EIP-4844

![]() Crypto Catalyst

Crypto Catalyst

Yesterday marked a milestone on the long road to a time when you and I can conduct banking without bankers — that is, a time when banks and credit card companies won’t take a cut from your everyday transactions.

Yesterday marked a milestone on the long road to a time when you and I can conduct banking without bankers — that is, a time when banks and credit card companies won’t take a cut from your everyday transactions.

[Reminder: Every time you use a credit card, the merchant forks over 2–3% to Visa or Mastercard. That’s a cost of doing business that gets passed on to you in the form of higher prices. Convenience comes at a cost.]

The short story is that Ethereum — the second-best known cryptocurrency after Bitcoin — experienced a radical upgrade.

With this upgrade, transaction costs will be slashed… and Ethereum will be able to process many more transactions at once.

“This has been in the works for about two years,” says Paradigm’s senior crypto analyst Chris Campbell.

“This has been in the works for about two years,” says Paradigm’s senior crypto analyst Chris Campbell.

In recent weeks, Chris has been traipsing through Central America to see how everyday people are using crypto in countries where government-issued currencies have, shall we say, a checkered history. First was Honduras. Then it was El Salvador, where Bitcoin became legal tender in 2021.

This week he’s in Costa Rica — where on Tuesday he hopped on a livestream with Paradigm’s investing iconoclast James Altucher. James had just spoken at the annual SXSW gathering in Austin, Texas. (You can watch a replay of the livestream right here.)

“There are a few things changing to the Ethereum protocol,” said Chris, “but the main thing to remember is what's called EIP-4844. And EIP means, Ethereum Improvement Proposal. And this is the main way that developers can pitch proposals and improvements to the network.

“So what this is going to do is, it's going to make Layer 2 blockchains, which are blockchains built on top of Ethereum. Make them way more affordable and scalable and reduce the transaction fees by up to 90%, and it'll also reduce Ethereum transaction fees by second-order effects.”

Not only will it slash the transaction fees, it will make Ethereum competitive with the likes of Visa. Visa is capable of processing 24,000 transactions per second. Until yesterday’s upgrade, Ethereum could process a paltry 15 at most.

Not only will it slash the transaction fees, it will make Ethereum competitive with the likes of Visa. Visa is capable of processing 24,000 transactions per second. Until yesterday’s upgrade, Ethereum could process a paltry 15 at most.

With the EIP-4844 upgrade, Ethereum transactions can take place outside the Ethereum blockchain for a fraction of a second before they return to the blockchain. Thus, the number of possible transactions grows by many orders of magnitude… and you can conduct tens of thousands of transactions while paying the fee for only one.

It’s true that Ethereum stands to benefit immensely from this upgrade.

It’s true that Ethereum stands to benefit immensely from this upgrade.

In fact, James Altucher is on record saying Ethereum’s current price — just under $4,000 — could become $400,000 by 2030.

But here’s the thing: There are other cryptos enabling this whole EIP-4844 process. And given their crucial role, their potential price appreciation is even greater.

Chris and James have been performing diligent research to identify the best of breed. During the livestream on Tuesday, they named one of them, absolutely free. You can buy it easily with a Coinbase account.

And as a reminder from yesterday, James also named four AI stocks he believes have explosive potential. The livestream is still available to watch at this link. There won’t be any hard sell for one of our premium services — just the essential background and actionable information.

![]() Yes, Stocks are Overvalued. And Your Point?

Yes, Stocks are Overvalued. And Your Point?

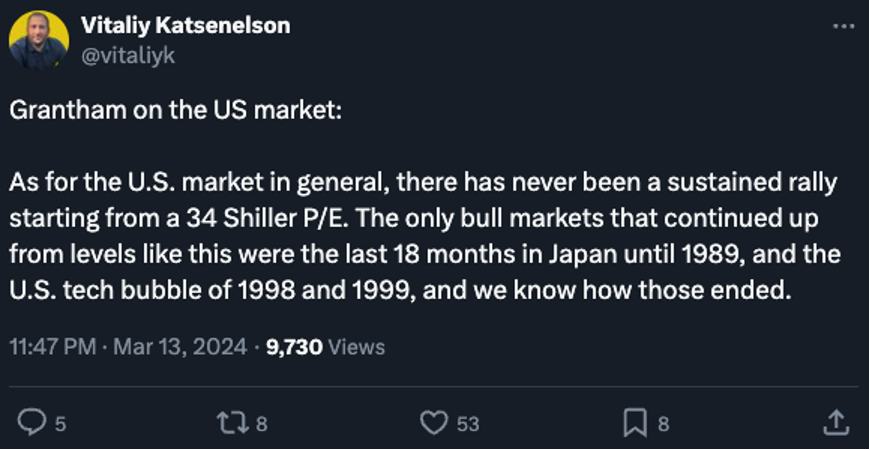

As we ease into our “market notes” bullet today, some food for thought, courtesy of the investing legend Jeremy Grantham…

As we ease into our “market notes” bullet today, some food for thought, courtesy of the investing legend Jeremy Grantham…

So let’s unpack a couple of things here. The “Shiller P/E” is a variation on the familiar price-earnings ratio. Developed by Yale economist Robert Shiller, it’s a measure of the broad stock market’s valuation over a 10-year time horizon.

And yes, it’s at a very elevated level right now. Maybe, especially if you’re a longer-term reader, you sense that stocks are extremely pricey. Perhaps you’re even tempted to short sell a stock or two, or maybe sink some money into put options.

But be careful. It comes back to what I told a crypto-averse reader on Tuesday about “just world” investing.

But be careful. It comes back to what I told a crypto-averse reader on Tuesday about “just world” investing.

In a just world, the market would not have a Shiller P/E of 34 and Nvidia would not be selling for a nosebleed 74 times earnings. And maybe Bitcoin wouldn’t be fetching over $70,000. (That’s a tougher call, given crypto’s brief history as an asset class.)

But it’s not a just world. You have to invest in the real world. Or as John Maynard Keynes famously quipped, “The market can remain irrational longer than you can remain solvent.” (Keynes was a horrible economist, but he was a really good investor!)

Yes, it’s all destined to end in tears — but not necessarily right away.

For his part, Grantham said the stock market was in a bubble in early 2021. But as he readily conceded that same year, “Bubbles are unbelievably easy to see; it's knowing when the bust will come that is trickier.”

All of which is to say that we at Paradigm Press are keenly aware of these crosscurrents. We’re also keenly aware of the trust you put in whichever editor(s) you’re paying good money to read.

Given the history of our parent and predecessor firms in calling the dot-com bust of 1999–2000 and the housing/credit bust of 2007–2008, we feel as if we have a leg up on the competition. Whatever the market gods have in store, we’ve got your back.

As for the markets today, it’s the commodity complex that continues to be the most interesting.

As for the markets today, it’s the commodity complex that continues to be the most interesting.

Crude has popped over $80 a barrel — in fact, over $81 for the first time since early November. And copper continues to hover around $4 a pound; China’s top copper smelters have agreed to production cuts for lack of raw metal.

Gold has slipped below $2,160 after yet another hotter-than-expected inflation number (more about that momentarily). But silver is resilient at $24.84.

The major U.S. stock indexes are treading water — none of them moving more than a quarter-percent on the day. The S&P 500 sits at 5,155, 20 points below its record close two days ago.

Bitcoin is in the red at the moment, but within striking distance of $72,000 again.

The big economic number of the day is wholesale inflation: The producer price index jumped 0.6% month-over-month. Oops — the typical Wall Street economist was looking for only 0.3%.

Elsewhere, retail sales rose 0.6% in February — but January’s already-punk number was revised lower to a 1.1% drop.

![]() China’s Rare Earth Dominance Is (Slowly) Easing

China’s Rare Earth Dominance Is (Slowly) Easing

Don’t look now, but China’s grip on the substances known as “rare earth elements” is starting to loosen.

Don’t look now, but China’s grip on the substances known as “rare earth elements” is starting to loosen.

So says a recent article at MarketWatch, citing Paradigm’s own mining-and-metals expert Byron King among others.

REEs are 17 elements with funky names that lie at the bottom of the periodic table you studied in high-school chemistry. They’re used in everything from your mobile phone to LED light bulbs to the magnets essential for electric vehicles.

Oh, and military applications. A “modern military simply does not work without REEs in electronics, optics, guidance, propulsion,” says Byron. “Absent REEs, we’re back to tossing rocks and sharp sticks.”

A decade ago, China accounted for 90% of global REE production. Today, it’s closer to 70%.

Other locales are slowly coming online — Brazil in South America, Mozambique and Tanzania in Africa. The United States? Yes, it has REEs but it’s also a “high-cost jurisdiction with lots of regulations.”

The best investing opportunities in REEs are fleeting. Byron got his readers into an outfit called Molycorp more than a decade ago — and then got out with a 178% gain in five months just before skyrocketing costs put it on the road to bankruptcy.

Still, if you want to take a flier on the sector, the best-known ETF is the VanEck Rare Earth/Strategic Metals ETF (REMX).

![]() Bureaucrats NOT Gone Wild (for Once)

Bureaucrats NOT Gone Wild (for Once)

From the Department of Problems We Didn’t Even Know Existed…

From the Department of Problems We Didn’t Even Know Existed…

“The United States and Canada might be the only countries in the world that don't require car companies to use amber lights for rear turn signals,” says a hand-wringing article at the automotive site The Drive. “There's no good reason for it, other than that the federal government hasn't decided that the status quo needs to change.”

The article includes a comprehensive table of automakers and how many of their current models have amber turn signals versus red. It goes on to assert that federal data have “suggested that amber turn signals reduce crash rates by more than five percent in some driving scenarios.”

Y’know, your editor has been driving for over 40 years and I’ve LITERALLY NEVER THOUGHT ABOUT THIS UNTIL NOW.

[You’ll just have to imagine me saying that in my best Sam Kinison voice. Or maybe Lewis Black.]

I mean, I didn’t even realize that turn signals come in different colors — or that one might be more visible than another under certain circumstances. And yet, after hundreds of thousands of miles driven over the course of an adult lifetime, somehow I’m still in one piece.

Indeed, despite this horrendous oversight by federal regulators, the motor vehicle fatality rate in these United States declined steadily for 50 years — well, until COVID and lockdowns in 2020 and everybody either forgot how to drive or suddenly started driving like assholes. What’s that all about, anyway?

The article concludes: “As long as lawmakers leave things as they are, turn signals on this side of the pond will remain a regulatory free-for-all.” God forbid, right?

![]() A Different Kind of Mailbag Section

A Different Kind of Mailbag Section

For our mailbag bullet today, I’m turning the tables. Or more precisely, I’m soliciting reader comments on a matter out of the blue.

For our mailbag bullet today, I’m turning the tables. Or more precisely, I’m soliciting reader comments on a matter out of the blue.

This inquiry is directed toward you if you’re a newer reader — specifically someone who came aboard late last year or early this year via a new subscription to Altucher’s Investment Network. I’m going to ask a simple question: What’s your opinion of Elon Musk?

I know, it’s a very broad question. That’s on purpose.

You’re among a sizable contingent of new readers who’ve joined us in the last four months or so and I’m trying to take your pulse, see what makes you tick. Musk is a lightning-rod figure, both in the world of technology and beyond. It’s hard not to have an opinion — and we want to know yours. Write here: feedback@paradigmpressroom.com

Could be a lively mailbag when Emily takes the helm for tomorrow’s issue…

Speaking of which, “I am relatively new to Paradigm Press,” a reader writes — “and I get too many emails each day to read from multiple sources.

Speaking of which, “I am relatively new to Paradigm Press,” a reader writes — “and I get too many emails each day to read from multiple sources.

“However, I thoroughly enjoyed reading the 5 Bullets on March 12, 2024. It was very well-written and not only informative but also clever, witty and entertaining. It was a very nice way to start my day.

“I look forward to the next email.”

Dave responds: Gee, thanks. It’s especially appreciated because I kinda thought I was off my game Tuesday!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets