Crypto’s Next Catalyst

![]() The Next — and Biggest — Stage of Crypto’s Rally

The Next — and Biggest — Stage of Crypto’s Rally

Every bull market goes through three distinct stages. Doesn’t matter the asset class — stocks, bonds, commodities, crypto.

Every bull market goes through three distinct stages. Doesn’t matter the asset class — stocks, bonds, commodities, crypto.

The first stage is when only the “smart money” is buying. We’re talking about a tiny number of people bold enough to buy at a moment when conventional wisdom says the asset is dead. (For instance, folks who bought stocks in early 2009 when it seemed the global financial crisis would never end.)

The second stage is when institutional investors — pensions, insurance companies, university endowments — start to buy.

The third and final stage is when retail investors like you start to buy. Often, this is the stage where the most explosive gains can be had. (For instance, the peak of the dot-com bubble in 1999.)

A variation on this theme is deals that are available only to the “smart money” at the outset.

A variation on this theme is deals that are available only to the “smart money” at the outset.

“Most of the best investment opportunities start as off-market opportunities,” says Paradigm’s AI-and-crypto authority James Altucher — “that is, small private deals not available on stock markets.

“If the deal or asset class does well enough, eventually it gets offered to the public,” James wrote on Monday to his PRO-level Altucher’s Investment Network readers.

For instance: “Private equity funds and hedge funds, which for a long time were only available to a select group of wealthy investors, are opening up their doors to every Tom, Dick and Harry with a pulse.”

By the same token, crypto became far more accessible four months ago today when the feds finally approved the launch of Bitcoin ETFs. (Credit where it’s due: James correctly forecast that approval to the day.)

A federal judge set the wheels in motion last October when he ordered the SEC to stop dragging its feet and say “yea” or “nay” to a Bitcoin ETF. Go figure: From that point forward, Bitcoin surged nearly 2.6X to a peak of nearly $74,000.

But the real start of crypto’s “Stage Three rally” is likely to start a few days from now with the much-ballyhooed Bitcoin halving.

But the real start of crypto’s “Stage Three rally” is likely to start a few days from now with the much-ballyhooed Bitcoin halving.

This will be the fourth halving in Bitcoin’s 15-year history. “Halving,” James reminds us, “is a change programmed into the Bitcoin blockchain that reduces the amount of rewards earned by miners. Beginning approximately April 20, miners will earn just 3.125 BTC for each Bitcoin block they produce, down from 6.25 BTC at present.”

For Bitcoin miners, that entails a substantial increase in costs: “Miners typically sell their Bitcoin in order to pay for operation expenses such as electricity, rent, system maintenance, etc.

“Following the halving, miners will have fewer Bitcoins to sell… which reduces the supply available for sale… resulting in an increase in price.”

All of this at a time when, as James reminds us, “anyone can buy Bitcoin directly from their brokerage or retirement account without having to bother with opening a new account on a cryptocurrency exchange, or bother with a separate account to track, additional tax filings, etc.”

Credible forecasters see Bitcoin rallying from less than $69,000 this morning to between $100,000–150,000 by year-end.

But what James is eyeing right now is the halo effect the Bitcoin halving will have on other cryptos — with a potential to make 100X your money over the next 12–18 months.

James has six in mind — which he’ll discuss during a special webcast set for this coming Sunday evening at 7:00 p.m. EDT. He’ll even name one of them during this event for free.

Spots are limited, but you can guarantee yourself access with just one click at this link.

![]() Here We Go Again (Inflation)

Here We Go Again (Inflation)

To the markets, which are gyrating after the release of an inflation number that was — wait for it! — “hotter than expected.”

To the markets, which are gyrating after the release of an inflation number that was — wait for it! — “hotter than expected.”

The month-over-month increase was 0.4% — in contrast with the typical Wall Street economist’s expectation of 0.3%. Shelter and gasoline account for more than half of that jump. Auto insurance — something a reader spotlighted for us recently — leaped 2.6% last month alone, which works out to 36% annualized.

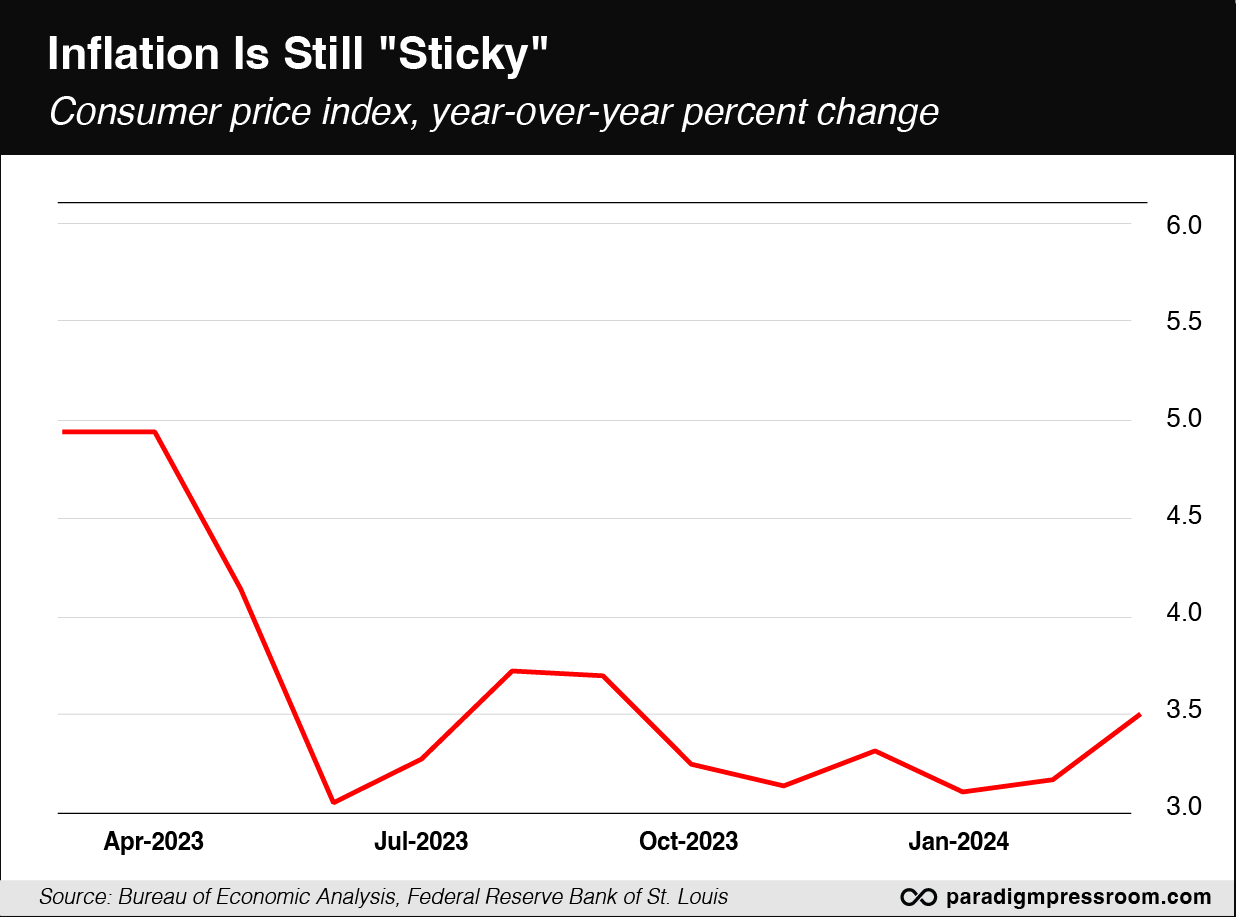

The year-over-year inflation rate rings in at 3.5%. It’s been stuck in a range of 3.1–3.7% for the last 10 months.

Gee — at this rate, in another couple of months, the mainstream won’t be able to tut-tut any more at igmo people in flyover country who think the inflation rate is moving in the “wrong direction.” (That’s a snarky reference to a Wall Street Journal poll we ripped to shreds last week.)

At the risk of repeating ourselves, the history of the last several decades in most of the world’s developed economies is sobering and indisputable: Once inflation sails past 5% — it got up to 9% in mid-2022 — it typically takes a decade to get back to “normal” 2% inflation.

In any event, all of Wall Street’s optimism at the start of 2024 — you know, the Federal Reserve cutting rates six times this year? — continues to be ground into dust. Last week’s chatter about three cuts has become today’s chatter about two — and a handful of pundits like former Treasury Secretary Larry Summers are even talking about a rate hike this year.

After the release of the numbers, nearly every major asset class is selling off…

After the release of the numbers, nearly every major asset class is selling off…

- All the major U.S. stock indexes are down at least 1%. At last check, the S&P 500 has shed 58 points, resting at 5,151. If you’re keeping score at home, that’s about a 2% drop from the S&P’s record close on March 28

- Bonds are selling off, pushing prices down and yields up. The yield on a 10-year Treasury note is up to 4.51%, the highest since mid-November

- Precious metals have been all over the place. As we check our screens, they’re down — but not dramatically — with gold at $2,335 and silver at $27.84.

Amid all that volatility, crude is looking like a relative oasis of calm — up a nickel at $85.28.

Speaking of economic numbers and their impact on the markets…

![]() Now It All Makes Sense

Now It All Makes Sense

All of a sudden, a raft of highly suspicious market moves in recent years is making much more sense.

All of a sudden, a raft of highly suspicious market moves in recent years is making much more sense.

One morning in December 2022, stock and bond futures began rallying 60 seconds before the release of the official inflation numbers.

That was hardly the first time: Research released in 2016 looked into the trading patterns related to 21 market-moving indicators in the United States over a six-year span. Among one-third of the indicators studied, there was strong evidence of unusual pre-announcement price action in stocks, bonds and futures. Traders acting on this early information might have pocketed an extra $20 million a year trading S&P 500 futures alone.

No one’s ever gotten to the bottom of who’s spilling the beans early. In years past, this suspicious activity could conceivably be blamed on reporters who got early access to the data so they could file their stories within moments of the data’s formal release.

But the government and the Federal Reserve steadily tightened up on this access throughout the 2010s. By the time COVID lockdowns and work-from-home came along in 2020, reporters ended up getting the numbers at the same time as everyone else.

So if reporters weren’t to blame, the only other explanation is government insiders.

So if reporters weren’t to blame, the only other explanation is government insiders.

Which brings us to the revelation that colleague Sean Ring detailed in today’s Rude Awakening: The Bureau of Labor Statistics has “Super Users” who get access to sooper-seekrit tranches of economic data that they can trade on. Not necessarily early data, but granular detail not available to the public.

Turns out that, per The New York Times and Bloomberg, some flunky economist at the agency was sending this data to Wall Street firms including JPMorgan and BlackRock — evidently in hopes of landing himself a cushy job at one of those Wall Street firms.

Who this flunky is and what his punishment will be have yet to be made public.

There’s no evidence at this time that higher-ups approved the “Super User” scheme. But if they did, don’t expect that evidence to ever become public.

Sean didn’t say this, but I will: Assuming this flunky is bounced on his ear, the whole Super User scandal can then be swept under the rug and attributed to one “bad apple” — allowing what might be a system of rampant abuses to continue on unchecked.

![]() Stupid Corporate Rebranding Tricks

Stupid Corporate Rebranding Tricks

Let’s see how the rebrand from “Twitter” to “X” is going…

Let’s see how the rebrand from “Twitter” to “X” is going…

That well, it seems.

“On Monday,” reports the Mashable site, “it appears X attempted to encourage users to cease referring to it as Twitter and instead adopt the name X. Some users began noticing that posts viewed via X for iOS were changing any references of ‘Twitter.com’ to ‘X.com’ automatically.”

Which might be fine if the change were executed properly. Unfortunately, “it became clear that there was another big issue: X was changing anything ending in ‘Twitter.com’ to ‘X.com.’”

The Pandora’s Box potential is immense: A scammer could post a link to “Netflitwitter”... which would appear to the user as “Netflix”... and anyone who clicked on it would go to the Netflitwitter scam site. (Fortunately, an online Good Samaritan snapped up the “Netflitwitter” domain before any hijinks could ensue.)

As the tech site The Register points out, “The potential for abuse here would be rife, given the number of legitimate, well-known brands most people would blindly trust. Netflix, Plex, Roblox, Clorox, Xerox — you get the picture.

“That's not even considering the potential for abuse of X-rated sites horned-up users might be otherwise too flustered to double-check for authenticity.”

In any event, X personnel have now remedied the issue.

Y’know, I’m sure there was plenty of fat to cut when Elon Musk took over the joint — but maybe he went a little too far?

![]() So What About that Memecoin Service, Anyway?

So What About that Memecoin Service, Anyway?

First off for our mailbag bullet today, thanks to everyone who responded to our broad inquiry last Friday about “Why do you have money in the markets?”

First off for our mailbag bullet today, thanks to everyone who responded to our broad inquiry last Friday about “Why do you have money in the markets?”

We got a terrific cross-section of responses that we shared yesterday and the day before. Whether you’re planning for the future or you’ve got the YOLO mentality, we appreciate your patronage and we take it seriously.

But we also got some feedback about our internal deliberations over whether to launch a premium trading service geared toward memecoins…

“I do not like the idea of recommending memecoins,” says one reader.

“I do not like the idea of recommending memecoins,” says one reader.

“I subscribe to the membership because I trust you guys have the professional knowledge and can pick out the stocks or cryptos that have a solid foundation and potential to grow up big. If it’s just for the gambling, I may be better off going to a casino, which will be more fun to play.

“Please keep doing your fantastic analysis and continue with your informational post. Thanks a lot for your hard work!”

“Resounding NO” adds another.

“Resounding NO” adds another.

“The primary niche Paradigm has is solid analysis of fundamentals and technicals on a foundation of best-in-class macroeconomics. Each extra factor pushes probability further to our favor. This applies even to the (clearly labeled) more speculative trades.

“It is most interesting that this question comes up when many of our carefully crafted trades of recent are now reaching fruition — fundamental factors aligning for great gains in Paradigm portfolios!

“Let the meme speculation crowd continue watching WallStreetBets or whatever other dubious source keeps them thrilled and largely broke. Odds are that for every flashy Lambo-driving meme winner there are 50 silently suffering meme losers behind on their rent.

“If YOLO, then let’s have it be a truly real life!”

Dave responds: The only positive feedback we got on the concept was from a 75-year-old who says she needs “quick money to get out of debt.”

I don’t know whether we’ll launch a high-end memecoin trading service. But I do know that’s not someone we’d want to sell it to. Not if we wanted to sleep at night…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets