorship Industrial Complex was dress rehearsal for digital ID.”

Note well: Ellison is another one of these opportunistic Democrat-turned Trumper types. His influence now is such that a recent Wired article described him as a “shadow president.”

Maybe I’m barking up the wrong tree — but right now I’m more concerned about all of that than I am about the Alinsky, Gramsci, Cloward-and-Piven stuff. Admittedly, your mileage may vary…