Trump: Reckless With Russia

![]() Washington Crosses a Red Line?

Washington Crosses a Red Line?

Until now, Washington’s support for Ukraine could be cast as defensive — drones, limited arms, broad intelligence. But openly helping Kyiv select targets inside Russia is something else entirely.

Until now, Washington’s support for Ukraine could be cast as defensive — drones, limited arms, broad intelligence. But openly helping Kyiv select targets inside Russia is something else entirely.

According to an exclusive report at The Wall Street Journal, the Trump administration has approved U.S. intelligence support for Ukrainian strikes on Russian energy infrastructure.

In fact, Trump signed off on letting the Pentagon and intelligence agencies share data that could enable Ukraine to hit refineries, pipelines and power plants hundreds of miles beyond the battlefield.

Officials are also weighing whether to send Tomahawk cruise missiles — capable of reaching 1,500 miles. The goal: deprive the Kremlin of energy revenue and weaken its war machine.

Well, that escalated quickly…

Early this morning, I reached out to retired U.S. Navy officer and Paradigm editor Byron King, who didn’t pull punches: “It’s an overt act of war against Russia, and truly a casus belli under even the minimal test of what’s called ‘belligerence’ under international law.”

For Byron, this is not just another tactic. It’s a dangerous escalation. “It’s one thing to tacitly support Ukraine,” he says. “It’s another to admit the U.S. is working to kill Russians.

“Turn it around: If Russia admitted it was supplying intelligence and munitions to kill Americans, what would we do?” Byron questions.

“Turn it around: If Russia admitted it was supplying intelligence and munitions to kill Americans, what would we do?” Byron questions.

The Kremlin is pressing the same point. Spokesman Dmitry Peskov wonders aloud whether Americans themselves will be directing missile strikes. If so, Moscow could treat the U.S. as a direct combatant.

Meanwhile, Byron stresses that Ukraine is of “negligible concern to the U.S. in terms of national interests.” Yet Washington has committed more than $180 billion in emergency funding since the war began — and NATO allies, Byron reminds us, have likely poured in just as much.

“We’ve invested staggering sums,” he says, “only to see burning tanks, wrecked artillery and Western weapons failing.

“Overall, our stuff does not pass the test of combat in Ukraine,” Byron concludes. Plus, he argues the U.S. military is built for rapid overseas interventions, not a grinding war of attrition against a continental power defending its own territory.

On the diplomacy front there’s little relief. Trump came into office promising to negotiate a ceasefire — “I could end this war in 24 hours” with one telephone call, he claimed on the campaign trail. But dialogue with Moscow has flatlined.

“Coming in the wake of the Alaska sit-down with Putin, it’s beyond comprehension,” Byron adds, “that Washington would now double down on escalation.”

The Trump administration’s decision marks a provocation — one that draws the U.S. directly into strikes on Russian soil and invites Moscow to see America as a combatant. Once that perception hardens, the margin for error shrinks.

This is not a viable strategy. It’s mission creep. And it risks dragging the U.S. into a war it never needed to fight.

![]() Silver Banishes Ghosts (1980 and 2011)

Silver Banishes Ghosts (1980 and 2011)

Gold (+47%) has been hogging the spotlight in 2025. But silver (+48%) is quietly stealing the show, delivering gains and inching toward new highs.

Gold (+47%) has been hogging the spotlight in 2025. But silver (+48%) is quietly stealing the show, delivering gains and inching toward new highs.

In fact, several Paradigm editors say this isn’t just a replay of the old “silver spikes then crashes” story. This time, the setup looks different.

“China is on track to have more solar power generation than the United States has total power generation,” says the aforementioned Byron King, also our resident geologist.

The Daily Reckoning’s Adam Sharp notes “China added 94 gigawatts of solar energy in May alone,” which required roughly 65 million ounces of silver.

With solar eating up so much supply, editor Sean Ring adds: “Silver’s industrial demand outstrips supply.”

Skeptics, however, love to point to 1980 and 2011 — the two infamous $50 silver spikes. But as Sean explains, context is key:

Skeptics, however, love to point to 1980 and 2011 — the two infamous $50 silver spikes. But as Sean explains, context is key:

- 1980: The Hunt brothers tried to corner the market, buying up a third of the world’s deliverable supply. That wasn’t a natural rally; it was a monopoly attempt crushed by regulators

- 2011: Europe’s debt crisis and America’s credit downgrade fueled a panic-driven “fear trade.” Industrial demand wasn’t in play yet.

This time, silver’s story is anchored in fundamentals, and once psychology joins in, it could turn into a stampede.

“People are going to see $50 and say, ‘I need to sell here because that’s the all-time high,’” says Sean. But he believes any pullbacks will be short-lived. “I think we’re going to see triple digits in silver.”

CBOE veteran trader Alan Knuckman reminds that silver’s inflation-adjusted 1980 high would be $72 today. Plus, other commodities like coffee (more on that in a moment), cocoa and gold have already blasted past old records.

Market analyst Dan Amoss further highlights opportunities in mining stocks still flying under the radar: “I still don’t see any [miners] or exchange-traded funds anywhere in the top 30 U.S. retail trading stocks,” he says. Translation: The crowd hasn’t piled in yet.

[Congrats are in order to Dan and the team at Rickards’ Insider Intel where subscribers just locked in 185% gains on a silver miner play!]

“Sure, silver will stay volatile — it’s in its DNA,” Sean concludes. “This time, [silver] won’t just fly to $50 — it’ll pitch a tent, plant a flag and start charging rent.”

Wouldn’t you know it, precious metals are pulling back today. The price of gold is down almost 1% to $3,861.10; meanwhile, the white metal’s dropped more than 3%, barely hanging onto $46.

Wouldn’t you know it, precious metals are pulling back today. The price of gold is down almost 1% to $3,861.10; meanwhile, the white metal’s dropped more than 3%, barely hanging onto $46.

- “I'm almost glad we're correcting,” says Adam Sharp at Paradigm’s private editorial Slack channel. “That parabolic move was making me nervous”

- “Yup, today is necessary,” Sean Ring confirms. “The good news is that it hasn’t broken any big trends.”

As for the other commodity we regularly track, oil’s down 2.15% to $60.45 for a barrel of West Texas crude.

Stocks, in the meantime, are mostly in the red. The Dow (-0.10%) and S&P 500 (-0.10%) are down to 46,405 and 6,705 respectively. But the tech-loving Nasdaq is up 0.15% to 22,790.

The crypto market, however, is in fine fiddle. Bitcoin’s rallying 2%, at the time of writing, just a hair below $120K. As for Bitcoin’s cuz, Ethereum, it’s up 2.60% to $4,440.

Keep reading for more on crypto’s outlook, and check back tomorrow for a plucky ETH prediction…

![]() “Cryptober is Still On”

“Cryptober is Still On”

“We thought the CLARITY Act — the next big bill for crypto — was going to glide through like an Olympic figure skater,” says Paradigm editor Chris Campbell.

“We thought the CLARITY Act — the next big bill for crypto — was going to glide through like an Olympic figure skater,” says Paradigm editor Chris Campbell.

“And… it was,” he says. “And then what happens? D.C. rage quits.”

The much-anticipated CLARITY Act aims to define once and for all which tokens are securities, which are commodities and how agencies like the SEC and CFTC should divide oversight. In short, it was meant to end the regulatory guessing game that’s plagued the industry for years.

That setback might seem discouraging, but as Chris points out, the market tells a different story. “Unlike the government, there’s no off switch for crypto. Blocks keep getting mined. Stablecoins keep moving billions. Ethereum keeps verifying transactions. 24/7. No holiday breaks.”

In fact, activity is accelerating. More than $300 billion worth of stablecoins now circulate on blockchains — double the number from January, and more than the entire crypto market cap just five years ago. Chris predicts “we’ll see half a trillion stablecoins by Christmas.

“But that’s only one part of the story. It’s the ‘everything else’ that makes me bullish…

- The SEC just met with the NYSE to put actual securities on-chain

- SWIFT [payment system] is OFFICIALLY working with Chainlink and Ethereum developers to rebuild settlement rails

- Visa is running pilots with USDC and EURC like they’re cash.”

So yes, the CLARITY Act is stuck for now. But crypto doesn’t wait on Capitol Hill. As Chris puts it: “To call days like this merely ‘bullish’ is like describing a supernova as ‘slightly twinkly.’”

The train hasn’t stopped — it’s just gathering speed. “October is historically a very bullish month for crypto,” Chris adds. “This one is setting up to be no different.”

And just in time for October 2025’s eerie overlap with a government shutdown, here’s a meme that captures the vibe…

And just in time for October 2025’s eerie overlap with a government shutdown, here’s a meme that captures the vibe…

![]() Grounds for Concern

Grounds for Concern

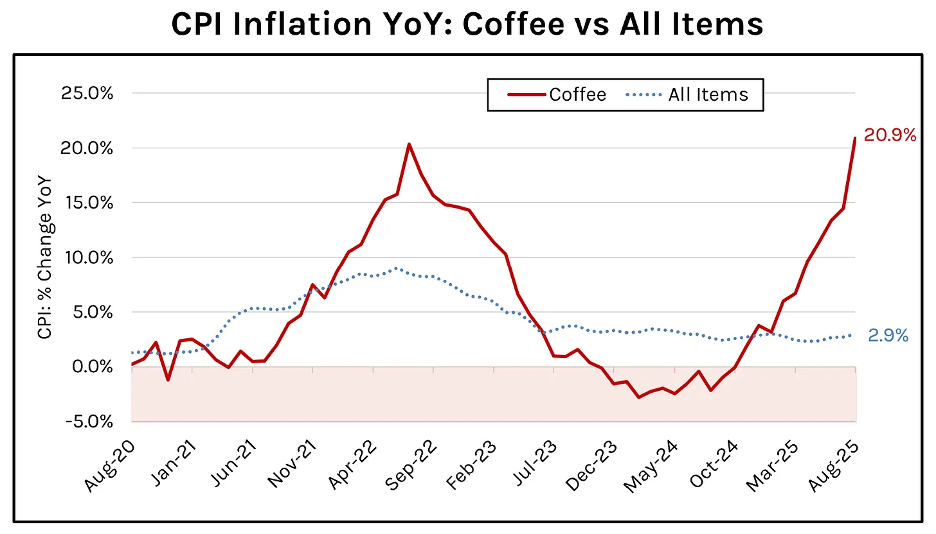

Monday was National Coffee Day… But who’s celebrating? Coffee prices have surged almost 21% over the past year, far exceeding overall inflation…

Monday was National Coffee Day… But who’s celebrating? Coffee prices have surged almost 21% over the past year, far exceeding overall inflation…

Source: BLS, Hedgeye

The reasons are straightforward: Severe droughts in Vietnam and Brazil — which together supply the majority of the world’s coffee beans — have slashed harvests and left global stockpiles at their lowest level in decades.

Vietnam’s crop has been hit particularly hard, down about 20% year-over-year, while Brazil’s shipments to the U.S. fell 46% this summer.

On top of inclement weather? Tariffs introduced earlier this year added a 20% duty on Vietnamese beans and a steep 50% tariff on Brazilian coffee. (See drought data points above. Uncanny symmetry, no?)

Thus Arabica futures hit $4.41 a pound in February — double the price in 2023. Of course, importers and roasters have passed those costs on to consumers, with packaged coffee on U.S. grocery shelves climbing at the fastest pace since 1997.

Now a bipartisan bill is trying to reverse course. Reps. Don Bacon (R-NE) and Ro Khanna (D-CA) have introduced legislation to repeal Trump-era coffee tariffs.

The bill would exempt roasted and decaffeinated coffee, as well as related products from any duties imposed after Jan. 19, 2025. Supporters argue the move is simple: Cut tariffs to bring down costs for everyday consumers.

Relief may also come from Mother Nature. Forecasts call for more rain in Brazil and Vietnam, which could help next year’s harvest. But analysts warn that global Arabica supply will still run short — by as much as 8.5 million bags in the coming crop year.

For coffee drinkers, that means higher prices aren’t going away soon. Even with political fixes, the world’s favorite pick-me-up is likely to remain an expensive habit well into 2026.

![]() A Reader Calls “Foul” on First Brands

A Reader Calls “Foul” on First Brands

“So what you are saying is that First Brands is not an exception but the rule; therefore, we just might be in for a terrible market crash,” a reader grouses about Wednesday’s 5 Bullets.“Hard to believe, and hard to believe you are promoting this.”

“So what you are saying is that First Brands is not an exception but the rule; therefore, we just might be in for a terrible market crash,” a reader grouses about Wednesday’s 5 Bullets.“Hard to believe, and hard to believe you are promoting this.”

Emily: I never said First Brands’ bankruptcy is “the rule.”

What I said is that First Brands is a small fracture beneath the surface of credit markets. Cracks don’t always lead to collapse, but they do reveal pressure points. And sometimes, they’re canaries in the coal mine.

Sure enough, just yesterday PIMCO President Christian Stracke warned of growing stress in corporate private credit. Keep in mind, PIMCO is one of the world’s largest bond managers, overseeing more than $2 trillion in assets.

Specifically, Stracke points out that more borrowers are asking to pay lenders not in cash, but in IOUs — so-called “payment in kind” loans.

In other words, even PIMCO sees the same widening fault lines I flagged yesterday.

No, First Brands is not proof the entire system will implode today. Or even tomorrow. But as Jim Rickards frequently reminds: Sometimes, it only takes a single snowflake to trigger an avalanche.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets