COVID Redux

![]() Countdown to Supply-Chain Snags

Countdown to Supply-Chain Snags

Sure, now the mainstream has figured out a huge port strike is about to begin…

Sure, now the mainstream has figured out a huge port strike is about to begin…

We started warning you back on June 11. The International Longshoremen’s Association was at odds with the U.S. Maritime Alliance — operators of the major ports on the East Coast and Gulf Coast.

And they’re still at odds. The current union contract expires tonight at midnight. As we said more than once last week, do not expect a Plast-minute agreement. Forty-five thousand dockworkers will walk.

If you’re interested in the details of the dispute — the two sides are hung up on pay and the use of robotics — you can now read about that anywhere.

As always, our aim here is to see where the puck is going, not where it is.

As always, our aim here is to see where the puck is going, not where it is.

“After two days, we will feel nothing from a strike,” says Byron King — Paradigm’s resident renaissance man. Having cut his teeth in the oil business as a geologist, and as a Navy flight officer with three decades of service… he knows a thing or two about logistics and the process of moving things from Point A to Point B.

The real trouble comes not after two days, but after two weeks: “After two weeks, we'll see some empty space on store shelves.” And look for the prices of gasoline, diesel and jet fuel to rise: “The strike will affect imports of heavy crude to blend at refineries.”

After three weeks, expect “significant factory shutdowns as parts are not flowing. Remember how entire auto plants shut down during COVID for lack of a few chips for circuit boards? Or how vehicles were parked in fields because there were no chips for key fobs?

“Shippers are already re-routing cargoes to the West Coast — unload in California to ship east to Virginia, for example.” Yes, it’s doable — but it’s more time, more expense, more fuel burn.

The losers in all of this will be the companies most dependent on shipping through the East and Gulf Coasts: According to figures from the trade data firm ImportGenius, Walmart tops the list, followed by Ikea and Samsung.

The winners will be the railroads and long-haul truckers with more demand for their services.

Well, up to a point: Hurricane Helene has done significant damage to Interstate 40 at the North Carolina-Tennessee state line — disrupting a crucial east-west corridor.

Speaking of Helene…

![]() And What About the Semiconductors?

And What About the Semiconductors?

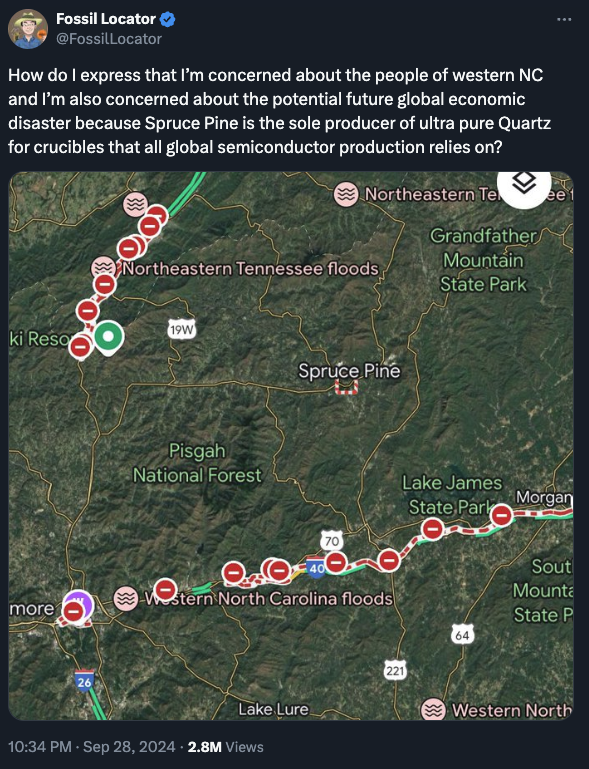

Apart from the human toll and the economic devastation left by Hurricane Helene… there’s the not-small factor of a hit to global semiconductor manufacturing.

Apart from the human toll and the economic devastation left by Hurricane Helene… there’s the not-small factor of a hit to global semiconductor manufacturing.

First, rewind to this headline from six months ago in the daily newspaper serving Raleigh, North Carolina…

The town of Spruce Pine, North Carolina — population 2,175 — sits just south of a mining complex that’s the world’s sole source of high-purity quartz used in the production of silicon wafers.

“It is rare, unheard of almost, for a single site to control the global supply of a crucial material,” writes Ed Conway in his 2023 book Material World. “Yet if you want to get high-purity quartz — the kind you need to make those crucibles without which you can’t make silicon wafers — it has to come from Spruce Pine.”

Chalk it up to a geological anomaly: Spruce Pine’s mineral deposits “formed 380 million years ago during the collision of Africa and North America,” wrote Erika Morphy at TechSpot earlier this year. “The intense heat and lack of water during their formation created quartz rock of unparalleled purity.

“These rocks are extracted from the ground and turned into quartz gravel, which is then processed into a fine sand. The silicon is separated from other minerals and then goes through a final milling. The final product is a powder that is shipped to refineries.”

Spruce Pine got more than two feet of rain from Tuesday through Saturday.

Spruce Pine got more than two feet of rain from Tuesday through Saturday.

Exactly what the impact is on quartz production, we don’t know. The mine is owned by Sibelco, a privately held Belgian firm. It is, to say the least, averse to publicity.

From Conway’s book: “When contractors from other companies are brought in for repairs [at the plant] they are literally blindfolded and marched into the factory up to the machine they need to fix.”

[For its part, Sibelco denies such secrecy.]

A few months ago, a Wharton professor named Ethan Mollick speculated that if the mines were to permanently halt operations for some reason, "it would likely [be] a few years of major disruption while techniques to generate alternatives were scaled up. But the disruption would be pretty catastrophic."

A permanent halt seems unlikely. But how temporary will “temporary” prove to be? We shall see…

![]() Not as Bad as First Thought

Not as Bad as First Thought

One of the major indicators that was screaming “incoming recession” has just been erased.

One of the major indicators that was screaming “incoming recession” has just been erased.

On Thursday, Paradigm macro maven Jim Rickards spotlighted for us the divergence between the widely reported economic measure of gross domestic product (GDP) and the less-followed measure of gross domestic income (GDI).

“GDP is supposed to be a near-mirror image of GDI (gross domestic income),” he said, “but there’s been a wide divergence in recent quarters. GDI is growing much more slowly and may soon be declining slightly. In the past, when GDP and GDI diverge, GDI tends to be more accurate and GDP plunges quickly to re-converge with GDI.”

Like the GDP figures, past GDI releases are subject to revisions based on new incoming data.

Lo and behold, the Commerce Department issued some upward revisions late last week. First-quarter GDI growth was revised from an annualized 1.3% to 3.0%. And second-quarter GDI growth was revised from an annualized 1.3% to 3.4%.

Your personal economic circumstances might be subpar. Your adult kids might be struggling to afford a house. Your neighbors might have had their hours cut back.

But if incomes in the aggregate are still holding up (and they are)… if relatively few people are filing first-time unemployment claims (that’s also the case)... and if oil prices sit near three-year lows (they do)...

… then it’s hard to say a “recession” is nigh — at least as economists conventionally describe it. Again, YMMV.

Speaking of the oil price, you’d never guess a widespread war is about to break out in the Middle East.

Speaking of the oil price, you’d never guess a widespread war is about to break out in the Middle East.

A barrel of West Texas Intermediate begins the week up a mere 15 cents at $68.33 even though Israel is about to launch a ground invasion of Lebanon at the same time it’s expanding an air war against the Houthis of Yemen.

Apparently no amount of geopolitical tension will move the oil price until the Straits of Hormuz are closed or a missile strikes an American warship.

Meanwhile, not much excitement in the major U.S. stock indexes. Both the S&P 500 and the Nasdaq have barely budged from last Friday’s close — which in the case of the S&P was a record weekly close.

Precious metals are still reeling after their take-down on Friday. But gold continues to hold the line on $2,600 and silver on $31, so it’s not all bad. Bitcoin, however, has slipped under the $65,000 floor that held for much of last week.

For the record: California Gov. Gavin Newsom has vetoed the AI-regulation bill we mentioned here last month.

For the record: California Gov. Gavin Newsom has vetoed the AI-regulation bill we mentioned here last month.

In theory, there might be enough momentum for an override, but in practice there’s little history of the California legislature spurning the governor’s wishes. The last time it happened was during Jerry Brown’s first stint as governor over 40 years ago.

![]() Kristofferson’s Future Financial Shock

Kristofferson’s Future Financial Shock

We wouldn’t ordinarily note the passing of Kris Kristofferson in these virtual pages — except for his appearance in a financial thriller that might serve as a glimpse into the future.

We wouldn’t ordinarily note the passing of Kris Kristofferson in these virtual pages — except for his appearance in a financial thriller that might serve as a glimpse into the future.

The print ad oversells the sex in the movie,

which was minimal (Image from MovieGoods)

Rollover, starring Kristofferson and Jane Fonda, came out in 1981. It wasn’t a particularly good movie, and it was a box-office bomb. But its fictional backdrop had a foundation in reality — Arab financiers panicking out of the U.S. dollar, triggering a financial collapse.

We’ve recounted the history before, but in brief: When the Iran hostage crisis broke out in November 1979 and Jimmy Carter froze Iranian assets, many wealthy people around the world — particularly in the Middle East — began to wonder if they might be next in line. The panic accelerated the following month when the Soviets invaded Afghanistan and Carter responded with a grain embargo.

Hot money flooded out of the dollar and into Swiss francs, West German marks and especially gold. Gold’s price in dollars more than doubled in four months to a record $800 in January 1980.

We’ve seen a similar panic since early 2022, albeit in slow motion — the de-dollarization movement among the BRICS countries and the Global South in general, after Russia invaded Ukraine and Joe Biden froze the assets of Russia’s central bank.

Worldwide, central bank purchases of gold set a record in 2022 — and the buying has continued at a furious pace in 2023–24. Not coincidentally, the dollar price of gold has risen from barely $1,800 at the time of the Russian invasion to over $2,600 now — up 44% in a little over 2½ years.

Anyway, you might want to watch Rollover sometime as a preview of coming attractions. It’s on Prime Video and Apple TV.

➢ Personally, I also enjoyed Kristofferson in Convoy — a Sam Peckinpah vehicle dripping with the sort of 1970s contempt for authority you just don’t see anymore. Told by a corrupt sheriff (Ernest Borgnine) that “I am the law — don’t you understand, I represent the law,” Kristofferson’s trucker character responds, “Well, piss on you and piss on your law.”

![]() Mailbag: More Property Taxes!

Mailbag: More Property Taxes!

“In response to my fellow Texan, I see that like most Texans, he doesn't understand how property taxes actually work,” a reader writes after last Thursday’s edition.

“In response to my fellow Texan, I see that like most Texans, he doesn't understand how property taxes actually work,” a reader writes after last Thursday’s edition.

[Once more unto the breach we go!]

“When I wrote, I said I was giving the short answer. Here's the longer version.

“Property taxes are not progressive. Within a county appraisal district, you will pay the same property tax rate whether your home value is $50,000 or $5 million. That is unlike federal income taxes where higher incomes have a higher tax rate.

“The amount of tax you pay is not primarily determined by your appraised value. It is determined by the tax rate your taxing authorities set. For example, a school system creates a budget for the next year and sets a tax rate based on the appraised value and how much is needed to meet the budget. I live in an area where home values have gone up considerably, but I've seen my tax rate lowered twice in the last 12 years because our local taxing authorities are mostly responsible people. Based on data from Tax-Rates.org, I pay 30% less in taxes than Austin (Travis County) which is 30 miles north of me. (See the interactive map at Tax-Rates.org.)

“In Texas, if you have the ability and desire to move, you can greatly lower your taxes. I'm retired now, but I've worked remotely for many years. I tried to get my wife to move to Pecos County. It would have cut our taxes 85%. A person living in Travis County (Austin) could cut their taxes 50% by moving next door to Lee County. In general, the population-dense areas of the state will always have higher taxes. That is because they have more irresponsible taxing authorities and a population that demands more services like elaborate sports complexes.

“Finally, the state does limit the taxing authorities on the homesteads of people over 65. My property value has doubled since 2014, but my taxes have not come close to doubling, even without the over 65 exemption. Two years ago the state made a change to the homestead value exemption. Last year, my tax bill went from $8.2K to $5.7K. I'm a happy camper. :-)”

“Local tax officials who seek to pad their budgets with higher revenues from rising property values are basically levying a windfall profits tax,” writes another. “Honest and competent local officials, such as where I live in rural Idaho, compensate for rising property assessments by lowering millage rates.

“Local tax officials who seek to pad their budgets with higher revenues from rising property values are basically levying a windfall profits tax,” writes another. “Honest and competent local officials, such as where I live in rural Idaho, compensate for rising property assessments by lowering millage rates.

“My property taxes have gone down in three of the last four years because the rising assessments have been enough to cover the county's basic budget plus growth from new arrivals, and millage rates have been reduced accordingly.”

Dave responds: Fascinating. If only there were a way to readily quantify and distribute that sort of information for people relocating. It’d be a lot more illuminating than the annual tax payment that you see on property listings at Zillow or Realtor.com!