YOLO

![]() Why Do You Have Money in the Markets?

Why Do You Have Money in the Markets?

An intriguing question came up on Wednesday during the Paradigm editorial team’s weekly conference call: Should we launch a premium trading service geared toward memecoins?

An intriguing question came up on Wednesday during the Paradigm editorial team’s weekly conference call: Should we launch a premium trading service geared toward memecoins?

Memecoins, if you’re not familiar with the term, are cryptos that have no purpose other than for speculation.

They’re not “money” or “currency” in the way that Bitcoin is a store of value or Ethereum is a medium of exchange. Sometimes they’re launched as a joke — as was Dogecoin, the original memecoin, in 2013. Frequently they’re subject to pump-and-dump schemes.

In early 2021, Dogecoin briefly leaped 9X “following Twitter encouragement from [Elon] Musk, Snoop Dogg and Gene Simmons,” per Wikipedia

In other words, there’s no “use case” for memecoins — except as lottery tickets.

That’s why they’re often derisively called “s***coins.”

“You are literally trading squirrel s*** back and forth,” says James Altucher’s senior stock analyst Bob Byrne — “hoping that someone will pay more than you.”

On one level, recommending memecoins is anathema to who we are and what we do.

On one level, recommending memecoins is anathema to who we are and what we do.

For as much as the newsletter biz is accused of promoting get-rich-quick schemes, the reality is that get-rich-quick is a terrible business model. Sure, it can bring customers in the door, but it can’t build a sustainable business with happy long-term customers who renew their subscriptions year after year.

Still, real people are making real money trading memecoins. Bob Byrne again: “I walked into the gym yesterday, and there was a modified Lamborghini Huracan sitting in the parking lot, and I said, ‘Who's that?’”

The answer: “Oh, that guy made tens of millions trading s***coins.”

If we launch a memecoin service, we would do it in part because we recognize that times have changed — and everyday folks are putting money in the markets for reasons that have nothing to do with “investing” or “trading” as it was known even five years ago.

If we launch a memecoin service, we would do it in part because we recognize that times have changed — and everyday folks are putting money in the markets for reasons that have nothing to do with “investing” or “trading” as it was known even five years ago.

For many people, it’s no longer about saving for retirement. Nor is it about achieving a higher standard of living. Nor is it about preserving wealth against the depredations of politicians and central bankers.

Instead, many people now view the markets as another form of gambling. (There’s the lottery ticket analogy again.)

It’s the investing version of “doom spending.”

It’s the investing version of “doom spending.”

Maybe you’ve heard that term: Times are so uncertain, society is so fragile, the future is so unknowable that there’s no point to any long-term financial goals.

The Wall Street Journal described the phenomenon like this last fall: “A tough housing market has more consumers writing off something they’d historically save for, while the pandemic showed the instability of any long-term plans related to health, work or day-to-day life. So they are spending on once-in-a-lifetime experiences because they worry they may not be able to do them later.”

The article profiled a couple from Seattle in their late 30s with a special-needs son who took a $10,000 trip to Hawaii and ran it up on the credit card: “We did not have the money,” said the husband, “and we were like, ‘Let’s just do this anyway.’”

And so it goes in the markets — the same YOLO (“You only live once”) mentality applies.

And so it goes in the markets — the same YOLO (“You only live once”) mentality applies.

It’s not just memecoins. As Bianco Research founder Jim Bianco points out on Xwitter this week, traditional finance puts crypto to shame in this regard.

More than half of all options traded these days are the “0DTE” variety that exist for only one trading day and expire on that day. And the ETF industry has spun up leveraged ETFs that promise 4X the gains of the SOX semiconductor index and 5X the gains of the “Magnificent 7.”

Personally, I don’t have a problem with this. No, I wouldn’t invest this way myself — but I completely understand why others would.

It is, in its way, a totally logical response to what the economist Kurt Richebacher called “late-stage degenerate capitalism” — Big Business in bed with Big Government, the dollar’s purchasing power cratering, a hollowed-out middle class.

And so while we deliberate over the logistics of a memecoin trading service, we conclude this Bullet No. 1 with an inquiry for you: Why do you have money in the markets? Are you planning for the future — or do you have the YOLO mindset?

All are welcome to reply… but as with our Elon Musk inquiry a couple of weeks ago, we’re especially interested in hearing from you if you’ve come aboard in recent months via Altucher’s Investment Network.

Drop us a line here: feedback@paradigmpressroom.com. Emily will share your responses next Monday and Tuesday.

![]() Eclipse Countdown (Have You Hit the ATM Yet?)

Eclipse Countdown (Have You Hit the ATM Yet?)

Maybe it’s doom spending that’s responsible for this?

Maybe it’s doom spending that’s responsible for this?

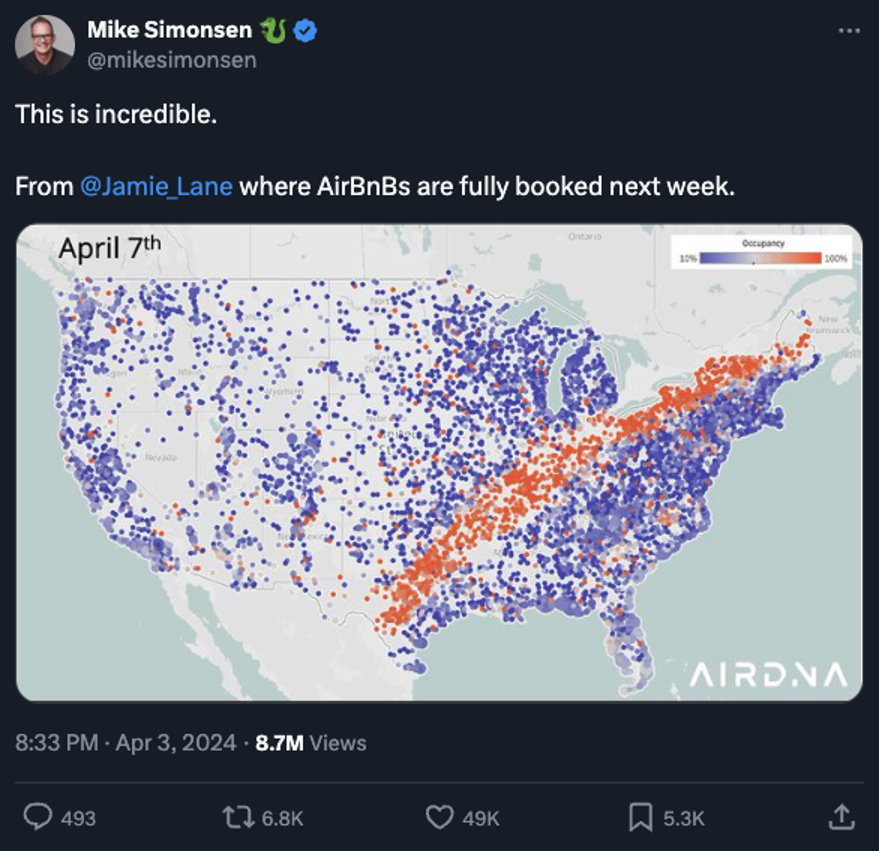

If you haven’t already deduced it, the orange section lies in the path of “totality” for the solar eclipse next Monday — where there will be total darkness in midafternoon.

As you might recall, we raised an eyebrow a month ago when local media within that path began disseminating “eclipse tips” from the authorities such as “Have communication plan with family/friends” and “Have cash on-hand in case of limited internet access.”

Really?

By one count, governors in 15 U.S. states have declared states of emergency — on the theory that cities like Dallas, Indianapolis and Cleveland will be overwhelmed with eclipse tourists, taxing public services to the max.

By one count, governors in 15 U.S. states have declared states of emergency — on the theory that cities like Dallas, Indianapolis and Cleveland will be overwhelmed with eclipse tourists, taxing public services to the max.

There was nothing like this with the eclipse in August 2017 that passed over St. Louis, Nashville and Charleston, South Carolina.

You don’t have to buy into the extreme social-media chatter — the weird Bible-prophecy stuff, or the C-130s that are supposed to spray biological weapons over the crowds — to figure something weird is going on. (The fact a 4.7 magnitude earthquake shook New York this morning is adding to the vibe…)

Then again, as colleague Chris Campbell pointed out this week in our sister e-letter Altucher Confidential, “LIFE IS ALWAYS WEIRD.”

“They want people to think twice about traveling,” he surmises. “They want you to cower at home.”

He has a point. Then again, he’s going to be hanging out on Monday as the skies darken over Texas with some very cool people including, as he says, “ASTRONAUTS.” (If it were me, I’d probably put it in all-caps too.)

Regardless, he says nothing good comes from acting out of fear. “We can choose to break the cycle and live from a place of curiosity, spotting and capturing the pockets of abundance. We can question fear-based narratives and trust our own inner compass. We can take responsibility for our own well-being and cultivate resilience in the face of uncertainty.”

Well said. Really, you should read the whole thing. It’s not strictly financial in nature, but it gets at the essence of what we do around here — empowering everyday folks to better their lives.

![]() The Markets Today: “Perfect Storm” Brewing

The Markets Today: “Perfect Storm” Brewing

“I think we have the perfect storm brewing for a decent market pullback,” writes Greg “Gunner” Guenthner to his Trading Desk readers.

“I think we have the perfect storm brewing for a decent market pullback,” writes Greg “Gunner” Guenthner to his Trading Desk readers.

“Investors are as bullish as they’ve been since early 2021, the situation in the Middle East is getting dicey again, oil is pushing higher and now the Fed is sending not-so-subtle warnings” about possibly no interest rate cuts if inflation remains sticky.

Stocks sold off hard toward the end of yesterday’s session — and crude popped to yet another high last seen in October. It might have been hawkish talk from a regional Fed president… or it might have been rumors of Iranian retaliation for an Israeli airstrike that killed an Iranian general earlier this week.

But for the moment, the major U.S. indexes are staging a rally despite another stronger-than-expected job number.

But for the moment, the major U.S. indexes are staging a rally despite another stronger-than-expected job number.

The wonks at the Bureau of Labor Statistics conjured 303,000 new jobs for March — and the revisions to February’s strong number were negligible. The official unemployment number ticked down to 3.8%.

Of course, there are always numbers under the hood that are less encouraging…

Still, it’s the headline number that Wall Street fixates on — and that number would suggest the Fed will keep interest rates “higher for longer.”

But if Mr. Market is worried about that prospect, he has a funny way of showing it: As we write, all the major indexes are up at least 1% on the day. At 5,212, the S&P 500 is on track for a weekly drop of three-quarters of a percent from last week’s record close.

In contrast, it’s gold that’s on track to notch a record close this week: At last check the bid is up $36 to $2,327. And silver is up nearly 50 cents to $27.34.

Crude is up nearly a buck again to $87.38. Again, it’s been nearly six months since a barrel of West Texas Intermediate has traded at this level.

[Editor’s note: No matter which direction the stock market goes, the aforementioned Greg Guenthner has you covered: His trading strategy had the power to turn a $40,000 model portfolio into $266,000 in a two-year span — and the market was not going up in a straight line. We’re accepting new memberships at The Trading Desk through this weekend. Access here.]

![]() Found Money

Found Money

The following, scraped from social media, is presented with no further comment…

The following, scraped from social media, is presented with no further comment…

![]() Perception IS Reality (Inflation)

Perception IS Reality (Inflation)

“I think you are spot-on about people’s recency bias when it comes to inflation,” a reader writes after yesterday’s foray into the media’s obsession with statistical abstractions versus real people’s lived experience.

“I think you are spot-on about people’s recency bias when it comes to inflation,” a reader writes after yesterday’s foray into the media’s obsession with statistical abstractions versus real people’s lived experience.

“Another point was mentioned in a post by Bloomberg’s John Authers this morning. He was talking about Nobel laureate Daniel Kahneman’s concepts of anchoring and framing and how basically gasoline is the proxy for inflation in most people’s minds because they buy it every week and see the numbers on big bold signs wherever they go.

“And so ever since Biden stopped drawing down the SPR, gas prices have drifted back up. Thus, people’s perception is that inflation is rising.

“Another issue that I mention frequently on InflationData.com is that prices go up but usually there is quite a lag before you get a compensating cost-of-living raise. So during that time you are paying higher prices but still living on last year’s salary.

“I always enjoy reading ‘The 5’ — Keep up the good work!”

“I had a bit of a chuckle (a wry sort of chuckle) at Bullet No. 1 yesterday,” adds another reader.

“I had a bit of a chuckle (a wry sort of chuckle) at Bullet No. 1 yesterday,” adds another reader.

“I was fortunate early in my career to have a fantastic sales/business development mentor. John had a variety of truisms and sayings that I still quote. One of them is ‘Perception IS reality,’ and I think it definitely applies here.

“The metrics that the academics use may demonstrate statistically that the economy is doing just fine/getting better. But that doesn't change the reality that average Americans see in their daily lives.

“The rate of inflation may be lower than it was a year ago, but that's meaningless for the average American who sees his grocery bill double year-over-year. The BLS may claim that the job market is strong, but the reality is different for someone who is looking for work and hasn't been able to find it (such as yours truly, at the moment).

“I think that the disconnect arises because the one-percenters, government hacks and academic ‘experts’ live in a different world than the average person and are insulated from many of the effects their decisions cause. They can absorb a doubling of their grocery bill because groceries are a relatively small percentage of their income.

“They don't have to worry about layoffs, cutting back to stretch your savings and worries about the future because that doesn't happen to people like them. Therefore it comes as no surprise that they are baffled when the ‘unwashed masses’ gripe about how the country is not in great shape. In their America, everything is all right; in the ‘real America,’ it's not.”

Dave responds: "I don't feel the pain of inflation anymore," San Francisco Fed president Mary Daly said in August 2022 — when the official inflation rate was 8.2%!

"I'm not immune to gas prices rising, food prices rising; I sometimes balk at the price of things, but I don’t find myself in a space where I have to make trade-offs, because I have enough. Many, many Americans have enough."

It was the most tone-deaf moment for a Fed pooh-bah since 2011, when inflation was on the minds of everyday folks and New York Fed president Bill Dudley made the mistake of holding a town hall in Queens.

On the basis of a wonky concept known as “hedonic adjustments,” Dudley essentially told the crowd that consumer price inflation was a figment of their imaginations. He cited the iPad — which had come on the market barely a year earlier.

“Today,” he explained, “you can buy an iPad 2 that costs the same as an iPad 1 that is twice as powerful. You have to look at the prices of all things.”

From the back of the room came the devastating rejoinder: “I can’t eat an iPad.”

Legendary!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets