Close Enough for Government Work

![]() “Careful What You Read on the Internet”

“Careful What You Read on the Internet”

Somebody made a helluva lot of money off this sequence of events late yesterday afternoon…

Somebody made a helluva lot of money off this sequence of events late yesterday afternoon…

As we’ve been reminding you since Friday, the Securities and Exchange Commission faces a deadline of today to give the thumbs-up or thumbs-down on Grayscale Investments’ application to issue a Bitcoin ETF.

A thumbs-up for Grayscale would presumably come with a thumbs-up for as many as 10 other companies that want to issue Bitcoin ETFs — including giants like JPMorgan and BlackRock — so that no one firm gets a leg up on any other firm.

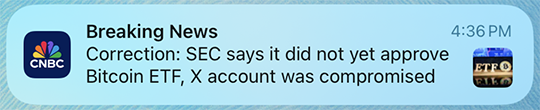

The bogus “approval” announcement came through the SEC’s own X-formerly-Twitter account.

You can see the result in this chart depicting Bitcoin’s price action between midday Sunday and midday today. Note the slender red line yesterday afternoon — an instantaneous jump to $48,000 and slide to $45,000.

You can see the result in this chart depicting Bitcoin’s price action between midday Sunday and midday today. Note the slender red line yesterday afternoon — an instantaneous jump to $48,000 and slide to $45,000.

Again, someone made a lot of money off of this. For the moment — and perhaps for all time — that someone’s identity is a mystery.

Immediately a narrative took hold: Oh look, Elon Musk’s cost-cutting at Xwitter bit him in the ass again. Look how sloppy their security is. But as the evening wore on, Xwitter issued this riposte.

Immediately a narrative took hold: Oh look, Elon Musk’s cost-cutting at Xwitter bit him in the ass again. Look how sloppy their security is. But as the evening wore on, Xwitter issued this riposte.

Seriously? No “2FA” protecting the social media account of a major government agency? If true, that’s on you, SEC.

Only three months ago that same agency issued this tweet — which has absolutely not aged well…

It’s hard to imagine Xwitter would make this allegation without ironclad proof. Not given Musk’s history of tangling with the SEC, going back to his infamous “funding secured” tweet about taking Tesla private in 2018.

OK, one more gag that associate editor Emily Clancy spotted this morning…

All of this is entertaining… but, in a way, a distraction from the real story.

All of this is entertaining… but, in a way, a distraction from the real story.

The SEC is bound by a court ruling to issue a decision on a Bitcoin ETF today. And while we can never completely rule out the possibility of a rejection… that possibility seems vanishingly small.

Again, BlackRock is one of the companies that wants to issue a Bitcoin ETF. BlackRock is the biggest asset manager in the world. What BlackRock wants, BlackRock gets — almost always.

In fact, Paradigm’s resident crypto evangelist James Altucher points out that BlackRock has brought business before the SEC on 576 occasions. Only once did the SEC turn down BlackRock’s wishes.

“An astonishing 99.8% success rate,” James points out. No wonder he believes an SEC decision today will set off what he calls “the final crypto bull run.”

Reminder: James first talked up Bitcoin on CNBC in 2013, when Bitcoin fetched only $114.

Going into today’s decision, it’s over $45,000. And James has every reason to expect a rally to $100,000 by year-end.

But that’s not where the biggest gains will come. “There are six tiny cryptos,” he says, “that could soar 10X, 50X, even 100X over the next 12 months that will far outperform Bitcoin.”

If you haven’t watched the Emergency Crypto Briefing James delivered last week, time’s running out. The decision could come at literally any moment. Watch now at this link — you can always come back to the rest of our 5 Bullets later…

![]() The “Disbelief Phase” Is Winding Down

The “Disbelief Phase” Is Winding Down

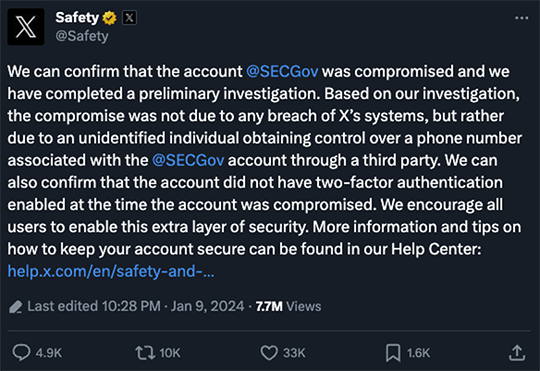

The stock market is stabilizing this week after its early 2024 swoon. The trouble last week can be chalked up to…

The stock market is stabilizing this week after its early 2024 swoon. The trouble last week can be chalked up to…

Uh… what can it be chalked up to? The attacks on cargo ships in the Red Sea? The jobs and manufacturing numbers? Worries about what the Federal Reserve will do in a few weeks?

When it comes to short-term moves — a time frame of a few days or less — it’s impossible to say and it doesn’t matter.

“We could debate the various effects of certain news items until we suck every molecule of oxygen from the room,” says Paradigm trading pro Greg “Gunner” Guenthner. “But none of our answers will get us closer to answering a much more important question: What happens next?”

The problem is that Mr. Market has a bad case of recency bias: Stocks rallied furiously in November and December, so they’re destined to continue doing so. Right?

The problem is that Mr. Market has a bad case of recency bias: Stocks rallied furiously in November and December, so they’re destined to continue doing so. Right?

“Despite everything that’s happened so far this month, too many traders are going to be stuck on the same melt-up frequency from late 2023,” Gunner says, “despite the fact that we’re dealing with dramatically different market conditions than we enjoyed just a couple weeks ago.

“If it isn’t already finished, the disbelief phase of the rally will end soon. When it does, we’re going to need to be a bit more tactical and cautious on the long side.

“A weeklong skid isn’t going to tell us much about the market,” Gunner continues. “But how the market bounces from here will certainly dictate how we trade for the next four to six weeks. If we see the leaders such as the semiconductors, tech-growth base breakouts and other hot names snap back to attention, we can brush this early January action off as some much-needed profit taking.

“On the other hand, we could see a weak bounce attempt that quickly runs out of steam as these market leaders approach those former highs. This is the kind of action that could lead to choppy trading and more downside heading into February.

“Anything is possible. But it’s important to work out these potential scenarios so we can work up our trading plans.”

For the moment, the major U.S. stock indexes are all in the green today — if barely.

For the moment, the major U.S. stock indexes are all in the green today — if barely.

None of them is up more than a quarter percent as we write, but the Nasdaq is up strongest, approaching 14,900 for the first time in 2024. The S&P 500 is up eight points to 4,764 — still about 30 points shy of the early-2022 record highs. The Dow has added 58 points to 37,583.

Crude is looking relatively stable, at least by recent standards — up 57 cents to $72.81. Precious metals remain in a small slump, gold at $2,028 and silver at $22.85.

![]() Rolling Blackouts in 2024

Rolling Blackouts in 2024

Not that it will make much difference, but a major Wall Street firm concurs with our concerns about the stability of the electric grid.

Not that it will make much difference, but a major Wall Street firm concurs with our concerns about the stability of the electric grid.

JPMorgan Chase strategist Michael Cembalest has issued a “Ten Surprises” forecast for 2024 — and one of the biggest on his list is rolling blackouts in major U.S. cities.

Cembalest spotted the same report we did in November from the North American Electric Reliability Corporation. It warned that most of the eastern two-thirds of the continent is at “elevated” risk of power cuts during extreme winter weather. (Which would be, uhh, right now in a lot of places…)

Cembalest dug deeper into NERC’s research — which found that peak loads are rising “at an alarming rate” thanks to rising demand, an increasing reliance on intermittent wind and solar power… and an expected 7% loss of generation capacity by 2033.

NERC says the most immediate risk is in five states — New York, Texas, Pennsylvania, Wisconsin and Tennessee.

The risk isn’t just in the winter, either: We noted high risk going into the summer of 2023 as well. Fortunately, that risk didn’t materialize — but the fact remains that coal and nuclear plants are being retired faster than wind and solar capacity is coming online.

Worse, Cembalest anticipates not only electric outages — but far messier natural gas outages. He reminds us we came dangerously close to natgas outages during a Christmas cold snap in 2022.

Worse, Cembalest anticipates not only electric outages — but far messier natural gas outages. He reminds us we came dangerously close to natgas outages during a Christmas cold snap in 2022.

“During a gas outage,” Cembalest writes, “local gas distribution companies would need to go building-by-building and shut off gas valves to ensure that residual gas does not seep through units whose pilot lights are out.

“During the system restoration process, the main distribution system would be purged; then workers would have to ensure at each point of service that heating and cooking gas lines are safely purged and operational before restoring service and relighting pilot lights.

“Any homes or buildings with safety issues would need remediation before any gas restoration.

'Even losing service to 130,000 customers would be considered a major outage and could have taken five to seven weeks to restore.

“A large outage could also cause extensive property damage due to burst water pipes within homes and buildings, since water expands when it freezes.”

Come to think of it, a gas outage would also transform those nifty Generac whole-house electricity backups… into giant outdoor doorstops.

➢ Brief backstory: I can’t help but like Cembalest, despite the contemptible company he works for. A few years ago I spotlighted an eye-opening report of his that revealed “socialism” as practiced in the Nordic countries actually entails more economic freedom than present-day America’s crony-capitalist model

➢ And for what it’s worth: Cembalest agrees with our own Jim Rickards’ call from last November: Joe Biden won’t be the Democrats’ presidential candidate by the time we get to Election Day on Nov. 5.

![]() And Now for Something Completely Different

And Now for Something Completely Different

If you thought AI was just about “large language models” like ChatGPT… this week’s Consumer Electronics Show will set you straight.

If you thought AI was just about “large language models” like ChatGPT… this week’s Consumer Electronics Show will set you straight.

Paradigm has a team led by publisher Matt Insley crawling every inch of exhibition space in Las Vegas.

“Here’s the future of construction,” says James Altucher’s chief stock analyst Bob Byrne — who sent us a short eye-opening video. “Drones survey the site and autonomous heavy machinery does the heavy lifting.”

That’s just a tiny sample of what’s on view this week at CES. Come back tomorrow for more highlights. Better yet, keep up with developments as they happen on our dedicated Paradigm at CES 2024 liveblog.

As I write, it’s still bright and early in the Pacific Time Zone – so keep a tab open on your browser and look for extensive coverage for the rest of today.

![]() Escape From the Taxman, State Edition

Escape From the Taxman, State Edition

We heard from a few readers after our item yesterday about state-to-state migration, evidently for tax reasons…

We heard from a few readers after our item yesterday about state-to-state migration, evidently for tax reasons…

“We left California in 2022 and finally settled in Virginia,” writes one. “Before that I lived in Pennsylvania for 20 years.

“I found CA tax rates were quite reasonable at my income level (~$200K) compared to PA. Once you make over $500K, then CA becomes unbearable.

“If you see your chart, all the Left Coast states have emigration even though a state like Washington has no income tax. We left CA because we were tired of the never-ending left-wing fascism, rainbow flags and COVID mandates and don't wish to yield to them any longer. I suspect there were many others like us.

“That's why East Coast house prices are still strong compared with Left Coast house prices. The West Coast Demoncrat is a whole different animal than the East Coast Democrat.”

“I'm from a state on your map that doesn't play by those rules, and has always been a bit different,” writes another.

“I'm from a state on your map that doesn't play by those rules, and has always been a bit different,” writes another.

“Alaska has no state income tax or sales tax. We get a Permanent Fund Dividend each year, and still, we were one of the 10 states losing the most population. (Yet when it's convenient in national news, our PFD is a reason people move here?)”

“Personal security is a key driver of migration!” asserts still another reader.

“Personal security is a key driver of migration!” asserts still another reader.

“Fleeing urban liberal failures is another reason. Urban flight to safer rural areas is a larger trend than migration to different state.”

Interesting point, which jibes with our final correspondent today…

See, there’s the matter of the folks already living in the places that are seeing huge in-migration…

See, there’s the matter of the folks already living in the places that are seeing huge in-migration…

“I am a 30-plus year Texas resident,” this reader writes, “and am planning on leaving Harris County (Houston) due to the increased taxes and lack of services (law enforcement response).

“I am still searching for my new home in Texas (plan to stay) but have noticed that the influx has made it difficult to find acreage as the appeal of selling to developers has made smaller parcels (10-plus acres) few and far between.”

Dave responds: I wish you luck, but yes, your timing is less than ideal with all the newcomers in your state.

Sometime during the first COVID summer of 2020, I remember reading a message board about migration from California to Idaho.

The natives didn’t much mind the Californians who’d moved in during the previous decade. If anything, the newcomers’ presence helped goose an otherwise moribund economy.

But the ex-Californians really resented the new pandemic-era arrivals from the Golden State — bidding up housing prices, crowding the restaurants and so on.

Having relocated in 2016 to a spot in the Upper Midwest that many people consider a tourist destination, my wife and I can definitely relate…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets