Dr. Google Prescribes AI

![]() Paging Dr. Google

Paging Dr. Google

About 7 million Americans are living with Alzheimer’s dementia today — that’s roughly the population of Houston, Texas.

About 7 million Americans are living with Alzheimer’s dementia today — that’s roughly the population of Houston, Texas.

By 2030? That number is projected to be more in line with the population of NYC.

Sadly, as of two weeks ago, that number also includes my close family member.

We noticed her memory slipping for about a year. But like so many things in life, her memory loss seemed to happen gradually. And then all at once.

Until one Sunday, she couldn’t remember my name. Or the names of my husband and children.

One MRI and a lumbar puncture later, the neurologist — from one of the most prominent hospitals in the country — called to confirm the diagnosis.

Believe me, nothing can prepare you for that phone call. (So many of you readers, heartbreakingly, can relate.)

Meanwhile, the medical community has been fumbling in the dark since Alzheimer’s disease was first discovered over 100 years ago.

Meanwhile, the medical community has been fumbling in the dark since Alzheimer’s disease was first discovered over 100 years ago.

So it’s about time fresh eyes search for causes and a cure. Even if those “eyes” aren’t human.

In February, for instance, researchers at UC San Francisco announced they’ve designed an AI that can predict the onset of Alzheimer’s seven years before symptoms appear with 72% accuracy, using random forest (RF) models.

Preliminary research from the University of Colorado this year also shows promising results for the experimental cancer drug Nutlin when used “off-label” for Alzheimer’s disease.

Among other things, Nutlin inhibits a key protein called MDM2 which is necessary for a phenomenon called “synaptic pruning” wherein the brain eliminates nerve cells and synapses it no longer needs.

Abnormal synaptic pruning is believed to cause cognitive impairment in the hippocampus, the memory- and emotion-regulating center of the brain.

So block MDM2… Block synaptic pruning… Potentially, block the harmful effects of Alzheimer’s disease.

“Still, it is possible that another chemical could inhibit MDM2 even more efficiently and with an even better safety profile,” says biotech writer Jonathan Schramm.

“In finding new drugs and in innovation… progress in computation and AI will help us [make] new discoveries and speed up the pace of discovery,” Schramm adds.

“In finding new drugs and in innovation… progress in computation and AI will help us [make] new discoveries and speed up the pace of discovery,” Schramm adds.

“Google's AlphaFold 3 is a prime example,” Paradigm’s AI forerunner James Altucher notes.

According to an article at Freethink: “AlphaFold 3 [is] an AI that could start us on the path to a future where we have effective medications for countless conditions that are untreatable today.”

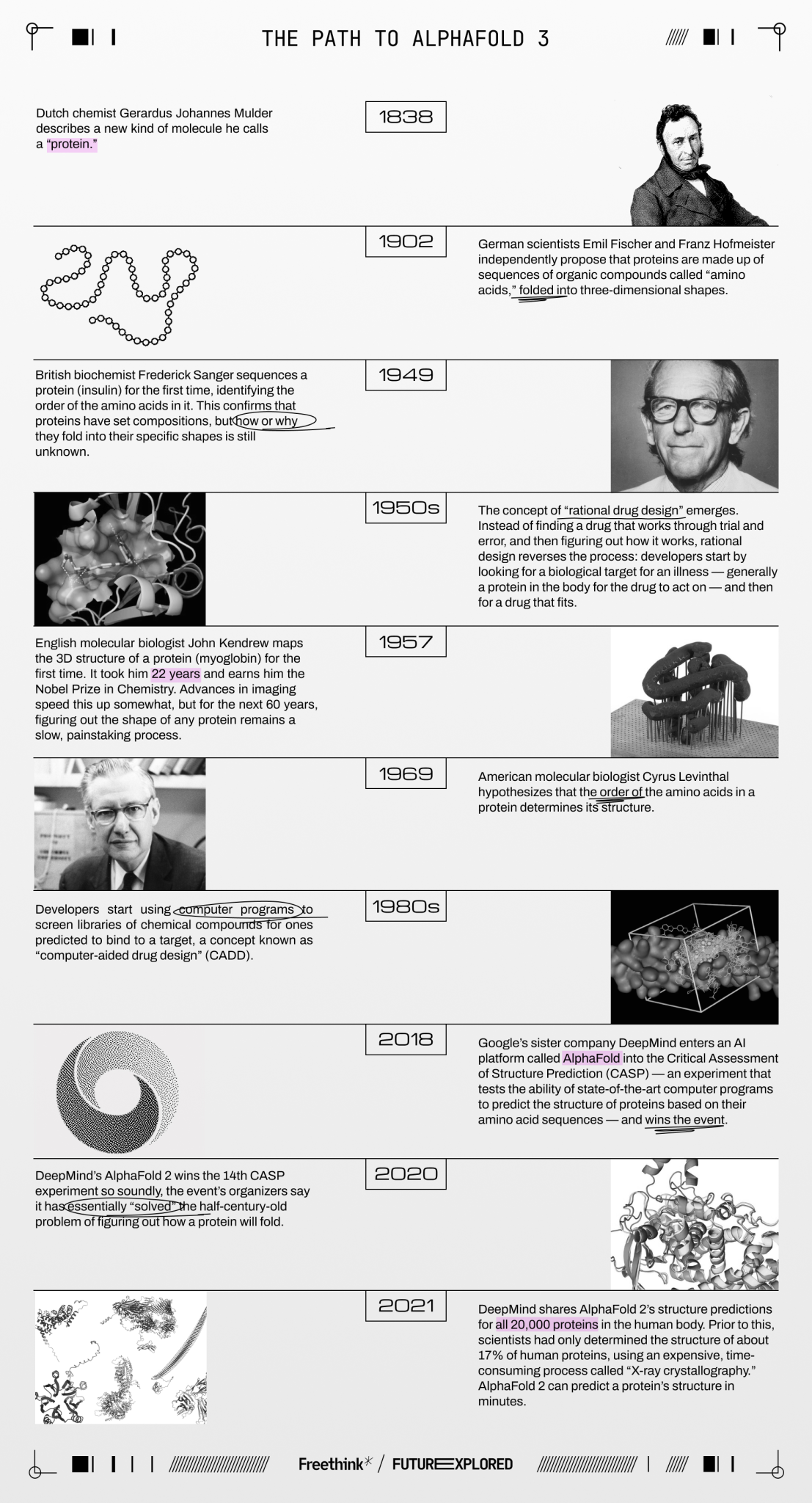

Here’s an almost 200-year timeline of progress…

Source: Freethinks

Click to enlarge

Which brings us to May this year: “[Google DeepMind] unveiled AlphaFold 3, which is able to predict the structure of both proteins and non-protein molecules, such as DNA and RNA, and how these molecules will bind to one another,” Freethink says.

It’s still early days, but this new AI tool could hasten the average six-year preclinical phase of drug development by rapidly modeling molecules and interactions — this when only 10% of drugs studied successfully make it through clinical trials.

James Altucher says: “By mapping out the structure of proteins at an unprecedented scale, this AI system could accelerate the development of lifesaving drugs by a thousand or even a million times.

“We're looking at companies that are going to change the world,” James summarizes.

“We're looking at companies that are going to change the world,” James summarizes.

“Think, of course, about how AI is revolutionizing health care. But AI’s also transforming crypto, computing and robotics (to name just a few industries).

“Innovation is happening so fast, faster than ever before in history.

“On the other hand, everyone's scared about politics, wars, the economy,” he says. “And I get that. But there's also so much excitement about the world-changing innovation happening in society right now.

“While economists worry about interest rates and recessions, investors should have a different mindset,” says James. “We should be looking at companies that are not strictly correlated to interest rates or inflation or the dollar.

“At the end of the year,” James forecasts, “there are going to be surprises that amaze us. Nothing's going to stop innovation in the private sector.

“And what's happening now is inning zero.”

It’s for sure zero hour for tech giant Apple.

In terms of AI, Apple’s been leapfrogged by its competitors — including Google.

But when CEO Tim Cook takes the stage at the Worldwide Developers Conference 2024, James Altucher believes that’s all about to change.

Exactly what AI breakthrough will Tim Cook announce on Monday?

Some analysts claim it’s “the most important day since the launch of the iPhone.”

You’ll get all the details just by attending James’ free “Apple’s 10X AI Announcement” event TONIGHT at 7:15 p.m. (ET).

There’s still time to join 20,000-plus online attendees for this momentous event.

So if you’re curious about what James calls the “AIPhone,” click to reserve your space right here.

![]() The Sun Shines on Solar

The Sun Shines on Solar

“A funny thing happens when a down-and-out stock starts to break out,” says Paradigm’s trading pro Greg “Gunner” Guenthner.

“A funny thing happens when a down-and-out stock starts to break out,” says Paradigm’s trading pro Greg “Gunner” Guenthner.

“First, no one believes it,” he says. “But as the breakouts expand, you’ll begin to hear some bullish whispers.

“That’s exactly what’s starting to happen with solar stocks.

“No one wanted anything to do with the solar names during the first quarter. The Invesco Solar ETF (TAN) was nearly chopped in half in 2023, and most of the most visible companies in the sector were limping into the new year at or near multiyear lows.

“Some of these stocks were still catching analyst downgrades as recently as January,” Gunner says. “At the time, the reasons to avoid these stocks made total sense: prices were up, installations were down and high interest rates were crushing demand.

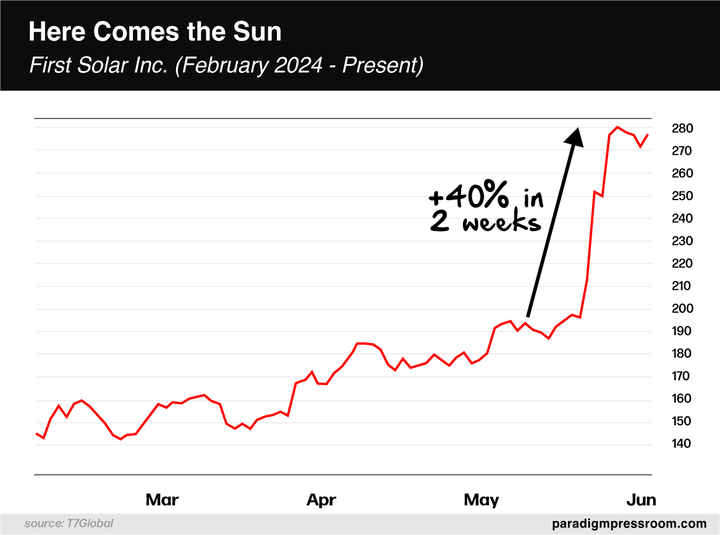

“But that was before First Solar Inc. (FLSR) broke out…

“FSLR suddenly launched higher in mid-May, jumping above $200 for the first time in nine months and sparking a rally that would push shares up 40% in just two weeks.

“You can probably guess what happened next…

“The solar story quickly began to change,” says Gunner.

“The solar story quickly began to change,” says Gunner.

“First, there was chatter about how Biden’s proposed China tariffs would offer a boost to the sector. Then, analysts began touting solar as an important piece of the artificial intelligence energy puzzle.”

UBS, in fact, now says FSLR is “an overlooked, direct beneficiary of increasing AI-driven electricity demand.”

Gunner adds: “Now we’re seeing other stocks in and around the sector beginning to firm up. And FSLR [continues] to consolidate right at the top of its range, which just so happens to be in the neighborhood of its all-time highs from early 2008.

“It’s still early in this solar narrative flip,” he cautions. “If these stocks can power through the summer chop, we could be looking at a new leading momentum sector heading into the third quarter.”

Plus, it’s another good reminder of the chart hound saying: “Narrative follows price.” Not the other way around…

FSLR is taking a breather at $272 this afternoon.

Looking at the overall stock market, the Big Board is the only major U.S. index currently in the green, up fractionally to 38,825.

Looking at the overall stock market, the Big Board is the only major U.S. index currently in the green, up fractionally to 38,825.

The Nasdaq and S&P 500, on the other hand, are both down about 0.15% to 17,160 and 5,345 respectively.

Commodities are looking healthy. Crude is up 2%, priced at $75.60 for a barrel of West Texas crude. Precious metals are in good shape. Gold is up 0.65% to $2,391 per ounce. But silver? Amazing! Up 4.25% to $31.35. (More on silver in just a moment.)

Crypto’s not really making any noteworthy moves at the time of writing. Bitcoin’s basically flat at $71,150 as is Ethereum at $3,830.

![]() The Base Case for Silver

The Base Case for Silver

“I have $5,000. What should I buy and hold for the next 10 years?”

“I have $5,000. What should I buy and hold for the next 10 years?”

That was the question a friend put to Paradigm editor — and bleeding-edge crypto adopter — Chris Campbell in 2012.

“He was looking for something fun, off the beaten path. Edgy,” Chris recounts.

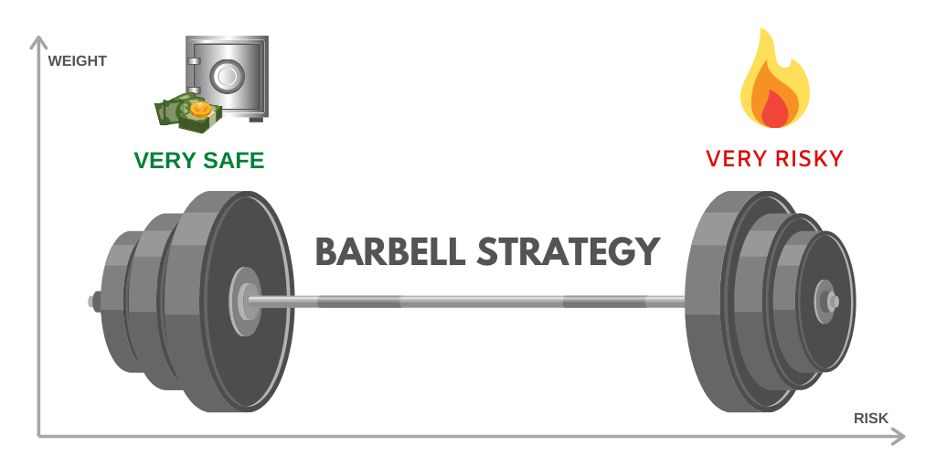

“I told him to get both silver and Bitcoin, a variation of the barbell strategy…

Courtesy: Quantilia

“Silver was never going to zero. Odds are, it would eventually go up. Bitcoin could go to zero, but it could also go to $100,000 or more.

“He looked at me like I was a lunatic,” Chris recalls. “Bitcoin was around $100. There was no friggin’ way it would ever see $100,000.

“Also, in 2012, nobody in the financial media was talking about Bitcoin. If they were, they were talking about how it was a scam.

“EVERYONE was talking about silver,” says Chris. “He bought $5,000 worth of silver at $34 per ounce.

“Twelve years later, he’s still down.

“Meanwhile, $2,500 in Bitcoin back then would be worth over $1.7 million today.”

Chris assures us his friend is doing just fine — despite the hard lesson learned. Chris also assures us his answer to the investment question put to him in 2012… would still be the same today.

“In recent months, [I see] an increasingly bullish case for silver,” says Chris. “For real this time.

“In recent months, [I see] an increasingly bullish case for silver,” says Chris. “For real this time.

“Executives from silver mining companies and analysts who follow the sector closely believe that silver is on the cusp of a major bull market, driven by a perfect storm of supply and demand factors.

“For four consecutive years, silver demand has outstripped supply, with the deficit expected to grow to a staggering 250 million ounces in 2024,” Chris notes.

“This structural shortage is the result of years of underinvestment in new mine supply, coupled with rapidly growing demand from both industrial and investment sources.

“On the demand side, solar panel manufacturing has emerged as a major consumer of silver, accounting for around 35% of total demand(!).

“Some projections show solar demand rising to 50% of total silver consumption in the coming years… 50%!” he emphasizes. (See Gunner’s assessment of the solar sector above.)

“Add to that, investment demand for silver is also heating up, particularly in the key Asian markets of India and China.

“Buyers in these countries have a clearer view of the supply/demand fundamentals than Western investors, prompting them to stock up on the metal.

“The base case for silver: $66,” says Chris. How does he come by that figure?

“The base case for silver: $66,” says Chris. How does he come by that figure?

“Best estimates suggest that primary silver mines, while benefiting from higher prices, would require silver prices to more than double to incentivize meaningful new production,” he says.

At the same time: “Resource nationalism in major silver-producing countries like Mexico, Peru and Chile is compounding the supply challenges.

“Governments in these countries are looking to take a larger share of mining profits, while tighter regulations and social opposition are making it harder than ever to build new silver mines.

“Finally, the monetary backdrop is also supportive for silver,” Chris says.

“Central banks around the world are accumulating gold at the fastest pace in decades, as confidence in the U.S. dollar wanes.

“This shift will benefit silver, which tends to follow gold directionally but with higher volatility.

“While often overlooked in favor of its yellow cousin, silver's moment in the spotlight may have finally arrived.

“I’ve heard it all before, of course,” Chris concludes. “But I can’t help it. I still love silver.”

![]() A New Spin on Money Laundering

A New Spin on Money Laundering

Move over metal detecting… Here comes magnet fishing!

Move over metal detecting… Here comes magnet fishing!

Just as it sounds, using a rope attached to a heavy magnet, hobbyists are angling in waterways to snag all manner of metal objects.

And, on May 31, NYC resident James Kane hit the motherlode when he pulled a safe from a lake in Flushing Meadows in Queens, New York.

Courtesy: NBC News, YouTube

Inside? About $80,000 - $100,000 worth of $100 bills. “Stacks of bills, dude!” James Kane cheered.

Upright citizen that he is, Kane contacted the local authorities about his newfound treasure.

The good news? Finders keepers.

The bad news? “The value and authenticity of the alleged currency,” says the NYPD, could not be determined due to the “severely disintegrated condition” of the bills.

Wah-wah…

![]() Horseshoes and Hand Grenades

Horseshoes and Hand Grenades

“Thank you for reporting on the trials of Mr. Spekker,” says a kindhearted contributor about a real-life David-and-Goliath story yesterday.

“Thank you for reporting on the trials of Mr. Spekker,” says a kindhearted contributor about a real-life David-and-Goliath story yesterday.

“He has a GoFundMe page. I made a small donation to his legal fund, though it might just be easier to repaint his van.”

Emily: If only it were that simple… Mr. Spekker already trademarked his small business in the U.K. Plus, he says he’s spent a considerable amount of money on ads with his branding.

“Only in jolly old England!” comments another reader.

One might assume U.K. policy would be hostile toward small-business owners. In reality, “over the past 25 years, small businesses have been responsible for two out of every three jobs created,” says U.K. trade publication Startups.

“Fast-forward to 2024, [small] businesses stepped up in a big way, creating a remarkable 300,000 new jobs.”

Let’s just hope U.K. wonks do better than their American counterparts at keeping accurate track of job creation. Horseshoes, hand grenades… and government stats, right?

Have a good one! Back tomorrow…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets