Oil Shock 2023

- The day Saudi oil goes offline

- Is CAT the canary in the coal mine?

- Winter power outage warning

- Stupid bureaucracy tricks, Illinois edition

- Does anybody really know what time it is?

![]() The Day Saudi Oil Goes Offline

The Day Saudi Oil Goes Offline

Just another day in the Middle East now — American F-15s bombing a target in Syria that the Pentagon says is used by “Iran’s Islamic Revolutionary Guard Corps (IRGC) and affiliated groups.”

Just another day in the Middle East now — American F-15s bombing a target in Syria that the Pentagon says is used by “Iran’s Islamic Revolutionary Guard Corps (IRGC) and affiliated groups.”

Look, I don’t mean to be a one-note Charlie this week about the risk of the Israel-Hamas conflict metastasizing into a U.S.-Iran war. I won’t even try to sell you on a Jim Rickards presentation today. I’m just struck by the complacency that shows up in the oil price; at $76.31, a barrel of West Texas Intermediate is up a buck today, but still down dramatically from $90 just three weeks ago.

This round of U.S. airstrikes is the second in recent weeks — supposedly intended to “deter” further attacks on U.S. forces in Iraq and Syria.

This round of U.S. airstrikes is the second in recent weeks — supposedly intended to “deter” further attacks on U.S. forces in Iraq and Syria.

Shia Muslim militias launched 19 attacks targeting U.S. forces between the time of the Hamas attack in Israel on Oct. 7 and the first round of U.S. airstrikes on Oct. 27.

Those airstrikes clearly didn’t have a “deterrent” effect; there’ve been at least 22 attacks since, injuring at least 45 U.S. troops.

Officially the story is that those injuries are minor. Unofficially, “I learned today from someone who regularly visits Walter Reed Medical Center in Bethesda, Maryland, that the wards are filling up with U.S. military personnel wounded in recent attacks on those bases,” writes former CIA officer Larry Johnson at his blog.

“The White House and the Department of Defense are working actively to suppress this information, apparently out of fear that the American public will recoil at news of the losses and step up pressure for the United States to get out of Iraq and Syria.”

To be sure, Iran has denied any role in the attacks and the Pentagon has previously said it has no evidence of direct Iranian involvement.

But in a way, it doesn’t matter: The process of escalation is underway. And once underway, it’s hard to reverse without intelligent diplomacy — something woefully lacking in the current U.S. administration.

As always, the biggest risk from the standpoint of everyday Americans is a disruption to Middle East oil supply.

As always, the biggest risk from the standpoint of everyday Americans is a disruption to Middle East oil supply.

And as described here yesterday, it’s trivially simple for Iran to cut off the Strait of Hormuz — blocking oil exports from Saudi Arabia and the other Gulf sheikdoms. In that eventuality, oil could easily reach $200 a barrel.

And yes, according to Paradigm’s own Byron King, the risk is very real.

Byron is uniquely qualified to address the present dangers. He cut his teeth as an oil field geologist before spending three decades as a U.S. Navy flight officer. He served extensive deployments in the Middle East, and he served as an aide to the highest-ranking officer in the entire navy, the chief of naval operations.

In a new interview we just released on the Paradigm Press YouTube channel, Byron describes everything from how high gasoline prices could leap… to the country whose air defenses could neuter American airpower. And because we don’t want to leave you feeling helpless, Byron names seven energy stocks to watch if Saudi Arabia’s oil goes offline…

These videos are strictly for your edification; we don’t try to sell anything during these interviews. We hope you like what you see. Better yet, if you have a YouTube account, we hope you subscribe.

![]() Is CAT the Canary In the Coal Mine?

Is CAT the Canary In the Coal Mine?

When demand for backhoes and bulldozers starts to fade, what does that say about the strength of the global economy?

When demand for backhoes and bulldozers starts to fade, what does that say about the strength of the global economy?

Caterpillar reported its quarterly numbers last week. They were fine — quarterly profits up 37% from a year ago, and a 12% sales increase driven in part by federal infrastructure spending.

“But while CAT's past profits were strong, the company's management team sounded less upbeat about future profits,” says Paradigm retirement pro Zach Scheidt. “In particular, CAT is challenged by weakness in China, and to a lesser extent in Europe and Latin America.”

The chart action in CAT is not encouraging right now. “Since CAT is a major bellwether for the overall global economy, the stock's breakdown is quite sobering. It tells me that growth may be challenged for some time to come, which means we need to play defense with our investments.”

Zach’s favorite defensive play right now remains the one we mentioned at the end of October — TLT, the 20+-year Treasury bond ETF.

“Long-term Treasury bonds are some of the very best investments I'm tracking in today's market,” he says.

Remember, as bond yields fall, bond prices rise. T-bond yields topped out around 5% when Zach was talking them up here in late October. This morning, they’re back to about 4.7%. Thus, TLT has rallied from $83.58 to $88.56.

But there’s still time to take advantage of the trend. If the economy is rolling over, rates will continue to move lower.

“I think buying shares of TLT is one of the smartest things you can do with your capital,” Zach concludes. “It's a great way to protect your hard-earned savings and do well if the economy weakens.”

“Believe it or not, we’re watching a historic streak shaping up in the markets,” Paradigm’s Greg Guenthner writes at The Trading Desk.

“Believe it or not, we’re watching a historic streak shaping up in the markets,” Paradigm’s Greg Guenthner writes at The Trading Desk.

“The S&P 500 has now posted an eight-day winning streak, which is its longest string of uninterrupted gains in two years.”

The last time we got nine days in a row? 2004, according to figures from Carson Group.

“I’m going to bet on red today,” Greg says. “That doesn’t mean we’re going to see a violent pullback. But I do expect the averages to rest sooner rather than later.”

Checking our screens, the S&P is barely in the green — up less than two points at 4,384. “The S&P is now knocking on the door to its October highs. That makes this the perfect place for a little consolidation.”

Treasury yields are moving up, the 10-year note now 4.55%. Precious metals are recovering from their latest drubbing — gold at $1,962 and silver at $22.91. Bitcoin raced past $37,000 in the last 24 hours — an 18-month high — but as we write it’s pulled back to $36,528.

Back to the price action in crude, briefly: West Texas Intermediate might be putting in a bottom similar to what the S&P 500 did in late October — falling just below the 200-day moving average, enough to fool amateur chart-watchers into believing there’s nowhere to go but down.

![]() Winter Power Outage Warning

Winter Power Outage Warning

The following is what’s become a seasonal reminder about the risk of “load shedding” — planned blackouts to prevent the power grid from collapsing.

The following is what’s become a seasonal reminder about the risk of “load shedding” — planned blackouts to prevent the power grid from collapsing.

From The Washington Post: “The nation’s power grid faces a sharp risk of buckling in the event of major storms or prolonged cold snaps this coming winter, according to the regulator that monitors the electricity system.”

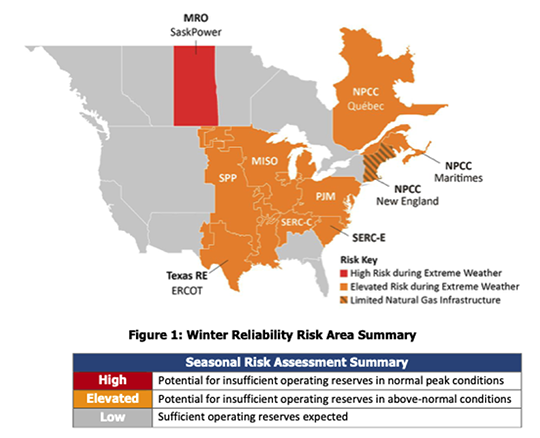

The North American Electric Reliability Corporation has issued its “winter reliability assessment.” Its conclusion: Most of the eastern two-thirds of the continent is at “elevated” risk of power cuts during extreme winter weather.

Here’s a map we snagged directly from the PDF of NERC’s report…

Those acronyms you see on the map? Those are the regional “interconnections” you’ve probably never heard of, but nonetheless rely on.

As a reminder, U.S. grid capacity is nearly unchanged from what it was in 2011 — even though demand keeps growing, especially as more people ditch conventional automobiles for electric vehicles.

We mentioned last winter how in the PJM region stretching from New Jersey to Chicago, 21% of power-generating capacity is set to retire by 2030. Older coal and nuclear plants will shut down, and there’s not nearly enough solar and wind power coming online to replace it.

You might want to set up a Google News alert or something similar for the interconnect in your area. That way, you’ll get a heads-up before trouble comes — as it almost did last winter during the Christmas Eve cold snap in PJM’s service area.

![]() Stupid Bureaucracy Tricks, Illinois Edition

Stupid Bureaucracy Tricks, Illinois Edition

Near as we can tell, this is not a parody…

Near as we can tell, this is not a parody…

The backdrop: In January, the state of Illinois enacted a new ban on what it classifies as “assault weapons.” In September, the Illinois State Police issued rules to implement the law.

Seems there’s a grandfather clause, under which owners can retain banned firearms and other items — as long as they register with the state. According to an Illinois State Police statement, “Individuals who possessed an assault weapon, assault weapon attachment, .50 caliber rifle or .50 caliber cartridge before the act took effect are required to submit an endorsement affidavit through their Firearm Owner’s Identification (FOID) Card account prior to Jan. 1, 2024,”

A few days ago the Illinois State Police held a hearing, allegedly to clarify the rules. Among those in attendance was gun rights advocate Todd Vandermyde. He described a replica of the lightsaber from the original 1977 Star Wars movie — pointing out that it was made with parts from now-banned firearms including a .50 caliber Browning machine gun.

Vandermyde asked if these particular lightsabers must be registered by existing owners as “assault weapons accessories.”

Vandermyde with a photo of lightsaber parts: “What do they have against Star Wars?” [Screengrab from State of Illinois/Vimeo]

The Illinois State Police’s lawyer answered in the most officious manner possible: “If it meets the definitions in the PICA Act,” she said, “then it will be subject to regulation and the endorsement affidavit process.”

As someone quipped on a firearms message board, “There’s been a disturbance in the force.”

![]() Does Anybody Really Know What Time It Is?

Does Anybody Really Know What Time It Is?

Our daylight saving time thread is still lively. A reader wishes to follow up on yesterday’s installment…

Our daylight saving time thread is still lively. A reader wishes to follow up on yesterday’s installment…

“Not to put too fine a point on it, but a Marine first sergeant ought to know how to deal with Zulu time. It's commonly used throughout the Department of Defense.”

Meanwhile, similar to China’s single time zone, “Russia has had a similar practice whereby folks mostly use local time, but the railroad uses Moscow time across all 11 time zones.”

Dave responds: Interesting.

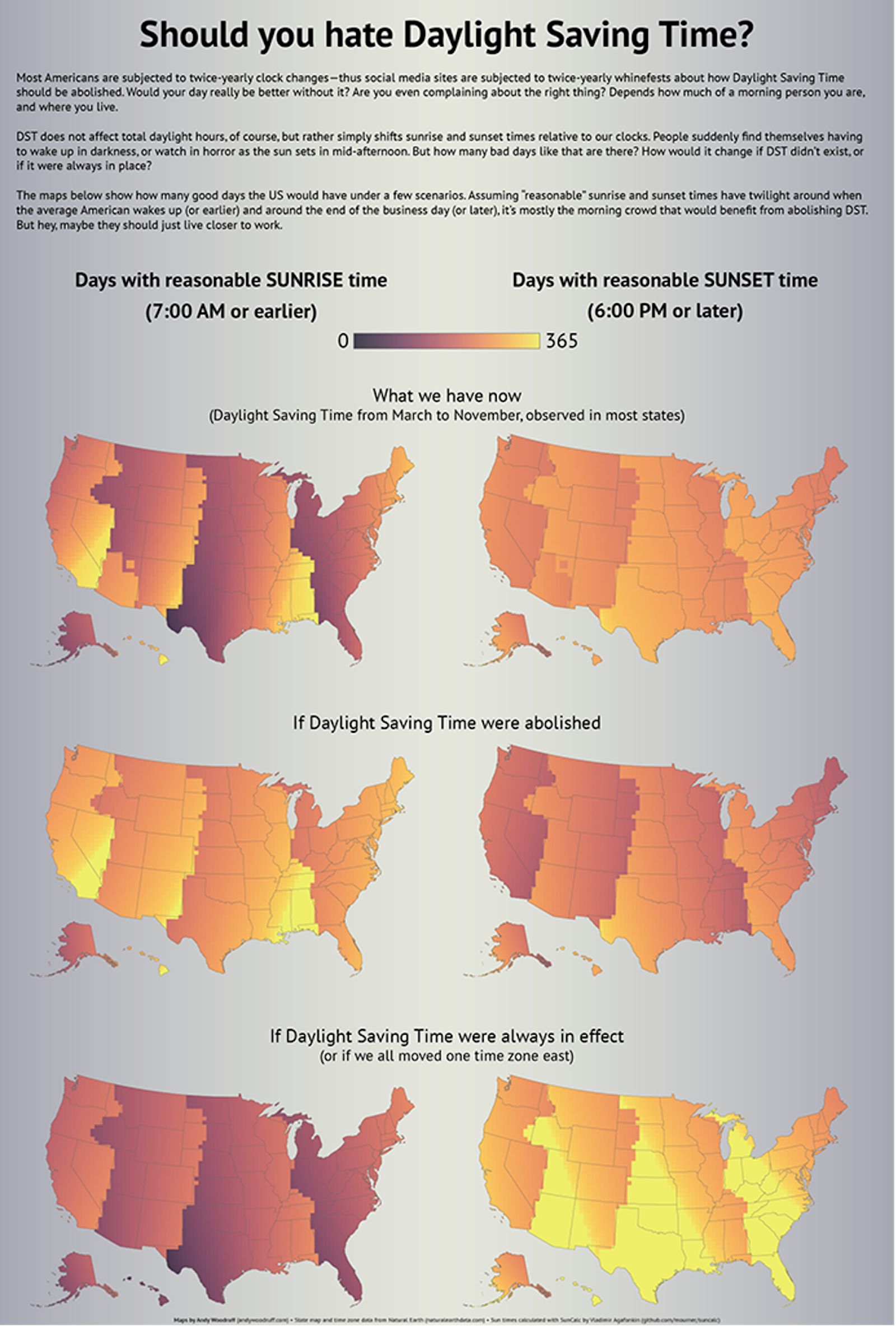

Forgot to mention: In addition to economist Allison Schrager’s proposal to have only two time zones in the continental United States, separated by one hour, the website standardtime.com proposes something similar, but with a two-hour separation.

Meh — I’d happily settle for the current time zones and year-round standard time.

For visual proof that it’s the superior solution, cartographer Andy Woodruff compiled this infographic a few years ago. (Click to enlarge.) In short, year-round standard time gives the most people the most opportunities for a sensible sunrise time before 7:00 a.m.

True, it wouldn’t be as good for Big Oil, convenience stores and outdoor industries. But that’s a small trade-off for better sleep, fewer heart attacks and fewer car crashes, no?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets